[ad_1]

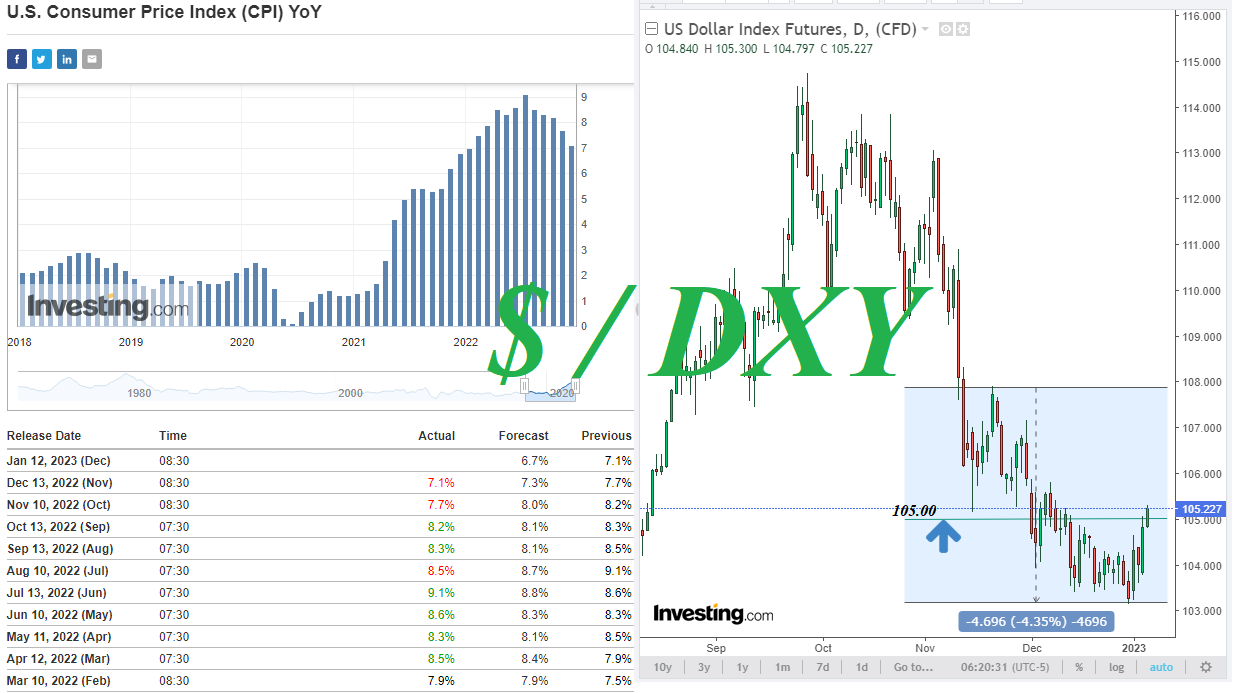

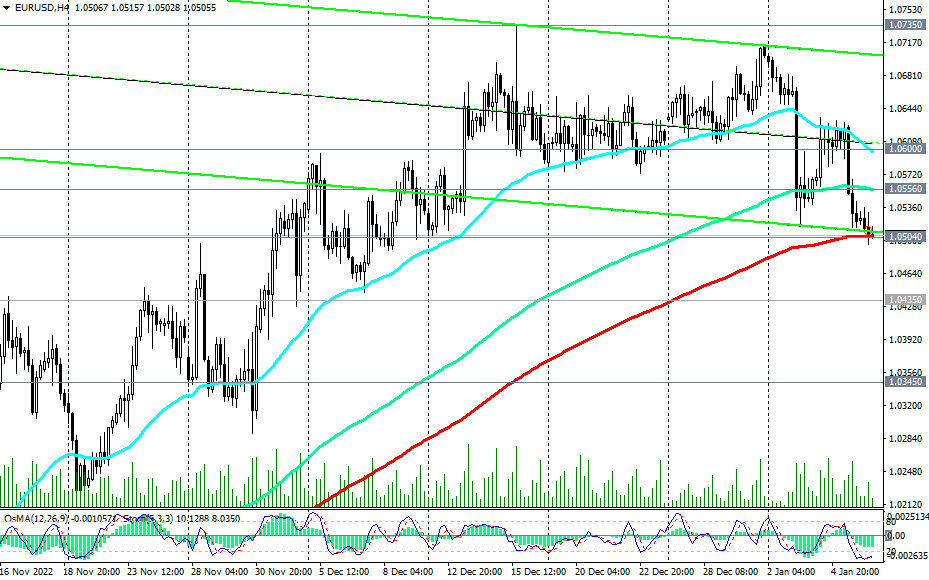

On the time of publication of the article, EUR/USD is testing for a breakdown an vital short-term assist degree 1.0504. Even though the index of enterprise sentiment within the European financial system, which determines the pattern of the Eurozone financial system as an entire, and core inflation within the Eurozone rose in December (by +0.6% and +5.2% in annual phrases), the euro fell instantly after the publication of the Eurostat report. Though core CPI rose, headline inflation within the Eurozone, as measured by the Harmonized Client Value Index (HICP), fell to 9.2% (year-on-year) in December (from 10.1% in November), which was additionally worse market expectations of 9.7%. The slowdown in inflation could contribute to a softer rhetoric of statements and actions of the ECB on the problem of financial coverage, and this can be a unfavorable issue for the euro.

In an alternate situation, the expansion of EUR/USD will resume. The breakdown of in the present day’s excessive at 1.0535 would be the first sign to renew lengthy positions, and the breakdown of the resistance degree 1.0556 shall be a affirmation. The closest development goal is the extent 1.0600, and the extra distant one is the native resistance degree and the utmost of December 1.0735.

However, from a technical viewpoint, brief positions stay preferable in the intervening time.

*) for vital occasions of the week, see the Most Vital Financial Occasions of the Week 01/02/2023 – 01/08/2023, and for the upcoming week – see the Most Vital Financial Occasions of the Week 01/09/2023 – 01/15/2023

Help ranges: 1.0504, 1.0435, 1.0400, 1.0345, 1.0300, 1.0190, 1.0000, 0.9745, 0.9700, 0.9600, 0.9550, 0.9500

Resistance ranges: 1.0535, 1.0556, 1.0600, 1.0700, 1.0735

[ad_2]