[ad_1]

What’s the ZigZag indicator which utilized in monetary markets?

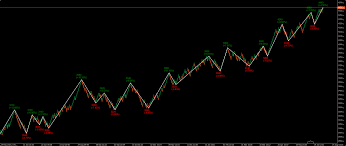

The ZigZag indicator is a technical evaluation instrument utilized in monetary markets, together with Foreign currency trading. It’s used to establish traits and potential pattern reversals by filtering out the noise within the value chart.

The ZigZag indicator works by on the lookout for value swings or waves within the chart, and it connects the excessive and low factors of those swings with straight strains. The indicator then attracts a zigzag line connecting these excessive and low factors, which exhibits the general pattern path of the market.

Merchants can use the ZigZag indicator to establish assist and resistance ranges, in addition to to find out potential entry and exit factors for his or her trades. You will need to notice that the ZigZag indicator must be used along with different technical indicators and evaluation strategies to make knowledgeable buying and selling choices.

Which parameters/inputs ZigZag indicator incorporates?

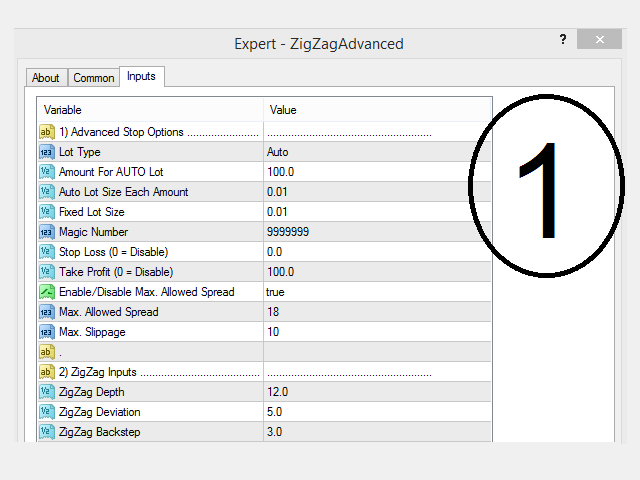

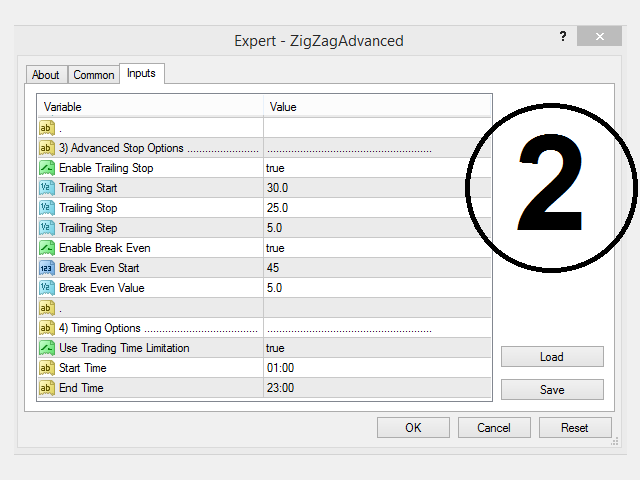

The ZigZag indicator has two important parameters or inputs:

-

Proportion or Worth deviation: This parameter specifies the minimal share or value motion required for the indicator to attract a brand new line or swing. For instance, if the share deviation is ready to five%, the indicator will solely draw a brand new line if the value strikes up or down by not less than 5%.

-

Depth: This parameter specifies the minimal variety of bars or candles required to type a swing. For instance, if the depth is ready to 10, the indicator will solely draw a brand new line if there have been not less than 10 bars or candles because the final swing.

-

Backstep: This parameter specifies the variety of bars or candles that should move earlier than the indicator can change path and draw a brand new line or swing.

The values of those parameters might be adjusted primarily based on the dealer’s choice and the traits of the market being analyzed. A better share or value deviation will lead to fewer swings being drawn, whereas a decrease deviation will lead to extra swings being drawn. Equally, the next depth worth will lead to fewer swings being drawn, whereas a decrease depth worth will lead to extra swings being drawn.

What’s the parameter “Depth” with equation and instance?

The “depth” parameter within the ZigZag indicator refers back to the minimal variety of bars or candles required to type a swing. The equation to calculate the depth is just the variety of bars or candles required to type a swing.

For instance, if the depth is ready to 10, then the ZigZag indicator will solely draw a brand new line or swing if there have been not less than 10 bars or candles because the final swing. If the value strikes up or down by lower than the desired share or value deviation inside 10 bars or candles, then the indicator is not going to draw a brand new line.

In different phrases, the depth parameter helps to filter out minor value fluctuations and noise, and solely attracts new swings when the value has moved considerably over a sure time period.

You will need to notice that the optimum worth for the depth parameter can differ relying available on the market being analyzed, the buying and selling technique being employed, and the timeframe getting used. Some merchants might desire a bigger depth parameter for longer-term evaluation, whereas others might desire a smaller depth parameter for shorter-term evaluation.

What’s the parameter “Deviation” with equation and instance?

The “deviation” parameter within the ZigZag indicator refers back to the minimal share or value motion required for the indicator to attract a brand new line or swing. The equation to calculate the deviation is:

Deviation = (Minimal Worth Motion / Present Worth) x 100

For instance, if the minimal value motion is ready to 10 pips and the present value is 1.2000, then the deviation can be:

Deviation = (10 / 1.2000) x 100 = 0.83%

Which means that the ZigZag indicator will solely draw a brand new line or swing if the value strikes up or down by not less than 0.83% from the final swing level.

The deviation parameter helps to filter out minor value fluctuations and noise, and solely attracts new swings when the value has moved a specific amount. This may also help merchants establish the general path of the pattern and potential reversal factors.

It is necessary to notice that the optimum worth for the deviation parameter can differ relying available on the market being analyzed, the buying and selling technique being employed, and the timeframe getting used. Merchants ought to experiment with completely different values to search out the setting that works finest for his or her particular wants.

What’s the parameter “Backstep” with equation and instance?

The “backstep” parameter within the ZigZag indicator refers back to the variety of bars or candles that should move earlier than the indicator can change path and draw a brand new line or swing. The equation to calculate the backstep is just the variety of bars or candles required to move earlier than the indicator can change path.

For instance, if the backstep is ready to three, then the ZigZag indicator will solely draw a brand new line or swing if the value has moved in the wrong way for not less than 3 bars or candles because the final swing. This helps to filter out minor value fluctuations and noise and solely attracts new swings when the value has moved considerably in the wrong way.

The backstep parameter can be utilized along with the deviation and depth parameters to assist merchants establish potential pattern reversals and entry or exit factors for his or her trades.

It is necessary to notice that the optimum worth for the backstep parameter can differ relying available on the market being analyzed, the buying and selling technique being employed, and the timeframe getting used. Merchants ought to experiment with completely different values to search out the setting that works finest for his or her particular wants.

Instance of how to attract the ZigZag strains manually, inputs are (Deviation of 5%, a Depth of 12 and Backstep of three)

Right here is the best way to manually draw ZigZag strains utilizing the desired enter values of a deviation of 5%, a depth of 12, and a backstep of three.

Let’s assume we’re a EUR/USD chart with a time-frame of 1 hour. Right here is an instance of how to attract the ZigZag strains manually:

-

Establish the primary swing excessive or low level. That is the place to begin for the ZigZag line.

-

Transfer ahead on the chart till the value strikes in the wrong way by not less than 5% from the place to begin. That is the primary swing low or excessive level, relying on the path of the pattern.

-

Mark the swing low or excessive level as the top level of the primary ZigZag line.

-

Transfer ahead on the chart till there have been not less than 12 bars or candles because the final swing level.

-

Search for the following swing excessive or low level that satisfies the deviation and depth standards.

-

If the brand new swing level is in the identical path because the earlier ZigZag line, mark it as the top level of the present ZigZag line. If the brand new swing level is in the wrong way, mark it as the top level of the present ZigZag line and draw a brand new ZigZag line from the earlier finish level to the brand new swing level.

-

Repeat steps 4-6 till the top of the chart.

-

If the present ZigZag line doesn’t have an finish level because of the lack of enough swing factors, the road is taken into account incomplete.

-

When a brand new swing level is recognized in the wrong way to the present ZigZag line, mark it as the beginning of a brand new ZigZag line.

It is necessary to notice that manually drawing ZigZag strains generally is a time-consuming course of, particularly on longer time frames or when analyzing a number of markets. The ZigZag indicator can automate this course of and supply merchants with an goal instrument to establish pattern reversals and potential entry or exit factors.

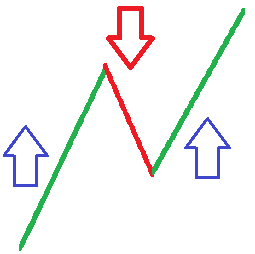

When to open a purchase and promote place with ZigZag indicator?

It is necessary to notice that the ZigZag indicator shouldn’t be utilized in isolation to open purchase and promote positions. It’s usually used as a instrument to establish potential pattern reversals and entry or exit factors, and must be mixed with different technical indicators and/or elementary evaluation to make buying and selling choices.

That being stated, listed below are some examples of how the ZigZag indicator can be utilized together with different evaluation to open purchase and promote positions:

The ZigZag indicator can be utilized in a wide range of methods to assist merchants establish potential purchase and promote indicators. Listed below are a couple of examples:

-

Pattern following: One of the frequent makes use of of the ZigZag indicator is to establish the general path of the pattern. Merchants can search for a sequence of upper highs and better lows to establish an uptrend or decrease lows and decrease highs to establish a downtrend. When the pattern is established, merchants can search for potential entry factors within the path of the pattern when the value retraces to a swing low or excessive level recognized by the ZigZag indicator.

-

Reversal buying and selling: The ZigZag indicator can be used to establish potential pattern reversals. Merchants can search for a change in path of the ZigZag strains to establish a possible reversal. For instance, if the ZigZag strains have been transferring up after which begin to transfer down, this might point out a possible reversal to a downtrend. Merchants can then search for a promote sign when the value retraces to a swing excessive level recognized by the ZigZag indicator.

-

Breakout buying and selling: One other approach to make use of the ZigZag indicator is to establish potential breakout alternatives. Merchants can search for a consolidation or ranging interval the place the value is transferring sideways and the ZigZag strains are comparatively flat. When the value breaks out of this vary, merchants can search for a purchase or promote sign within the path of the breakout utilizing the swing excessive or low factors recognized by the ZigZag indicator.

Purchase positions:

- Search for a bullish divergence between the value and the ZigZag indicator. Open a purchase place when the ZigZag line breaks above the earlier excessive swing level.

- Search for a bullish chart sample, corresponding to a double backside or ascending triangle, that’s confirmed by the ZigZag indicator breaking above the sample’s resistance degree.

- Search for a bullish candlestick sample, corresponding to a hammer or bullish engulfing, that’s confirmed by the ZigZag indicator breaking above the excessive of the sample.

- Search for a pullback in an uptrend that’s confirmed by the ZigZag indicator breaking above the earlier excessive swing level.

- Search for a breakout of a key resistance degree that’s confirmed by the ZigZag indicator breaking above the identical degree.

- Search for a bullish crossover of the ZigZag indicator with a transferring common or different trend-following indicator.

Promote positions:

- Search for a bearish divergence between the value and the ZigZag indicator. Open a promote place when the ZigZag line breaks beneath the earlier low swing level.

- Search for a bearish chart sample, corresponding to a head and shoulders or descending triangle, that’s confirmed by the ZigZag indicator breaking beneath the sample’s assist degree.

- Search for a bearish candlestick sample, corresponding to a capturing star or bearish engulfing, that’s confirmed by the ZigZag indicator breaking beneath the low of the sample.

- Search for a pullback in a downtrend that’s confirmed by the ZigZag indicator breaking beneath the earlier low swing level.

- Search for a breakout of a key assist degree that’s confirmed by the ZigZag indicator breaking beneath the identical degree.

- Search for a bearish crossover of the ZigZag indicator with a transferring common or different trend-following indicator.

Once more, it is necessary to make use of the ZigZag indicator together with different technical and/or elementary evaluation to make knowledgeable buying and selling choices

Specialists

Most rated

[ad_2]