[ad_1]

The San Diego metropolitan space incorporates a strong housing market—with a few of the highest historic lease and value appreciation in the USA. Anchored by a rising economic system, low unemployment, and a big army presence, the San Diego actual property market affords traders a steady base with sturdy long-term progress prospects.

Financial Overview

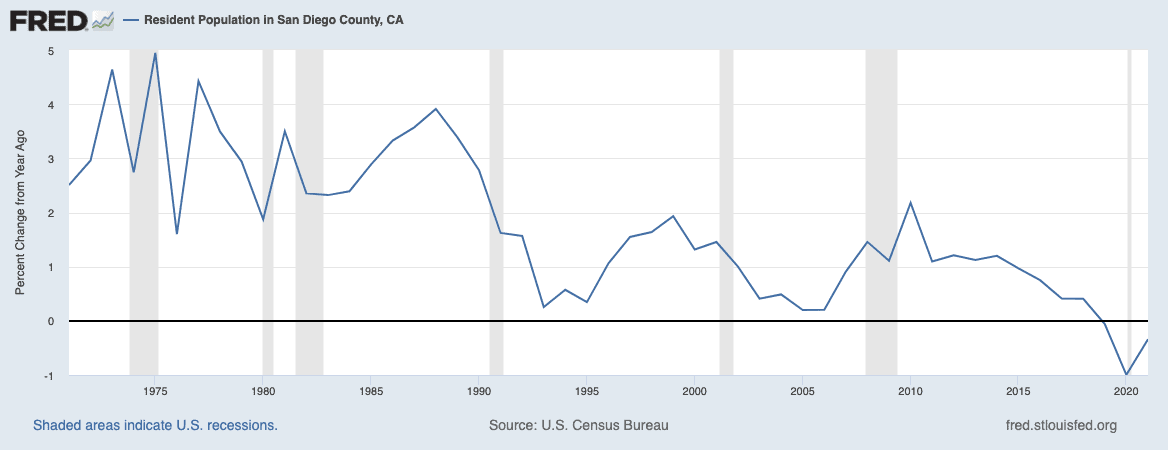

San Diego, situated in Southern California, is the eighth largest metropolitan space in the USA, with a inhabitants of about 3.3M folks. From 2010-2022, San Diego County grew practically 7%, however current estimates present a 0.4% decline in inhabitants from 2020-2021. For context, the state of California total had an estimated decline of 0.8% throughout the identical interval.

Wages in San Diego are very excessive, with the median family revenue coming in at simply above $82,000, in comparison with a nationwide common of $65,000. Poverty charges are comparatively low at 9.5% in comparison with the nationwide common of 11.6%. These sturdy financial indicators are partially pushed by a extremely educated workforce, with practically 40% of residents holding a bachelor’s diploma or larger.

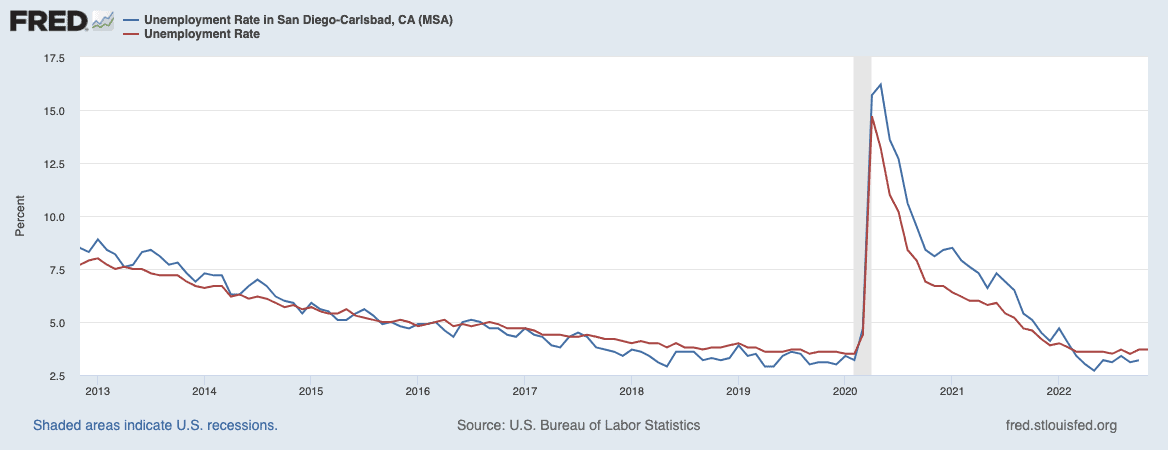

One in every of San Diego’s best strengths is its labor market. Unemployment charges remained solidly under the nationwide common for a few years pre-pandemic and have returned to very low lows in 2022.

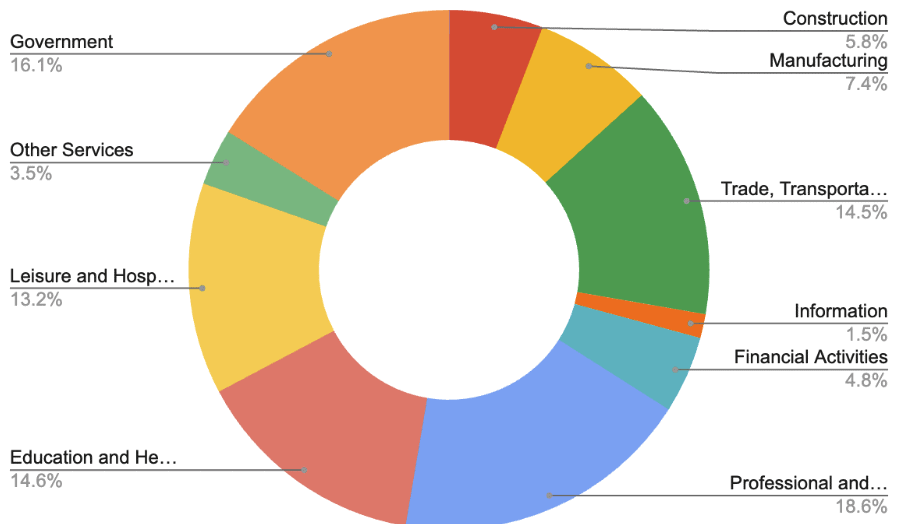

An necessary financial issue for actual property traders is the diversification of employment in a goal market. When an space is very depending on one trade, it makes the market extra inclined to financial cycles. San Diego, nevertheless, has a well-diversified economic system with a robust illustration in schooling, hospitality, commerce, skilled companies, and authorities.

Housing Costs

San Diego has a robust monitor document of property appreciation, rising a staggering 270% from the lows of the good recession in 2009 to present day, based on the S&P/Case-Shiller Index. Consequently, San Diego has a comparatively excessive entry level with a median sale value of virtually $828,000 as of October 2022.

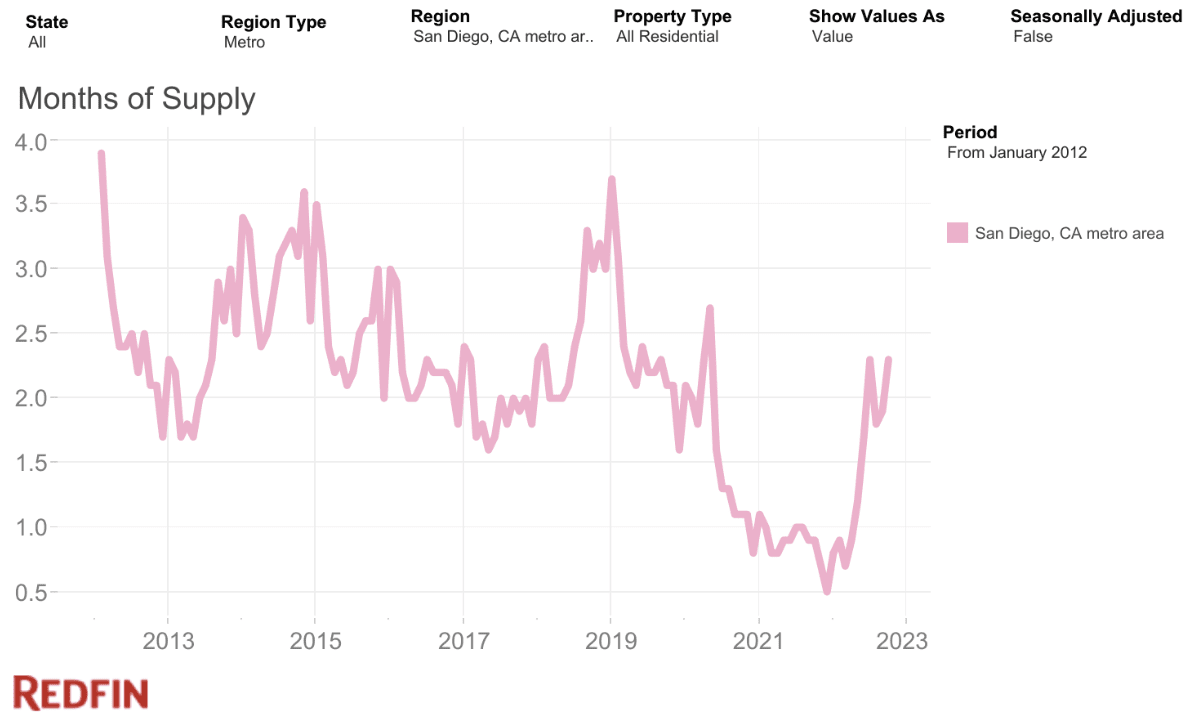

As with many markets, the San Diego market is displaying indicators of adjusting course. Since June, stock (as measured by months of provide) has elevated from pandemic lows and has began to degree off close to pre-pandemic averages.

This shift presents each alternative and threat for actual property traders. With high-priced markets that appreciated quickly in the course of the pandemic, the danger of value corrections is appreciable. It’s doubtless that costs will come down in San Diego in 2023.

Nonetheless, growing stock and value declines imply that the San Diego market has shifted from a vendor’s to a purchaser’s market. When consumers have pricing energy, they need to concentrate on shopping for properties under asking value to insulate themselves in opposition to potential future value declines.

Hire Developments

For traders, one of the vital enticing causes to spend money on San Diego is the sturdy lease progress. The median lease in San Diego is above $3,100 and has grown 10% in simply the final 12 months alone. Whereas lease progress is beginning to decelerate, San Diego nonetheless has one of many nation’s highest year-over-year rental progress charges. It’s a extremely fascinating place to dwell, and the demand for rental items is powerful.

Discover a San Diego Agent in Minutes

Join with market professional David Greene and different investor-friendly brokers who may also help you discover, analyze, and shut your subsequent deal:

- Search “San Diego”

- Enter your funding standards

- Choose David Greene or different brokers you need to contact

Money Circulation Prospects

With probably falling dwelling values mixed with excessive rents, money movement prospects in San Diego are prone to enhance within the coming months. That mentioned, money movement is comparatively arduous to come back by as measured by the rent-to-price ratio (RTP).

Usually talking, the upper the RTP, the higher. Something with an RTP near 1% is taken into account a superb space for money movement, however it’s not a tough and quick rule. However that doesn’t imply money movement can’t be discovered. There are good methods for actual property traders to make use of to generate wonderful returns in San Diego.

Successful Methods

Based on David Greene, an area market professional, short-term leases, medium-term leases, and home hacking are all wonderful methods to seek out money movement on this market. Conventional buy-and-hold investing can nonetheless work however will doubtless require some value-add work to make the numbers pencil out.

If you happen to can generate a superb cash-on-cash return with a few of the methods talked about above, San Diego could possibly be a successful marketplace for traders, given its popularity for nice appreciation. Appreciation may decelerate or reverse in 2023, however the long-term prospects stay very sturdy.

Getting Began: Spend money on San Diego

To study investing in San Diego, accomplice with an area investor-friendly actual property agent like David Greene, who may also help you discover, analyze, and shut the precise deal.

Right here’s the right way to contact David on Agent Finder. It’s straightforward:

- Search “San Diego”

- Enter your funding standards

- Choose David Greene or different brokers you need to contact

David is a nationally acknowledged authority on actual property—he’s an agent, lender, investor, creator, and co-host of the BiggerPockets Actual Property Podcast. He’s been featured on CNN, Forbes, HGTV, and extra. David is the primary to know which methods work, when the market shifts, and the perfect areas for investing that can meet your objectives.

Discover an Agent in Minutes

Match with an investor-friendly actual property agent who may also help you discover, analyze, and shut your subsequent deal.

- Streamline your search.

- Faucet right into a trusted community.

- Leverage market and technique experience.

Word By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]