[ad_1]

New examine examines whether or not hole for older owners resulting from low down funds or slower appreciation.

Homes are crucial. For many households, their home is the only largest asset outdoors the advantages promised from Social Safety. The issue is that Black households are much less prone to personal properties and, after they do, they see decrease wealth accumulation in comparison with White owners. A current examine by Heart researchers focuses on the second situation – the destiny of Black households who do turn into owners. Particularly, what share of the housing wealth hole amongst older Black and White owners is because of disparities on the time of first buy, and what share is because of slower appreciation over the course of homeownership?

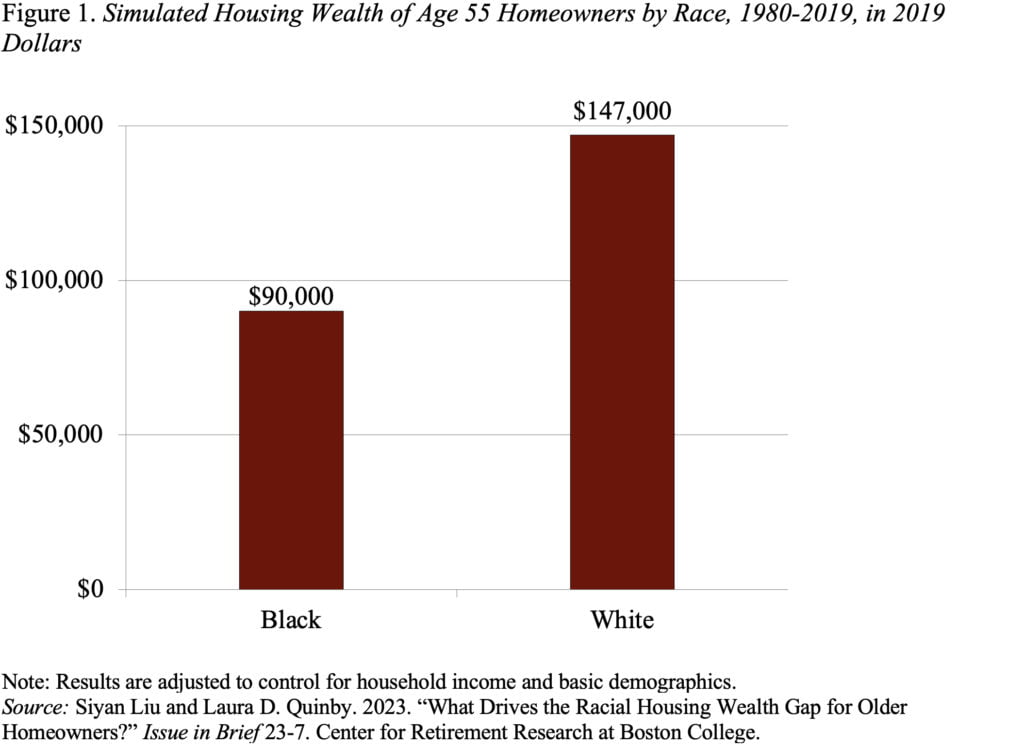

The examine makes use of the Panel Research of Earnings Dynamics (PSID) to have a look at the expertise of Black and White households who purchase their first residence between 1980-2000 and follows them by way of 2019, limiting the pattern to those that are nonetheless owners at age 55. The aim is to match Black and White owners who, primarily based on their very own socioeconomic traits, might sound equally properly located to build up housing wealth. The outcomes present that after controlling for earnings and fundamental demographics, Black owners approaching retirement have solely 61 % of the housing wealth held by older White owners (see Determine 1).

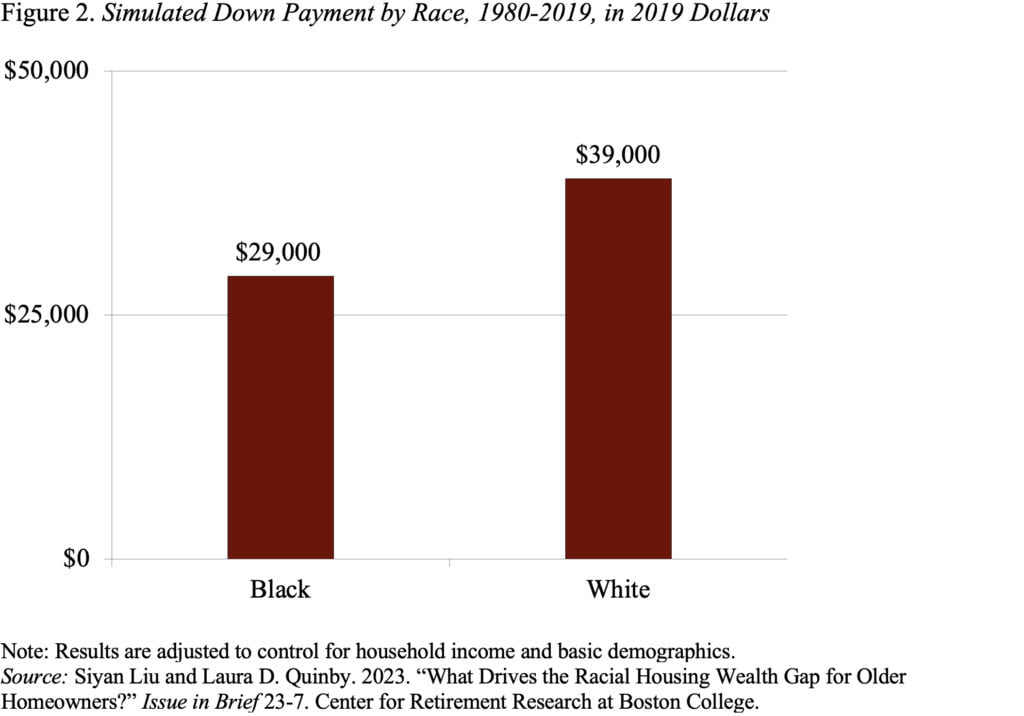

To know the drivers of this hole, the authors start by evaluating the down funds for Black households and their otherwise-similar White counterparts. It seems that the down funds of Black homebuyers, who’re much less prone to obtain help from dad and mom, are solely 67 % of these of Whites (see Determine 2). In consequence, Black households are constrained to purchasing cheaper first properties than White households.

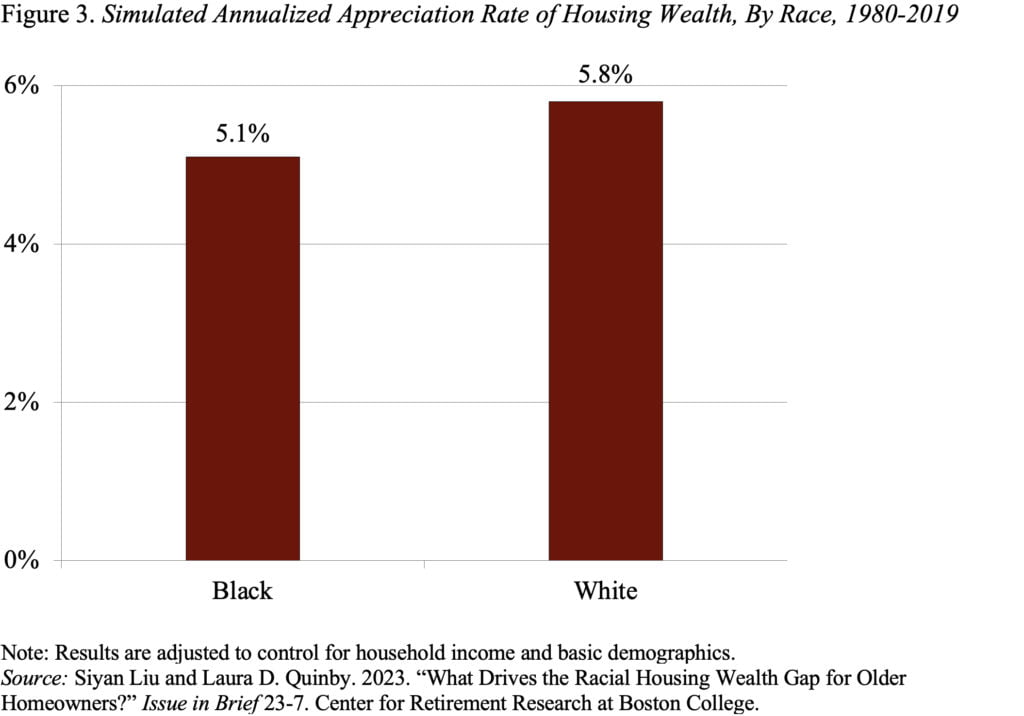

Not solely do Black owners begin from a weaker place, however their housing wealth additionally grows extra slowly over time (see Determine 3). Compounding a 0.7-percentage-point drawback over many years makes a giant distinction.

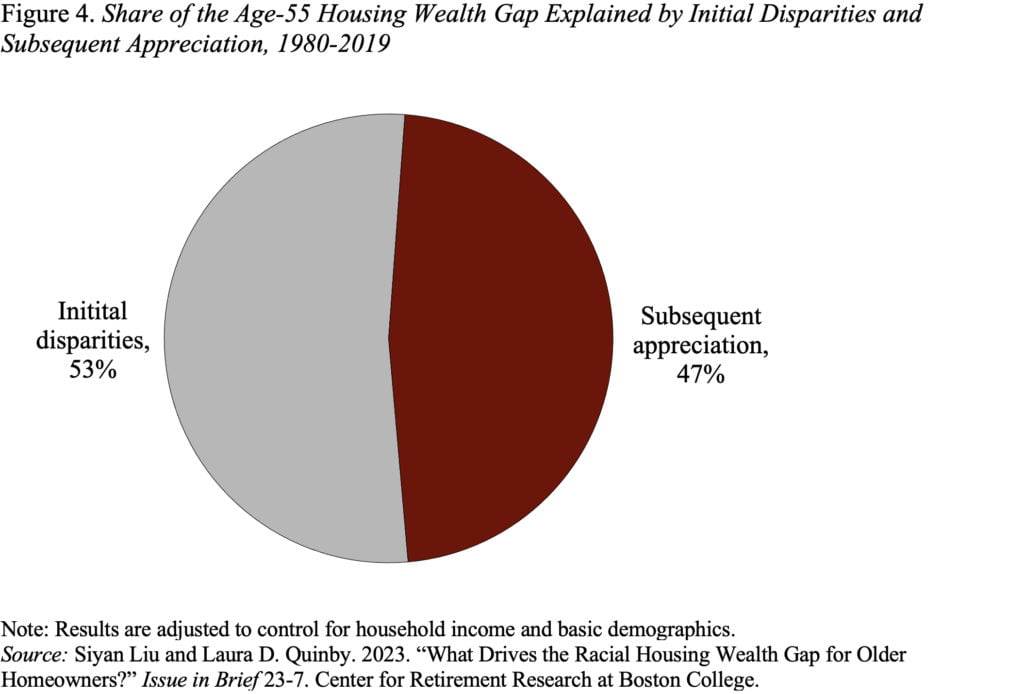

The query is the related significance of the down fee versus the speed of appreciation in explaining the housing wealth hole. One technique to reply that query is to contemplate how massive the hole would have been had Black households began off with the identical down fee as White households, however then subsequently earned their precise, decrease appreciation fee. Determine 4 presents the outcomes. Whereas, the precise share is delicate to how the thought experiment is framed, each the down fee and the slower appreciation play a major function.

In brief, Black households begin with a smaller down fee, see much less appreciation as residential segregation pushes them into less-expensive neighborhoods with restricted public funding and slower appreciation, and are much less prone to improve their starter properties to bigger, costlier homes with quicker appreciation.

[ad_2]