[ad_1]

The Fed begins its March FOMC assembly right this moment.

Tomorrow at 2PM EDT, the Fed will announce its coverage determination for the month. And it doesn’t matter what the Fed does, it’s in SERIOUS hassle.

Why?

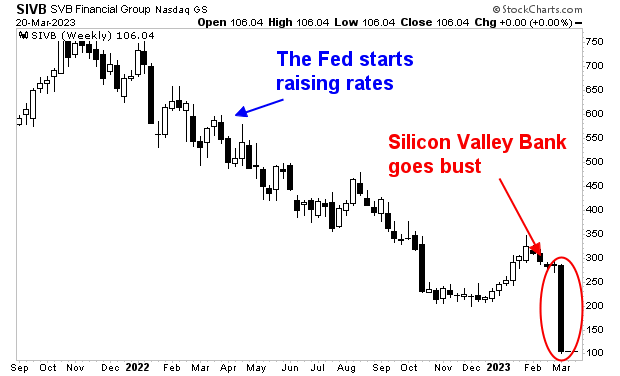

If the Fed raises charges, that is solely going to extend stress on the banking system.

Depositors, each within the U.S. and Europe, are fleeing banks as a result of A) the banks pay subsequent to nothing in curiosity, whereas you possibly can earn 3%-4% in a Cash Market Fund or short-term T-Payments and B) depositors are actually terrified that the banks at which they maintain their cash may go bust.

Take into account that U.S. simply skilled its 2nd and third largest financial institution failures in historical past within the final two weeks. And over the weekend, the $1.4 trillion behemoth Credit score Suisse needed to be rescued by UBS and the Swiss Authorities.

Put merely, the problems that resulted in Silicon Valley Financial institution and Credit score Suisse going bust / needing to be rescued will solely worsen if the Fed decides to boost charges once more tomorrow.

The choice for the Fed isn’t a lot better.

Inflation is at the moment clocking in at 6%.

If the Fed doesn’t elevate charges tomorrow, then inflation will rage.

I’m speaking a couple of scenario during which the U.S. turns into an rising market, with inflation uncontrolled, a foreign money collapse, and extra.

Put merely, the Fed is screwed both approach.

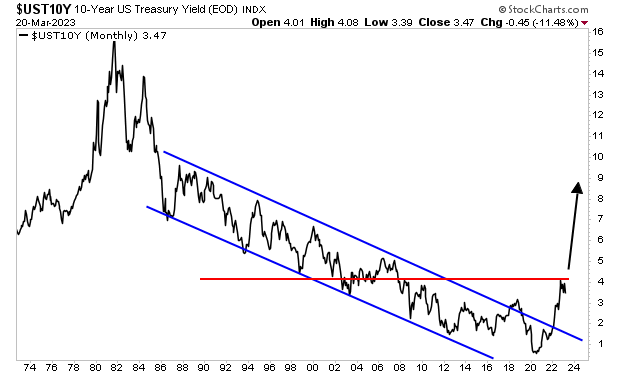

Sure, if the Fed doesn’t hike charges tomorrow there shall be a aid rally in danger belongings. However that aid will rapidly flip to terror as U.S. Treasury yields explode increased.

Bear in mind, the U.S. has over $31 TRILLION in debt and a Debt to GDP ratio of 120%. There are over $70 trillion debt securities within the monetary system and one other $500 TRILLION in derivatives that commerce based mostly on rates of interest.

What’s occurs to all that debt if the yield on the 10-12 months U.S. Treasury spikes to 7% and even 9% if the Fed permits inflation to rage out of concern of worsening the financial institution disaster?

[ad_2]