[ad_1]

Andrew Bailey, the Governor of the Financial institution of England, gave one other of his excruciating speeches on economics yesterday.

You solely needed to learn it to understand how far adrift from actuality he’s. Begin with this:

Financial coverage, in different phrases, works via the administration of combination demand within the financial system. Merely put, when inflation is just too excessive, we enhance Financial institution Price to dampen demand; when inflation is just too low, we scale back Financial institution Price to spice up demand.

The plain query Bailey needed to reply as a consequence is the place is the proof of extra demand? In a rustic with consumption flatlining and incomes falling there will be none. He clearly has not seen that straightforward reality.

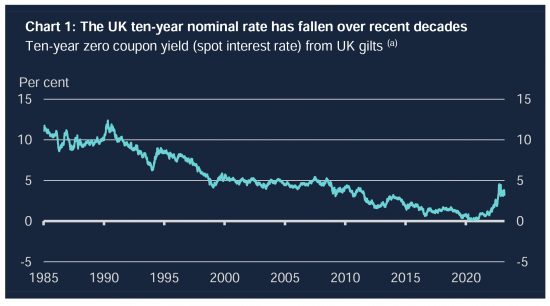

As a substitute, Bailey tried to justify this chart:

Bailey claimed that the aberrational uptick on the finish of the chart, which is in fact the results of his coverage, could possibly be defined as follows:

A very good a part of this decline will be defined by decrease inflation itself. It displays the success of inflation concentrating on in delivering low and secure inflation over lengthy intervals of time. Beneath inflation concentrating on, financial coverage makers act decisively to return inflation to focus on at any time when shocks trigger costs to rise or fall by an excessive amount of. So even when inflation is now excessive, individuals can belief inflation to come back again down to focus on. Because of this, savers have come to demand a decrease premium to compensate for anticipated inflation.

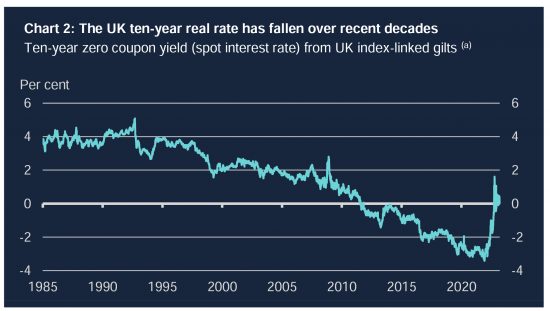

Very politely, that is drivel. The declare is that the Financial institution has been so good at concentrating on inflation the necessity for curiosity funds has pale away. His personal subsequent chart proves that’s nonsense:

Folks didn’t quit on curiosity. As a substitute, charges went markedly damaging from 2008 onwards. The development was closely downwards. The present coverage he’s selling, within the absence of any clarification of its want based mostly on there being no extra demand within the financial system, is a blatant try to revive optimistic rates of interest. The issue is that there isn’t any proof to counsel such charges are sustainable.

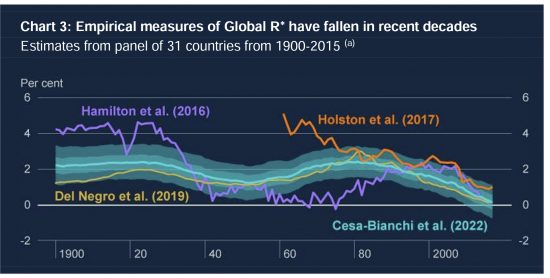

That is proven in his third chart, which refers to international common long run rates of interest, the place the persistent downward development is seen because the onset of neoliberalism and the expansion in inequality:

Bailey has a unique clarification for this. He argues the downward development is for 2 causes. The primary is that there are extra outdated individuals within the UK. The second is that productiveness in companies has fallen, particularly since 2008. He stated:

As individuals accumulate financial savings over their working life to fund their retirement, wealth within the financial system will increase because the age distribution shifts in direction of older cohorts.

As statements of the plain go, that is first fee. This has all the time been true. What he stated subsequent shouldn’t be true:

So ageing households have sought to lend extra at a time when much less productive companies have sought to borrow much less. The one strategy to set up an equilibrium between the provision and demand available in the market for investable funds – that’s, to incentivise companies to take a position this extra wealth into productive capital – has been for the value of these funds, the actual rate of interest, to fall.

That is nonsense for 3 causes.

First, it means that markets set rates of interest. However the entire premise of central financial institution regulation of financial coverage is that the central financial institution is in a position to take action. Bailey has to consider that that is true or his complete argument, and job, fails. He can not make each arguments in the identical speech: solely one among them is true.

Second, the argument assumes that banks are intermediaries between savers and buyers and that funding comes from saved funds. However the Financial institution of England admitted that this mannequin of banking was not true in 2014. They admitted that it’s credit score that funds lending and so funding, and so saving. In that case, as soon as once more he can not make an argument that the Financial institution is aware of shouldn’t be true.

Third, he ignores the truth that financial savings have different makes use of, comparable to hypothesis. Financialised markets haven’t made their returns from investing: they’ve made cash from speculating in cash itself. Once more, it’s absurd that he doesn’t acknowledge this reality.

The result’s Bailey’s claims make no sense in any respect.

That stated, he could also be slightly nearer to the reality on productiveness, the place he stated:

[F]ollowing the monetary disaster, manufacturing productiveness progress fell again sharply. This fall in manufacturing productiveness is the primary reason for the slowdown.

The explanations behind it are a lot debated – and productiveness could also be more durable to measure within the trendy financial system the place companies make investments as a lot in intangible capital, like software program and branding, as in bodily capital, like buildings and equipment. Measurement issues could possibly be a giant a part of this. However a lot additionally factors to structural change. Maybe new concepts have change into more durable to come back by, or maybe technological innovation and specialisation have pale as globalisation slowed.

I feel he’s proper about measurement. He’s additionally proper in regards to the scarcity of concepts: there look like only a few. There may be nothing like the thought of the web round now to rework the entire means of enterprise and to rework markets as there was within the 90s and 00s. AI shouldn’t be it, I’m pretty positive.

However being partially proper doesn’t assist his argument that enterprise shouldn’t be investing because of this. It’s not investing for 3 causes.

The primary is that there are greater superficial returns to be constituted of hypothesis.

The second is that there’s that there isn’t any actual demand for what enterprise is making. The individuals with cash to spend – the extra aged – are saving extra exactly as a result of that’s the case.

Third, elevated inequality as a result of the wealthier are saving extra has lowered the multiplier impact on funding – and so has lowered the motivation to do it.

Even damaging actual rates of interest didn’t induce companies to spend on funding. Why Bailey now thinks artificially excessive optimistic rates of interest, set with the deliberate intention of deflating the market in actual items and providers, will obtain that consequence is difficult to think about.

Bailey’s argument is that getting older individuals again to work will apparently resolve this downside. Once more, when he additionally thinks that they’ve the means not to take action, how this is sensible is under no circumstances clear. Certainly, how he even makes the leap from one place to the opposite – besides by saying that that is the place the expansion potential within the financial system is – is difficult to fathom.

Bailey concluded saying warfare has hit us onerous, as have the phrases of commerce (name it Brexit). There’s a downturn, he says, in earnings that we’ve to acknowledge, however regardless of that he’s intent on forcing inflation down by deflating the financial system some extra. And, he added, he noticed no menace from a banking disaster, to which he had not beforehand referred. These conclusions didn’t movement from something he stated. I’ve to conclude that every one that got here earlier than the conclusion was a useless try and justify excessive rates of interest when in actuality none may ever be present in the true financial system.

So what ought to he have stated? I provide simply three of many issues that he might need thought-about.

The primary is that inequality must be tackled, very urgently. Cash needs to be given to those that can spend it and be taken away from those that won’t. The distortionary results of extra financial savings must be addressed.

Second, markets are out of concepts as a result of general individuals know we don’t want extra ‘stuff’. What we want is sustainability. It’s the actual reverse of extra uselessly differentiated merchandise solely able to being offered on the again of large promoting campaigns that create emotions of dissatisfaction which the merchandise they’re selling can not dispel as a result of they meet no identified human want.

Third, what we want as a substitute is extra public providers. The best way to ship progress is to provide what individuals really need, which is an improved NHS, higher schooling, social care and justice, and all from individuals paid pretty to ship these issues. He’s unsuitable to look to the marketplace for options in different phrases: what we’ve is a shortfall in state provide within the UK.

Bailey bought nowhere close to this. It reveals how unsuitable it’s to place financial coverage within the arms of such an individual and his acolytes: they don’t have any clue about economics, the true world or what’s required. Dwelling in their very own very comfy bubbles ensures that. All they’ll do is make up falsehoods to justify what they’re doing, and as this speech confirmed, Bailey shouldn’t be even excellent at that.

[ad_2]