[ad_1]

The next is an edited extract from the report that Danny Blanchflower and I’ve submitted to the Home of Commons Treasury Committee on quantitative easing (QE), quantitative tightening (QT) and the Financial institution of England Asset Buy Facility.

The goal of this a part of the report is to point out that the extent of band gross sales deliberate by HM Treasury and the Financial institution of England together over the subsequent few years is completely unsustainable with out pushing curiosity ranges to unprecedentedly excessive ranges that will likely be deeply damaging to the financial system, which is why we advocate that QT be deserted.

The submission is very necessary now. A wave of banking stress within the USA and Europe is already proving us to be proper, as is the brand new credit score line required by banks to revive market solvency. It’s obviously obvious that the forecasts now we have made within the report displaying the hazard of cancelling QE, implementing QE and the ensuing excessive actual rate of interest coverage is totally proper. So too then is court docket coverage prescription, which is fee cuts, cancelling QT altogether and a brand new spherical of QE.

The information sources used for the analysis that follows has been printed by the federal government or its businesses:

- HM Treasury’s Debt Administration Workplace

- The Financial institution of England

- The Financial institution of England Financial Coverage Committee

- The Home of Commons Library

- The Workplace for Nationwide Statistics

- The Workplace for Finances Accountability

The place interpretation has been required that is famous within the related part beneath, however nothing however official sources have been used within the manufacturing of this report. An in depth bibliography of sources is hooked up.

Specifically, information has been extracted to point out:

- The gross worth of presidency bonds (gilts) issued by yr. The Debt Administration Workplace printed this information for all years to 2021/22 coated by this overview. Thereafter the figured has been computed by evaluating the forecast public sector borrowing requirement for 2022 – 2028 as printed by the Workplace for Finances Accountability in November 2022 and the forecast gilt redemptions forecast by the Debt Administration Workplace in March 2022.

- The federal government bonds (gilts) redeemed annually. As all UK authorities bonds at the moment are issued for a finite interval some fall attributable to be repaid to these individuals or establishments proudly owning them yearly. The figures for deliberate redemptions for April 2022 onwards have been taken from Debt Administration Workplace forecasts printed in March 2022. Figures for earlier years have been estimated by evaluating the overall determine for gilts in concern on the finish of every such yr as printed by the Workplace for Nationwide Statistics in October 2022 with the worth of bonds notified as issued by the DMO for every such yr as suggested by the Debt Administration Workplace in its annual report back to March 2022, the distinction being assumed to be redemptions.

- Internet UK authorities bonds issued have been calculated as the web of gross bonds issued much less bonds redeemed in a yr.

- Quantitative easing information is predicated on publications by the Financial institution of England web site in December 2022 with allocation to years previous to 2020 being primarily based on information printed by the Home of Commons Library in 2016.

- Quantitative tightening information has been primarily based on Financial institution of England ahead steering statements. They’ve mentioned that they want to scale back the dimensions of their gilt holdings and set a goal of an £80 billion discount in that complete holding within the yr from September 2023. It has been assumed that this stage of quantitative tightening will proceed every year thereafter, however as famous beneath this assumption is different within the discussions that observe.

GDP till March 2022 information has been imputed from information within the Workplace for Nationwide Statistics public funds launch for October 2022 to make sure consistency with different information used on this train. Forecast information from thereon from the Workplace for Finances Accountability forecasts issued in November.

CPI information to 2022 is that printed by the ONS while forecast CPI thereafter has been taken from the OBR forecast of November 2022.

Financial institution of England base fee information has been extracted from its web site.

Besides as famous no different information sources are used within the work.

Estimates should not adjusted for inflation as money flows are being mentioned.

It’s assumed all through the workings that observe that every one gilt redemptions are reinvested in various gilt choices, excepting from 2022 when QT operations change this assumption. The idea is taken into account affordable in London’s monetary markets.

Based mostly upon this date the core discovering of the evaluation that follows is summarised in Chart 3:

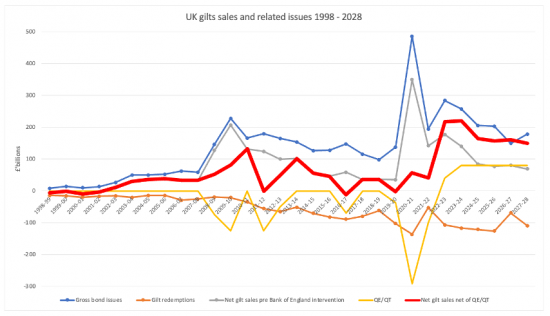

UK gilt gross sales and associated points 1998 – 2028

The information that helps this chart is out there in appendix 1 to the report.

This chart means that till 2008 modest gilt gross sales and regular gilt redemptions led to very low ranges of web gilt gross sales from 1998 till 2002, with solely a modest enhance thereafter. Given that there have been no QE or QT operations on this interval web gross sales earlier than and after such operations have been the identical and are highlighted by the daring pink line on the chart.

From 2008 onwards gross gilt gross sales elevated considerably over ranges seen earlier than the monetary disaster of that yr. Nevertheless, quantitative easing had a big impression from 2009 onwards and considerably diminished web gilt gross sales after taking redemptions under consideration. The outcome was that in two years (2011-12, and once more in 2016-17 when a post-Brexit spherical of QE happened) there have been web unfavourable bond gross sales within the yr.

The Covid pandemic modified authorities funds significantly. Regardless of the claims made by the federal government that taxpayers paid for this disaster that was not true: gross bond gross sales did, at beforehand distinctive ranges. Nevertheless, QE additionally reached beforehand unanticipated ranges and the web outcome was that precise borrowing within the two disaster years of 2020-21 and 2021-22 was a median of £49.2bn every year, which in contrast favourably with the typical web borrowing of £48.1 billion every year from 2008 to 2020.

The distinctive interval on the chart is the info for the interval from April 2022 onwards. Pushed by distinctive prices arising from authorities monetary help to shoppers and companies ensuing from the power worth disaster that developed as a consequence of the struggle in Ukraine that started in February 2022 the UK authorities deficit was forecast to extend in 2022-23 to £177bn, which can also be assumed to be the worth of web gilt gross sales in that yr.

That deficit is forecast to fall after 2020-23, however common gilt redemptions from 2022 to 2028 at £108.2bn every year are anticipated to be a lot greater than the typical of £61.1 billion every year from 2008 to 2020.

On prime of the ensuing greater than traditionally skilled ranges of web gilt gross sales, the impression of QE is predicted to vanish on this interval (an odd exception to help solvency in monetary markets in October 2022 being famous). That’s as a result of the Financial institution of England has introduced its intention to begin lively quantitative tightening operations. Passive quantitative tightening started in February 2022 when the proceeds of gilt redemptions within the portfolio held by the Financial institution of England ceased to be reinvested in gilts as they occurred. These mixed quantitative tightening impacts are forecast by the Financial institution of England to be on the fee of £80 billion within the first yr of that train and have been forecast for this train on the similar fee annually thereafter. If that occurs, then common bond gross sales that the monetary markets will likely be anticipated to fund from 2022 till 2028 will common £178 billion every year, which is an unprecedented sum.

Solely within the years 2010-11 and 2013-14 have monetary markets been anticipated to fund greater than £100 billion in a yr in web bond points, and the primary was nearly instantly adopted by important quantitative easing. From 2022 onwards anticipated web gilt gross sales exceed £200 billion in some years and are £178 billion on common within the interval 2022 – 2028.

Consequently, what this information makes clear is that the present authorities is forecasting that it’s going to borrow, earlier than both QE or QT are thought-about, at unprecedented charges over the subsequent few years, which interval will embrace nearly your complete lifetime of the subsequent parliament and whichever authorities is then in workplace. Common borrowing over this era earlier than QE or QT are taken under consideration is prone to exceed £100 billion a yr and is larger than in any previous interval. Even permitting for the impression of inflation, which the OBR forecasts counsel will likely be near zero by 2024 and modest thereafter (see beneath), the outcome will likely be an unprecedented demand for presidency borrowing from monetary markets throughout this era until motion is taken to handle this concern.

That impression will seemingly embrace these results:

- Sustained, greater than in any other case required ranges of Financial institution of England base fee to take care of a sufficiently excessive rate of interest atmosphere to draw international funds into UK authorities bonds;

- Loosening of economic rules to permit London to turn out to be (as soon as once more) the epicentre for ‘sizzling’ funds of questionable origin, cementing its repute as a tax haven and creating circumstances probably comparable to those who existed previous to the 2008 monetary crash;

- Important and persevering with downward strain on authorities spending plans to attempt to maintain borrowing inside indicated ranges regardless of the ensuing impression on society. Austerity will turn out to be endemic, in different phrases.

If the Financial institution of England have been to pursue its plan for quantitative tightening these issues would turn out to be very a lot worse. That is exacerbated by the truth that there may be, primarily based on the info famous, no obvious capability for the Financial institution of England to hunt to promote additional bonds right into a monetary market when these markets’ web willingness to supply funding to the federal government at rates of interest which can be sustainable for the remainder of the financial system could also be restricted.

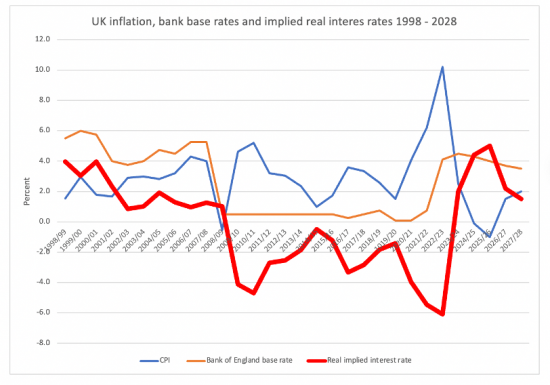

This final level would possibly clarify the terribly excessive web constructive actual charges of curiosity forecast by the Workplace for Finances Accountability at current, that are as proven on this chart which compares forecast Financial institution of England base charges with forecast CPI inflation charges:

Sources as famous in textual content, writer calculations

These actions in rates of interest, displaying 2022 – 23 in isolation due to the distinctive inflation in that single yr will be summarised as follows:

Desk – Actual rates of interest

| CPI | Base fee | Actual rate of interest | |

| Common 1998 – 2008 | 2.8 | 4.9 | 2.1 |

| Common 2008 – 2020 | 2.6 | 0.5 | -2.2 |

| Common 2020 – 2022 | 5.1 | 0.4 | -4.7 |

| 2022-23 | 10.2 | 4.1 | -6.1 |

| Common 2022 – 2028 | 1.0 | 4.0 | 3.0 |

Sources, as famous in textual content

While not acknowledged, the idea behind this projection have to be that the one means by which the distinctive fee of gilt gross sales, famous beforehand, will be sustained is by paying distinctive actual rates of interest to those that would possibly purchase these bonds, lots of whom will come from exterior the UK.

The impression of those charges on households with excessive ranges of private debt, and most particularly on households with mortgages, are not possible to overstate: in lots of instances these households can have unaffordable borrowing if persistent excessive web constructive actual rates of interest persist at, or above, the charges famous in Chart 6, which information is summarised in appendix 2 to this notice. As a consequence, excessive ranges of private chapter would possibly outcome. This in flip would possibly result in mortgage default and a possible banking disaster. These looking for to hire home lodging in its place won’t discover issues any higher: many landlords borrow closely to purchase their property portfolios and consequently they have an inclination to cross on rising curiosity prices to their tenants by means of elevated rents. These dwelling in rental lodging are prone to face crises of affordability because of this.

The impression of those excessive rate of interest prices is prone to be seen past the housing market:

- Indebted households can have little or no capability to spend on client items past these required to maintain themselves, with important recessionary impression on the remainder of the financial system, and most particularly the retail, leisure and hospitality sectors.

- The price of enterprise funding will likely be excessive. Total charges of UK enterprise funding have been low even when rates of interest have been maintained at low ranges from 2009 to 2021. They’re now prone to fall additional nonetheless, additionally contributing to a recessionary atmosphere.

- In a recessionary atmosphere the chance that authorities taxation revenues will be maintained on the ranges forecast by the Workplace for Finances Accountability in November 2022 is diminished.

- If governments search to equate present (i.e. non-investment associated) expenditure with taxation revenues both in a monetary yr or over a restricted variety of years, as is the at present acknowledged goal of each the UK’s main political events, then important downward strain on authorities expenditure will outcome.

- The consequence is prone to be a sustained recession in a scenario the place public companies are failing.

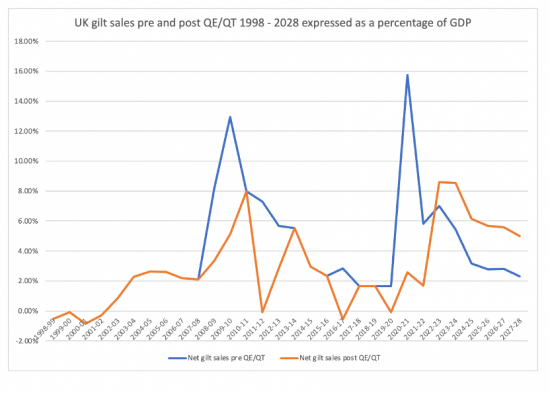

The aberrational nature of what’s forecast is emphasised by this Chart:

Sources: as famous in textual content

Sources: as famous in textual content

The persistent stage of gilt gross sales forecast for 2022-23 onwards is in contrast to something beforehand famous when expressed as a proportion of GDP. There is no such thing as a proof that this stage of gross sales is sustainable if QT takes place as at present deliberate, and possibly in any case given the state of the financial system

There are a number of methods by which the potential financial crises that the famous deliberate stage of gilt gross sales would possibly give rise to will be averted.

Firstly, and most clearly, the Financial institution of England could possibly be instructed to finish its quantitative tightening programme, whose sole function would seems to be to help excessive rates of interest when the financial system has no want of those and they’re, as an alternative, economically harmful. This nevertheless, could also be seen as impacting the Financial institution’s independence. There are main points although of groupthink which have to be overcome (Blanchflower, D. and A. Levin, (2023) ‘Fostering range of views in financial policymaking’, Finance & Growth, IMF, March.

Secondly, the Financial institution of England could possibly be instructed to cut back its financial institution base charges on the first attainable alternative[2]. On condition that the elevated rates of interest now being promoted by the Financial institution of England should not required to handle the inflation we’re struggling, whose origins are in Covid provide chain disruption and power and meals worth disruption created by struggle in Ukraine, each of which have occurred wholly exterior the UK, this lower would have little or no impression on UK inflation charges. These charges are, in any case, forecast by the OBR to fall to round zero or beneath by early 2024 as a possible consequence of the mathematical strategies used to calculate inflation indices.

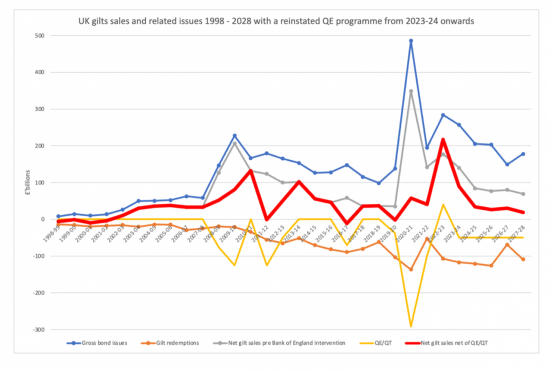

Third, on condition that the scenario now confronted by the UK has been created by struggle, and because of this the seemingly impression of some power worth will increase will proceed for a while, the present financial scenario must be thought-about as aberrant as have been the circumstances in 2008 and 2020 and using QE to help authorities spending while concurrently preserving rates of interest low have to be thought-about. A QE programme of £50bn a yr might remodel the borrowing outlook of the UK authorities and depart averaging anticipated borrowing at charges broadly in keeping with these of the final fourteen years. The next chart demonstrates the impression of changing the QT programme with a QE programme of £50 billion every year, from 2023-24 onwards.

Sources as famous in textual content, with a QE programme of £50 billion pa substituted for the Financial institution of England proposed QT programme of £80bn pa from 2023-24 onwards

As is evident from the highlighted pink line, web gilt gross sales to monetary markets fall to the degrees with which they’re acquainted if this QE programme is put in place. Consequently rates of interest is also diminished, significantly, and a lot of the stresses within the UK financial system could possibly be eliminated because of this, with a steady financial atmosphere being created, all on account of this single change in coverage.

In abstract, there may be compelling proof that QT will create important upward strain on UK rates of interest that can because of this transfer nicely out of the vary to which the UK financial system is used over the past decade or extra with potential important adversarial penalties that we propose must be prevented. A renewed programme of QE might obtain this purpose and ship stability for UK monetary markets because of this.

[1] https://obr.uk/obtain/economic-and-fiscal-outlook-march-2022/

[2] The Chancellor has the tacit means to do that backed by the powers in s19, Financial institution of England Act 1998 to over-rule the Financial institution’s selections

[ad_2]