[ad_1]

It is a skilled “Threat Administration Knowledgeable Advisor” specifically designed to barter the NASDAQ Index to move the so-called Prop Agency Challenges. This EA has a number of capabilities that supply the person the safety and profitability obligatory to beat the Challenges of any Prop Agency.

Its buying and selling logic relies on the “Peaks and Valleys” value motion setup which goals for prime danger/return targets with very small danger taking, on the lookout for protected and reasonable revenue targets.

Beneath, I’ll present you and clarify all of its parameters and functionalities (so as of appearence, from to prime to backside) utilizing goal language and examples for higher understanding.

//——

SECTION_MAGICNUMBER = ——-// DEFINE THE MAGICNUMBER //——

parameter MAGICMA = (6894 by default)

On this exterior parameter, the person should sort the EA’s MagicNumber.

//——

SECTION_STOPLOSS_TAKEPROFIT = ——-// DEFINE SL, TP AND OTHER PARAMETERS //——

parameter Base_lot = (0.1 by default)

Lot dimension used as base for every x factors on base_sl_calc parameter

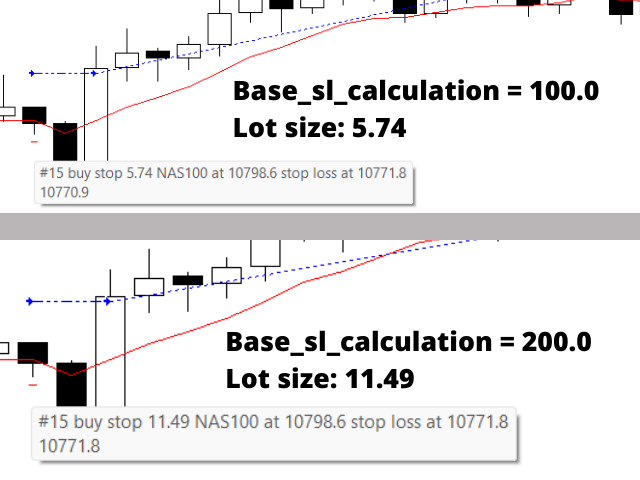

parameter Base_sl_calculation = (100.0 by default)

Distance in factors as base for lot dimension calculation

So, what these two parameters do is working togheter in an effort to outline the order’s lot dimension based mostly on a ratio. If the Base_sl_calculation is elevated, the lot dimension is predicted to be higher too.

For higher visualization, verify the photographs beneath:

parameter Max_sl_points = (300.0 by default)

Most distance allowed for cease loss. If the worth motion informs an extended stoploss in factors, the EA will ignore it and set because the Max_sl_points.

parameter Min_sl_points = (150.0 by default);

Minimal distance allowed for cease loss. If the worth motion informs a shorter stoploss in factors, the EA will ignore it and set because the Min_sl_points.

parameter Max_candles_pend_orders = (12 by default)

Max quantity of open candles in pending order

parameter Tp_sl_multiplier = (7 by default)

Threat/return desired for take revenue based mostly on cease loss distance in factors

parameter Max_slippage = (7 by default);

Max slippage allowed in factors

parameter Max_spread_allowed = (15 by default)

Max unfold allowed in factors

parameter Max_cons_daily_loss_filter = (false by default)

Allow or disable most consecutive day by day losses filter

parameter Max_consec_daily_losses = (3 by default)

Outline most consecutive day by day losses

//——

SECTION_AVERAGE_FILTER = ——-// DEFINE AVERAGE FILTER FOR THE SETUP //——

parameter Average_filter = (true by default)

Allow or disable common filter

parameter ENUM_MA_METHOD Average_Method = (MODE_EMA by default)

Select the Shifting Common’s technique

Average_period = (9 by default)

Set shifting common’s interval

//——

SECTION_INCREMENTAL_LOT_FUNCTION = ——-// BELOW, PARAMETERS FOR INCREMENTAL LOT FUNCTION //——

parameter Increment_Lot = (0.1 by default)

Lot added in case of loss.

parameter Max_Loss_Counter_Inc = (24 by default)

Restrict of ranges allowed for Incremental Lot Addition

parameter Max_Lot_Opened = (50.0 by default)

Max lot dimension allowed

//——

SECTION_MAXLOSS_MODE_DEFINITION = ——-// BELOW, PARAMETERS FOR DEFINING MAX LOSS ALLOWED //——

parameter Max_Loss_Mode = (0 – Off by default) , 1 – Nominal, 2 – Proportion

By default, the EA works with no restriction for Most Loss

parameter Loss_target = (1915.00 by default)

This parameter is used solely when the “Nominal” mode is chosen for the Max_Loss_Mode. If the Account’s Fairness or Steadiness is beneath this worth, the EA stops buying and selling.

parameter Percentage_balance_loss = (4.8 by default)

This parameter is used solely when the “Proportion” mode is chosen for the Max_Loss_Mode. If the Account’s Fairness or Steadiness is beneath this worth in share of the unique steadiness, the EA stops buying and selling.

parameter Initial_balance_loss = (2000.00 by default)

Worth of steadiness for max loss share calculation

//——

SECTION_PROFIT_MODE_DEFINITION = ——-// BELOW, PARAMETERS FOR DEFINING THE ACHIEVEMENT OF THE TARGET BALANCE //——

parameter Profit_Target_Mode = (0 – Off by default) , 1 – Nominal, 2 – Proportion

By default, the EA works with no revenue goal

parameter Target_balance = (5410.00 by default)

This parameter is used solely when the “Nominal” mode is chosen for the Profit_Target_Mode. If the Account’s Fairness or Steadiness is above this worth, the EA stops buying and selling.

parameter Percentage_balance = (8.2 by default)

This parameter is used solely when the “Proportion” mode is chosen for the Profit_Target_Mode . If the Account’s Fairness or Steadiness is above this worth in share of the unique steadiness, the EA stops buying and selling.

parameter Initial_balance = (5000.00 by default)

Worth of steadiness for revenue goal share calculation

//——

SECTION_DAILY_PROF_LOSS = ——-// DEFINE DAILY PROFIT AND LOSS //——

parameter Seek_daily_profit = (false by default)

Search max day by day revenue (true) or not (false)

parameter Daily_profit = (100.0 by default)

Max day by day revenue worth. If the day by day fairness achieved a complete day by day revenue equal or above this, the EA stops buying and selling on that day.

parameter Seek_daily_loss = (false by default)

Search max day by day loss (true) or not (false)

parameter Daily_loss = (220.0 by default)

Search max day by day loss or not. If the day by day fairness suffers losses equal or beneath this, the EA stops buying and selling on that day.

//——

SECTION_EQUITY_LOSS_PREVENT = ——-// FUNCTION TO AVOID UNDESIRED ‘PULLBACK LOSS’ IN CHALLENGES //——

parameter Seek_equity_loss = (false by default)

Allow (true) or disable (false) Fairness Loss Stop

parameter Daily_equity_loss = (220.0 by default)

Max day by day loss in Fairness.

//——

SECTION_PROTECTION_SECTION = ——-// SET BREAKEVEN LEVELS OR TRAILING STOP OR NEITHER //——

parameter Profit_Protection = (1 – BreakevenOn by default), 0 – NoBreakevenNoTrailingStop, 2 – Trailing Cease

BREAKEVEN_DEFINITION = “——-// SET BREAKEVEN LEVELS PARAMETERS //——“;

parameter Be_tolerance_points = (60.0 by default)

Worth in factors the worth should shut in favor to reset the loss counter.Which means that if the worth reverts and touches a Breakeven stage, if that Breakeven is beneath 60 factors after the entry value (in line with the instance above), the “loss counter” returns to zero, resets, and thus the calculation of the lot as properly. In any other case, if the worth reaches the Breakeven stage beneath 60 factors, the EA will proceed to keep up the identical present stage of “loss rely”, in order to not reset the lot.

parameter Perc_gain_1_activation = (30.0 by default)

Proportion in favor of revenue to activate 1° step_gain

parameter Perc_gain_2_activation = (80.0 by default)

Proportion in favor of revenue to activate 2° step_gain

parameter Perc_gain_1_be = (3.0 by default)

Desired share of achieve for the 1° stage of BE

parameter Perc_gain_2_be = (40.0 by default)

Desired share of achieve for the two° stage of BE

TRAILING_STOP_DEFINITION = “——-// SET TRAILING STOP PARAMETERS //——“;

parameter Threshold_points = (350.0 by default)

The quantity of factors value should go in direction of revenue to activate the Trailing Cease operation

parameter Trail_points = (150.0 by default)

The quantity of factors set for the Path of the Trailing Cease operate

parameter Step_points = (150.0 by default)

The quantity of factors set for the Step of the Trailing Cease operate

//——

SECTION_WORKING_TIME = ——-// DEFINE THE TIME INTERVAL FOR WORKING AND ORDERS OPENING //——

parameter Time_filter = (false by default)

Allow (true) or disable (false) time filter

parameter Initial_order_hour = (1 by default)

Preliminary hour for order opening

parameter Final_order_hour = (21 by default)

Ultimate hour for order opening

//—— SECTION_CLOSE_FRIDAY = ——-// DEFINE THE ‘CLOSE ALL TRADES AT FRIDAY’ FUNCTION //——

parameter Close_friday = (true by default)

Allow (true) or disable (false) shut all trades friday operate

parameter Max_friday_hour = (18 by default)

After this hour all trades are closed in friday. Irrespective of if in revenue or in loss.

parameter Close_only_if_profit = (true by default)

Allow (true) or disable (false) this operate which works this manner: Whether it is Friday and there may be an open order with a loss, the EA is not going to shut this order instantly till the time is bigger than that outlined within the “Max_friday_hour” parameter. Thus, if this order in our instance turns a revenue, and the present time is the same as or higher than that outlined within the parameter “After_hour_profit_closes” , then sure, the EA will shut the order earlier than “Max_friday_hour”.

If, then again, that order was already in revenue and the time is the same as or higher than “After_hour_profit_closes”, on this case the EA will shut that order with the revenue it’s exhibiting. This operate goals to make sure that on Friday the person can accumulate some revenue earlier than “Max_friday_hour”.

parameter After_hour_profit_closes = (16 by default)

If it is friday and after this hour, the order in revenue is closed

//——

SECTION_MONTHLY_GAIN_TARGET = ——-// DEFINE PERCENTAGE OF MONTHLY GAIN //——

parameter Seek_monthly_target = (false by default)

Search month-to-month share or not

parameter Monthly_gain_perc = (2.5 by default)

Month-to-month share to be achieved

//——

SECTION_NEWS_FILTER = ——-// NEWS FILTER PARAMETERS //——

parameter News_filter_on = (false by default)

Allow (true) or disable (false) the information filter

parameter NoTradeAfterNews = (30 by default)

No commerce x minutes after information

parameter NoTradeBeforeNews = (30 by default)

No commerce x minutes earlier than information

parameter NewsLight = (false by default)

Allow (true) or disable (false) mild information filter

parameter NewsMedium = (false by default)

Allow (true) or disable (false) medium information filter

parameter NewsHard = (false by default)

Allow (true) or disable (false) exhausting information filter

parameter Your_Time_Zone_GMT = (3 by default)

Your Time Zone, GMT (for information)

//——

SECTION_SEND_NOTIFICATION = ——-// ENABLE OR DISABLE NOTIFICATIONS ON TRADES //——

parameter Notification_Options = (0 – NoNotifications by default), 1 – OrdersAndResults, 2 – OrdersOnly, 3 – ResultsOnly

While you resolve you wish to be notified solely about Orders, it means you do not wish to be notified, for instance, concerning the EA attaining a “consequence” like hitting the month-to-month achieve.

Should you select “OrdersOnly,” each time the EA opens an order or when an order is closed with a optimistic or destructive consequence, the EA will ship a notification to the MQL app. In any other case, if you wish to be notified when the month-to-month goal is hit, when the revenue goal is hit, when the utmost loss is hit, and even when the EA is eliminated for security, then Outcomes ought to be chosen.

The very best follow is to set this parameter to “Orders and Outcomes.” This manner, you can be conscious of each conditions.

//——

SECTION_SPECIAL_FUNCTIONS = ——-// FUNCTIONS SPECIALLY MADE FOR PROP FIRM CHALLENGES //——

parameter Special_initial_balance = (2000.0 by default)

Preliminary steadiness used for all of the “particular capabilities”

parameter Offset_balance_profit = (10.0 by default)

“Further” worth added to Special_initial_balance to guard towards slippage, terminal malfunction, lagging, low latency or gradual connection

SECTION_PREVENT_DRAWDOWN = ——-// FUNCTION TO PREVENT LARGE DRAWDOWN //——

parameter Balance_prevent_actions = (0 – NoActions by default), 1 – HalfLotSize , 2 – DoubleLotSize

The person chooses which motion the EA will do when the present steadiness is beneath the following two parameters.

parameter Balance_first_value_prevent = (1990.0 by default)

Beneath this, forestall actions are taken to get better preliminary steadiness which would be the one chosen on the parameter “Balance_prevent_actions”.

So, for instance, if the present steadiness is beneath 1990.0 and the motion chosen is “HalfLotSize”, the EA will open half of the calculated lot dimension. When the present steadiness reachs once more the “General_initial_balance”, the lot dimension would be the “regular” dimension once more.

paramater Balance_second_value_prevent = (1960.0 by default)

Beneath this, forestall actions are taken to get better again the “Balance_first_value_prevent”. The actions can be at all times by reducing the present lot dimension in half.

So, if the unique lot dimension can be 0.2, after the steadiness going beneath the primary stage of steadiness safety, the lot dimension can be lower in half to 0.1, then if the steadiness retains taking place beneath this secound stage, the lot can be lower in half once more to 0.05, if the person has chosen the “HalfLotSize” motion.

SECTION_SECURE_PROFIT = ——-// FUNCTION TO ‘SECURE PROFIT’ //——

parameter Secure_profit_actions = (0 – NoActions by default), 1 – HalfLotSize , 2 – DoubleLotSize

The person chooses which motion the EA will do when the present steadiness is above the following parameter “Balance_secure_profit).

parameter Balance_secure_profit = (5300.0 by default)

Above this, steadiness warning actions can be taken to succeed in goal revenue.

So, for instance, if the present steadiness is above 5300.0 and the motion chosen is “HalfLotSize”, the EA will open half of the calculated lot dimension till it achieves the specified objective of the problem.

parameter BreakevenOnInitialBalance = (false by default)

It units a everlasting Breakeven stage to guard the account towards a sudden sequence of unhealthy trades when the account steadiness has already reached a worth above tje “Balance_secure_profit” in order that the dealer can at the very least ask for the Reset of the Problem and check out once more another time the entire problem from the start.

SECTION_FREE_REPEAT_CHASE = ——-// FUNCTION TO ‘FREE REPEAT CHASE’ //——

parameter FRC_actions = (0 – NoActions by default), 1 – HalfLotSize , 2 – DoubleLotSize

What this operate does is, by informing the quantity of x days handed on the parameter “Days_challenge_trading”, if the Account Steadiness is beneath the unique one, the EA will take some actions chosen by the person (half the lot dimension or double it) to get better the unique steadiness. Proper after attaining that, the EA closes all open trades and is eliminated. So by doing that, the person can wait till the tip of the Problem’s time to request free limitless repeats or retakes.

parameter Days_challenge_trading = (20 by default)

The person should inform the times handed which is able to set off the FRC_actions.

//—– END OF PART 01. CLICK HERE FOR PART 02 OF THIS DOCUMENT IN WHICH WE DISCUSS ABOUT THE BACKTESTING RESULTS AND LEARN DEEPER ABOUT THE FUNCTIONS SPECIALLY MADE FOR THE CHALLENGES —–//

[ad_2]