[ad_1]

After a higher-than-expected February jobs report, the Fed has once more positioned itself to proceed elevating charges by way of 2023 to curb inflation.

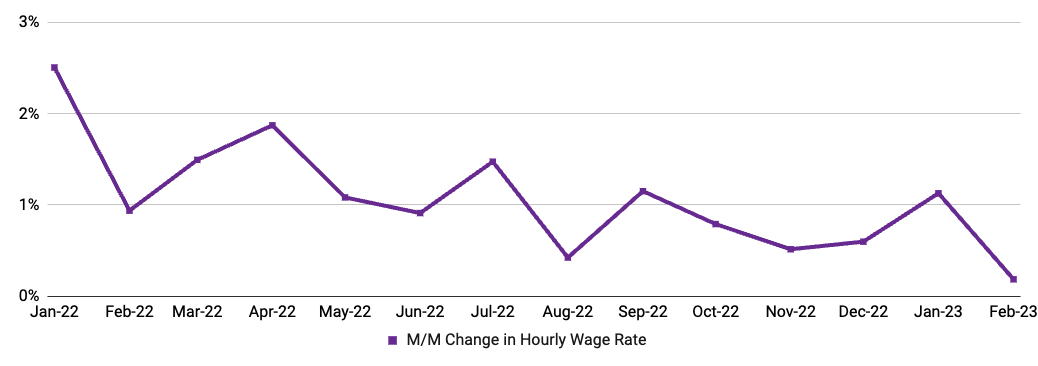

Our information from the US and Canada displays a slight decline in core employment metrics throughout February – and notably, a stark decline in wage inflation.

Larger non-farm payroll provides than anticipated in February have renewed curiosity within the Federal Reserve’s quick plans to boost charges in an effort to place the brakes on a sizzling economic system. As in prior iterations of this report, Homebase seeks to know how the broader financial setting is affecting small companies and their staff through the begin of 2023 by analyzing behavioral information from greater than two million staff working at multiple hundred thousand SMBs.

Abstract of findings: February noticed a slowdown in hours labored and staff working, throughout most industries and main metro areas

- Core indicators have been comparatively flat by way of the primary 2 months of 2023; in comparison with the identical time interval final 12 months, we don’t see the month-to-month development that we noticed on the identical time in 2022.

- Core indicators have been comparatively flat by way of the primary 2 months of 2023; in comparison with the identical time interval final 12 months, we don’t see the month-to-month development that we noticed on the identical time in 2022.

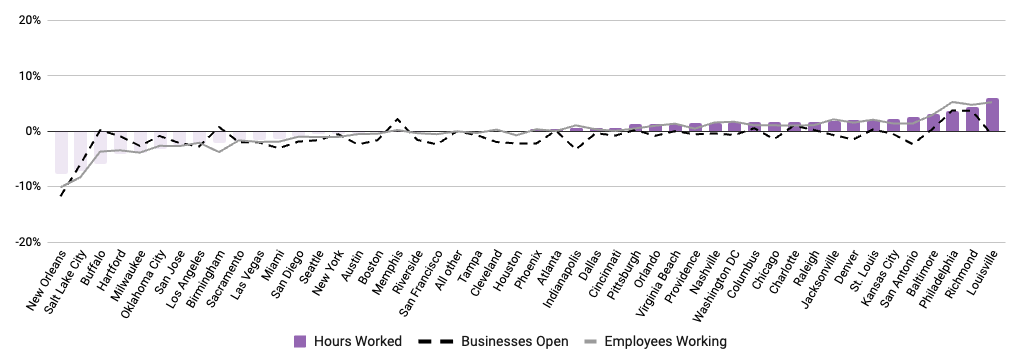

- We see comparatively low month-over-month variance in financial efficiency throughout metro areas, with the common MSA experiencing declines throughout core employment metrics.

- Wage inflation, whereas nonetheless optimistic, hit its lowest level since October 2021.

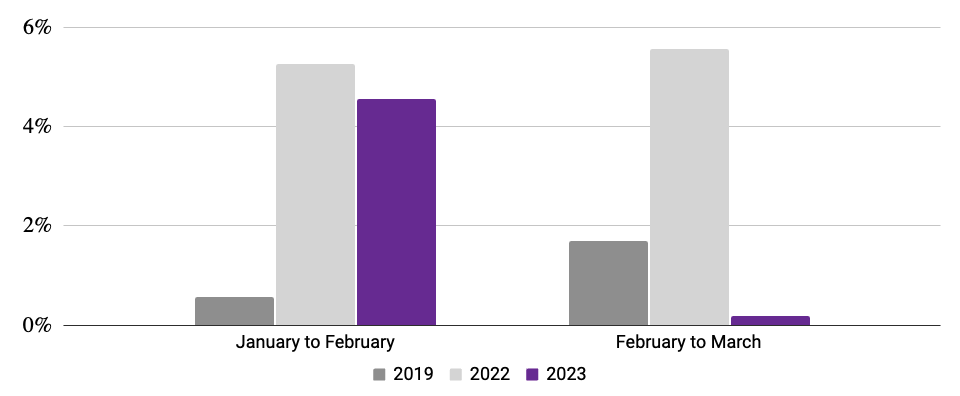

February employment grew slower than lately

After a robust January, February noticed a big drop in employment development. Homebase information additionally confirmed declines throughout hours labored for workers

Staff working

(Month-to-month change in 7-day common, relative to January of reported 12 months)

Companies open

(Month-to-month change in 7-day common, relative to January of reported 12 months)

Supply: Homebase information.

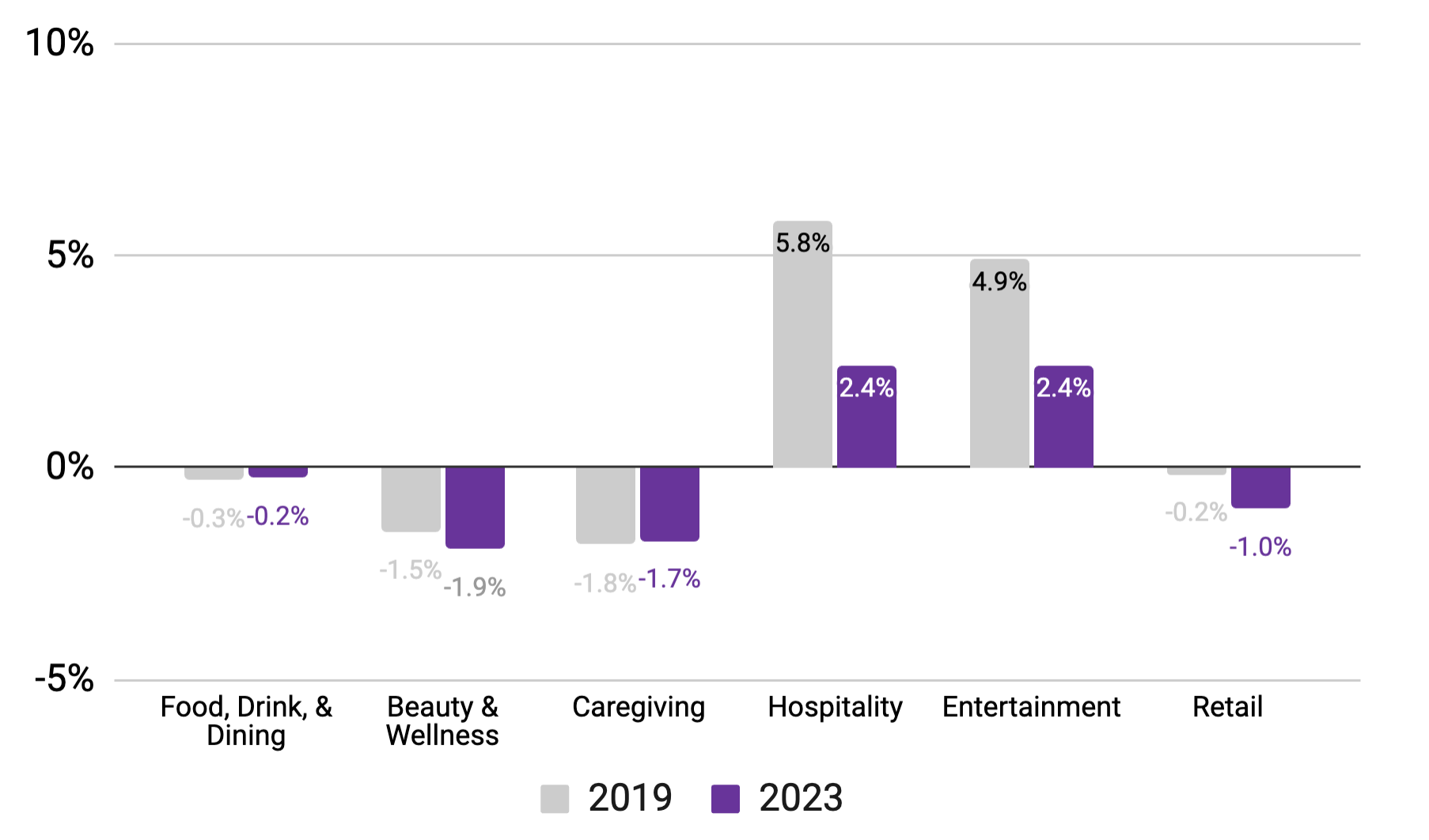

Most industries noticed a decline in employment, with Hospitality and Leisure because the outliers

After a robust begin to the 12 months, key industries declined in February. Leisure, food and drinks, and hospitality are nonetheless up relative to December employment.

Employment metrics are down about 1% for the retail sector, which has seen a major downturn in latest weeks

% change in staff working

(Mid-February vs. mid-January, utilizing Jan. ‘19 and Jan. ‘23 baselines)1

1. February 17-23 vs. January 13-19 (2019) and February 19-25 vs. January 15-21 (2023). Pronounced dips typically coincide with main US Holidays. Supply: Homebase information

Areas fared in another way in February, with climate and seasonality driving a number of the variations

Observe: February 19-25 vs. January 15-21. Supply: Homebase information

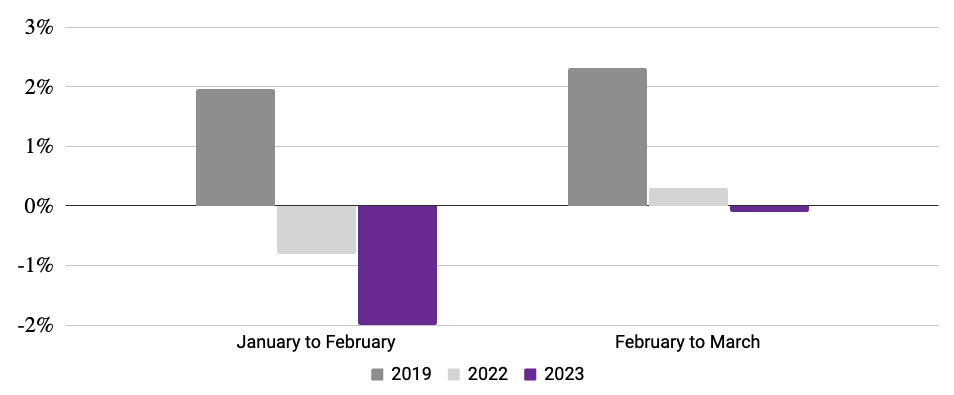

February noticed wage inflation hit its lowest degree since 2021

Wage inflation

Month-over-month change in common hourly wages

Worker

Pulse Test

A February pulse survey of roughly eight hundred staff reveals a constant, optimistic outlook in the direction of job prospects.

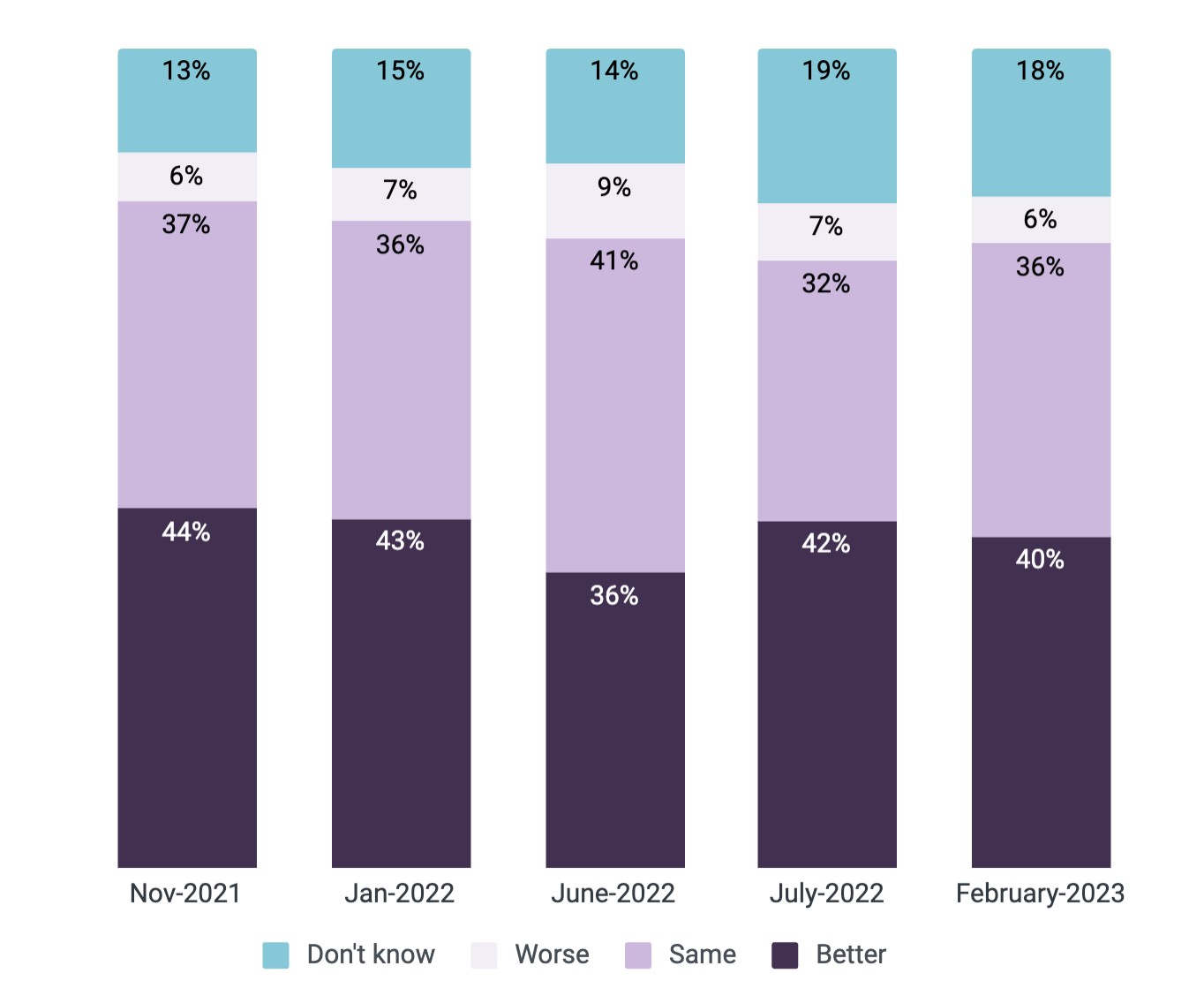

Staff see their job prospects bettering within the coming 12 months

Most staff surveyed see their job prospects bettering (40%) or staying the identical (35%) in a 12 months, whereas solely 6% suppose they’ll have worse choices than they do at this time. This represents a barely much less destructive outlook in comparison with mid-2022, and elevated uncertainty in comparison with the start of final 12 months. With inflation high of thoughts for a lot of, small enterprise staff have remained assured that they’ll proceed to have choices on the place they work sooner or later.

Survey query: Do you suppose your job choices will probably be higher, about the identical, or worse in 12 months in comparison with at this time?

Supply: Homebase Worker Pulse Survey. N = 873 (Feb. 2023)

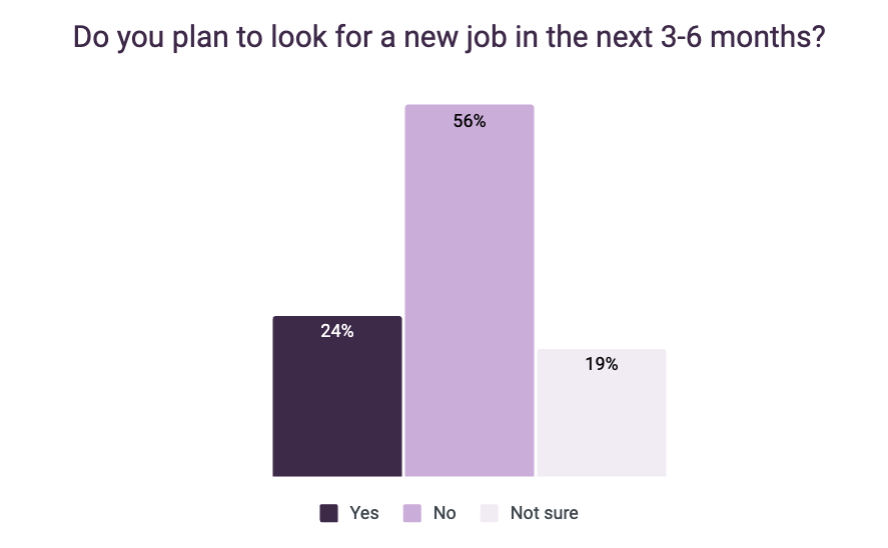

Practically 25% of staff plan to search for a brand new job within the coming months

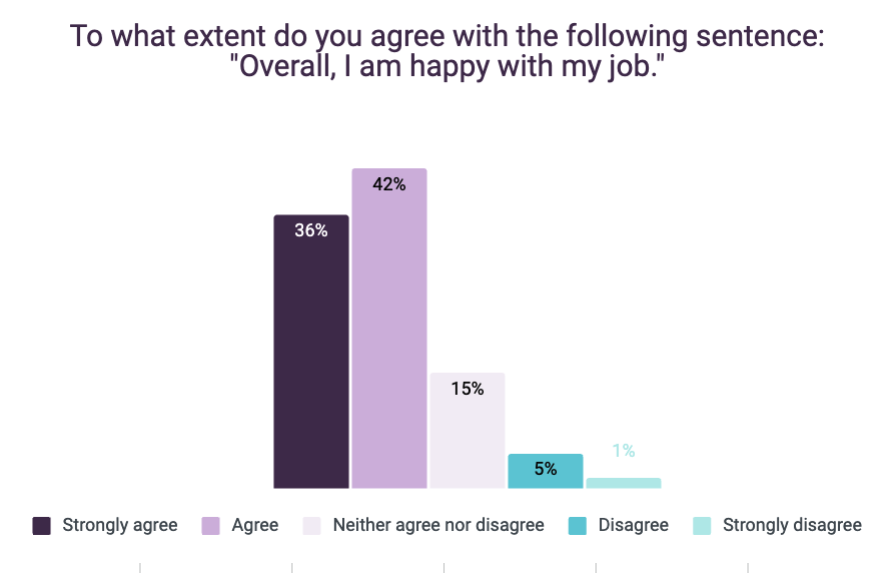

Whereas a majority of staff are typically happy with their jobs, that doesn’t essentially imply that they plan to stick with their present employers long-term; simply 57% of staff surveyed haven’t any plans to search for a brand new alternative within the subsequent 6 months, though 78% report being pleased with their job. Because the labor market stays sizzling, small enterprise staff are conscious of the alternatives that they’ve in entrance of them.

That mentioned, our October survey noticed 48% of staff say that they weren’t planning to search for a brand new job within the coming 12 months, indicating that financial concern is boosting retention in comparison with prior months.

Supply: Homebase Worker Pulse Survey. N = 873 (Feb. 2023)

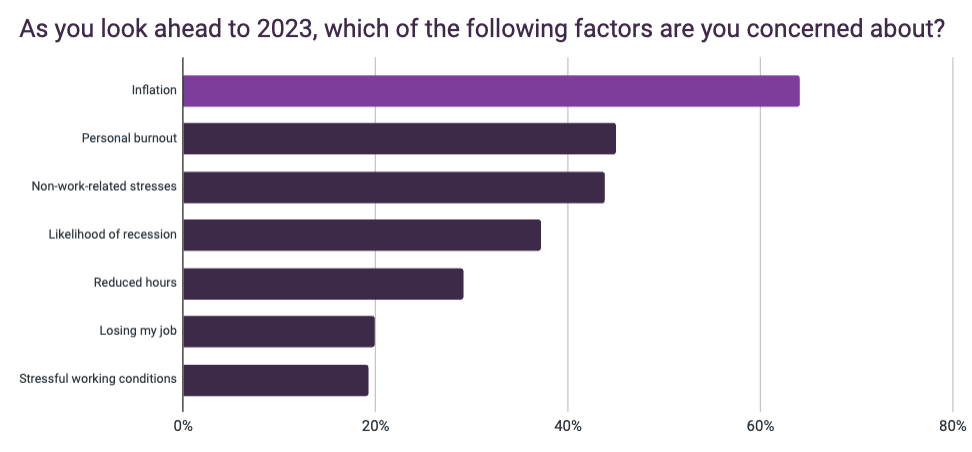

Inflation isn’t only a speaking level for economists – it’s the highest concern for staff, too

Of all points that staff are dealing with – each at and outdoors of labor – solely inflation was cited as a priority for a majority (64%) of these surveyed. Employees really feel safe about their jobs and the hours out there to them, however fear about how far their paychecks will go for them in an inflationary setting.

Supply: Homebase Worker Pulse Survey. N = 873 (Feb. 2023)

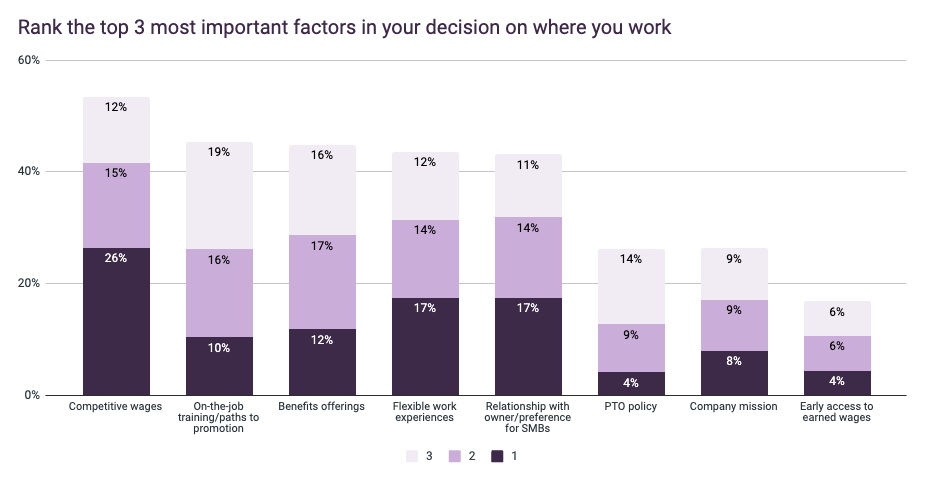

Within the face of inflation, wages stay the highest precedence for employee

It ought to come as no shock that the largest consider the place respondents resolve to work is wages, as 54% cited wages as a high 3 issue of their employment choices. Advantages and employer-sponsored upskilling are shut behind, indicating that employers must be investing of their workforces as a way to entice and retain expertise.

Supply: Homebase Worker Pulse Survey. N = 873 (Feb. 2023)

For a PDF of our February report, please see under; if you happen to select to make use of this information for analysis or reporting functions, please cite Homebase.

[ad_2]