[ad_1]

The Baltic Dry Index (BDI) makes for an fascinating, however imperfect, main indicator for the actions of inventory costs. I do not know precisely why this works, and why it often stops working, however the relationship has been happening for years and so, sooner or later, one simply stops asking why.

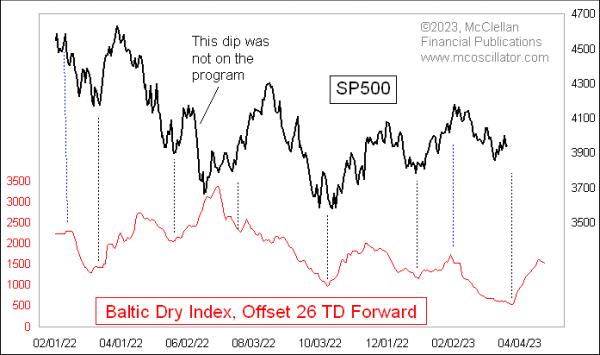

On this week’s chart, the plot of the BDI is shifted ahead within the chart by 26 buying and selling days. I’ve used 24TD earlier than, and, in the intervening time, a 26TD lag time appears to be working higher. I do that shift within the chart to make it simpler to see how the BDI’s actions get repeated within the plot of the S&P 500.

The Baltic Dry Index is calculated and revealed by the Baltic Alternate, a maritime business affiliation and freight market info supplier. The BDI is a median of the transport charges charged for 3 totally different classes of dry bulk timecharter ships. The “dry” reference means it’s speaking about lease charges for cargo ships that haul supplies like iron ore, versus ships that haul containers, or oil tankers. Analysts view the BDI’s pricing info as a sign of financial energy, as corporations are roughly keen to pay up for getting industrially-essential supplies shipped.

How that interprets into being a sign of what inventory costs are going to do 26TD later is a part of the fascinating thriller. However it has been working this manner for years.

Proper now, this mannequin is saying that costs ought to resume their decline towards a low due on the finish of March 2023, after which flip upward in April, at the least for some time. The newest information for the BDI exhibits a tiny downturn, which can matter for inventory costs, however not till after the 26TD lag time goes by.

Earlier than you exit and plan your buying and selling primarily based on this chart, it is very important word that this relationship doesn’t at all times work completely. Famous in that chart above is a major adversarial tour off observe in June 2022, when the S&P 500 fell laborious, in disagreement with the BDI’s message. That was adopted in July and August 2022 by the S&P 500 working additional laborious to rally and attempt to get itself again on observe.

There have been different cases within the historical past of this relationship the place the inventory market went off observe in an excellent larger approach. Here’s a longer-term look again:

The entire relationship went via a yearlong interval of inversion again in 2019, which was coincidentally (or not?) proper after the collapse of a retention pond at an iron mine in Brazil run by the corporate Vale, which despatched an enormous disruption via the entire iron ore market. The main indication relationship received again into sync once more simply in time for the COVID Crash backside in March 2020, however it inverted once more on the finish of 2020. It labored properly in 2021 and early 2022, after which we are able to see on this long-term chart that the bizarre inventory market dip in June 2022 was one other occasion of an inversion to this relationship.

Any main indication relationship that’s fickle sufficient to invert prior to now is suspect for maybe doing so once more sooner or later, and normally in the intervening time when one is relying on it most fervently to maintain working.

So in case you select to consider on this relationship, which appears to be working rather well proper now, simply remember that it doesn’t advantage one’s full belief.

Subscribe to High Advisors Nook to be notified at any time when a brand new submit is added to this weblog!

[ad_2]