[ad_1]

Divergence buying and selling might be some of the underrated technical evaluation methods that many new merchants overlook. It isn’t as well-liked as a method as most simplistic buying and selling setups are. Nevertheless, with the appropriate oscillator indicator and the appropriate parameters, merchants might considerably enhance their buying and selling accuracy utilizing divergences.

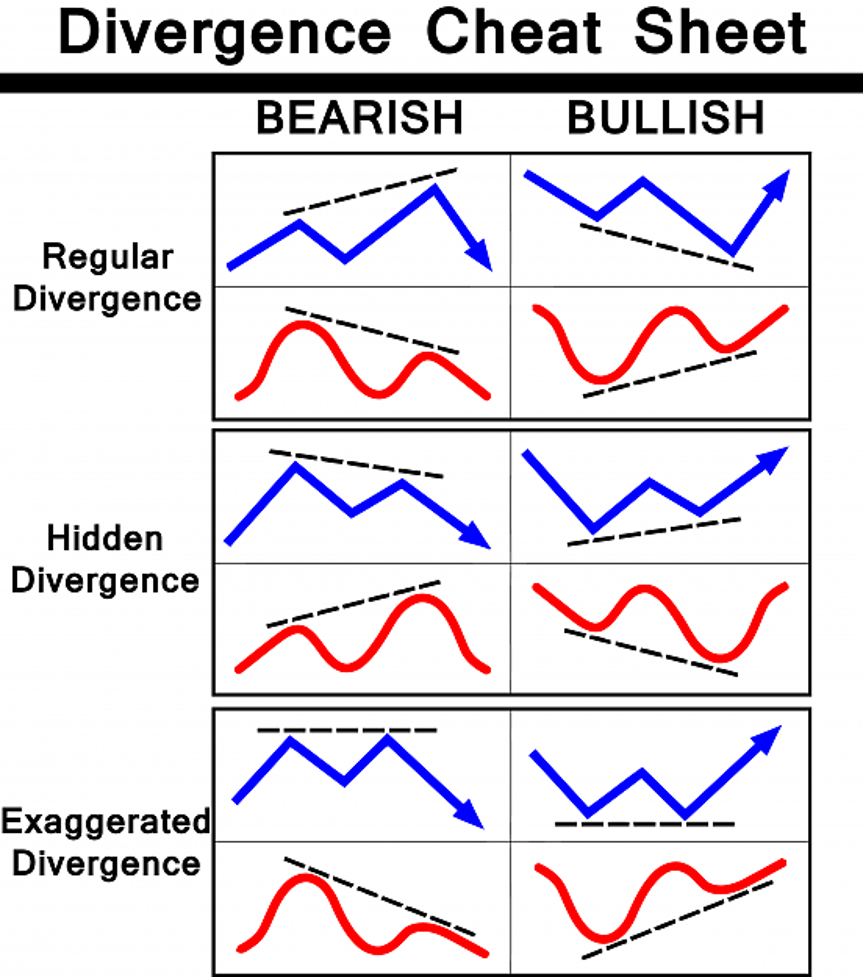

Divergences are principally discrepancies within the magnitude of the value swings based mostly on worth motion in comparison with the swings based mostly on peaks and troughs on an oscillator.

In buying and selling, oscillators are technical indicators which generally point out momentum by plotting strains or histogram bars that oscillate round a median or inside a spread. These oscillators would normally observe the motion of worth motion fairly carefully. It creates peaks at any time when swing highs are shaped and troughs at any time when swing lows are shaped.

The peak and depth of an oscillators peaks and troughs would normally mirror that of the swing excessive and swing low of worth motion. Nevertheless, there are cases whereby the peak and depth of the peaks and troughs of an oscillator would differ from that of worth motion. These circumstances are referred to as divergences. Beneath is a chart of what the various kinds of divergences seem like.

Hidden Divergences are significantly attention-grabbing as a result of this sort of divergence sometimes happens in a trending market as outlined by worth motion merchants. Value motion merchants outline an uptrend as worth motion creating increased swing highs and swing lows, whereas downtrends are outlined as worth motion creating decrease swing highs and swing lows. Based mostly on the chart above, that is precisely what hidden divergence worth motion seems like. Nevertheless, the oscillator in a hidden divergence would create an exaggerated peak or trough which signifies that worth is overextended. This creates a first-rate situation for worth to reverse and create and worth swing within the course of the pattern.

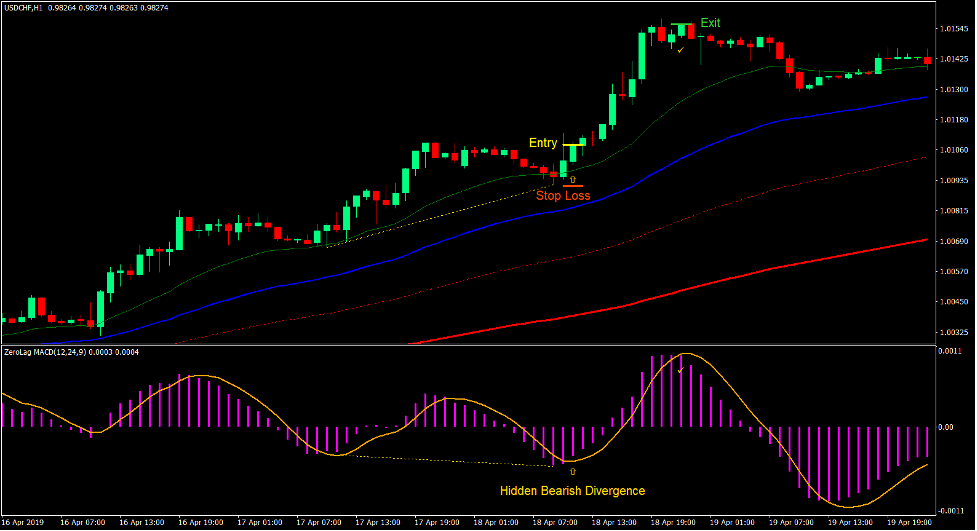

Right here we’ll study a hidden divergence setup utilizing a customized technical indicator, which is the Zero Lag MACD.

Zero Lag MACD

The Zero Lag MACD is a customized technical indicator which relies on the basic Transferring Common Convergence and Divergence (MACD).

The basic MACD is a well-liked momentum oscillator which relies on the crossover of two shifting common strains. It plots its MACD line based mostly on the distinction of two underlying shifting common strains. That is referred to as the MACD line. Different variations plot a histogram bar quite than a line, such because the Zero Lag MACD. The MACD then plots a sign line which is a shifting common derived from the primary MACD line or histogram.

Crossovers between the MACD line or histogram and the sign line point out a momentum reversal. Merchants can use this as an entry sign based mostly on momentum reversals.

The placement of the crossover additionally signifies the likelihood of the reversal. Crossovers occurring removed from the midline point out that worth is both overbought or oversold and might be prime for a pointy reversal.

This indicator, being an oscillator, additionally works effectively when used with divergence methods.

The standard MACD might at occasions be too lagging. The Zero Lag MACD is a model of the MACD which considerably decreases the quantity of lag making the indicator an awesome momentum reversal indicator.

Carter MA

Carter MA is a customized technical indicator which relies on shifting averages. It plots a set of modified shifting common strains which can be utilized to establish pattern course.

Merchants use widespread shifting common line durations to establish short-term, mid-term and long-term traits, such because the 21-period, 50-period, 100-period and 200-period shifting common strains. Carter MA plots these shifting common strains which helps merchants establish the overall pattern course.

Development course might be recognized utilizing the Carter MA indicator based mostly on how the shifting common strains are stacked. The market is in an uptrend if the short-term shifting common strains are above the long-term shifting common strains, and in a downtrend if the short-term shifting common strains are beneath the long-term shifting common strains. Merchants can even establish if the market is reversing if the strains are crossing over or if the market shouldn’t be trending if the strains are usually not clearly stacked.

The areas between the strains might additionally act as a dynamic space of assist or resistance. Merchants can commerce bounces from these areas buying and selling within the course of the pattern.

Buying and selling Technique

Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique is a pattern following divergence buying and selling technique which makes use of the Zero Lag MACD and the Carter MA indicator.

Development course is recognized first utilizing the Carter MA indicator. That is merely based mostly on how the shifting common strains are stacked.

The Carter MA indicator can also be used as a dynamic space of assist or resistance. Value motion ought to present that it’s respecting the realm between the inexperienced and blue strains as an space of dynamic assist or resistance.

The Zero Lag MACD is used to establish hidden divergences evaluating its peaks troughs with swing highs and swing lows of worth motion. Legitimate commerce setups are thought-about if a hidden divergence is noticed.

Commerce alerts are generated as quickly because the MACD bars cross the sign line.

Indicators:

Most popular Time Frames: 1-hour, 4-hour and each day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

Purchase Commerce Setup

Entry

- The Carter MA strains ought to be stacked within the following order:

- Inexperienced Line: high

- Blue Line: second from the highest

- Dotted Crimson Line: second from the underside

- Strong Crimson Line: backside

- Value motion ought to retrace in the direction of the realm between the inexperienced and blue strains.

- Value motion ought to present indicators of bullish worth rejection on the dynamic assist space.

- A bullish hidden divergence ought to be noticed on the Zero Lag MACD.

- Enter a purchase order as quickly because the bars on the Zero Lag MACD crosses above the sign line.

Cease Loss

- Set the cease loss on a assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the bars on the Zero Lag MACD crosses beneath the sign line.

Promote Commerce Setup

Entry

- The Carter MA strains ought to be stacked within the following order:

- Inexperienced Line: backside

- Blue Line: second from the underside

- Dotted Crimson Line: second from the highest

- Strong Crimson Line: high

- Value motion ought to retrace in the direction of the realm between the inexperienced and blue strains.

- Value motion ought to present indicators of bearish worth rejection on the dynamic resistance space.

- A bearish hidden divergence ought to be noticed on the Zero Lag MACD.

- Enter a promote order as quickly because the bars on the Zero Lag MACD crosses beneath the sign line.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the bars on the Zero Lag MACD crosses above the sign line.

Conclusion

This easy buying and selling technique is an efficient pattern following technique, which is mixed with a divergence buying and selling setup. This technique may be thought-about as a excessive likelihood buying and selling technique.

There are merchants who use the identical kind of buying and selling technique who declare to have an accuracy degree of round 60%.

The important thing buying and selling this technique is in being disciplined sufficient to commerce solely when the market is clearly trending and to keep away from buying and selling if it’s not.

Foreign exchange Buying and selling Methods Set up Directions

Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past information and buying and selling alerts.

Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique supplies a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The right way to set up Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique?

- Obtain Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique

- You will note Carter MA Zero Lag MACD Divergence Foreign exchange Buying and selling Technique is on the market in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]