[ad_1]

Final week, I wrote concerning the Advance-Decline information for “excessive yield” bonds, that are reported on daily basis by FINRA at this web site. Additionally they report Advance-Decline information on the “funding grade” bonds there, and people information are (form of) helpful for monitoring extremes in that portion of the bond market, as they have an inclination to behave extra like T-Bonds whereas the excessive yield bonds act extra just like the inventory market.

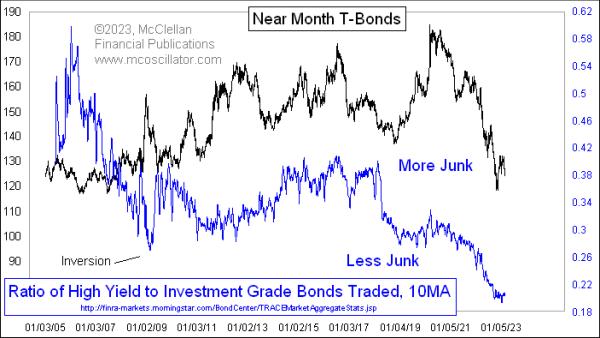

Since I’ve these information on every of the classes of bonds, it occurred to me, a couple of years in the past, to run a comparability of them over time, simply to see what data it would present. That examine led to this week’s chart.

What I did was to sum the Advances plus Declines for every bond class (the unchanged numbers are very low, and thus inconsequential). That allowed me to create a every day ratio of what number of of every class of bonds trades every day. That information generally is a bit noisy, and so I smoothed these every day ratio information with a 10-day easy shifting common to get what you see right here.

The primary remark is that the ratio has been trending downward over time, that means that there are comparatively extra bonds buying and selling which might be rated as funding grade, and fewer which might be within the junk class. However I needed to discover a deeper that means, and so I in contrast these information first to inventory costs, then to bond costs, which is what you see above. The bond comparability was rather more fascinating.

There may be an apparent constructive correlation between T-Bond costs and this ratio over time, particularly over concerning the final 10 years or so. At occasions within the late 2000s (the FINRA information start in 2005), there have been inversions of the 2 plots, which is unusual. The most important inversion got here in December 2008, within the throes of the Nice Monetary Disaster, as buyers sought the higher assurance of a assured “return of funding” in T-Bonds, and as firms weren’t in a position to challenge junk debt. That was a very distinctive time in historical past.

So what can we conclude from this largely constructive correlation the remainder of the time? As bond costs fall, yields go up usually. So the need of buyers to succeed in for yield can go down incrementally, making it tougher for firms to challenge low grade bonds to finance their operations. That leads these firms to both discover different methods of getting the capital they want, or make different preparations, resembling mergers, inventory issuance, and so on.

Proper now, we’re seeing this ratio on the lowest stage of the out there information (since 2005), that means that there’s simply not as a lot junk debt on the market in comparison with excessive grade debt as what has been “regular” for the previous few years. That doesn’t essentially imply there are fewer marginal firms on the market, whose debt could be rated poorly, however moderately that the flexibility of these firms to challenge debt on this bond market setting is only a lot worse.

Subscribe to High Advisors Nook to be notified each time a brand new put up is added to this weblog!

[ad_2]