[ad_1]

My technique relies on classical buying and selling fundamentals and refinement of indicators broadly utilized in all types of markets. The precept of working in line with the pattern and utilizing confirmed indicators included within the interface of widespread buying and selling terminals make it up-to-date and handy for utilizing in all markets and buying and selling platforms. The technique relies on the precept of simultaneous mixed use of a number of indicators.

A few of them have been refined and modified, and their additional work has been examined in follow for a very long time. This represents a fancy buying and selling system or smart-strategy, which has an excellent danger/return ratio. All the required parameters described above are mixed in a brand new indicator known as Owl Good Ranges which shows the ensuing parameter of the work of all of the components of the buying and selling system in interplay. I named my technique Owl as a result of I affiliate the owl with knowledge. The truth is, I made an try to mix well-known traditional instruments in order that they might be used collectively as appropriately as potential.

Principally, it is a ready-made software, utilizing which you’ll be able to totally work on the proposed new worthwhile buying and selling technique.

Contents:

Introduction

1. Worthwhile buying and selling – buying and selling within the pattern course

1.1. How you can decide the pattern appropriately?

1.2. What’s the distinction between a worldwide pattern and an area tendency?

1.3. Buying and selling by pattern2. The set of instruments of the Owl technique and their building

2.1. Fractals

2.2. Valable ZigZag

2.3. Fibonacci ranges3. Buying and selling technique

3.1. The essential ideas of the Owl technique

3.2. StopLoss and TakeProfit ranges

3.3. Triple Display screen technique by A. Elder

3.4. Useless zone4. Extra instruments and entry factors

4.1. Sloping channel

4.2. Fibonacci Fan5. Cash administration

Conclusion

Introduction

It’s generally identified that to commerce on the markets a dealer wants psychological preparation, monetary calculation and buying and selling technique. Psychological preparation is geared toward self-discipline, stress-resistance, clear shallowness and emotional intelligence. Monetary calculation makes it potential to optimally allocate obtainable assets and never solely decrease dangers but in addition to appropriately deal with them, typically by a justified enhance. A buying and selling technique is the very technical methodology {that a} dealer makes use of in his work. This advanced idea consists of numerous constants and variables. These are indicators, charts of various timeframes, forecasted time of starting and finish of a commerce, hedging, change of buying and selling lot quantity and plenty of different issues.

If one in every of these three elements will likely be eliminated: psychological preparation, monetary calculation or buying and selling technique, nothing will work out for the dealer. On this article will likely be detailed description of one in every of them, the brand new buying and selling technique Owl, which consists of 5 components together with evaluation of classical indicators, their modification, description of buying and selling methods and, after all, illustrations.

1. Worthwhile buying and selling – buying and selling within the pattern course.

The elemental foundation of buying and selling on the inventory alternate is the flexibility to appropriately decide the worldwide pattern – the course of worth motion and motion of cash in a single or one other asset for a most time interval. Buying and selling within the established world pattern is the primary issue for profitable worthwhile buying and selling.

What’s a pattern?

All adjustments in the marketplace are the consequence of cash motion which is fastened by the change of costs. Thus, the markets are pushed by cash and the more cash flows into the market the extra demand will increase and, accordingly, the worth will increase in an upward pattern, and vice versa, if cash begins to go away the asset, demand decreases and the worth falls which is mirrored in a downward pattern on the chart.

1.1 How you can decide the pattern appropriately?

The signal of a pattern is absolutely easy: it’s the fixed updating of the utmost and minimal values of a wave-like motion of the worth chart in an upward or downward course. You possibly can see this in any market, on the chart of any asset.

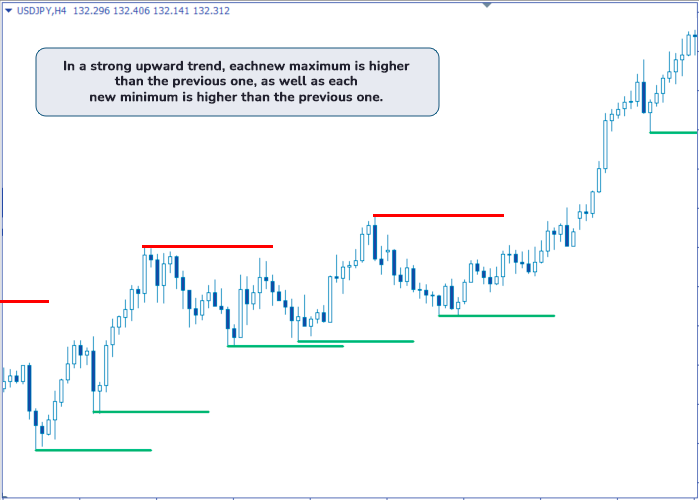

Charts transfer in a wave-like method, coming into overbought and oversold zones or from correction to continuation of the pattern, and vice versa. If the worth maximums are consistently up to date and the help ranges on the reverse corrections are greater than the earlier ones – there may be an upward pattern (Fig. 1.) and the demand for the asset continues to extend.

Fig. 1. Upward pattern

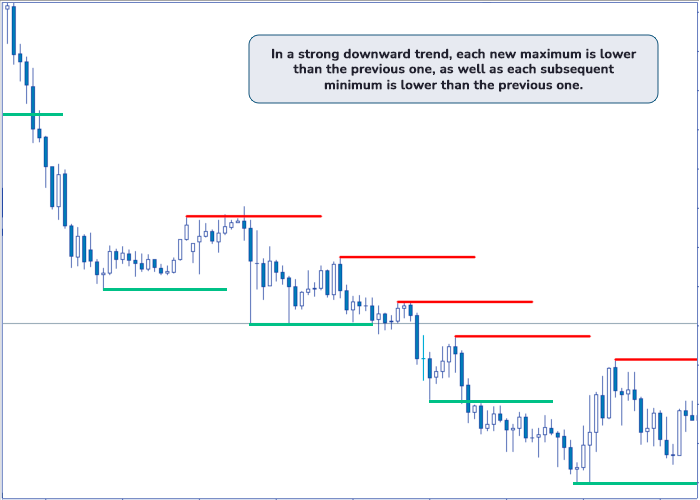

If the worth minimums are consistently up to date and the help ranges on the reverse corrections are decrease than the earlier ones – the downward pattern stays and the demand for the asset continues to lower (Fig. 2.).

Fig. 2. Downward pattern.

The right dedication of the worldwide pattern permits to search out optimum market entry factors for making worthwhile trades.

1.2 What’s the distinction between a worldwide pattern and an area tendency?

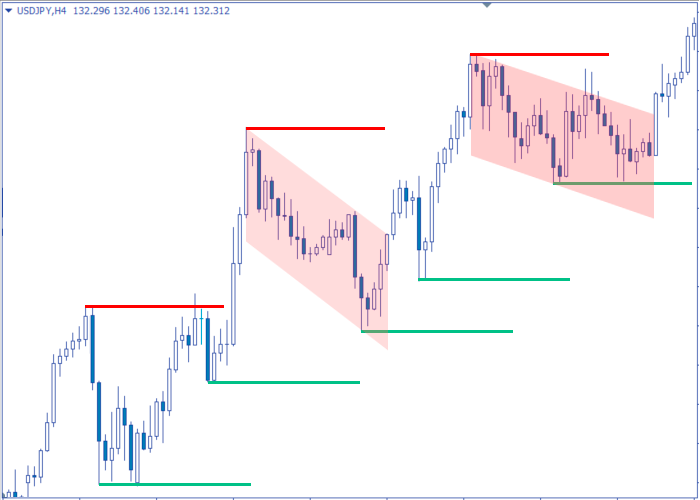

There are two most vital elements to differentiate between an area tendency and a worldwide pattern. The primary issue is a major change in worth, permitting the dealer to make a revenue on shopping for and additional promoting. The second is the length of the worth vary change over time. A scientific rise in worth and a corrective pattern to it are most clearly seen in scale. The tendency is all the time a lot shorter than the pattern within the chart phase and, correspondingly, within the time vary (Fig. 3).

Fig. 3. Downward native tendencies.

If we plot the visible illustration of the borders of a channel or pattern, we’ll clearly see that the tendency is all the time inside these limits and doesn’t break the channel borders, whereas the pattern breaks all of the borders when it adjustments its course.

A sign for distinguishing between a bent and a pattern is scale: a bent is all the time a number of instances smaller than a pattern by way of its scale.

1.3 Buying and selling by Development

Why is it value to commerce by pattern? If cash “will get up” in a sure course they want a while in any market to redistribute themselves. A worldwide pattern reversal doesn’t occur instantly.

The issue of discovering the second or entry level into the market is to reliably establish a pattern reversal or a rebound from a help/resistance degree after a corrective pattern.

Why is it essential to commerce solely by the pattern? Initially, as a result of the pattern is extended whereas the native tendency towards the pattern may be small. If the market entry level is chosen incorrectly whereas pattern buying and selling and in the course of the correction the market turns towards the dealer, the rebound and continuation of worth motion alongside the pattern will permit the dealer to exit of the drawdown into the revenue, in case of sensible cash administration and trades hedging.

If StopLoss triggers in the intervening time of pattern reversal and the commerce closes with a loss, the dealer can open a brand new commerce of bigger quantity to compensate for the losses and are available out with a revenue.

Understanding what’s going on out there provides further benefits for the revenue and solely the pattern can be utilized as a place to begin.

There’s additionally counter-trend buying and selling which permits one to make revenue throughout correction. Its characteristic consists within the short-term offers compared with offers on a pattern. Nonetheless, to commerce on a correction, the pattern is set in any case, its comparatively short-term nature is taken into consideration and this turns into the exception that solely confirms the rule. That’s the reason it can’t be known as a counter-trend commerce within the direct sense of the phrase, it’s carried out solely at inverse correction sections.

Buying and selling by pattern and proper dedication of factors not just for coming into but in addition for exiting the market, closing trades permits to be at an extended distance from the shocks related to market reversals, and stay within the statistical advantages.

Along with the upward and downward pattern varieties, there’s a horizontal motion of the market on the chart within the so-called “sideways” or “flat”. The wavy worth motion right here goes in a horizontal channel of minimal and most values.

Understanding the precept of buying and selling by pattern makes it potential to reduce the dangers of economic losses and it’s the foundation for the event of actual and efficient buying and selling methods.

2. The set of instruments of the Owl technique and their building

2.1 Fractals

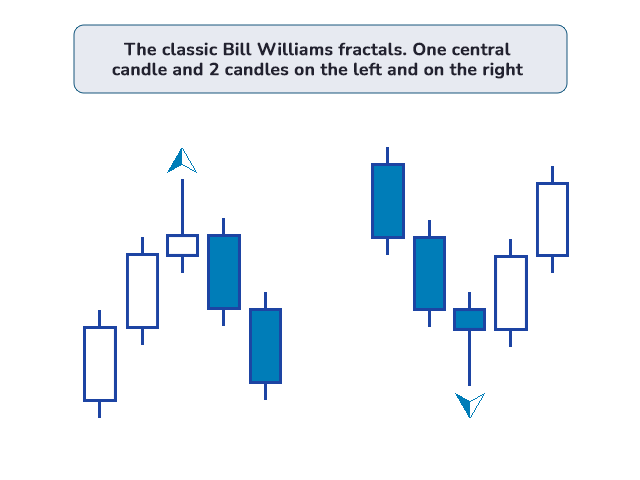

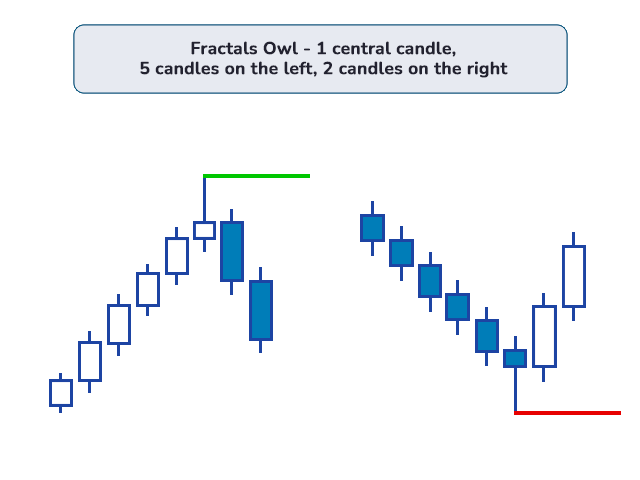

The buying and selling indicator “Fractal” was created by the well-known market buying and selling theorist Invoice M. Williams (1932-2019). A fractal is a graphical mixture of 5 bars or candles indicating the energy of patrons or sellers at a sure cut-off date. Some bars or candles could also be on the identical degree, however as a rule, 5 adjoining candles with completely different ranges are used to find out a fractal, amongst which there must be two candles on the left and on the best from the very best – excessive – in an upward pattern, or from the bottom – low – in a downward pattern.

The interface of the MetaTrader 5 and 4 buying and selling platforms has a preinstalled Fractal indicator which may be simply adjusted at any timeframe. Some merchants evaluate Fractal with the human palm the place the higher or decrease, relying on its course up or down, may be the center, the longest finger (Fig. 4).

Fig. 4. Classical fractals by B. Williams.

The fractal is marked on the chart with the arrow; by the fractal line you’ll be able to clearly see the course of motion and attribute adjustments in worth motion, in addition to decide the help and resistance ranges.

Fig. 5. Fractals within the Owl technique.

The definition of a fractal within the Owl technique is completely different from the traditional one. Within the Full Fractals Indicator, with the intention to index a fractal, the final 5 candles are taken to the left from the excessive or low candle, not like the traditional two, and to the best two candles are taken (Fig. 5).

All fractals within the Owl technique are marked with brief horizontal coloured traces.

2.2 Valable ZigZag

The wave nature of the market was as soon as rigorously developed by Ralph Nelson Elliott (1871-1948), an American financier who created the wave idea that interprets the monetary markets via a system of visible wave patterns on worth charts.

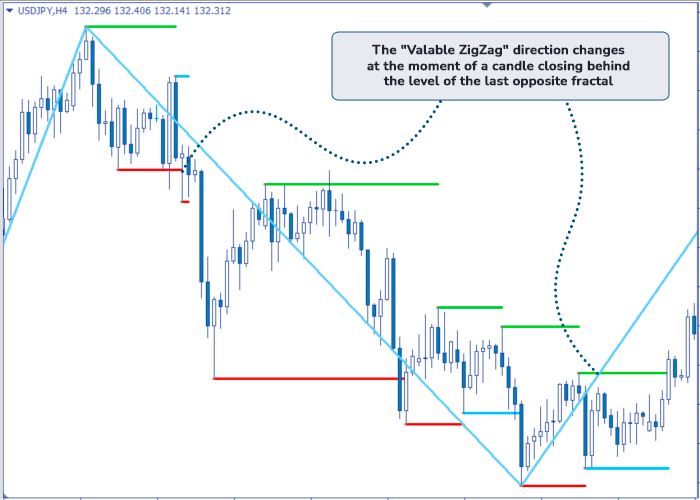

The ZigZag indicator, on which we’ll focus in additional element, permits us to know the wave-like market actions. The proposed model of the ZigZag by the Owl technique accommodates a smaller variety of bends, thus enlarging the wave.

Fig. 6. Valable ZigZag.

The ZigZag determines the primary buying and selling course. The work of the indicator and its appropriate dedication on the chart is carefully linked with the earlier indicator – the fractal. As fractal maximums or minimums shift within the pattern course, the road of Valable ZigZag doesn’t change its course, not like the traditional one (Fig. 6).

Fig. 7. Change of course of the Valable ZigZag.

Thus, the Valable ZigZag combines a number of actions throughout the pattern into one and doesn’t change so long as maximums/minimums of the fractals transfer within the course with the ZigZag. So as to change the course of the ZigZag, a candle should break the extent of the earlier fractal candle within the reverse motion and transfer above or under that fractal (Fig. 7).

For the reason that ZigZag indicator units the buying and selling course, its upward course will imply buying and selling solely to purchase, and its downward course will imply buying and selling solely to promote.

2.3 Fibonacci ranges

Fibonacci ranges or Fibonacci Grid is current within the arsenal of just about each dealer, because it exhibits superb buying and selling leads to the inventory market, FOREX and the cryptocurrency market.

This indicator relies on the sequence of numbers found by the Italian scientist Leonardo of Pisa (ca. 1170 – ca. 1250), one of many first main mathematicians in medieval Europe. The essential precept of the sequence is that the primary two numbers in it are equal to 0 and 1, and every subsequent quantity is the same as the sum of the earlier two.

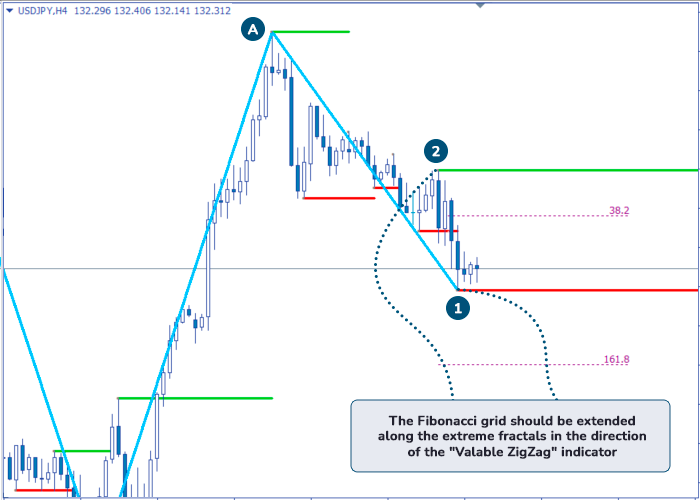

Fig. 8. Fibonacci Grid set by a downward pattern. А – change of course of the Valable ZigZag. 2 – higher Owl-fractal or “0” degree of the Fibonacci Grid. 1 – decrease Owl-fractal.

The Fibonacci Grid stretches from the fractals that testify to the start of a corrective motion able to turning right into a pattern change. Numerical values of ranges akin to 0; 23.6; 38.2; 50; 61.2; 161.8 correspond to the mathematical sequence found by the Italian mathematician. The quantity 161.8 signifies the extent of the golden part and exhibits that the utmost motion in a single course was occurred and that the backward correction can occur quickly. If the worth reaches this degree, it’s potential to take a revenue and readjust the Fibonacci Grid a while later.

The particularity of making use of the Fibonacci Grid within the Owl technique is that the indicator is utilized in an inseparable reference to the Valable ZigZag indicator and the Owl model of the fractal.

The Fibonacci ranges grid must be adjusted between two reverse fractals positioned to the best of the pattern change level in line with the Valable ZigZag indicator. Whether it is directed upward, to purchase, then the extent 0 is ready on the level of the acute decrease fractal and the extent 100 is ready on the level of the acute higher fractal. If ZigZag is directed downward, to promote, the Fibonacci Grid is prolonged from the outermost higher fractal with the 0 degree to the outermost decrease one with the 100 degree.

It’s potential to enter the market at ranges 38.2; 50; 61.2 and if the pattern change is set appropriately, there’ll nonetheless be sufficient motion on the chart as much as the extent of 161.8 to make a revenue.

If the pattern is just not strongly outlined and is are inclined to flat, it’s potential to enter the market at ranges 38.2, 50, understanding that the worth could not attain the extent of 161.8 and making an attempt to repair revenue at different, earlier, ranges of the Fibonacci Grid. If the pattern is clearly outlined, the extent of 61.8 would be the greatest entry level, whereas the market could not attain the 38.2 degree and quite a few potential worthwhile trades will likely be missed.

3. Buying and selling technique.

3.1 The essential ideas of the Owl Technique

The Owl technique relies on the simultaneous use of a number of indicators: ZigZag, Fractal and Fibonacci Grid. On the identical time, the Fractal indicator is modified and accommodates eight candles as a substitute of 5. The ZigZag indicator has a smaller variety of bends since it is just used for figuring out the pattern course and known as Valable ZigZag within the technique.

A buying and selling sign seems solely when sure positions of adjoining fractals on the chart relative to the Valable ZigZag permit to plot Fibonacci ranges (see particulars within the Owl Good Ranges Indicator Information).

Fig. 9. Buying and selling based mostly on the Fibonacci Grid. А – change of course of the Valable ZigZag. 2 – higher Owl-fractal or “0” degree of the Fibonacci Grid. 1 – decrease Owl-fractal.

It’s potential to enter the market from one of many ranges 38.2, 50 or 61.8. The entry level must be chosen relative to the market dynamics which in any case must be decided earlier than coming into it. If market motion has began, it’s essential to enter from 61.2, as a result of quite a few worthwhile trades may be missed when coming into at 38.2. If the pattern motion is just not robust, it’s higher to enter from 38.2. On the inventory market – commodity monetary devices and shares, the extent of fifty% of motion works very effectively (Fig.9).

3.2 StopLoss and TakeProfit ranges.

StopLoss must be put behind the zero line of the Fibonacci’s Grid for 2-5 factors, and TakeProfit degree is 161.8. You possibly can shut the order not in full however on the degree of fifty% of 161.8, i.e. shut 50% of place or half of the order quantity, the remaining half must be closed when the course of Valable ZigZag adjustments (Fig. 9).

On the degree of 100% of Fibonacci Grid the orders must be moved to the breakeven place: the StopLoss degree must be set on the opening degree +1 level to cowl the commissions.

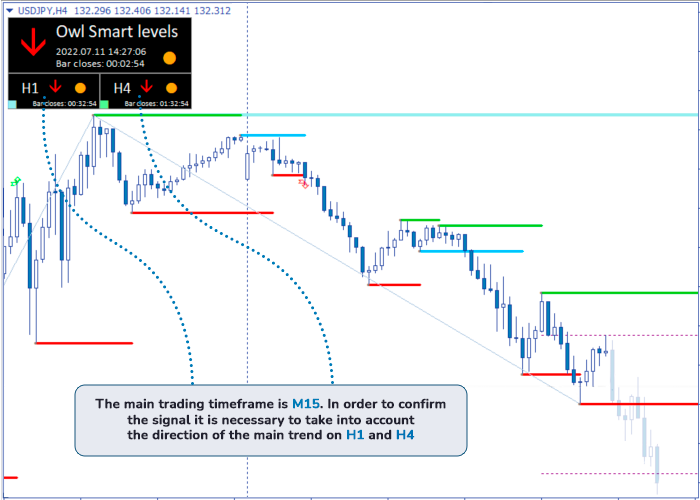

3.3 Triple Display screen technique by A. Elder’s.

The tactic of triple display of the well-known and most skilled dealer Alexander Elder (born in 1951) consists in the truth that for making buying and selling choices, charts on three timeframes are studied concurrently: the primary one, the place the commerce is finished, and two timeframes, every of which is 4 instances greater than the earlier one.

For instance, in the event you commerce on the chart with the timeframe M15, then to verify the course of the market, the charts with the timeframes H1 and H4 are linked.

The course of the primary pattern decided by the Valable ZigZag Indicator is vital. If the course coincides on all timeframes it means the potential of discovering the primary entry sign with the formation of the Fibonacci Grid.

Fig. 10. Value course displayed on the indicator by three timeframes.

Thus, if the Valable ZigZag and the M15 timeframe present an upward motion course, H1 exhibits an upward motion course and H4 exhibits the identical vector – because of this the chance of this motion remaining for a while is maximal, the market goes up and it’s potential to observe the market course and take earnings in case buying and selling by pattern. So as to do that, we have to discover fractal 1 and fractal 2 positioned to the best of the change of course, stretch the Fibonacci Grid and enter the market.

The Elder’s technique is described in additional particulars by the creator himself, however within the Owl solely its most important precept is utilized.

3.4 Useless zone

A lifeless zone is shaped when the motion on the charts in timeframes H1 and H4 is in numerous instructions. On the chart with one timeframe the motion can go upward whereas with one other one it may possibly go downward.

It is a zone through which, comparatively talking, the market is undecided and to enter right now, each to purchase and to promote, doesn’t make sense and is dangerous sufficient, it’s higher to attend till the market comes out of this zone and exhibits a transparent course. After that, you’ll be able to search for entry factors into the market.

The Owl Good Ranges Indicator exhibits the lifeless zone in purple, warning you that buying and selling in it’s undesirable.

Fig. 11. Useless zone.

4. Extra instruments and entry factors

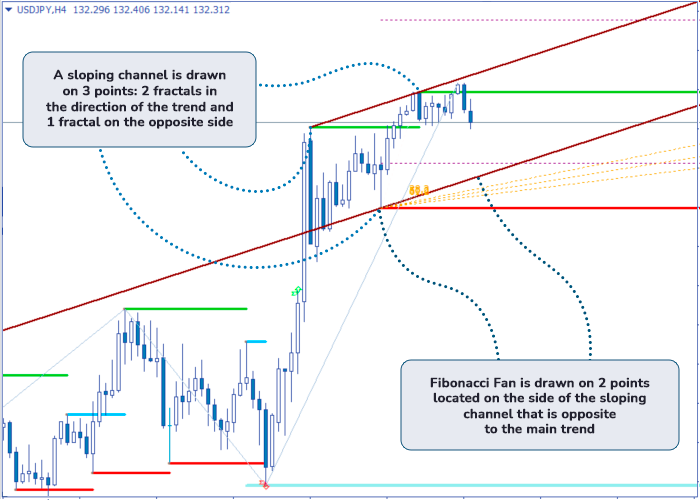

4.1 Sloping channel

The Owl technique assumes an extra software for working with a worth chart akin to a sloping channel. Just like the Valable ZigZag, it’s plotted utilizing fractals within the course of the pattern. To plot the road of the higher border of the channel, it’s essential to take the factors of two peaks of the higher fractals; to plot the parallel line of the decrease border, it will likely be sufficient to take one, the third level of the decrease fractal.

Thus, if there are two higher fractals, that are located to the best of the purpose of change of the pattern course in line with ZigZag, and there’s a third, decrease fractal located between them, we are able to simply create a channel. On this channel, directed upward, you’ll be able to search for further entry factors to purchase (Fig. 12).

When the chart strikes the worth downward with the corresponding course of the Valable ZigZag indicator, it’s essential to establish two decrease fractals to attract the decrease boundary line, and one higher fractal to attract the higher boundary line of the channel, parallel to the decrease one.

4.2 Fibonacci Fan

After the channel is plotted another further software can be utilized together with the channel – the Fibonacci Fan. It is very important observe that if the channel is just not used within the Owl technique, the Fibonacci Fan is just not used both – these instruments for working with the chart are plotted one relative to the opposite.

The Fibonacci Fan consists of a number of rays fanning out from the primary ray to the best and, just like the Grid, has values similar to the Fibonacci numbers sequence – 38.2; 50; 61.8.

The Fibonacci Fan is, in a way, a number one indicator and provides an early backward sign for a reversal. Its rays symbolize, comparatively talking, further help ranges in respect to the sloping channel. If the worth “breaks via” the fan and goes additional away from it, we should always not open a commerce on reversal from the channel line. On this case we are able to commerce on the reversal from the primary pattern, as a result of as a rule, when the fan is damaged via, it definitively confirms the breakout of the corresponding channel border.

Fig. 12. Sloping Channel and Fibonacci Fan (in yellow).

If the worth “rebounds” from the fan, there is a chance to enter the market when the pattern reverses or tendencies seem, sooner than most merchants who use solely the sloping channel and even the Fibonacci Grid do, and even sooner than the ZigZag indicator turns over.

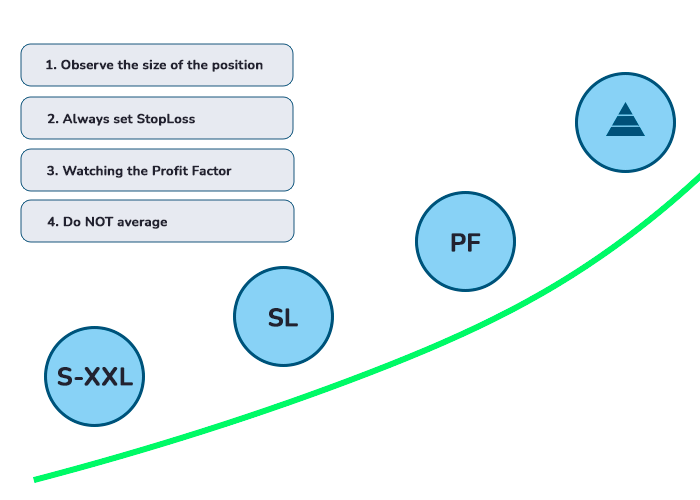

5. Cash administration.

The premise of coming into any market is a well-thought and deliberate cash administration. It’s actually extra vital than selecting a buying and selling technique.

Dedication of optimum deposit and buying and selling lot quantity is important with the intention to clear up the primary activity of a dealer – to maintain the deposit. If the target of conserving the deposit is solved, and a dealer earns revenue, even a small one, it signifies that the dealer trades efficiently and he’s a profitable dealer. There isn’t a must attempt for the exaggerated share of worthwhile trades, akin to 70-90%, and overstate the corresponding dangers in your buying and selling technique. Many giant merchants steadily earn in the marketplace with the share of worthwhile transactions not rather more than 50%. If the technique is efficient and competent, it would convey its personal advantages. You shouldn’t intrude and cut back the amount of transactions after the losses, in addition to attempt to catch up by unreasonably inflating the amount of heaps.

Initially, it is sufficient to put minimal dangers for a collection of 10 dropping trades and for the quantity not exceeding 15% of the deposit. The chance would appear to be small, however it ought to by no means be forgotten about potential market crashes and sudden corrections. Many merchants don’t bear in mind the potential of an extended collection of dropping trades, whereas this is without doubt one of the most important the explanation why they in the end lose their total deposit. Subsequently, the quantity of deposit must be ample to beat the drawdown, and this doesn’t imply large, however it does imply that there’s a sure ratio of deposit dimension and buying and selling lot quantity.

To return out of a drawdown, it’s potential to strive regularly growing order sizes when market conduct turns into clear, because the chance of the subsequent commerce to be worthwhile solely will increase with each dropping commerce earlier than it.

Determine 13. Cash administration Guidelines.

The Owl technique has a charge of return a minimum of two instances greater than the target loss ratio. That’s the reason even having such a ratio of worthwhile trades to dropping trades as 1:3, it permits merchants to remain in constructive positions and save the deposit. It is vital to know that any software ought to work in skilful arms and the system of risk-management continues to be of major significance for individuals who enter the market with the Owl technique.

Conclusion.

For the Owl Technique growth there have been used fragments of the buying and selling system by the world well-known dealer Invoice Williams, components of the wave evaluation idea by the well-known buying and selling analyst Ralph Elliott, and likewise examined by many merchants in follow and very fashionable indicators: Fibonacci Grid and Fibonacci Fan, in addition to ZigZag. The technique additionally consists of Alexander Elder’s buying and selling precept – the strategy of simultaneous use of three screens.

The modification of classical indicators applied within the Owl, doesn’t change their essence, however dynamically adapts them to the altering market situations on the present stage. Simply as not all the classical candle fashions work, a minimum of on completely different markets, some indicators can a minimum of work with a lag, making their use in fashionable buying and selling much less helpful than it might be fascinating.

The Owl technique relies on the precept of simultaneous mixed use of a number of indicators. A few of them have been refined and modified, and their additional work has been examined in follow for a very long time. This represents a fancy buying and selling system or smart-strategy, which has an excellent danger/return ratio.

All the required parameters described above are mixed in a brand new indicator known as Owl Good Ranges which shows the ensuing parameter of the work of all of the components of the buying and selling system in interplay. Principally, it is a ready-made software, utilizing which you’ll be able to totally work on the brand new worthwhile buying and selling technique described above.

[ad_2]