[ad_1]

Having $2,000 to $3,000 to speculate is an effective feeling, however the way you allocate these funds can impression your funds greater than you would possibly understand. The place investing your small nest egg and including to it frequently can result in important returns over time, stuffing $2,000 to $3,000 in money underneath your mattress can imply shedding cash to inflation over time.

Earlier than you determine the place to speculate $2,000 to $3,000, take into consideration when you’ll want the cash. Whereas some choices are designed to maintain your cash protected within the quick time period, taking up extra danger can yield higher outcomes over the long term.

That will help you determine what to do, listed here are 17 of one of the best methods for investing $2000 to $3000.

Finest Brief-Time period Investments for $2,000 to $3,000

Whereas investing $2,000 to $3,000 can assist you make progress in the direction of any variety of monetary objectives, there are conditions the place chances are you’ll must entry your cash within the close to time period. Possibly you’re attempting to save up a down cost on your first residence, or maybe you’re saving for a serious renovation venture or school tuition.

In any case, the funding choices under will assist you to defend the principal of your funding whereas securing some return.

1. Excessive-Yield Financial savings Account

Excessive-yield financial savings accounts include FDIC insurance coverage, that means your deposits are federally protected in quantities as much as $250,000 per depositor per account. However when you received’t lose any cash by investing your $2,000 to $3,000 in one among these accounts, you’ll must accept a decrease return.

Thankfully, in the present day’s rising rate of interest surroundings means you may earn extra in a financial savings account than you may only a 12 months in the past. For instance, opening a UFB Elite Financial savings account with UFB Direct can assist you earn a 3.11% APY with zero month-to-month upkeep charges and no minimal deposit requirement.

Whereas incomes a bit of over 3% again in your financial savings received’t assist you to get wealthy, it could possibly assist you to sustain with inflation whereas defending your money till you want it.

2. Excessive-Yield Certificates of Deposit

You may also look into high-yield certificates of deposit, or CDs, which require you to decide to saving for a selected size of time (normally just a few months to a number of years). You’ll be able to money out your CD and get your principal again (plus curiosity) as soon as the time period of your CD ends, but you’ll be charged a penalty if it is advisable to entry your CD earlier than it reaches maturity.

Certificates of deposit (CDs) additionally have a tendency to supply increased rates of interest than financial savings accounts, though minimal stability necessities can apply.

The place can you discover the finest CD charges? A platform referred to as SaveBetter gives high-yield certificates of deposit (CDs) by way of varied banks and credit score unions, a few of which supply yields over 4% in the mean time with a minimal deposit requirement of simply $1 to get began.

3. Brief-Time period Company Bond Funds

Brief-term company bond funds can assist you protect capital whereas creating revenue, they usually do that by investing in company bonds with maturities starting from one to 3 years. These funds have a tendency to supply higher long-term yields than financial savings and cash market accounts, though returns aren’t assured, and these funds aren’t risk-free.

Should you’re contemplating short-term company bond funds as a part of your funding technique, you will get began with brokerage platforms like Zacks Commerce and TD Ameritrade.

4. Cash Market Account

You may also think about investing your $2,000 to $3,000 in a cash market account, which works equally to a high-yield financial savings account. Whereas cash market accounts are likely to have increased minimal deposit necessities than financial savings accounts, they usually include checkbooks and debit playing cards that make it simpler to entry your cash if wanted.

As soon as once more, UFB Direct stands out on this area attributable to its distinctive cash market account yields with the potential for no charges. The yield on their cash market account is at present set at 3.11%, and you’ll profit from perks like on-line account entry, cellular deposit, and check-writing privileges.

Keep in mind that their cash market account expenses a $10 month-to-month upkeep payment on accounts under $5,000.

- * No minimal deposit required

- * No upkeep charges

- * 24/7 entry to your funds

- * FDIC insured

5. Collection I Financial savings Bonds

Collection I Financial savings Bonds (additionally referred to as I Bonds) provide one other risk-free solution to develop your preliminary funding, they usually’re a superb possibility for those who solely have $2,000 to $3,000 to speculate proper now. This government-backed bond possibility enables you to make investments as much as $10,000 per 12 months with none danger of losses, and the present fee for I Bonds is ready at 9.62%.

This fee goes up and down over time, and it’s best to know that it’s essential to preserve your cash invested in Collection I Financial savings Bonds for no less than one 12 months. Additionally, word that you just’ll pay a small penalty (three months of curiosity) if it is advisable to entry your cash inside 60 months after your preliminary funding.

This makes I Bonds barely much less liquid than different choices like high-yield financial savings accounts, though the return you’ll obtain will likely be a lot increased over the long run.

6. Pay Down Excessive-Curiosity Debt

Paying down high-interest debt could not really feel like investing, however you’ll safe a return in proportion to the rate of interest you’re paying.

Subsequent up, think about paying down high-interest debt, resembling bank card debt or automobile loans. Whereas paying down debt could not really feel such as you’re investing in a standard sense, this technique can assist you safe a return in proportion to the rate of interest you’re paying.

For instance, let’s say you owe $3,000 in bank card debt on a card with a 19% APR. Should you paid simply $85 monthly on the cardboard till your stability was paid off, it might take 53 months to develop into debt-free, and you’d pay $1,428 in bank card curiosity alongside the way in which.

Should you took $3,000 in money and used it to repay that bank card stability, nonetheless, you’d successfully save $1,428 in curiosity and release extra of your revenue to speculate from that time ahead.

Finest Methods to Make investments $2,000 to $3,000 for the Lengthy-Time period

Whereas the methods I’ve instructed are good, you continue to want to think about your funding timeline. If in case you have 5 or extra years to speculate or are keen to tackle extra danger to safe the next return, you’ll possible need to think about a special set of choices altogether.

Keep in mind that taking up extra danger can imply shedding cash, particularly within the first few years. Listed below are a number of the finest methods to speculate $2,000 to $3,000 if you wish to give attention to constructing wealth and know you received’t must entry this cash instantly.

7. Spend money on the Inventory Market

For so long as anybody can keep in mind, investing within the inventory market has been the most effective methods to construct wealth over the long run. Whereas the market was down considerably in 2022, it’s essential to keep in mind that the common annual inventory market return is round 7% after accounting for inflation.

Your $2,000 to $3,000 funding will multiply with that type of return. Should you make investments $3,000 in the present day and earn 7% for the subsequent 25 years, for instance, you’ll wind up with $16,282.30 with out including one other dime to your account.

However the place and the way do you have to put money into the inventory market? Whilst you can at all times put money into particular person shares and hope for one of the best, it could possibly make sense to unfold your funding out over many various investments.

You are able to do this by way of a platform referred to as M1 Finance, which helps you to create or choose from funding “pies” unfold out throughout many various shares and exchange-traded funds (ETFs) by way of fractional shares.

Not solely are you able to create a customized pie of investments, however you may select from expertly curated pies that have been created to suit completely different funding timelines and danger profiles. Better of all, M1 Finance enables you to make investments commission-free, and you’ll handle your account on the go together with the platform’s highly-rated cellular app.

- * Account Minimal $100

- * Construct customized portfolios (or)

- * Select professional portfolios

- * Shares, ETFs, REITs

8. Actual Property Crowdfunding

Investing in actual property is one other sensible solution to construct long-term wealth, but not everybody needs to be a landlord. Not solely that, however in the present day’s mortgage charges make turning a revenue on rental actual property significantly tougher than only a few years in the past.

Thankfully, you may put money into actual property rather more passively with assist from a platform like Fundrise or Realty Mogul. Each firms allow you to put money into varied varieties of actual property, from business to residential, and also you by no means must take care of unruly tenants or constructing upkeep and repairs.

Fundrise is one among my favourite funding methods, primarily as a result of it’s passive, and you’ve got the potential for glorious returns with comparatively low charges. You’ll be able to start investing with Fundrise with as little as $10, and the corporate’s buyers noticed common returns of seven.31% in 2020 and 22.99% in 2021. To this point in 2022, Fundrise buyers have seen common returns of 5.40%.

You’ll be able to study extra about investing in Fundrise in my Fundrise Evaluate, or get began with Fundrise utilizing my unique hyperlink under:

- * Spend money on actual property with $10

- * Open to all buyers

- * On-line simple to make use of website and app

9. Open a Roth IRA

If in case you have $2,000 to $3,000 to speculate and need to use that cash for retirement, chances are you’ll need to think about opening a Roth IRA. This retirement account enables you to make investments with after-tax {dollars}, that means you don’t get a tax profit upfront. Nevertheless, your cash grows tax-free, and also you received’t must pay revenue taxes if you withdraw the cash after retirement.

One other Roth IRA secret is you can withdraw your contributions (however not earnings) earlier than retirement age with out paying the penalty. You’ll be able to put money into a Roth IRA and begin to withdraw your contributions just a few years from now, penalty-free if it is advisable to.

You must also know that there are quite a few platforms you should use to open a Roth IRA, and every has its execs and cons. For instance, platforms like M1 Finance and Robinhood allow you to open a Roth IRA and select your investments with no charges. But, a robo-advisor like Betterment can construct your portfolio and handle your account in trade for an annual administration payment.

The chart under gives an outline of a number of the finest locations to open a Roth IRA, in addition to their advantages:

| Betterment | M1 Finance | Robinhood | |

| Annual Administration Charges | 0.25% to 0.40% | None | None |

| Minimal Stability Requirement | $0 | $100 for funding accounts $500 for retirement accounts |

$0 |

| Funding Choices | Shares, bonds, ETFs, cryptocurrency, and extra | Funding “pies” with fractional shares | Shares, bonds, ETFs, cryptocurrency, and extra |

| Opinions | Betterment Evaluate | M1 Finance Evaluate | Robinhood Evaluate |

It’s price noting that revenue caps restrict who can contribute to a Roth IRA. Should you’re a high-earner and questioning for those who can qualify, head right here earlier than you open an account: Roth IRA Guidelines and Contribution Limits for 2022.

10. Begin a Weblog

Possibly you need to put money into your self in a roundabout way or in a small enterprise that may assist you to earn a considerably passive revenue. A weblog allows you to do this, though it could take a while – even a number of years – to get a return in your funding.

I ought to know. I began this web site you’re studying greater than a decade in the past, and it took me not less than a 12 months to earn a gentle revenue. Over time, I realized the ins and outs of digital advertising and marketing and what it takes to make a weblog profitable. And whereas I’ve had many ups and downs through the years and loads of setbacks, I’ve simply used this web site to earn thousands and thousands of {dollars}! That’s the ability of running a blog!

The excellent news about beginning a weblog is that you just received’t want $2,000 to $3,000 to get began. You could possibly construct a easy template and arrange internet hosting on your weblog for just a few hundred bucks.

Should you’re interested by what it takes to get began as a blogger, begin by studying this text: How To Begin A Weblog From Scratch And Make It Work.

Within the meantime, think about signing up for my free Make 1k Running a blog course. It teaches you precisely what to do to earn your first $1,000 on-line, and you will get free entry from the second you join!

11. Dividend Shares

When you’ve $2,000 to $3,000 to speculate, getting began with dividend shares is one other technique to think about. Dividend shares have the potential to extend in worth over time, similar to conventional shares, but in addition they pay out common dividends (or funds) to buyers. In consequence, many individuals put money into dividend shares to construct passive revenue streams to fund their life or pay for early retirement.

Making $1,000 monthly with dividend shares is feasible if in case you have a big sufficient portfolio and know what you’re doing. However for those who solely have $2,000 to $3,000 to speculate proper now, you’ll have to start out from scratch.

One technique entails investing in high-dividend-paying shares generally known as Dividend Aristocrats. There are 65 completely different firms and dividend shares on this record, and they’re identified for providing glorious yields over not less than 25 years.

Dividend Aristocrats are distinguished, established firms with a market capitalization of not less than $3 billion. This implies you’re investing in firms with a confirmed monitor file and an extended historical past of constructive returns.

The place are you able to put money into dividend shares, together with Dividend Aristocrats? Many platforms allow you to construct a portfolio that fits your funding timeline and objectives, however Robinhood and Webull allow you to make investments with no commissions.

12. Well being Financial savings Account (HSA)

If in case you have a excessive deductible well being plan (HDHP), you can even think about investing $2,000 to $3,000 in a well being financial savings account (HSA). These accounts allow you to get a direct tax deduction within the 12 months you contribute, and your cash grows tax-free till you select to make use of it for eligible healthcare bills.

Should you don’t use your cash by age 65, you should use your HSA account funds for something you need, though you’ll must pay revenue taxes on distributions you’re taking past that age. If it is advisable to take a distribution earlier than age 65, alternatively, you’ll must pay revenue taxes, and you’ll be charged a 20% penalty.

Along with the actual fact this cash will solely be accessible penalty-free if in case you have eligible healthcare bills, you additionally must keep in mind that contribution limits apply to this account annually. In 2023, people can contribute as much as $3,850 to an HSA, whereas households can contribute as much as $7,750. This quantity exceeds final 12 months’s limits of $3,650 for people and $7,300 for households in 2022.

The place do you have to open an HSA? A spread of platforms allow you to open this kind of account, and lots of allow you to make investments your HSA funds in varied underlying investments like mutual funds and index funds. A number of the finest HSA accounts to take a look at embrace the Vigorous HSA and HSA Financial institution.

13. Spend money on Earnings Accelerators

One other solution to put money into your self entails investing in one thing I name “revenue accelerators.” These aren’t conventional investments, but investing $2,000 to $3,000 in an revenue accelerator can assist you develop wealth in methods you’ve by no means imagined.

A number of the revenue accelerators I like to recommend embrace:

- Accelerated studying (i.e., studying books, taking a web-based course, attending conferences, and so on.)

- Private teaching (i.e., hiring knowledgeable coach in your discipline or business)

- Becoming a member of a mastermind group

- Hiring a mentor in your discipline

- Constructing relationships by investing in different individuals

Should you’re interested by revenue accelerators and the way they can assist you improve your income and even discover new methods to earn cash, try my new YouTube video on the subject:

14. Rent a Robo-Advisor

If in case you have $2,000 to $3,000 to speculate however really feel overwhelmed by all of your choices, it could be time to name in skilled assist. Nevertheless, you don’t must work with a standard monetary advisor who could also be extra involved in rising their wealth than serving to you construct up yours. As a substitute, you may go for a robo-advisor that makes use of monetary software program that can assist you discover the suitable investments on your danger tolerance and timeline.

Whereas many on-line monetary advisors are on the market, a number of the finest robo-advisors embrace Betterment, M1 Finance, SoFi Cash, Private Capital, and Wealthfront. Every of those firms does issues barely in a different way, but all of them assist you to select a personalized portfolio that may assist you to develop your $2,000 to $3,000 over time.

Some robo-advisors are free to make use of, but others cost an annual administration payment that can assist you choose and handle your investments. The chart under highlights one of the best robo-advisors in operation in the present day, plus their yearly charges and minimal stability necessities:

15. Spend money on Crypto

You may also think about investing in crypto, though you’ll need to proceed cautiously for those who accomplish that. In spite of everything, the crypto scene has been extremely unstable during the last 12 months, and it seems crypto might not be the hedge in opposition to inflation many stated it might be.

With that in thoughts, the most effective crypto methods proper now entails shopping for and holding — and even HODLing (holding on for pricey life). This may make sense for those who consider the worth of fashionable cryptocurrencies like Bitcoin and Ethereum can solely go up from right here.

If you wish to put money into crypto, you may open an account with any of one of the best crypto exchanges. Probably the most distinguished platforms to think about embrace Gemini, Binance.US, Coinbase, and KuCoin.

When you open an account, you may instantly put money into Bitcoin and different cryptocurrencies. Nevertheless, you must also analysis the finest crypto wallets to maintain your digital property protected from hackers and thieves till you’re able to promote.

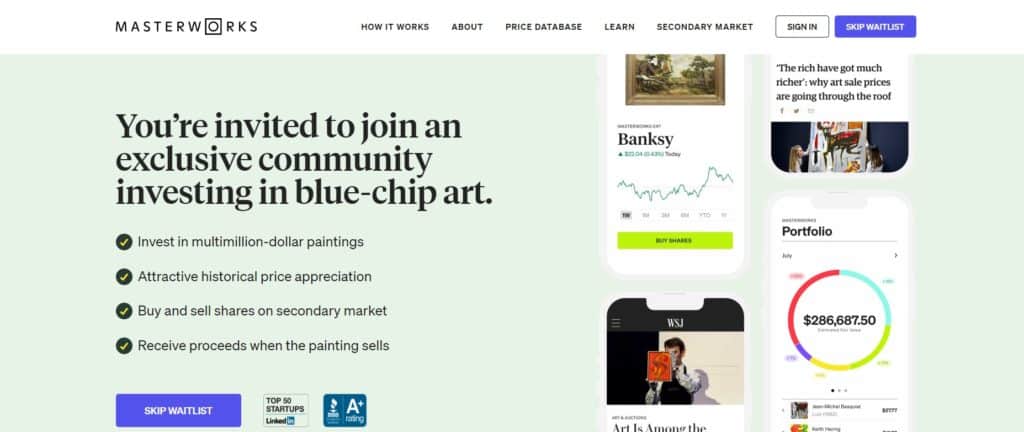

16. Spend money on Artwork and Collectibles

Investing in artwork appears like one thing solely wealthy individuals do, but an array of on-line platforms let nearly anybody put money into worthwhile art work and collectibles. One instance is a platform referred to as Masterworks. This web site lets customers put money into varied artwork items and even collections of artwork, and Masterworks buyers have achieved web annualized realized returns of 29.03% so far.

Like actual property crowdfunding platforms, Masterworks enables you to purchase “slices” or fractional shares of multi-million greenback work and collections. You’ll be able to promote your shares on the Masterworks secondary market or wait to obtain proceeds out of your funding when a portray sells. Both manner, it’s best to know that your funding received’t be completely liquid and you can lose cash for those who purchase or promote on the unsuitable time.

Along with artwork crowdfunding, you may think about investing in non-fungible tokens or NFTs. NFTs could be provided as digital items of artwork that may develop in worth equally to conventional art work, though NFTs may come within the type of digital actual property or digital keepsakes.

No matter you’re into, you should buy NFTs on platforms like OpenSea and Rarible. Simply keep in mind that, like different investments with the potential for prime long-term yields, you may lose cash with NFTs within the quick time period.

17. Begin a YouTube Channel

You may also think about beginning a YouTube channel to develop your cash, though chances are you’ll not must spend anyplace near $2,000 to $3,000 to start out the method. Making a YouTube channel and constructing a following with out an preliminary funding could also be potential. Nevertheless, chances are you’ll get extra traction upfront for those who put money into a great digicam, skilled lighting, and a few primary video modifying software program.

I can let you know from expertise that I wasn’t positive what I used to be moving into after I began my very own YouTube Channel referred to as Wealth Hacker. Nevertheless, I constructed it to the purpose the place I now have almost 400,000 subscribers! I additionally earn quite a bit on YouTube by way of sources like show advertisements and sponsorships.

Should you’re prepared to start out getting cash on YouTube, it is advisable to determine a theme on your channel and a normal concept of what you hope to perform.

Finest Methods to Make investments $2000 to $3000: Remaining Ideas

Should you’re on the lookout for one of the best methods to speculate $2000 to $3000, any of the choices I outlined can assist you obtain your objectives. Maintain your funding time horizon in thoughts and whether or not you’re keen to tackle extra danger to safe the next yield over time.

Should you don’t want the money for not less than 5 years and doubtlessly not till retirement, you’re higher off investing within the inventory market or by way of a crowdfunding platform that has reported stable outcomes. Should you want a spot to maintain your cash within the quick time period, a high-yield financial savings account, cash market account, or certificates of deposit (CD) might be your finest wager.

Cited Analysis Articles

1. FDIC Insurance coverage. (2020, Could 5). Federal Deposit Insurance coverage Company (FDIC): Definition & Limits. Retrieved from https://www.investopedia.com/phrases/f/fdic.asp

2. Treasury Direct. (n.d.) I Bonds. Retrieved from https://www.treasurydirect.gov/savings-bonds/i-bonds/

3. Dividend Energy. (2022, Nov 29). The record of Dividend Aristocrats. Retrieved from https://www.dividendpower.org/2020/02/03/the-list-of-dividend-aristocrats-in-2020/

[ad_2]