[ad_1]

- Tapestry Inc TPR, the New York-based home of life-style manufacturers consisting of Coach, Kate Spade, and Stuart Weitzman, reported a second-quarter FY23 gross sales decline of 5% year-on-year to $2.025 billion, marginally lacking the analyst consensus of $2.03 billion.

- Adjusted EPS of $1.33 beat the analyst consensus of $1.27.

- Gross revenue fell 4.7% Y/Y to $1.39 billion, with the margin increasing 50 foundation factors to 68.6%.

- Working margin contracted 100 foundation factors to twenty.6%, and working earnings for the quarter decreased 9.7% to $418 million.

- Tapestry held $846 million in money and equivalents as of Dec. 31, 2022.

- Stock on the finish of Q2 rose 30.1% to $976 million. The corporate mentioned it stays on monitor to finish the fiscal yr with stock up single digits versus the prior yr.

- Tapestry is on monitor to repurchase $700 million in widespread inventory within the present fiscal yr. In the course of the first six months of FY23, Tapestry spent $300 million to repurchase 8.4 million shares.

- TPR continues to anticipate paying an annual dividend of $1.20 per share, representing a 20% improve in comparison with prior yr, totaling roughly $300 million.

- Outlook: Tapestry raised its FY23 EPS outlook from $3.60-$3.70 to $3.70-$3.75 versus the consensus of $3.65.

- The corporate expects FY23 gross sales of $6.6 billion (prior view $6.5 billion – $6.6 billion) versus the consensus of $6.61 billion.

- Value Motion: TPR shares are buying and selling increased by 6.07% at $45.83 on the final verify Thursday.

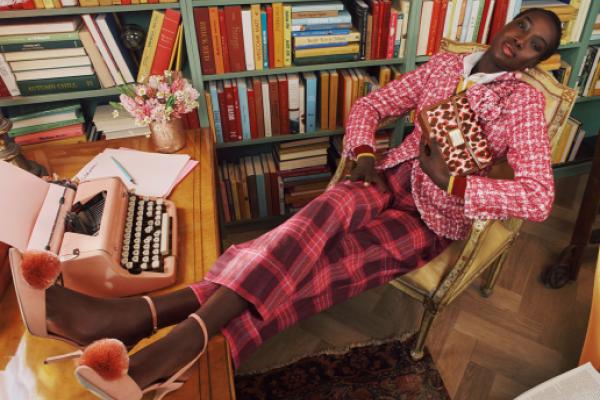

- Picture Through Firm

© 2023 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]