[ad_1]

Enterprise goes nicely, your workers are joyful, and also you’re rising a loyal buyer base. However there should be one piece of the puzzle lacking in your small enterprise operations — determining how one can make payroll much less of a chore.

However paying employees, retaining data, and managing taxes don’t must create hours of additional give you the results you want every week. With the suitable course of and instruments, you’ll get extra face-to-face time with workers and clients and stop payroll from operating into your free time.

That’s why we created this information on doing payroll for small companies. We cowl every part from how one can arrange payroll to what you must know when the time involves file taxes, in addition to what software program you should utilize to simplify payroll and every part that comes together with it.

Step #1: Perceive payroll legal guidelines and laws

Typically, it’s not simply the bodily act of operating payroll that eats into your day — it’s determining the advanced guidelines and laws behind the method that takes up a lot time.

Following payroll legal guidelines and laws is important to keep away from critical authorized and monetary penalties, so it’s essential to do issues proper. And that may imply retaining monitor of plenty of transferring components — suppose native, state, and federal tax laws, in addition to wage and hour legal guidelines.

For instance, every state has distinctive payday necessities, and failure to comply with them can imply coping with fines and even authorized motion.

You additionally must appropriately classify employees members as exempt or non-exempt, which can decide whether or not they’re eligible for additional time pay and different Truthful Labor Requirements Act (FLSA) protections.

That’s to not point out precisely figuring out whether or not employees are impartial contractors or workers. As much as a 3rd of employers misclassify employees as impartial contractors, a mistake which may price tons of, even hundreds, in penalties.

Studying and staying updated with all these laws could really feel like an entire job in itself. That’s why we advocate utilizing a software like Homebase HR and compliance, which may monitor all of your worker hours in a single place and assist you keep on prime of wage and hour legal guidelines, particularly in terms of breaks and additional time.

Our platform may also notify you when labor legal guidelines change on the state or federal degree, and our workforce of HR Execs is all the time there to overview your procedures and offer you recommendation while you’re feeling misplaced.

Step #2: Arrange payroll methods

After getting a basic understanding of the legal guidelines and laws you must comply with, it’s time to file your corporation with the federal government. Which means registering your corporation identify with native and state governments and making use of to your tax ID, or employer identification quantity (EIN).

However one of the essential steps when doing payroll to your small enterprise is choosing and establishing your payroll system. And selecting a handbook course of could be difficult as it will possibly imply hours of additional work and dear errors.

So, search for payroll software program that makes your job simpler whereas serving to you keep correct and environment friendly fee methods. Some options to search for embody:

- On the spot conversion of timesheets into hours and wages in order that they’re prepared for payroll

- Computerized tax submitting and issuing of W-2s and 1099s

- Computerized issuing of funds to workers, the state, and the Inside Income Service (IRS)

- Self-onboarding and doc e-signing for workers

- Time card file storage for compliance with the FLSA’s record-keeping guidelines

Basically, you desire a payroll system that allows you to pay workers and file taxes with the clicking of a button. The system must also be clean to implement and simple for workers to make use of on autopilot.

And ideally, select a software that provides different HR options, like hiring and onboarding and workforce communication, so you’ll be able to maintain all of your primary inner processes beneath one roof.

Step #3: Calculate payroll

Now that you know the way to arrange payroll, it’s time to get on together with your calculations. Which means figuring out gross pay, estimating taxes, and making pre-tax deductions for issues like 401(okay) plans and medical health insurance.

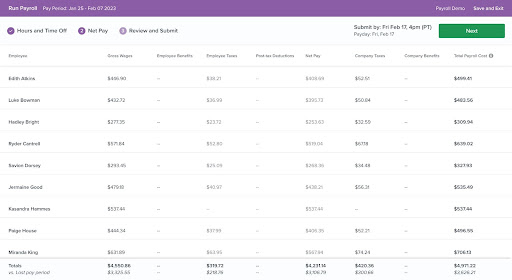

Determining payroll taxes could be advanced, however while you use software program like Homebase, the software can mechanically calculate, pay, and file for you. Our platform is designed for hourly groups with distinctive pay charges and exemptions, and it’s appropriate for companies in nearly any business.

Caption: Homebase may give you a transparent overview of what every worker is making and what portion of your complete payroll goes to taxes.

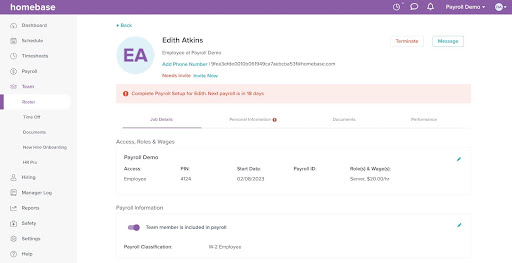

Homebase payroll additionally permits you to set roles, wages, and worker classification for every of your workforce members and permits you to run payroll to your entire workforce with simply a few clicks.

Caption: Homebase permits you to set distinctive wages, roles, and payroll classifications for every worker.

Plus, utilizing a complete software like Homebase takes the stress out of creating positive you’re complying with legal guidelines and laws and helps you keep away from over or underpaying your workers.

Step #4: Pay workers

Now, it’s time to your workforce’s favourite a part of this entire course of — payday! And with 50% of employees reporting they’d contemplate quitting their job because of repeated payroll errors, ensuring the correct amount exhibits up in individuals’s financial institution accounts is important.

Payroll accuracy isn’t simply essential for sustaining workforce morale but additionally for staying compliant with legal guidelines and laws and defending your corporation.

However paying workforce members isn’t nearly handing over a verify. It’s essential maintain monitor of most well-liked fee strategies, concern individuals’s funds through paycheck or direct deposit on time, and distribute the proper tax types.

Once more, automating these processes helps reduce errors and cut back your workload.

Caption: The Homebase app notifies workers once they receives a commission, making it straightforward for them to view their pay stubs and see precisely how a lot they made.

Step #5: Maintain correct data

Even when you’ve despatched out your funds, your work isn’t finished but. The FLSA requires employers to maintain fundamental data for all their non-exempt workers consisting of right information in regards to the employee, their hours, and their wages.

Storing correct data can also be essential for making knowledgeable selections about payroll. In any case, payroll prices could make up as a lot as half of all your corporation bills, relying on the business you’re in.

And when revenue margins are tight, it’s important to know precisely the place your income goes. Having detailed payroll data helps you identify whether or not you’re operating your corporation sustainably.

So, maintain in-depth documentation about worker hours and wages, and make sure to retailer payroll information securely to guard your workforce members and your corporation. You don’t need individuals to fret about their privateness, and also you definitely can’t danger that info entering into the flawed fingers.

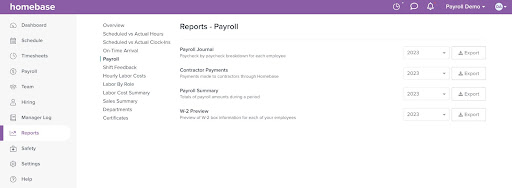

That is another excuse why utilizing a complete payroll software that generates and shops experiences is a should — you received’t must undergo the additional work of making them your self and can know they’re saved in a secure place.

Caption: Homebase precisely generates and shops payroll experiences for you, from complete summaries to W-2 previews.

Step #6: Handle payroll taxes

It’s a truth of life: “nothing is definite besides loss of life and taxes.” We’re positive you already understand how essential it’s to remain on prime of your payroll taxes to remain compliant with legal guidelines and laws and keep away from penalties and late charges.

And whereas nobody can get out of taxes, Benjamin Franklin didn’t must be so morbid in regards to the subject. When correctly managed, payroll taxes don’t must be such a trouble.

Managing your payroll taxes means:

- Establishing who your taxable employees are

- Figuring out which wages are taxable

- Figuring out which payroll taxes apply to you

- Familiarizing your self with the types and procedures for submitting taxes

- Submitting quarterly and annual tax experiences

Once more, we advocate automating this course of with a specialised software that may calculate, pay, and file your taxes for you. As a result of let’s face it — except you’re an authorized public accountant (CPA), paying taxes can really feel like making an attempt to learn a international language.

And bear in mind, completely different states have completely different payroll legal guidelines and tax charges, which could be exhausting to maintain up with by your self. That is the place a specialised software may also help you out.

Excellent payroll to ship out paychecks on time and maintain your corporation thriving

Now that you just’ve learn and understood these recommendations on how one can do payroll for a small enterprise, it’s time to place your learnings into apply. Comply with the above steps for how one can arrange payroll, pay your workers, maintain data, and file your taxes to maintain your individuals joyful and your corporation operating easily.

And bear in mind, you don’t must maintain payroll alone. Think about using a software like Homebase payroll to simplify and automate the method and handle all of your HR duties in a single place.

[ad_2]