[ad_1]

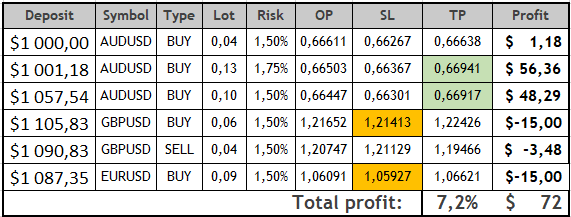

In the present day I current you an summary of offers made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD forex pairs for the week from March 13 to 17, 2023.

For comfort and well timed receipt of indicators I take advantage of the Owl Sensible Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the pattern route of the upper timeframe.

EURUSD evaluation

The primary asset we are going to shortly evaluation is EURUSD. The reviewwill be brief as a result of the indicator has proven just one commerce on this asset and sadly the commerce was unprofitable as a result of excessive market volatility on this space.

Fig. 1. EURUSD BUY 0.09, OpenPrice = 1.06091, StopLoss = 1.05927, TakeProfit = 1.06621, Revenue = -15$.

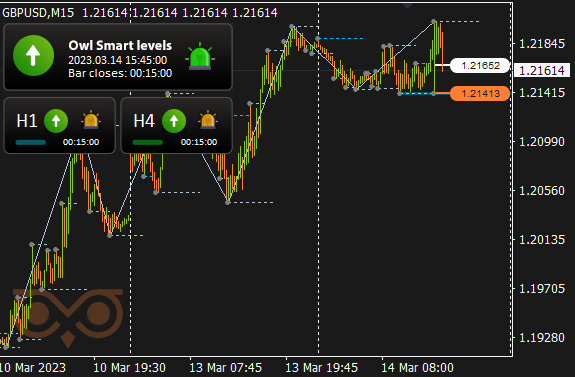

GBPUSD evaluation

The Owl Sensible Ranges Indicator has not but been skilled to take international information under consideration however the dealer who makes use of the indicator can do it. It’s well-known that in the course of the launch of particularly important information the market habits is tough to foretell: there may be sturdy risky fluctuations and gaps. Within the morning of March 14 there have been launched two information which influenced the GBP-pair buying and selling a technique or one other: 1) The common payroll together with bonuses and a couple of) Change within the variety of jobless claims.

The commerce was unfavorable on March 14. Coincidence? I do not assume so. Though, in fact, we do not make a direct correlation right here and we’re not timing it.

Fig. 2. GBPUSD BUY 0.06, OpenPrice = 1.21652, StopLoss = 1.21413, TakeProfit = 1.22426, Revenue = -15$.

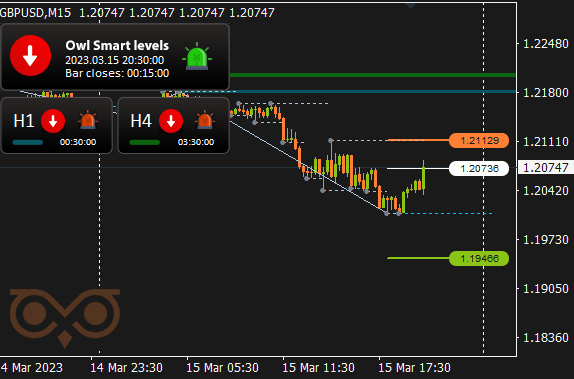

The subsequent shedding commerce was saved and the loss was minimized decreasing it to the worth of “arithmetic error”. Common readers know that after opening a commerce it’s obligatory to watch the indicator, and if it exhibits the change of the large arrow route, the commerce ought to be closed within the “handbook mode” with out ready till the StopLoss order does it.

Fig. 3. GBPUSD SELL 0.04, OpenPrice = 1.20747, StopLoss = 1.21129, TakeProfit = 1.19466, Revenue = -3.48$.

Additional, on March 16 and 17 the marketplace for probably the most half was within the lifeless zone the place the indicator doesn’t suggest to open trades.

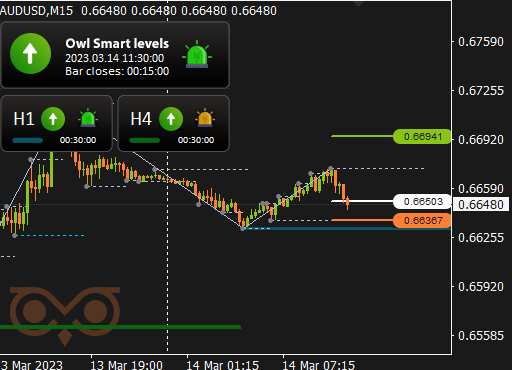

AUDUSD evaluation

On March 13 and 14 there have been two critical information for USD, and on the sixteenth there was information for each USD and AUD. Owl Sensible Ranges dealt with these buying and selling days very nicely suggesting trades within the asset, though considered one of them nonetheless needed to be “saved”.

Fig. 4. AUDUSD BUY 0.04, OpenPrice = 0.66611, StopLoss = 0.66267, TakeProfit = 0.66638, Revenue = +1.18$.

In fact, this was a commerce with three “666” within the worth of the OpenPrice quantity. The market modified route and the commerce needed to be closed at 0.66638 as a substitute of the a lot anticipated 0.67723. The large arrow on the Owl Sensible Ranges modified route and shade from inexperienced to pink signaling this sudden change in route. The commerce has introduced in an entire greenback however it has remained within the plus, which, the truth is, corresponds to our job – to stay worthwhile beneath any circumstances.

Fig.5. AUDUSD BUY 0.13, OpenPrice = 0.66503, StopLoss = 0.66367, TakeProfit = 0.66941, Revenue = +56.36$.

The subsequent commerce (Fig. 5) has “classically” closed at TakeProfit and has introduced a very good revenue.

Then, on March 15, the market was within the lifeless zone nearly a day. It appeared that the week might be closed this fashion on the forex pair however the subsequent day the indicator discovered another worthwhile commerce, which put the week in its closing place.

Fig.6. AUDUSD BUY 0,13, OpenPrice = 0,66447, StopLoss = 0,66301, TakeProfit = 0,66917, Revenue = +48.29$.

The final commerce of the week additionally was closed with TakeProfit. Simply because the earlier one, it introduced fairly a very good revenue making fairly a good revenue for a small deposit.

Abstract:

On this evaluation I attempted to remind you that whereas planning a buying and selling technique, it’s helpful to contemplate the key international information that may considerably have an effect on the market volatility. And, though the buying and selling technique utilizing the Owl Sensible Ranges Indicator relies solely on the technical evaluation, the basic evaluation, the truth is, shouldn’t be forgotten and it may be very helpful to take its principal elements into consideration through the use of the indicator.

See different critiques of the Owl Sensible Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]