[ad_1]

Whereas planning on your future, you is perhaps questioning the place to speculate your cash for safekeeping and development. In spite of everything, you’ve labored exhausting all through your life to gather a nest egg for whenever you retire; you need to be sure you are making essentially the most out of it.

When trying into totally different IRA accounts that you could contribute to, one factor you may consider is the IRA withdrawal age and the way that may impression you and your future. Fortunately, TurboTax consultants might help you perceive IRAs at any level all through the tax yr, however we’ve additionally compiled an entire information to understanding the ins and outs of withdrawing from an IRA account.

When Can I Withdraw My IRA With out Penalty?

Understanding when you’ll be able to withdraw your IRA funds is a vital a part of deciding the way you need to make investments your cash. Most IRA plans observe the identical withdrawal patterns, nevertheless it’s vital to know the distinctions of every plan.

Conventional IRA

For a conventional IRA, in the event you take a distribution earlier than the age of 59.5, you may be taxed at your regular tax fee and penalized 10% of the distribution quantity. When you’ve hit the age of 59.5, chances are you’ll begin to take distributions with out the ten% penalty, however you’ll nonetheless be taxed, as these funds went into your account with pre-tax {dollars}.

There are specific circumstances the place you possibly can take an early IRA withdrawal earlier than the age of 59.5 and keep away from the ten% penalty; these embrace:

- Certified increased schooling bills: This consists of room and board, tuition, charges and provides for your self or your partner, kids and grandchildren.

- Dwelling buy: You possibly can withdraw as much as $10,000 towards the acquisition of your first residence.

- Start or adoption of a kid: You possibly can withdraw as much as $5,000 following the start or adoption of a kid.

- Medical bills and medical insurance premiums: You possibly can take a distribution for unreimbursed medical bills. These should exceed 7.5% of your adjusted gross earnings (AGI). You too can withdraw to pay for medical insurance premiums for your self, your partner or your kids if you find yourself unemployed for 12 weeks or extra.

- Considerably equal funds: When you take a sequence of distributions which might be unfold equally over your life, you possibly can keep away from the penalty. You should take one distribution per yr and can’t modify the schedule till 5 years have handed otherwise you grow to be 59.5, whichever is later.

- Certified reservist distributions: When you’re referred to as to energetic responsibility for greater than 179 days, you possibly can take a penalty-free distribution, though it have to be made in the course of the interval of energetic responsibility.

- Demise or complete and everlasting incapacity: You possibly can withdraw IRA funds with out penalty in the event you grow to be disabled, and in the event you die, your beneficiary or property can withdraw with out penalty.

Different IRA Accounts

There are just a few different IRA sorts to bear in mind:

- Simplified Worker Pension (SEP) IRA: The sort of account permits an employer to make retirement plan contributions to a conventional IRA that’s established within the worker’s title. That is often completed by a small enterprise or self-employed people.

- Financial savings Incentive Match PLan for Workers (SIMPLE) IRA: This plan is offered to small companies that don’t have another sort of retirement plan. That is just like a 401(okay) plan, permitting for each worker and employer contributions.

The SEP-IRA and SIMPLE IRA work equally to the standard IRA plan. You possibly can take distributions from these plans at any time; nevertheless, you may be topic to a ten% penalty and earnings taxes if you’re beneath the age of 59.5, and simply earnings taxes if over the age of 59.5. The identical circumstances that may allow you to keep away from the ten% penalty are in place with the standard IRA plan.

It’s vital to notice that there’s a 25% tax in the event you withdraw out of your SIMPLE IRA within the first two years of the plan being open. This penalty takes the place of the ten% early withdrawal penalty acknowledged above.

Roth IRA

Roth IRAs work slightly in a different way than conventional IRAs, as they supply slightly extra leeway for the account proprietor. Not like the standard IRA, cash contributed to your Roth IRA is post-tax, that means that it’s taxed earlier than it goes into the account.

You possibly can take a Roth IRA distribution in your contributions at any time with out penalty or taxes. When you want to withdraw your Roth IRA earnings, nevertheless, there are particular circumstances the place there are not any taxes or penalties:

- You have to be age 59.5 or older, and

- Your Roth IRA account have to be energetic for 5 years or extra

When you want to make a withdrawal in your earnings out of your Roth IRA, are youthful than 59.5 and the account is lower than 5 years outdated, you owe each earnings taxes and a ten% penalty on distributions. You possibly can keep away from the ten% penalty in the event you meet one of many following standards:

- Certified increased schooling bills: This consists of room and board, tuition, charges and provides for your self or your partner, kids and grandchildren.

- Dwelling buy: You possibly can withdraw as much as $10,000 towards the acquisition of your first residence.

- Start or adoption of a kid: You possibly can withdraw as much as $5,000 following the start or adoption of a kid.

- Medical bills and medical insurance premiums: You possibly can take a distribution for unreimbursed medical bills. These should exceed 7.5% of your adjusted gross earnings (AGI). You too can withdraw to pay for medical insurance premiums for your self, your partner or your kids if you find yourself unemployed for 12 weeks or extra.

- Considerably equal funds: When you take a sequence of distributions which might be unfold equally over your life, you possibly can keep away from the penalty. You should take one distribution per yr and can’t modify the schedule till 5 years have handed otherwise you grow to be 59.5, whichever is later.

- Certified reservist distributions: When you’re referred to as to energetic responsibility for greater than 179 days, you possibly can take a penalty-free distribution, though it have to be made in the course of the interval of energetic responsibility.

- Demise or complete and everlasting incapacity: You possibly can withdraw IRA funds with out penalty in the event you grow to be disabled, and in the event you die, your beneficiary or property can withdraw with out penalty.

When you want to make a withdrawal in your earnings out of your Roth IRA, are youthful than 59.5 and the account is 5 years or older, you owe each earnings taxes and a ten% penalty on distributions. You possibly can keep away from the ten% penalty and taxes in the event you meet one of many following standards:

- Dwelling buy: You possibly can withdraw as much as $10,000 towards the acquisition of your first residence.

- Demise or complete and everlasting incapacity: You possibly can withdraw IRA funds with out penalty in the event you grow to be disabled, and in the event you die, your beneficiary or property can withdraw with out penalty.

When you want to make a withdrawal in your earnings out of your Roth IRA, you’re 59.5 years or older and the account is lower than 5 years outdated, you’ll owe earnings tax however not a ten% penalty.

When you want to make a withdrawal in your earnings out of your Roth IRA, are 59.5 years or older and the account is 5 years or older, you possibly can withdraw earnings with no tax and no penalty.

How A lot Can I Withdraw From My IRA?

Understanding when you possibly can withdraw out of your IRA is just one a part of the equation; understanding how a lot you possibly can withdraw out of your IRA account is the second half in figuring out in the event you ought to spend money on a conventional IRA or Roth IRA.

Conventional IRA

With a conventional IRA, there isn’t a month-to-month or yearly restrict on how a lot cash you possibly can withdraw; you possibly can take as little or as a lot as you’d like or want. Nevertheless, there are some things to bear in mind earlier than you faucet into this account:

- If you’re not but 59.5 years outdated, you may be topic to earnings tax and potential penalties. These can add up shortly, doubtlessly costing you extra in the long term.

- The extra you withdraw (particularly throughout an early distribution), the much less cash you’ll have on your future.

- When you take a distribution that’s greater than you want, you may miss out on future positive aspects.

Different IRA Accounts

The SEP-IRA and SIMPLE IRAs observe the identical guidelines as above; there isn’t a restrict on how a lot you possibly can withdraw, although it is very important be conscious of the identical stipulations with regard to taxes and penalties.

Roth IRA

Just like the above accounts, the Roth IRA account doesn’t have a withdrawal restrict; you possibly can withdraw as a lot or as little as you’d like each month or yr. Bear in mind: You possibly can withdraw your contributions tax- and penalty-free at any time, and you may withdraw your earnings with out taxes and penalties when you’ve reached the age of 59.5 and the account has reached an age of 5 years.

When Do I Must Begin Withdrawing From My IRA?

Relying on the IRA account you’ve, you may want to begin taking distributions out of your account, even in the event you don’t essentially want the cash instantly.

Conventional IRA

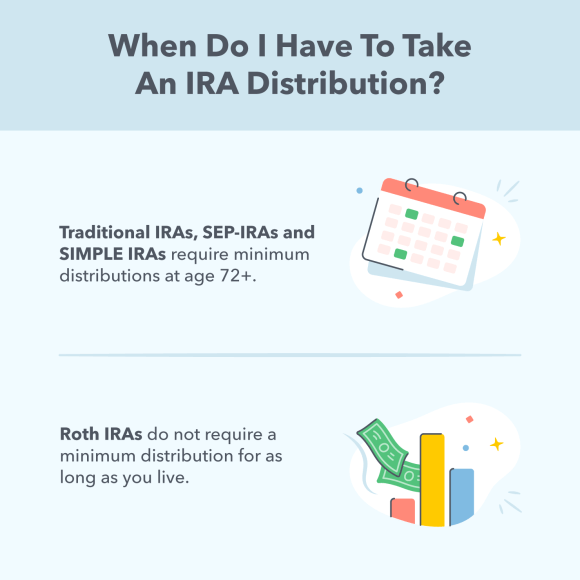

As a result of your hard-earned {dollars} are added to your conventional IRA account pre-tax, it’s not unreasonable to grasp that the IRS would ultimately need to begin amassing taxes. To assist guarantee this, the IRS mandates required minimal distributions (RMDs) after a sure age.

The quantity of distributions you will need to take is decided by the IRS; they divide the quantity of the IRA account steadiness on December 31 of the earlier yr by your life expectancy. This cash will probably be taxed as earnings at your present fee, and it’s vital to know that in the event you miss an RMD, the IRS will penalize you 50% of the whole quantity that ought to have been withdrawn.

You should begin taking RMDs by April 1 of the yr after you flip 72 years outdated, even in the event you don’t want the cash. The deadline annually to take these distributions is December 31. If you want, you possibly can at all times take greater than the RMD, however do do not forget that all distributions are taxed as earnings at your customary tax fee together with any further earnings you will have.

Different IRA Accounts

Just like a conventional IRA, the SEP-IRA and SIMPLE IRA each require RMDs to be taken on the age of 72. Once more, these are taxed as earnings at your customary tax fee, together with some other earnings you’ve made all year long.

Roth IRA

Not like the above accounts, a Roth IRA account doesn’t have an RMD clause. If you do not need to withdraw your funds at a sure time, you don’t need to — you possibly can let the funds proceed to develop tax-free for so long as you’d like.

It’s vital to notice that in the event you had been to die, your beneficiaries (aside from a surviving partner) should take RMDs from the account after it’s inherited.

Do I Pay Taxes on My IRA Withdrawal?

One other vital side of IRA withdrawals is the quantity of taxes that you will want to pay, each throughout contribution and on the time of distribution.

Conventional IRA

As a result of conventional IRAs are funded with pre-tax {dollars}, these withdrawals are taxed as common earnings primarily based in your tax bracket for that tax yr. Sadly, whilst you can keep away from the ten% penalty by ready till the age of 59.5 to withdraw out of your IRA account, you will be unable to keep away from the taxes.

Your conventional IRA deduction is taken into account tax-deductible if you’re not lined by a retirement plan, corresponding to a 401(okay), out of your employer. If you’re married, your partner additionally can’t be lined by a retirement plan to ensure that these deductions to be tax-deductible.

Different IRA Accounts

Just like a conventional IRA, SEP-IRAs and SIMPLE IRAs are additionally funded by pre-tax {dollars}; subsequently, when making a withdrawal, you will need to pay earnings tax at your customary tax fee.

Roth IRA

As a result of Roth IRA contributions are funded with post-tax {dollars}, these contributions may be withdrawn tax-free. On account of this, your withdrawals should not tax-deductible. As well as, certified distributions (these which might be taken after you’ve reached age 59.5 and the account has been open for 5 or extra years) should not topic to taxes both.

Understanding the IRA withdrawal age, irrespective of the kind of IRA, is vital to maximise the cash in your pocket and keep away from pointless penalties. By working with a TurboTax Stay tax knowledgeable, you possibly can guarantee that you’re not solely contributing to the very best plan on your circumstance but additionally making your cash be just right for you.

[ad_2]