[ad_1]

I’ve been requested to recommend why I’m so assured inflation will fall this yr. Let me provide a proof.

First, there’s easy arithmetic. Inflation is a measure of the change in costs, and never of absolute value ranges. So it compares costs in a month with the costs of comparable commodities a yr earlier and the general weighted distinction is the inflation charge.

Costs grew a bit in autumn 2021 as a consequence of Covid reopening, which was badly managed. They elevated dramatically at uncooked materials ranges when battle in Ukraine broke out. That fed via to shopper costs. Inflation grew.

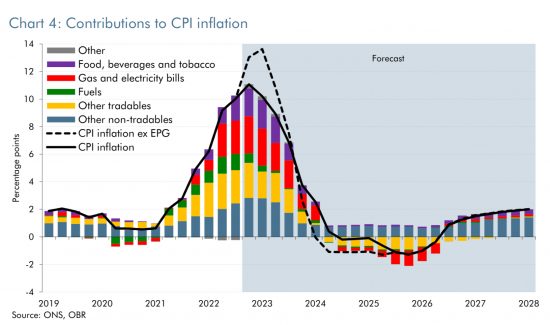

Nonetheless, there have been no extra value shocks since then. So there is no such thing as a motive for costs to continue to grow as soon as they’ve caught up with what occurred. They’re doing this now. As that strategy of adjustment slows, because it inevitably will, inflation will fall, inevitably. All severe commentators now agree on this. That is the Workplace for Price range Duty forecast from November 2022 (black line):

This fall has nothing to do with growing rates of interest, austerity or low pay will increase: it’s simply right down to maths. Coverage will not be delivering this, occasions are.

This fall has nothing to do with growing rates of interest, austerity or low pay will increase: it’s simply right down to maths. Coverage will not be delivering this, occasions are.

Be aware although that falling inflation doesn’t imply falling costs: it simply means will increase cease. So falling inflation is not any motive to disclaim pay will increase.

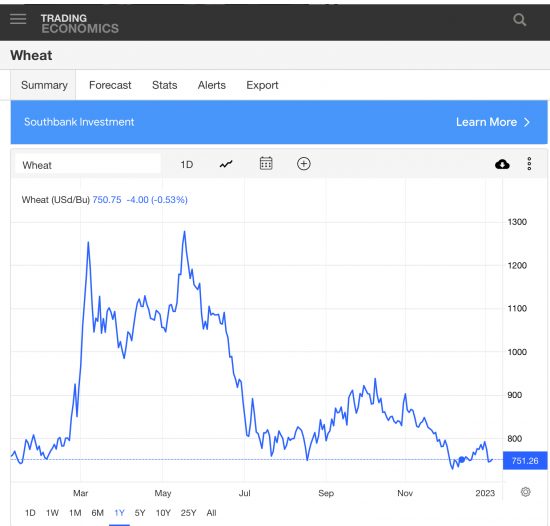

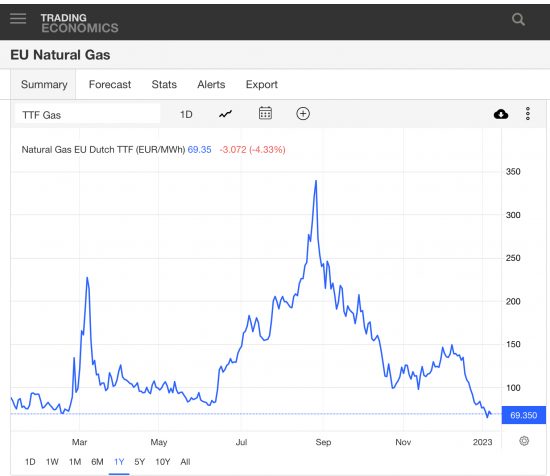

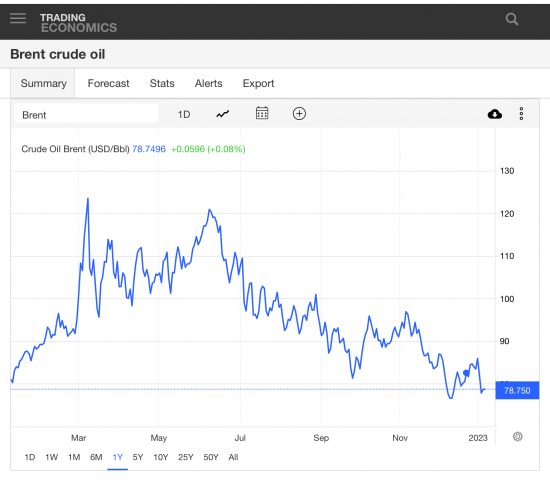

However there’s a twist relating to costs. That’s that they’re falling relating to commodities. Take a look at these charts, for Brent oil, EU gasoline costs and wheat, plotted over the past yr and all from Buying and selling Economics:

There’s a widespread theme: costs are again the place they have been pre the battle in Ukraine. From their peak costs have fallen. In time this needs to be mirrored in shopper costs, and the Workplace for Price range Duty do truly forecast deflation (falling shopper costs) in 2024 and 2025 for that reason.

There’s a widespread theme: costs are again the place they have been pre the battle in Ukraine. From their peak costs have fallen. In time this needs to be mirrored in shopper costs, and the Workplace for Price range Duty do truly forecast deflation (falling shopper costs) in 2024 and 2025 for that reason.

Once more, I stress that this has nothing to do with the federal government or its insurance policies, and nothing in any respect to do with rising rates of interest. It’s merely that the panic that elevated costs has handed. Shortages haven’t bern as dangerous as anticipated. Markets have returned to regular. Simply as individuals panicked about bathroom rolls in March 2020 so did commodity merchants panic in March 2022. Their panic has simply had greater implications for us all, however the behaviour was a lot the identical.

I see no motive for these costs to spike once more at current. In that case even when individuals get inflation matching pay rises and that will increase some costs the return to regular of those commodity costs ought to counter that in inflationary phrases. For as soon as, I feel the OBR has this proper: deflation is more likely than inflation in 2024 given present circumstances. Inflation goes away.

What will not be going away is the austerity, rate of interest rises and pay suppression that inflation has been the excuse for. The rentier capitalists haven’t let this disaster go to waste: they’ve used it to wreak havoc when there was no motive to take action. The ache will proceed then lengthy after the trigger has gone, and that’s by authorities alternative.

[ad_2]