[ad_1]

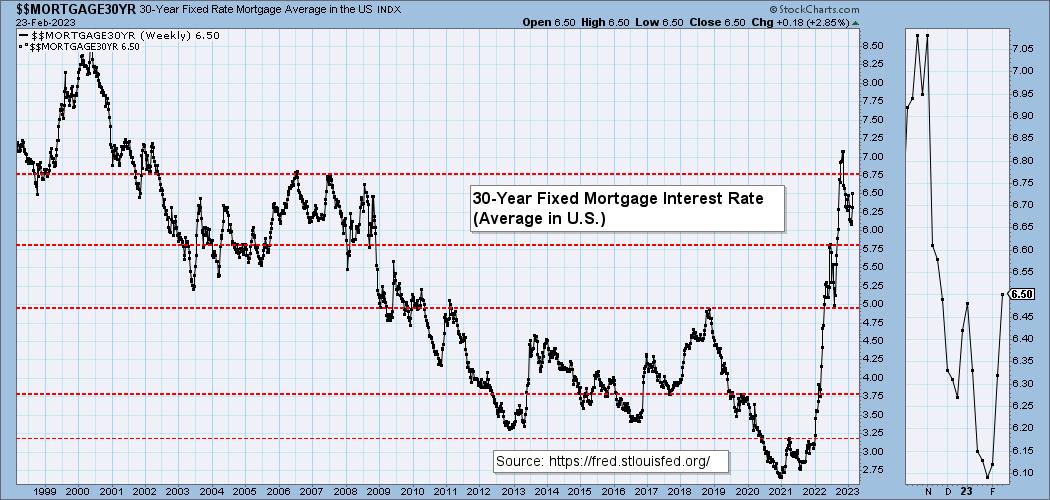

We watch the 30-Yr Fastened Mortgage Curiosity Price, as a result of, for probably the most half, folks purchase properties based mostly upon the utmost month-to-month cost they will afford. As charges rise, a hard and fast month-to-month cost will carry a smaller mortgage quantity. As shopping for energy has been shrinking, residence costs have come beneath stress.

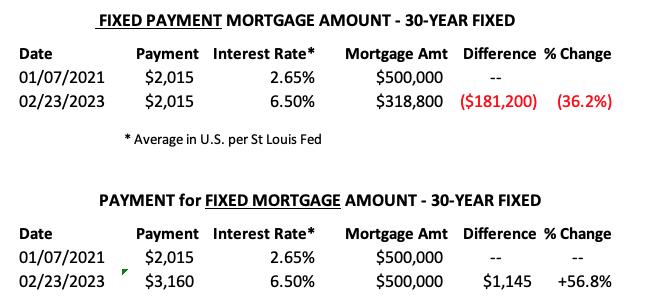

This week the 30-Yr Fastened Price rose from 6.32 to six.50. The next desk exhibits that, because the historic low within the 30-Yr Fastened Price mortgage, the identical month-to-month cost can solely service a mortgage that’s one-third smaller than in January 2021. Or the identical dimension mortgage ($500,000) would require a cost that’s 56.8% larger.

This chart exhibits that charges are again to about the place they had been at the beginning of the Monetary Disaster.

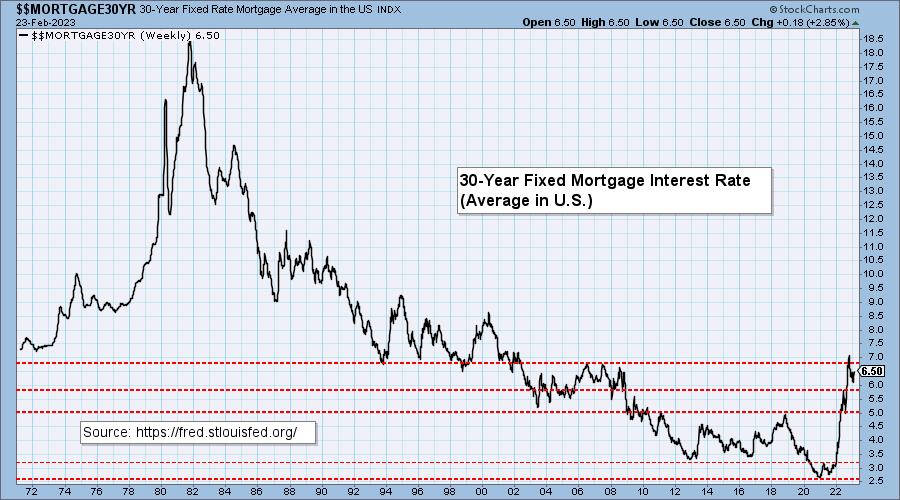

I hear plenty of gnashing of enamel about excessive rates of interest, however once we purchased our first residence in 1964, the rate of interest was 7.25%. Once we purchased our current residence in 1972, the rate of interest was 7.25%, so 6.5% appears fairly good to me.

The chart under exhibits the explosion of charges within the Nineteen Seventies and Eighties. I do not understand how right now’s inflation compares to that interval, however it does show how unhealthy issues can get if inflation is just not tamed.

CONCLUSION: Present rates of interest are, for my part, considerably regular excluding the inversion. I hear fantasies about when the Fed can begin to reduce, however reducing charges may simply ship us again to the place the present inflation troubles started.

Watch the most recent episode of DecisionPoint on StockCharts TV’s YouTube channel right here!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Record

DecisionPoint Golden Cross/Silver Cross Index Chart Record

DecisionPoint Sector Chart Record

Value Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint is just not a registered funding advisor. Funding and buying and selling selections are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical assets, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the net. DecisionPoint focuses on inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Be taught Extra

Subscribe to DecisionPoint to be notified every time a brand new put up is added to this weblog!

[ad_2]