[ad_1]

Typically markets development, generally they oscillate and generally they merely frustrate. I might enterprise to guess that buying and selling since 2022 falls into the frustration basket. Development following and momentum methods are struggling as a result of huge strikes are failing to increase and become developments. Imply-reversion methods had been doing nicely, however received hit with the regional financial institution disaster the final two weeks.

Current promoting strain, nevertheless, was not restricted to regional banks and the finance sector. In reality, promoting strain was broad sufficient to push our Composite Breadth Mannequin into unfavorable territory, which alerts a bear market. A bear market sign doesn’t at all times result in an prolonged decline, but it surely does point out above common danger for shares and stock-based ETFs. With the atmosphere for shares trying shaky, immediately’s commentary will concentrate on a risk-off ETF and a defensive ETF in a buying and selling vary.

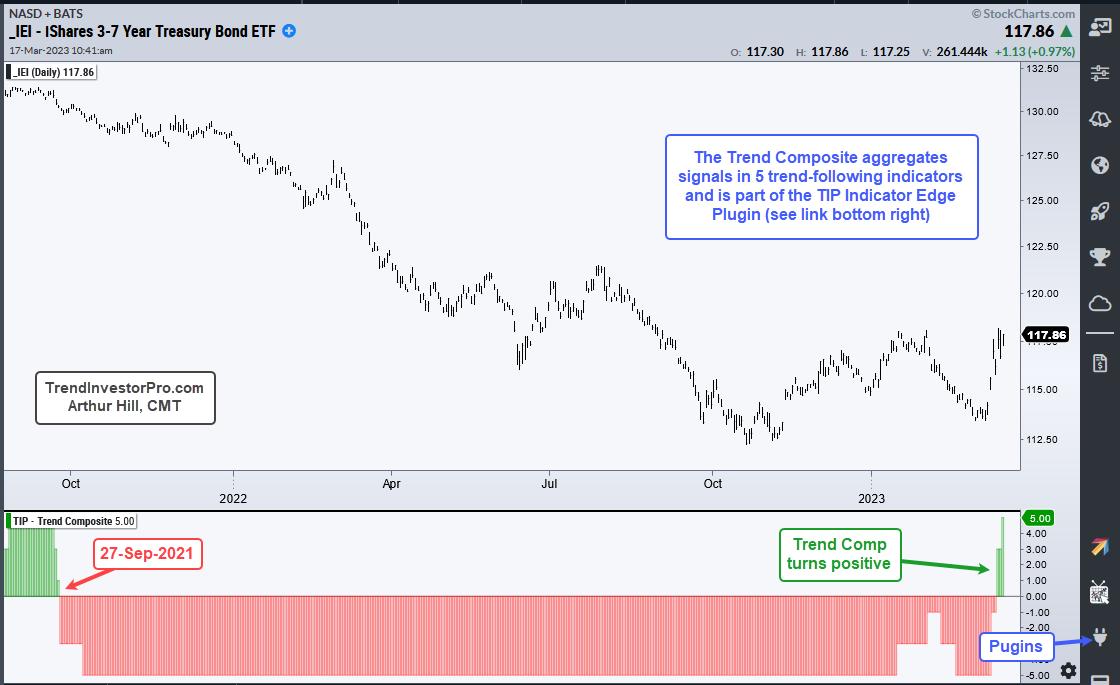

First, now we have a non-stock ETF that reversed an prolonged downtrend with a giant surge this month. The chart under reveals the 3-7 Yr Treasury Bond ETF (IEI) with the Development Composite turning constructive this week. This reverses a downtrend sign from September 2021. With the March surge, IEI is on the verge of breaking its January-February highs. Additionally be aware that IEI was not too long ago added to our All Climate ETF technique as a result of it was a high-ranking non-stock ETF.

The following chart reveals the Healthcare SPDR (XLV) with the Development Composite. As with every different development indicator, the Development Composite doesn’t work when costs oscillate (don’t development). The indicator window reveals the Development Composite whipsawing as XLV gyrates between 140 and 120. XLV is in a buying and selling vary so I shall be watching the swings for alerts, not the Development Composite. The present swing is down with the early March excessive marking resistance. A breakout right here would reverse the downswing.

On the lookout for a extra systematic strategy to buying and selling and evaluation? TrendInvestorPro has three quantified buying and selling methods for ETFs. First, there’s an All Climate Technique that makes use of market timing to set the tone. Second, now we have a trend-momentum technique that trades the strongest stock-based ETFs in bull markets. And third, now we have a short-term Imply-Reversion technique that trades in any form of market. Click on right here to study extra and get fast entry.

The Development Composite, ATR Trailing Cease and 9 different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to study extra and take your evaluation course of to the following stage.

————————————-

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out development, discovering alerts throughout the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified every time a brand new publish is added to this weblog!

[ad_2]