[ad_1]

In our guide Develop Your Wealth in 2023, we featured our projections for the Financial Fashionable Household.

To start with the Granddad of the Household — Russell 2000 (IWM) — in December 2022, we wrote this:

“The Russell 2000 IWM is the granddad of the Household. Therefore, we take his efficiency severely. Firstly of 2022, IWM was already breaking down, effectively forward of the S&P 500 (SPY). The month-to-month chart is the perfect one to make use of for a longer-term outlook for 2023.

“The inexperienced line or 80-month shifting common represents a few typical enterprise cycle.The 80-month shifting common is the megatrend identifier. Ought to any of the important thing elements fail the 80-month MA in 2023, the requires ‘recession’ or extra ache from stagflation will solely get extra painful for the market. As such, IWM solely broke it as soon as since September 2011 and that’s in the course of the pandemic. So, if we low cost that point as uncommon, we are able to say that it has been 12 years in a bullish megatrend. In October 2022, IWM touched it precisely.

“Now, coming into the brand new yr, that October low is vital. If IWM holds and will get again by the 23-month MA or blue line, then a bullish pattern will proceed. Ought to the 80-month breakdown, I might put together for a tricky time, with pandemic ranges in focus.”

And right here we’re on the Ides of March.

IWM couldn’t clear the 23-month shifting common. And, with the current information, IWM has fallen in value, however nonetheless significantly above the 80-month shifting common. Neither indicative of progress nor recession, we would name {that a} buying and selling vary.

We additionally name it stagflation.

With PPI and CPI coming in softer, on the heels of banks in disaster, the market turned its consideration to the notion that the Fed will cut back charges this yr. In truth, some predict the Fed will decrease charges by 2% come December 2023. Sorry, however this resonates with the chaos concept and gold close to $3000 per ounce.

Anyhoo, IWM held (though nonetheless weakest of the indices) and NASDAQ plus tech shares took off. Which brings us to Sister Semiconductors.

From the Outlook:

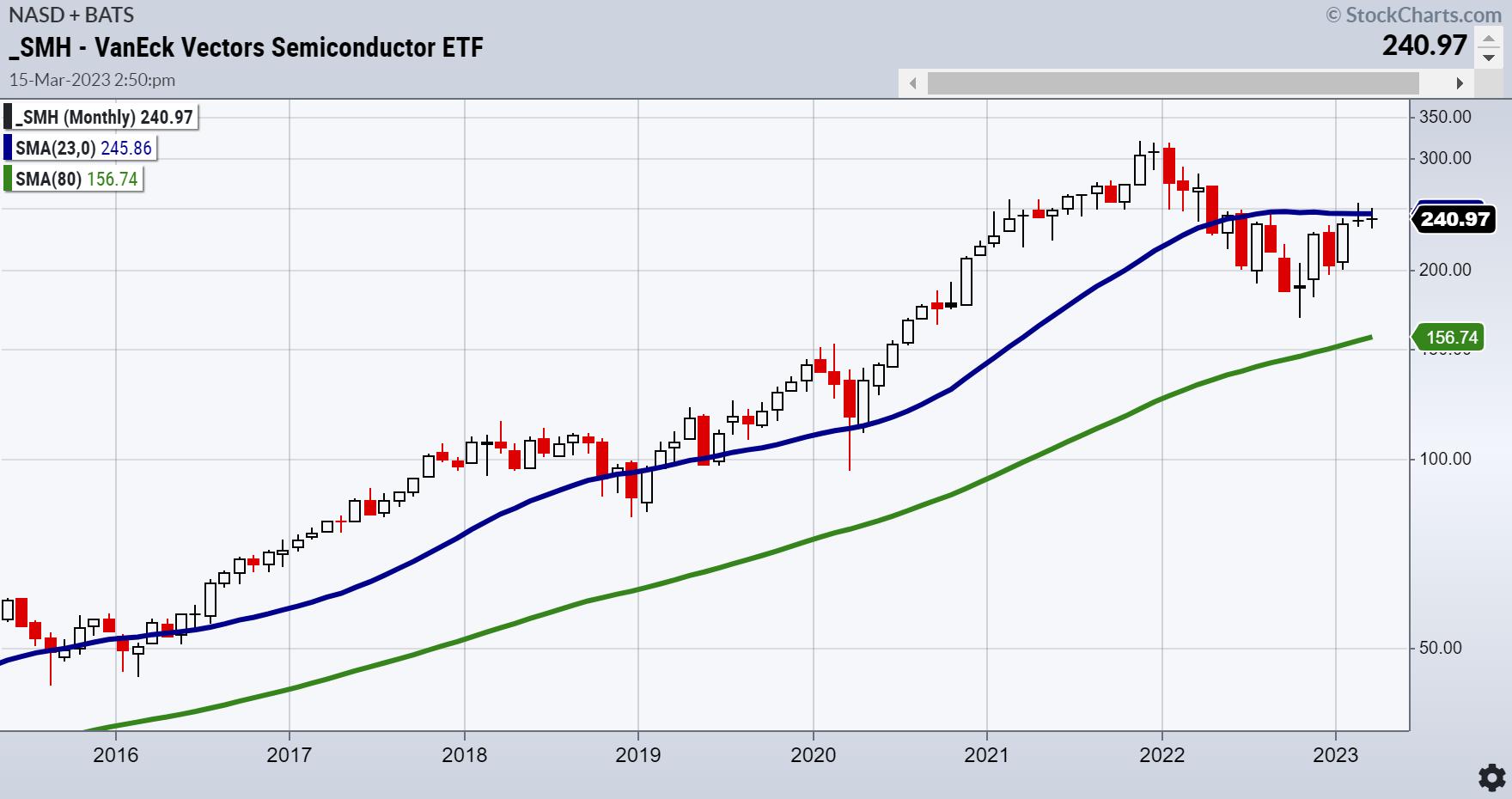

“SMH has not traded under the 80-month MA since October 2010. In truth, the U.S. tech sector and the survival of chip know-how has been the brilliant spot for 13 years! Even the pandemic didn’t carry this sector under the 23-month MA, as we’re closely reliant on tech for all the things.

“Will that proceed if the remainder of the household fails? And, if SMH stays robust, can it ease the ache of recession?”

With March half over, we are going to see what our Sister Semiconductors are fabricated from. Over the 23-month, and making a living shall be simpler. Nonetheless, with out Gramps in tow, it will likely be a short-lived rally.

Lastly, our Full Dealer Bullish Reversal Scan had 2 tech inventory picks. Intel (INTC) and Intuit (INTU) — two Tech shares that ought to profit if this chip rally sustains.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Advisor, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Ebook in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Mish within the Media

Mish sees alternative in Vietnam, is buying and selling SPX as a variety, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole talk about particular inventory suggestions and Fed expectations on TD Ameritrade.

Mish joined the March 10 closing bell protection on Yahoo! Finance, which you’ll see at this hyperlink!

Mish goes by the macro by key sectors and commodities on this look on CMC Markets.

Mish joins Mary Ellen McGonagle (of MEM Funding Analysis) and Erin Swenlin (of DecisionPoint.com) on the March 2023 version of StockCharts TV’s The Pitch.

Mish talks ladies in finance for Worldwide Ladies’s Day on Enterprise First AM.

Mish focuses on protection shares on this look on CNBC Asia.

Mish factors out a Biotech inventory and a Transportation inventory to observe if the market settles on Enterprise First AM.

Mish joins Maggie Lake on Actual Imaginative and prescient to speak commodities and setups!

Examine Mish’s article concerning the implications of elevated sugar costs on this article from Kitco!

Whereas the indices stay vary sure, Mish exhibits you many rising developments on the Wednesday, March 1 version of StockCharts TV’s Your Every day 5!

Mish joins Enterprise First AM for Inventory Selecting Time on this video!

See Mish sit down with Amber Kanwar of BNN Bloomberg to debate the present market circumstances and a few picks.

Click on right here to observe Mish and StockCharts.com’s David Keller be part of Jared Blikre as they talk about buying and selling, recommendation to new traders, crypto, and AI on Yahoo Finance.

In her newest video for CMC Markets, MarketGauge’s Mish Schneider shares insights on the gold, the S&P 500 and pure fuel and what merchants can count on because the markets stay blended.

Coming Up:

March sixteenth: The Last Bar with Dave Keller, StockCharts TV, and Twitter Areas with Wolf Monetary

March seventeenth: CheddarTV Closing Bell

March twentieth: Madam Dealer Podcast with Ashley Kyle Miller

March twenty second: The RoShowPod with Rosanna Prestia

And down the street

March twenty fourth: Opening Bell with BNN Bloomberg

March thirtieth: Your Every day 5, StockCharts TV

March thirty first: Pageant of Studying Actual Imaginative and prescient “Portfolio Physician”

April 24-26: Mish at The Cash Present in Las Vegas

Could 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 390 stays extremely pivotal, particularly on a closing foundation; 380 help.

- Russell 2000 (IWM): Calendar vary help degree at 172.00, resistance 180.

- Dow (DIA): 310 help, 324 resistance.

- Nasdaq (QQQ): Wow-290 key, 300 subsequent space to pierce.

- Regional Banks (KRE): 44 help, 50 resistance.

- Semiconductors (SMH): 240 pivotal support–strongest, but nonetheless under the 2-yr biz cycle.

- Transportation (IYT): 218-219 so pivotal.

- Biotechnology (IBB): 126.50 shifting common resistance.

- Retail (XRT): 60 huge help and 64 huge resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary data and schooling to hundreds of people, in addition to to massive monetary establishments and publications comparable to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified every time a brand new put up is added to this weblog!

[ad_2]