[ad_1]

One of many large unexamined assumptions of lots of the questions I’ve been getting lately is that politics issues to economics. I get questions from each side—how unhealthy will it’s if candidate X wins? All of them assume that candidate X, whoever it’s, has the flexibility to considerably have an effect on the financial system and the markets. However is that basically the case?

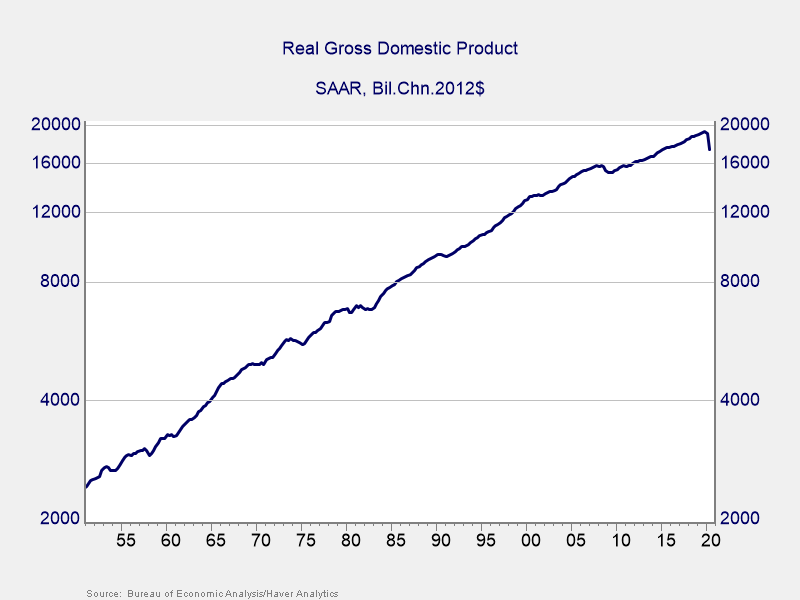

Charting the Financial system’s Progress

The chart beneath exhibits the dimensions of the financial system over the previous 70 years. In contrast to most charts used on the weblog, I’ve created this one in fixed {dollars} (i.e., it takes out the results of inflation). Inflation makes development in some years look a lot better than it actually was. As such, utilizing actual {dollars} is a greater measure of the particular measurement of the financial system. I’ve additionally used a logarithmic scale for the chart, which is considerably uncommon in {that a} log scale higher captures development over time. In different phrases, this chart exhibits, in actual {dollars} and proportion phrases, how the financial system has grown over the previous 70 years.

Regular development. The primary takeaway, for me, is how regular development was over multidecade durations. From 1950 to the early Seventies, development was regular. Progress then slowed (i.e., the slope obtained much less steep) a bit by concerning the mid-2000s. Since then, development has been a bit slower but. In all that point, with occasional setbacks, development has been regular whatever the politics of the assorted administrations throughout these many years. Wanting on the financial system from a excessive degree, you may’t even see the results of politics.

Exterior shocks. Possibly a greater place to look, although, is the place the slope drops off. We see that the majority lately and considerably within the coronavirus disaster, earlier than that with the good monetary disaster, and earlier than that with the Fed’s campaign towards inflation within the early Nineteen Eighties and the OPEC oil shock within the mid-Seventies.

These are the most important declines over latest many years. In all instances, it was an exterior shock that generated the disaster and the decline. Sure, you can definitely argue that the political response exacerbated the results. However in all instances, the disaster itself went past politics.

So, Does Politics Have an effect on the Financial system?

If we have a look at politics in isolation, the results on the financial development charge, over the long run, seem very restricted. Does politics affect the financial system? After all. Is that impact vital over time? Not from a long-range perspective.

This dialogue is as shut—possibly nearer—to politics as I prefer to get. I’m not arguing for (or towards) any particular person politician or coverage, which can effectively have had financial results at a given time. I’m saying that, as an investor with a multiyear time horizon, historical past exhibits that the results will doubtless even out over time.

You may see this with extra rapid knowledge as effectively. When Obama was elected, I obtained many calls asking what to do when the financial system and inventory market collapsed. When Trump was elected, I obtained the identical calls, albeit from a special set of individuals. And, within the leadup to this election, I’ve been getting calls from each side, every satisfied that the top is close to if the opposite facet wins.

Have a look at the Lengthy Time period

From an financial viewpoint, development comes from inhabitants beneficial properties, reinvestment of capital, and technological enchancment. No matter who wins, all of these elements will proceed. So, my response to the Obama panic, the Trump panic, and the present panic is similar: have a look at the long run. Progress will proceed.

This type of evaluation, and context, is essential to remaining calm. If we glance again over time, we are able to see what’s probably to occur and why. Who wins the election definitely issues. Vote to your chosen candidate, as a result of it can be crucial. However one of many key causes behind the success of the U.S. financial system is the truth that it’s largely impartial of politics.

Thank goodness for that.

Editor’s Word: The authentic model of this text appeared on the Impartial Market Observer.

[ad_2]