![9 Sensible Methods to Make investments $1K in 2023 [Proven Investment Strategies] 9 Sensible Methods to Make investments $1K in 2023 [Proven Investment Strategies]](https://bizagility.org/wp-content/uploads/2018/04/how-to-invest-1000-dollars-scaled.jpg)

[ad_1]

In response to a current Gallup ballot, greater than half of American adults (58%) have cash invested within the inventory market. Though the median holdings (quantities invested) range primarily based on age, earnings, and different demographic elements, it’s clear that People see the worth of investing — even when their publicity is proscribed to a office 401(ok).

In case you have a fully-funded emergency fund and have an additional $1,000 that you just don’t instantly want, you’ve quite a lot of choices. Sadly, the sheer variety of funding choices to select from could be overwhelming and downright complicated.

That’s why I wished to share a few of my favourite methods to speculate $1,000. No matter choice you make, try to be happy with your self for taking the time to be considerate along with your cash.

#1: Construct a Diversified Portfolio With Fractional Share Investing

Threat degree: Medium

Though you may at all times spend money on particular person shares, fractional share investing enables you to buy a fraction or “slice” of a inventory you need. This investing technique enables you to diversify your investments to the max, and spend money on big-name shares you couldn’t in any other case afford. For instance, a share of Amazon (AMZN) inventory is buying and selling for over $3,000 as of this writing.

The place your $1,000 funding wouldn’t get you within the door with a single share, fractional share investing enables you to make investments your $1,000 right into a slice of 1 Amazon inventory.

This fashion of shopping for inventory is ideal when you solely have $100 to start out investing, nevertheless it works properly for buyers who've $1,000 or $5,000 to speculate, too.

How It Works:

Investing in fractional shares is as straightforward as investing in conventional shares or ETFs. All you must do is discover a brokerage agency that permits fractional share investing. From there, you may analysis choices and spend money on the fractional share market at your personal tempo.

The place to Get Began:

Many on-line brokers provide real-time fractional share investing with out charging commissions. Fractional shares could be as small as 1/1,000,000 of a share, so you may unfold your $1,000 preliminary funding throughout lots of of various corporations.

Who It’s Greatest For:

Fractional share investing is an effective possibility for anybody who desires to diversify their portfolio by investing in several corporations.

Execs

- Diversify your investments throughout many shares and ETFs

- Put money into massive corporations with share costs of over $1,000

- Fractional share investing could be commission-free relying on the brokerage you choose

Cons

- Not all brokerage companies provide fractional share investing

- Prices can add up rapidly with brokerages that cost commissions for trades

#2: Construct a Micro Actual Property Portfolio

Threat degree: Medium

There are dozens of the way you may get began investing in actual property, however the best is thru Fundrise. With simply $500 (solely half of the cash you must make investments), you may make an preliminary funding.

You should utilize their starter portfolio, which places your cash into a number of totally different REITs and offers you instantaneous diversification. One other strong possibility to take a look at is Realty Mogul.

How It Works:

Fundrise REITs allow you to make investments no matter cash you've (on this case, $1,000) into actual property with out having to develop into a landlord. Merely open an account, switch some cash to get began, and choose a portfolio possibility that aligns along with your urge for food for danger and your targets.

Fundrise takes care of the grunt work of actual property administration and discovering new investments for you. As a facet be aware, Fundrise buyers earned a mean platform return of twenty-two.99% in 2021(3.49% in 2022 up to now). You may try my 4-year Fundrise returns right here.

The place to Get Began:

In the event you’re in search of a fast and straightforward solution to spend money on actual property with out having to handle buildings or having your investments diminished from charges, Fundrise is your go-to possibility. Be taught extra about investing with Fundrise.

Who It’s Greatest For:

Fundrise is a perfect funding possibility for shoppers who need publicity to actual property markets with out having to develop into a landlord or cope with particular person properties.

Execs

- Low minimal stability of $500 required to get began

- Distinctive returns up to now (common return of twenty-two.99% in 2021)

- Solely 0.15% in annual advisory charges

Cons

- This funding possibility just isn't liquid, and it might probably take months to get your cash out

- Like different investments, previous outcomes should not a assure of future returns

#3: Let Dividends Pay Your Month-to-month Payments

Threat degree: Low

What when you might get your mobile supplier to pay your cellphone invoice each month? That might be fairly candy, proper? Heck yeah, it might!

That’s precisely what might occur when you invested your $1,000 right into a telecommunication inventory similar to Verizon or AT&T that each pay a salty dividend.

In the event you owned sufficient shares the dividend funds might cowl your month-to-month invoice so it’s such as you’re getting your cellphone without cost. Are you able to hear me now?

You may apply this to different month-to-month bills similar to your electrical energy invoice, web, gasoline, leisure, and groceries. Right here’s some examples of corporations you most likely pay for his or her service that has a inventory that pays a dividend.

| Service | Firm | Dividend Yield |

| Utilities | Duke Vitality | 4% |

| Communications | AT&T | 5.68% |

| Groceries | Kroger | 1.44% |

| Fuel | Exxon Mobil | 4.01% |

| Web | Comcast | 2.3% |

| Quick Meals | McDonald’s | 2.2% |

In the event you want a refresher on dividends, try this text on how you can make investments and generate income on dividends.

One of many best platforms to construct a customized dividend portfolio is M1 Finance.

#4: Open a Roth IRA

Threat degree: Varies

A Roth IRA is a kind of funding account that permits you to make investments after-tax {dollars} for retirement. From there, your cash can develop tax-free, and you'll withdraw your funds with out having to pay earnings taxes when you attain retirement age. For 2023, the most contribution quantity throughout IRA accounts is $6,500 for most individuals. Nevertheless, people ages 50 and older can contribute as much as $7,500.

How It Works:

Revenue caps restrict who can contribute to a Roth IRA, however be aware that contributions are phased out fully for single filers who earn greater than $153,000 and married {couples} who earn greater than $228,000.

The place to Get Began:

Eligible buyers can open a Roth IRA with any brokerage account that provides this sort of account. Among the hottest brokerage companies that provide Roth IRAs embody Betterment, Stash, M1 Finance, and TD Ameritrade.

Who It’s Greatest For:

Investing in a Roth IRA is smart for anybody who’s saving for retirement or a future purpose. One of these account can also be best for anybody who desires to arrange a tax-free earnings supply for his or her retirement years. Be taught extra in regards to the finest investments for a Roth IRA.

Execs

- Your cash grows tax-free and you'll withdraw funds with out paying earnings taxes in retirement

- You may withdraw contributions (not earnings) at any time with out penalty

- Most brokerage companies make opening a Roth IRA a breeze

Cons

- Low annual contribution limits

- Revenue caps restrict who can use this account

- You make investments with after-tax {dollars}, that means you can't deduct your contributions the yr you make investments

#5: Construct Up a Excessive-Yield Emergency Fund

Threat degree: Low

If you wish to earn some curiosity along with your $1,000 however can’t afford to lose any of it, then a high-yield financial savings account is the best choice. These deposit accounts provide higher rates of interest than what you’d get out of your native brick-and-mortar financial institution.

How It Works:

These accounts received’t earn quite a lot of curiosity, but when they’re FDIC-insured there’s no likelihood of dropping the cash. You too can withdraw your money at any time when you want it.

The place to Get Began:

The UFB Direct Rewards Financial savings provides one of many highest yields obtainable with a financial savings account right now. You may even get the best fee with no minimal deposit and no month-to-month upkeep charges.

Who It’s Greatest For:

Most individuals have to have some emergency financial savings within the financial institution. Nonetheless, this account’s a superb possibility for anybody who has $1,000 to speculate however may want their cash within the brief time period.

#6: Construct a Portfolio with Low-Price ETFs

Threat degree: Varies

Trade-traded funds (ETFs) have made it a lot simpler to diversify your portfolio. One of these funding is much like a mutual fund in you could buy many alternative shares in a single ETF.

How It Works:

ETFs allow you to buy an assortment of shares and different securities in a single fell swoop. You may spend money on ETFs with many of the main brokerage companies, and you'll often achieve this with low funding charges (or no charges).

The place to Get Began:

M1 Finance is among the finest choices with regards to buying ETFs. This investing platform provides over 1300 totally different ETFs you could commerce without cost, which is admittedly a tremendous deal. Learn my full M1 Finance Evaluate.

Who It’s Greatest For:

Investing in ETFs could make sense for any investor. It’s much more helpful for these with $1,000 to speculate as a result of ETFs allow you to diversify greater than you might with particular person shares.

Execs

- ETFs usually have low expense ratios, and also you might be able to make investments or commerce with no charges

- You may often get began with a low account minimal (or no account minimal)

- Diversify your investments

Cons

- Include the identical danger as different inventory market investments

- You may have to do vital analysis to seek out out which ETFs to spend money on

#7: Let a Robo-Advisor Make investments On Your Behalf

Threat degree: Varies

Robo-advisors are expertise platforms that use science and superior algorithms to make funding selections in your behalf. Because of the recognition of robo-advisors, Deloitte believes the robo-advisor business may need as a lot as $16 trillion in property below administration (AUM) by 2025.

How It Works:

While you open an account with a robo-advisor, you usually begin the method by answering an array of questions on your funds and your targets. From there, the robo-advisor makes use of laptop algorithms to seek out the perfect funding choices in your danger tolerance and your funding timeline.

The place to Get Began:

I virtually at all times suggest Betterment as my best choice amongst robo-advisors as a result of their user-friendly and intuitive interface, their low charges, and their suite of different monetary merchandise. You may open an account with Betterment with no minimal stability requirement. Be taught extra in my Betterment overview.

Who It’s Greatest For:

Robo-advisors are geared to buyers who need assist determining which investments will work finest for his or her portfolio.

Execs

- Charges are comparatively low; you will pay .25% per yr ($2.50 per $1,000) in your invested stability

- Simple solution to begin investing when you're a novice

- Expertise makes sensible investing decisions in your behalf

Cons

- Charges required, which could not be the case when you make investments by yourself

- You won't find out about investing when you let a third-party platform make most selections in your behalf

#8: Pay Off Debt

Paying off debt just isn't often what involves thoughts while you’re fascinated by investing your cash however the stats don’t lie. People’ debt load continues to extend yr over yr and whereas your mortgage fee could also be low and also you’ve had a few of your pupil loans forgiven, the curiosity that you just’re paying in your different debt is killing your means to build up wealth.

Despite the fact that $1,000 could not have a major affect on whittling down the quantity of debt that you've got, it’s an important and important step in the direction of attaining monetary freedom. I can’t specific in phrases what it felt like after I lastly paid off my pupil loans and bank cards that I had recklessly amassed at school.

I can’t put a price on how free I felt.

Taking $1,000 and making use of it in the direction of your debt get you one step nearer to feeling the euphoria of being debt-free.

#9: Put money into Your self

I do know it could sound cliche however investing in your self will in the end provide the highest ROI or return on funding I do know.

The primary time that I ever heard this expression I didn’t actually perceive what it meant. As I started the trail of conventional investing and surrounded myself with different profitable business-savvy entrepreneurs I began to lastly perceive what investing in your self actually meant.

Beginning small may very well be merely shopping for a e-book or shopping for a $20 course on Udemy. A bigger funding may very well be attending that convention that you just’ve been laying aside yearly or possibly it’s signing up for that enterprise coach that your friends have spoken so extremely about.

I can attest that every one of those have had an affect on my private and monetary success and all of which have been lower than $1,000.

The bigger investments in myself have been enterprise teaching applications and in addition high-ticket programs.

Programs have been given a nasty rap these days primarily due to money-hungry gurus which can be all inquisitive about lining their pockets.

Put aside a superb quantity of $1,000 or extra for programs that you just suppose are properly definitely worth the effort. I’ve even created just a few programs myself which have obtained reward and admiration for the data and worth that they supplied. You may try my two most up-to-date programs “Passive Revenue Accelerator” and “10x Targets Accelerator.”

In the event you decide the appropriate course or teaching program, you may simply begin making $1,000 monthly.

Your Funding Fashion

Earlier than you dump $1,000 (or another sum) into an funding, spend time fascinated by your investing type. For essentially the most half, your investing type is decided by contemplating:

- Timeline to speculate

- Whether or not you want quick access to your cash

- Urge for food for danger

- Common curiosity in studying about investing

If you'd like a 3rd social gathering to do many of the be just right for you, then there’s a superb likelihood a robo-advisor, like Betterment, is what you want.

In any case, Betterment expenses low charges, but makes use of expertise to make sensible funding selections for you. You may open a Betterment account, set it as much as be funded commonly, and (principally) go away it alone. In the event you’d relatively spend your time and power in your profession or your hobbies, going this route is an effective alternative.

That mentioned, some individuals desire the do-it-yourself possibility. This could make sense if you wish to study extra about investing by being hands-on so that you develop into a greater investor over time. It’s additionally a smart path when you simply wish to perceive the internal workings of frequent funding methods.

In the event you suppose you’d be higher off as a DIY investor, then investing in ETFs with Fundrise could be higher choices.

The Backside Line – Investing $1,000 Proper Now

Irrespective of the way you select to speculate $1,000, know you’re taking an essential first step. The truth that you made it this far on this overview tells me you’re severe about making a sensible funding. You’re leagues away from most individuals who don’t hassle with investing till it’s far too late.

However there’s nonetheless work to do to make sure you discover the perfect funding possibility in your wants and targets. Resolve in your investing type and analysis all of the choices I listed on this information. With a while and planning, your $1,000 could be primed for development very quickly.

FAQ’s on Investing $1,000

It’s typically not a good suggestion to attempt to get a fast return in your funding, particularly when you’re investing a small amount of cash like $1,000. The rationale for that is that investments which have the potential to generate a fast return additionally are usually greater danger, and there’s a superb likelihood you might lose some or your entire cash. However when you can abdomen the danger, listed here are some choices you might contemplate:

One possibility for investing $1,000 {dollars} for a fast return may very well be to spend money on short-term high-yield financial savings accounts or certificates of deposit (CDs) supplied by banks and credit score unions. A majority of these investments usually provide greater rates of interest than conventional financial savings accounts and might present a return on funding inside just a few months to a yr.

A second possibility may very well be to spend money on short-term bonds or bond funds, which may present a gentle stream of earnings and could be offered rapidly if wanted. Nevertheless, there's a danger that the worth of the bonds could lower if rates of interest rise.

Another choice may very well be to spend money on crowdfunding actual property platforms. That is the method of pooling collectively cash from a bunch of individuals to spend money on an actual property property. This may be accomplished by way of a web site or app that connects buyers with property builders or house owners. Traders can often count on to obtain a share of the earnings from the property, relying on how a lot they make investments.

It is very important rigorously analysis and evaluate totally different funding choices and their potential dangers and rewards earlier than making any selections. Additionally it is really helpful to seek the advice of with a monetary advisor for personalised recommendation.

$1,000 generally is a good beginning funding for individuals who are new to investing and wish to begin constructing their portfolio. It permits for a degree of diversification and permits the investor to check the waters with out risking a major amount of cash.

Nevertheless, you will need to rigorously analysis and evaluate totally different funding choices and their potential dangers and rewards earlier than making any selections. Additionally it is really helpful to seek the advice of with a monetary advisor for personalised recommendation and to make sure that the funding aligns with the person’s monetary targets and danger tolerance.

There are a variety of choices for investing $1,000, together with:

1. Excessive-yield financial savings accounts or certificates of deposit (CDs) supplied by banks and credit score unions. A majority of these investments usually provide greater rates of interest than conventional financial savings accounts and might present a return on funding inside just a few months to a yr.

2. Brief-term bonds or bond funds, which may present a gentle stream of earnings and could be offered rapidly if wanted. Nevertheless, there's a danger that the worth of the bonds could lower if rates of interest rise

3. Low-cost index funds, which may present a diversified funding portfolio at a low value.

4. Particular person shares or ETFs, which may present the potential for greater returns but in addition carry the next degree of danger.

It is very important rigorously analysis and evaluate totally different funding choices and their potential dangers and rewards earlier than making any selections. Additionally it is really helpful to seek the advice of with a monetary advisor for personalised recommendation.

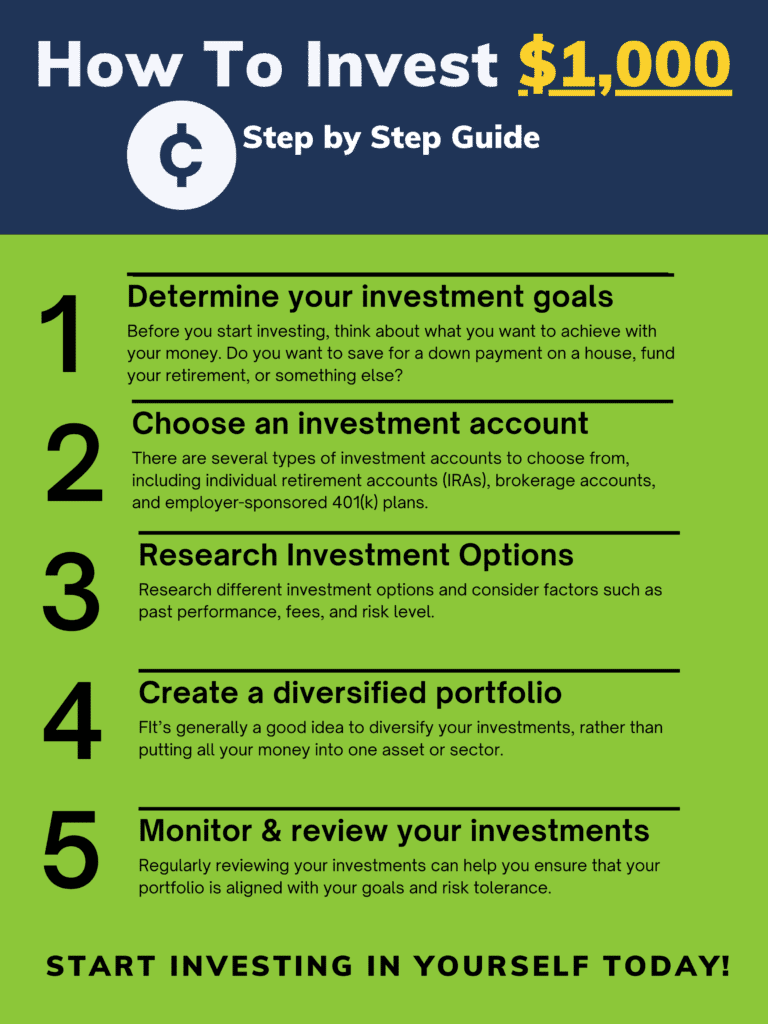

Easy methods to Make investments $1,000 – Step by Step

Time wanted: 1 hour and half-hour.

Easy methods to Begin Investing with $1,000

- Decide your funding targets

Earlier than you begin investing, take into consideration what you wish to obtain along with your cash. Do you wish to save for a down cost on a home, fund your retirement, or one thing else? Your funding targets will enable you resolve the place to allocate your funds.

- Select an funding account

There are a number of forms of funding accounts to select from, together with particular person retirement accounts (IRAs), brokerage accounts, and employer-sponsored 401(ok) plans. Think about elements similar to charges, tax implications, and account minimums when deciding which account is best for you.

- Analysis funding choices

After you have an funding account arrange, it’s time to resolve what to spend money on. You may spend money on a wide range of property, together with shares, bonds, mutual funds, and exchange-traded funds (ETFs). Analysis totally different funding choices and contemplate elements similar to previous efficiency, charges, and danger degree.

- Create a diversified portfolio

It’s typically a good suggestion to diversify your investments, relatively than placing all of your cash into one asset or sector. A diversified portfolio may help cut back danger and improve the potential for long-term development.

- Monitor and overview your investments

Frequently reviewing your investments may help you make sure that your portfolio is aligned along with your targets and danger tolerance. Think about reallocating your property if needed to take care of a balanced portfolio.

Cited Analysis Articles

- Gallup Information: What Proportion of People Personal Inventory?https://information.gallup.com/ballot/266807/percentage-americans-owns-stock.aspx

- IRS.gov Quantity of Roth IRA Contributions That You Can Make For 2023 https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2023

[ad_2]