[ad_1]

Shares are bouncing this morning on bulletins that the Feds will backstop ALL of the deposits on the now bankrupt Silicon Valley Monetary Group (SIVB) AKA Silicon Valley financial institution.

This can be a large mistake. The banking system is in deep trouble and it’s not clear that the $25 billion bailout the Feds crafted can be sufficient to take care of fallout.

One different financial institution (Signature) has already been closed, whereas a lot of the regional banks in California have seen their shares halted.

What’s inflicting all of this?

Two issues:

1) For the primary time in 15 years, depositors can earn 4% or 5% in yield.

2) Banks are as much as the eyeballs in rubbish loans made in the course of the pandemic.

Relating to #1, most banks at the moment are paying out one thing like 0.05% or decrease on deposits. In the meantime, cash market accounts and short-term T-bills are paying 4% of 5%.

On account of this depositors are pulling cash out of banks. And since the banks have to take care of leverage ratios primarily based on capital necessities, the banks are being pressured to promote property (deleverage).

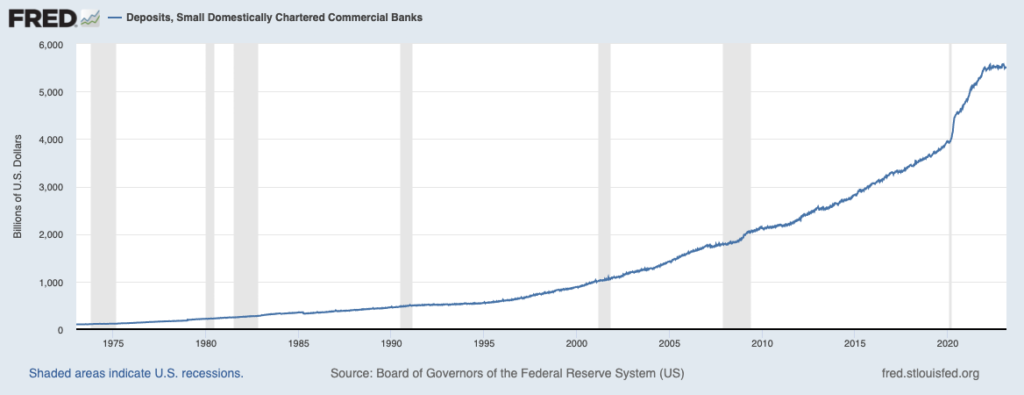

We’re not speaking a few small sum of money both. There may be $5.5 trillion in deposits in small/ regional banks within the U.S.

This brings us to #2.

SIVB went bananas with its lending following the pandemic courtesy of all of the bail-out/ stimulus cash. SIVB was the financial institution for (h/t DiscloseTV):

1) Some 1,500 local weather and energy-tech firms.

2) Greater than 60% of all community-based photo voltaic financing.

3) Numerous “woke” packages that financed politically-tied entities/ startups.

Look, a financial institution can lend cash to whoever it likes… however while you throw lending requirements out the window and begin loaning cash primarily based solely on political ideology (versus whether or not or not the particular person/ enterprise might ever pay you again) it’s a recipe for catastrophe.

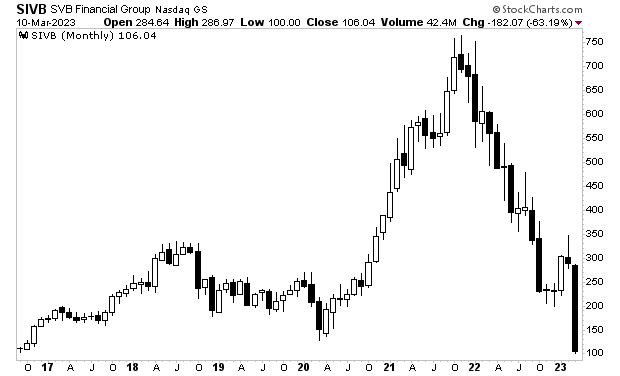

By doing this, SIVB went from the forty second largest financial institution to the fifteenth largest financial institution within the U.S. within the span of THREE YEARS. The chart beneath isn’t of a tech start-up or micro-cap… it’s that of a BANK. Sure, it went from $150 per share to $750 per share in lower than two years.

Which brings us to right now.

SIVB is NOT the one financial institution with these issues, simply as Bear Stearns wasn’t the one financial institution with publicity to subprime mortgage loans in 2008. There is no such thing as a simple approach out of this mess.

Keep in mind, there are over $5.5 TRILLION in deposits sitting in regional banks within the U.S. The Fed thinks {that a} $25 billion bailout fund can be sufficient to prop up the banks as a significant share of this leaves to hunt greater yields.

Good luck with that!

Oh… and by the best way… our proprietary Bear Market Set off… the one which predicted the Tech Crash in addition to the Nice Monetary Disaster… is on a confirmed SELL sign for the primary time since 2008.

In the event you’ve but to take steps to arrange for what’s coming, we simply revealed a brand new unique particular report Make investments Throughout This Bear Market.

It particulars the #1 funding to personal in the course of the bear market in addition to how you can make investments to probably generate life altering wealth when it ends.

To select up your FREE copy, swing by:

phoenixcapitalmarketing.com/BM.html

PS. Our new investing podcast Bulls, Bears & BS is formally dwell and obtainable on each main podcast utility (Apple, Spotify, and many others.)

To obtain or hear, swing by:

[ad_2]