[ad_1]

Markets are absorbing the information of one other financial institution failure this morning. Because the monetary business begins to wobble with the fallout from the sudden change in rates of interest, it’s extra vital than ever to guard capital.

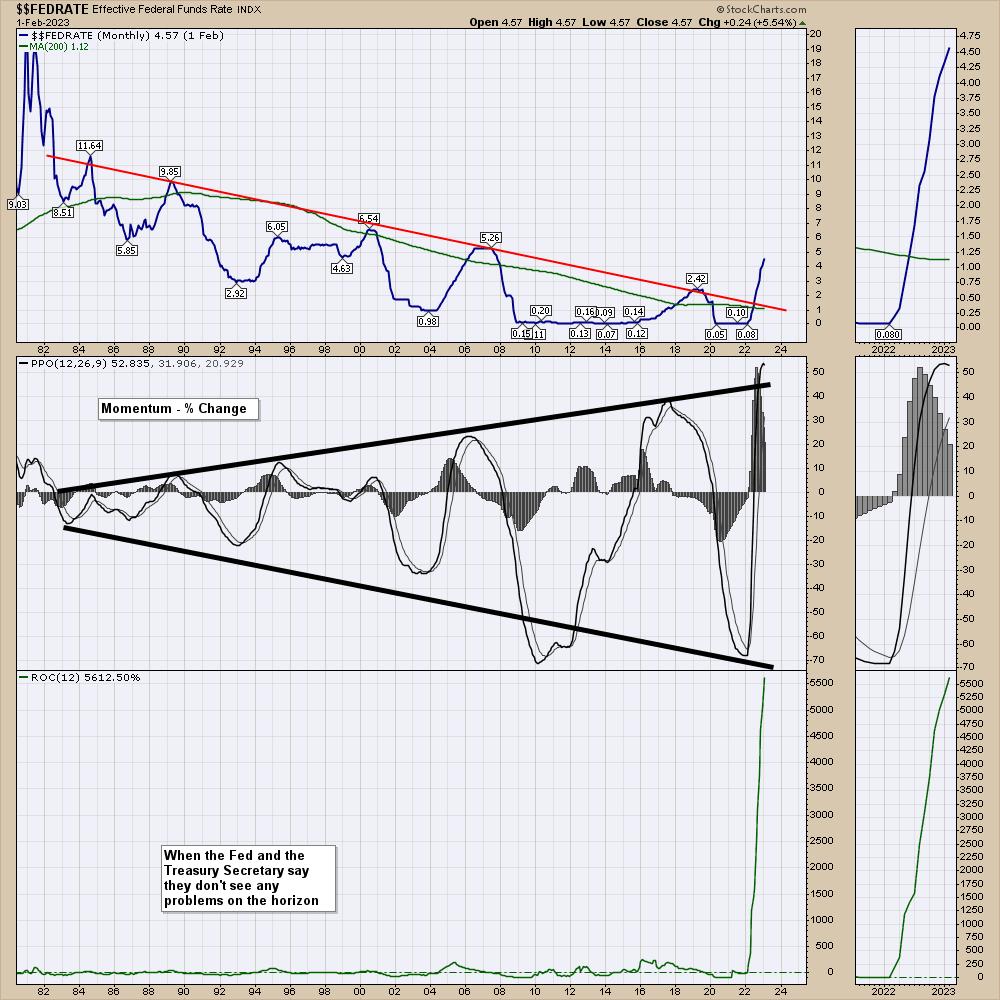

Under is my go-to chart in regards to the change in rates of interest. The Fed is predicted to lift charges within the coming weeks.

The highest panel is the present Fed Funds Price. The terminal charge is predicted to be above the 2007 highs.

The center panel is the momentum of the Fed charge modifications. What’s vital for me is that evidently every certainly one of these swings is wider and better than earlier than. If this was a crankshaft, saying “we’re getting wobbly or wobblier” could be a greater approach to put it. Additionally, discover the vertical transfer lately on the PPO. That is multi function 12 months, in comparison with the interval after the nice monetary disaster taking 8 years to maneuver from low to excessive.

The underside panel is the present charge of change. By far, the quickest charge of change. As we’ve got seen two banks fail in the previous few weeks, will we begin to see extra contagion? Janet Yellen talked about she has a number of banks on her watchlist proper now.

Because the starting of the 12 months, we’ve got seen each SI and SIVB stop. Now we have additionally watched the demise of FTX. Nonetheless, every problem appears to wobble the market, however not break it. That is the excellent news.

Right here is the final chart of SIVB. The ultimate SCTR prime for SIVB was in October 2021. The ultimate value excessive was on the prime of the $NDX in November 2022. In below 16 months, the financial institution was worn out.

Right here is the chart of SI. Silvergate went public in 2019. After a euphoric transfer into November 2021, the inventory made a collection of decrease lows and decrease highs, dropping from $240 to $2.75 in 16 months.

As this market continues preventing off dangerous information, this turns into an vital week to remember.

I mentioned the tender state of affairs for the $SPX on Market Buzz this previous Wednesday. Here’s a hyperlink to the recording.

I will even be internet hosting an data session about defending capital and profiting from bull market runs on March 14th, 2023 at 11:00 AM. Register right here to get free entry to the dwell occasion.

The charts broke lengthy earlier than the businesses did. Shopping for shares with weak SCTR rankings in industries like finance is a part of the issue. Charts give us extra data in a single image than all of the CEO interviews over the previous few years. What buyers do with their cash relative to the inventory is extra vital than the CEO’s feedback, in my view.

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).

Subscribe to The Canadian Technician to be notified at any time when a brand new put up is added to this weblog!

[ad_2]