[ad_1]

Again in March and once more in August, I famous that “We’re undoubtedly reaching the boundaries of affordability for Individuals,” which ought to “cool the true property market” and sure “trigger a correction” however with out the unpleasantness of a crash.

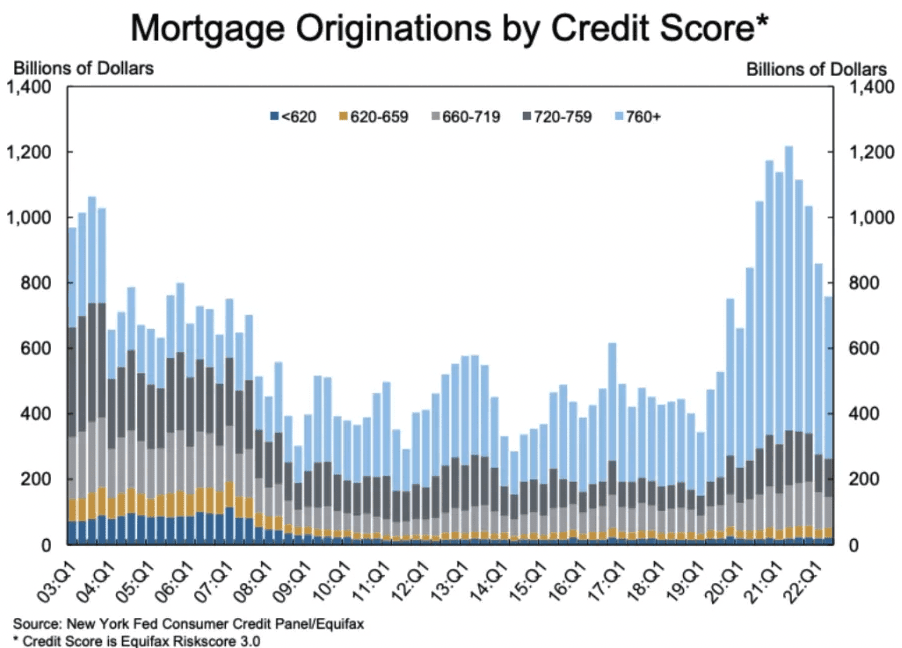

This, in my humble judgment, remains to be the case as the true property market is—not like in 2008—buoyed by far more certified consumers with considerably extra fairness of their houses and long-term, low-interest, mounted debt versus the teaser charges of the early to mid-aughts. A chart of mortgage originations by credit score rating ought to drive that time residence.

Nonetheless, I used to be clearly mistaken about one factor. I didn’t imagine there was enough “political will” to essentially sort out inflation. That also could also be true because the Fed might rapidly abandon its present course. However given the litany of fee will increase and the alerts of extra to return, it will seem that high-interest charges might be with us for fairly a while.

Certainly, the three% mortgage I received on my private residence final yr can be greater than twice that now. As Dave Meyer put it, the Fed has made it clear that they need a housing correction to happen to cut back inflation and deal with near-historic ranges of unaffordability.

So, the place does that depart us now?

A Housing Correction and the “Sellers Strike”

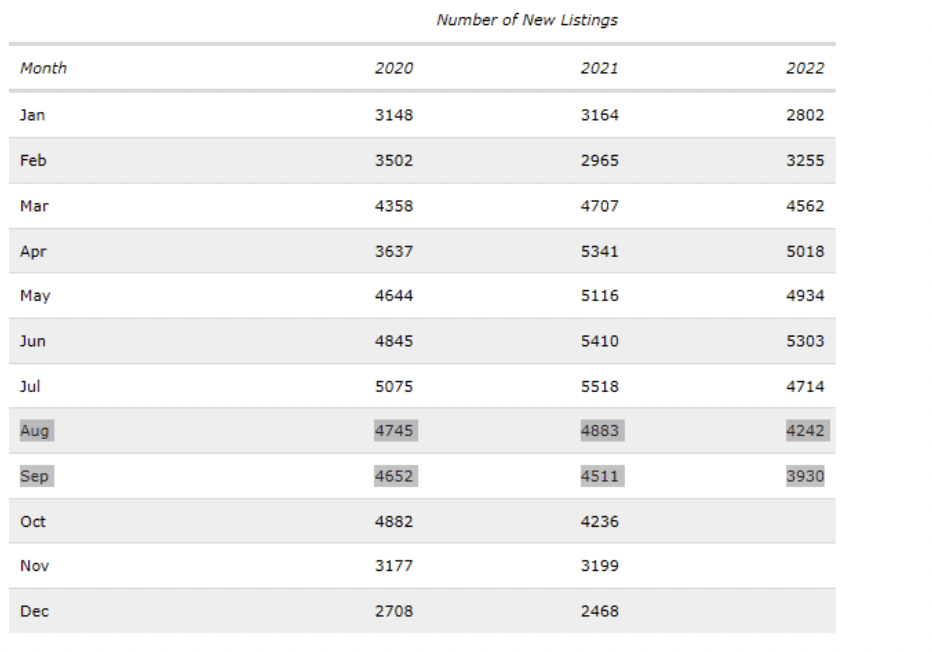

That is what the variety of new listings appears like within the Kansas Metropolis Metro Space, the place I stay:

New listings in September 2022 had been down nearly 600 from 2021, a 12.9% lower. They had been down a full 15.5% from 2020.

Thus, regardless of the speed will increase, stock solely crept up from 1.5 to 1.7 months in September 2022. A balanced market is six months, so that is nonetheless thought of a “vendor’s market.” (Though I might argue with this, given how odd the present market is.)

It’s essential to take a look at year-over-year (YoY) comparisons right here as new listings observe a cyclical sample and all the time fall off throughout the winter. As an illustration, the year-over-year pattern for brand new listings nationally fell 23.6% YoY in October.

Nonetheless, houses on the market are nonetheless up 5% from final October. This improve in stock got here largely as a result of fewer gross sales and almost 20% of consumers backing out of signed contracts. There are additionally some somewhat amusing headlines, resembling “common sale-to-list-price ratio fell to 99% in September.” It had been a shade over 103%, which is, effectively, not precisely typical.

Total, that is what Invoice McBride calls “the sellers strike.” There merely aren’t very many good causes for householders to attempt to promote their home proper now. So, they don’t. Subsequently, we should always count on this pattern to speed up and be with us for fairly a while.

Individuals Are Staying Put

Of late, Individuals have been considerably much less more likely to transfer than they’d in years previous. As The Hill famous in 2021:

“New knowledge from the U.S. Census Bureau exhibits simply 8.4 p.c of Individuals stay in a special home than they lived in a yr in the past. That’s the lowest fee of motion that the bureau has recorded at any time since 1948.

“That share implies that about 27.1 million individuals moved houses within the final yr, additionally the bottom ever recorded.”

Even earlier than the pandemic, document lows had been being set. The explanations for this are many, together with an getting old inhabitants, fewer kids, and, after all, housing being so costly.

In that very same vein, the variety of new residence listings was additionally falling even earlier than costs went by the roof and the current rate of interest hikes.

The typical length of homeownership went as much as eight years, a rise of “about three years over the past decade,” in accordance with The Zebra. The change within the median size of keep is much more dramatic. It has nearly tripled from about 5 years in 1985 to 13.2 years in 2021.

If you consider it, it is smart. Why transfer, significantly now?

Most owners (roughly 95%) have 30-year, fixed-rate mortgages. Anybody who took out a mortgage within the final 5 years has a fee under no less than 4%. Why would you ever voluntarily repay such a mortgage?

And as we have now seen, fewer and fewer persons are.

Apparently sufficient, the identical factor is occurring within the rental market.

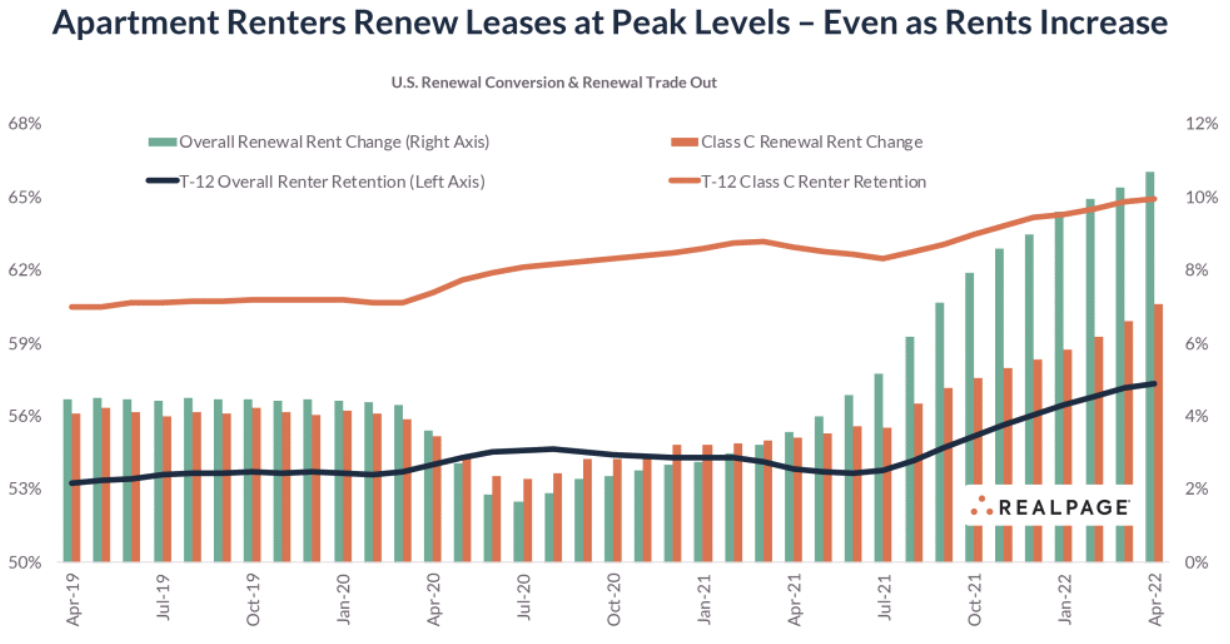

Tenants are renewing their leases at a document degree. In April of 2022, over 65% of tenants renewed their lease versus simply over 56% in 2019, in accordance with RealPage.

This additionally is smart for those who perceive that the enormous lease will increase you hear about are only for new listings. For instance, again in April, when the year-over-year lease improve for brand new listings was 16.9%, NPR discovered that the typical tenant was solely paying 4.8% extra than the yr earlier than.

The reason being that only a few landlords are keen to boost lease all the way in which to market on present tenants. Growing the lease far more than 5% typically conjures up a tenant to go away simply out of spite. So, if lease is (or no less than was) going up 16.9% elsewhere however solely 4.8% the place you might be, you’re more likely to keep put.

So, is the USA—birthed in a struggle in opposition to monarchy and entrenched aristocracy—regressing to a realm of feudal serfs certain to the land they presently inhabit?

Effectively, in the interim, kind of.

Alternatives In This Very Odd Market

The House owner That Rents

The “sellers strike” has and can proceed to buoy the housing market so long as rates of interest are excessive (no less than by post-2008 crash requirements). On the identical time, it’s seemingly cooling the rental market, and I believe many householders who have to relocate are selecting to lease out their houses as a substitute of promoting them, and thus the quantity of leases is rising.

Asking rents are beginning to reasonable. From a excessive year-over-year improve of 18% in April, they’re now down to simply 7.4% in November and only one.2% increased than in October.

Even nonetheless, rents are fairly a bit increased than they had been even a couple of years in the past, so persevering with to carry leases as a landlord ought to do high-quality within the close to time period.

Moreover, for any home-owner on the market who wants to maneuver for a job relocation or whatnot, one of the best play is more likely to lease your present residence after which discover a rental the place you might be transferring to. In any case, the softening rental market will assist you to find a rental equally as a lot because it hurts you in renting out your present residence.

And once more, why repay your 2.65% mortgage in your present residence to get a 6.95% mortgage on a brand new one? That’s not a very profitable type of arbitrage proper there.

I believe the “home-owner who rents” will grow to be far more frequent within the subsequent yr or so. And whereas such concepts could come naturally to the readership of BiggerPockets, they seemingly received’t naturally happen to the “regular” home-owner regardless of it being of their finest monetary curiosity. So please be certain to enlighten others about their choices on this excessive (by current requirements) rate of interest surroundings.

Topic To

The subsequent main alternative is a little more rife with uncertainty, and that is the notorious “topic to” technique.

“Topic to” simply implies that the acquisition is “topic to the present financing.” Successfully, the customer assumes an unassumable mortgage.

Or in different phrases, the customer takes the deed to the property and makes the mortgage funds, however the mortgage stays within the vendor’s title.

The benefits to the customer, on this case, are apparent. If you happen to can “assume” a mortgage at 2.85% on a property, how a lot does the acquisition value even matter?

There are a number of issues, although. To begin with, it’s good to significantly construct rapport with the vendor to ensure that them to belief you to pay their mortgage on a home they now not personal. In any case, for those who don’t make the funds, it’s the vendor’s credit score that may take the hit.

Secondly, nearly each mortgage and deed of belief has a “due on gross sales” clause. This permits a financial institution to name the mortgage due the second the property transfers possession. Up to now, banks have very hardly ever executed so. It could be totally different this time round, although. Would a financial institution preserve a 3% mortgage on its books when the going fee is over 6%?

All we are able to actually say is that we don’t know for positive. If you happen to do make use of this technique, it is best to have a plan B to refinance or promote the property if the financial institution does elect to name the mortgage due.

Lastly, holding a mortgage with out the corresponding property will significantly have an effect on a vendor’s debt-to-income ratio and make it very troublesome to purchase a brand new property. On the identical time, as a topic to purchaser, I might by no means wish to repay any mortgage made between 2018 and the center of 2022. Thus, there may very well be a long-term battle and even an moral difficulty that wasn’t current a lot when topic to’s first turned widespread within the early 2010s.

Although you might not have a fiduciary responsibility to the vendor, try to be very clear about what the ramifications may very well be with the vendor upfront. I might suggest even coming to an settlement or one thing to that impact about how lengthy you’ll preserve that mortgage in place earlier than refinancing or promoting.

Conclusion

So long as charges keep excessive, the “sellers strike” ought to proceed. Anticipate very low charges of recent listings for the foreseeable future. The true property market will soften and decline a bit, however with no sturdy incentive to promote, the sellers strike, amongst different components, ought to preserve it afloat.

Discover an Agent in Minutes

Match with an investor-friendly actual property agent who can assist you discover, analyze, and shut your subsequent deal.

- Streamline your search.

- Faucet right into a trusted community.

- Leverage market and technique experience.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]