[ad_1]

The creator’s technique of Alexander Elder, a former Russian emigrant who left medical observe in psychiatry for a profession as a dealer.

Possessing the expertise of a author (he went from a journalist to an editor of a specialised alternate journal), in his writings the creator confirmed the dependence of value motion on the “temper of the group”. On this foundation, Elder developed a variety of indicators and buying and selling methods, with the assistance of which he proposed to “guess” the needs of the majority of merchants, figuring out the place you may comply with the group and the place the group is mistaken. An outline of the symptoms may be discovered by studying the creator’s books, there are Russian-language publications, the symptoms themselves are included within the primary package deal of many buying and selling platforms, for instance, Metatrader .

Developed and described by Elder in his bestseller titled within the Russian model – “Easy methods to play and win on the inventory alternate.”

The essence of the technique is straightforward, each dealer is aware of about the advantages of buying and selling with the pattern . The creator of the technique proposes to substantiate the discovered pattern pattern on all timeframes: short-term , long-term and medium-term . It’s believed that the indicators which have handed the triple choice have the very best probability of being worthwhile.

Techniques

The working timeframe (the timeframe on which the dealer performs the principle work) is outlined as medium-term. We show extra chart home windows an order of magnitude greater than the working one and an order of magnitude decrease. That’s, for a four-hour chart, such timeframes may be day by day and hourly.

In truth, selecting the size of the buying and selling vary is an issue. As a result of the query arises, what’s the optimum distance between the three screens? When answering this query, it ought to be taken into consideration that the postulates of the market say that the accuracy of the sign is dependent upon the scale of the analyzed time interval, the upper, the extra correct.

To determine on the selection of “distance” between the three screens, a easy discount of market fluctuations to calendar elements utilizing a coefficient calculated by Alexander Edler will assist. Having decided {that a} week pertains to a day by day candle as 1 to five (working 5 days), a month may be represented to per week as 1 to 4, 5, and many others., the creator on the pages of his works instructed selecting time intervals by multiplying (dividing) the beginning timeframe by an element of 5. Thus, being a scalper , if you will commerce on five-minute durations, select a short-term vary – 1 minute, long-term – half-hour (we use rounding as much as the scale of ordinary timeframes).

Easy methods to decide the pattern at these intervals, the way to discover out the state of the market and the path of the pattern? The market doesn’t give precise solutions, being a set of chances and alternatives decided by technical evaluation indicators. The creator of the three-screen system determines the state of the market by way of the mixed use of pattern indicators and oscillators. The Adler pattern appears like this: in an uptrend, pattern indicators are rising, oscillators point out overbought , in a downtrend, pattern indicators are falling and oscillators point out oversold .

On a long-term chart, the pattern is often pronounced, there are not any market noises, the evaluation begins from this chart, after which descending.

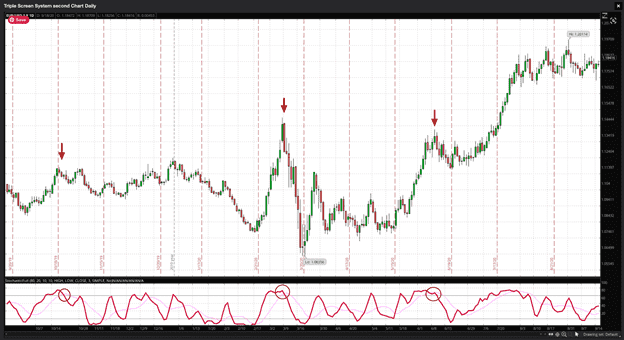

MACD will greatest deal with the duty of figuring out the pattern in the long run, on this evaluation a modified idea of research is used, we decide the slope of the straight line drawn alongside the tops of the final two bars of the histogram, the path of the slope will point out the pattern, the angle – power.

Alexander Elder’s First Display

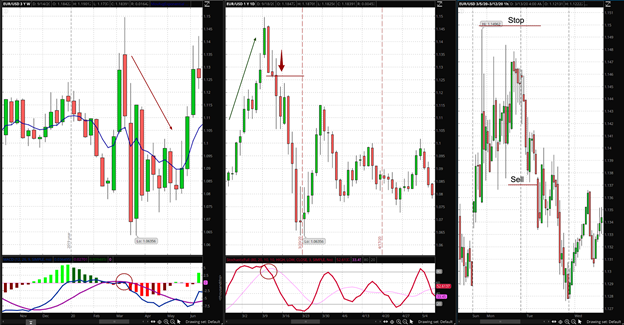

Allow us to use a triple display in Foreign currency trading with the EUR/USD foreign money pair for instance. That is the display used to determine the dominant pattern within the asset and to determine through which path we’ll make the commerce.

First, watch the chart. If the EUR/USD is trending up, we’ll determine shopping for alternatives; however, if trending down, we might search to promote the EUR/USD.

For this, we’ll use a weekly chart with two pattern indicators, an Exponential Shifting Common (EMA) with 13 durations, and a Shifting Common Convergence Divergence indicator (MACD) with 12,26,9 settings.

The following step is to attempt to determine MACD actions away from the zero space. If the MACD is shifting upward after crossing the zero space, it will likely be an uptrend. If MACD is crossing down from the world above zero, it will likely be a downtrend. The EMA will affirm the path of the tide too.

Elder’s Second Display

As soon as we now have recognized the pattern’s path, we then swap to watching the second display. This chart will assist us determine the short-term state of affairs and know when the dominant pattern is able to resume its run after a pause.

Step one is to determine brief time period reversals which can be exhausted or completed. It could be a contrarian motion from the long-term pattern or a smaller pattern that goes in the other way of the dominant one.

For this objective, we’ll use the stochastic oscillator. Dr. Elder additionally recommends the Relative Energy Index (RSI) and William %R. You’ll be able to select your favourite one.

The second step is to determine the break. This sign will seem when the stochastic leaves the overbought or oversold areas and returns to extra median values within the middle of its vary.

When studying stochastics, we comply with the Okay line and the D line. The Okay line is quicker than the D line. You must determine when the D line strikes into overbought, over the 80 line, or oversold, beneath the 20 line.

The set off would happen when the D line enters overbought or oversold situations; it can present us a path change. Your affirmation will probably be in the meanwhile the D line crosses the Okay line.

Lastly, you’d go brief when the stochastic is getting back from overbought situations. However, you’d purchase the asset when the indicator is getting back from an oversold space.

Now, you’ve a dominant pattern recognized and have recognized the exhaustion of a reversal towards that — the time has arrived to attempt to decide a exact entry level.

Elder’s Third Display

After figuring out the dominant pattern within the first display, and getting a sign from the second display, we transfer to the third display. It can present us with exact entry factors.

Within the third display, you must ideally search for breakouts within the path of the dominant pattern. Elder makes use of a way of trailing stops to find out particular entry factors.

For instance, if we’re on the lookout for bullish entry factors in a day by day chart used as our intermediate display, we might use a trailing purchase cease one level above the day prior to this’s excessive.

However, if we’re on the lookout for a promoting entry level, we’ll use a trailing promote cease one level beneath the day prior to this’s low.

The idea says that if the market retakes its uptrend and hits your cease, your lengthy place will probably be activated. Nonetheless, if the market goes towards you, then your cease will probably be deactivated.

In that case, you may path your cease and set a brand new one by dropping it to 1 level above the utmost of the day that has simply handed. Based on Elder’s guidelines, it’s possible you’ll maintain trailing it till activated or till you determine to keep away from the commerce when you see the weekly pattern has modified its path.

However, if we recognized a dominant downtrend and watched a mid-term uptrend, the promote order will probably be positioned one level beneath the low of the earlier interval from which the oscillator activated the sign. The stop-loss is then positioned behind the two-day excessive value.

Lastly, the second to take earnings will probably be decided by your trailing cease as soon as you might be ready. You’ll be able to set it to guard 50 p.c of your operating earnings or, within the case of shorter time frames, a hard and fast pip worth ought to work simply as nicely.

One other technique to decide your revenue taking stage is to observe for oversold ranges if you end up brief, and overbought ranges if you end up lengthy and, due to this fact, when the oscillator begins to return to a traditional stage, exit the commerce manually.

Based on Dr. Elder, the third display doesn’t want a separate chart or an extra indicator. You’ll be able to commerce the Elder triple display technique with solely two screens, in any case!

Automate your buying and selling with our Robots and Utilities

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Danger supervisor MT4 – https://www.mql5.com/en/market/product/72214

Danger supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

3 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410

[ad_2]