[ad_1]

In line with the FCA – the UK’s Monetary Conduct Authority – mortgage stress within the UK is rising. New knowledge that they’ve issued in the present day reveals that:

- 356,000 extra folks with mortgages might face fee issues by the top of June 2024. That is down from early estimates, however stays important.

- These transferring from a hard and fast price might pay £340 a month extra on common.

- Londoners and people within the South East are most certainly to be stretched.

Stockbrokers Hargreaves Lansdown estimate consequently that:

- By the top of the yr, 26% of mortgage payers might be prone to default – over 2 million.

- 650,000 are at ‘excessive threat’ as a result of they don’t seem to be solely face a harmful hike of their mortgage funds, however they do not have emergency financial savings to guard them.

- 347,000 are at ‘crucial threat’, as a result of on high of the additional prices and financial savings shortfalls, they’re already spending extra cash every month than they’ve coming in.

- Singletons, older folks and Londoners are notably in danger.

- Remortgaging in 2023 will swallow an additional 3.1% of your revenue after tax – £2,120 a yr.

Because the Guardian notes this morning:

The [FCA] has instructed banks to think about slashing mortgage funds for debtors battling rising payments, because it revealed that 356,000 householders could possibly be prone to lacking their month-to-month instalments by summer season 2024.

The steering from the Monetary Conduct Authority confirms how lenders can help clients who’ve missed funds or are nervous they might fall behind, together with by extending the time period of their mortgage to decrease the month-to-month quantity due, or quickly slashing funds.

This was totally predictable, after all. I did predict it. And additionally it is wholly pointless. That’s as a result of the present charges of curiosity being promoted by the Financial institution of England aren’t wanted to sort out inflation.

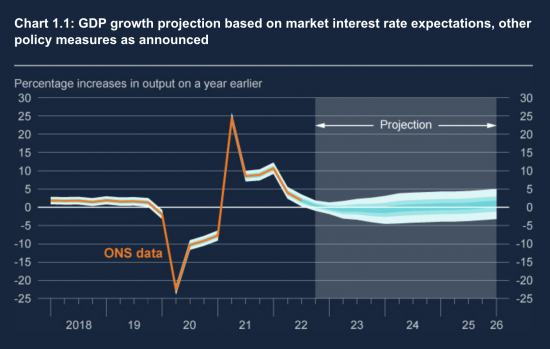

The newest Financial Coverage Committee report from the Financial institution of England consists of this chart:

The message of that chart is unambiguous, as Prof Danny Blanchflower and I might be arguing in a report we are going to undergo the Home of Commons Treasury Committee on quantitative easing and quantitative tightening subsequent week. It’s that if present anticipated charges create a major threat of an financial downturn – as they clearly do – then these charges are clearly too excessive.

What’s required now isn’t just help for these on extremely excessive rates of interest however a right away reduce in rates of interest. We might be suggesting 1% straightaway with the expectation of extra to observe.

Like so many different crises that this nation faces, this one has been made by the federal government getting virtually all elements of its coverage flawed. The Chancellor might overrule the Financial institution of England on price coverage. He’s not. All these dealing with appreciable stress consequently know who responsible. They may begin with the Governor of the Financial institution of England. However the actual particular person responsible is in 11 Downing Road.

[ad_2]