[ad_1]

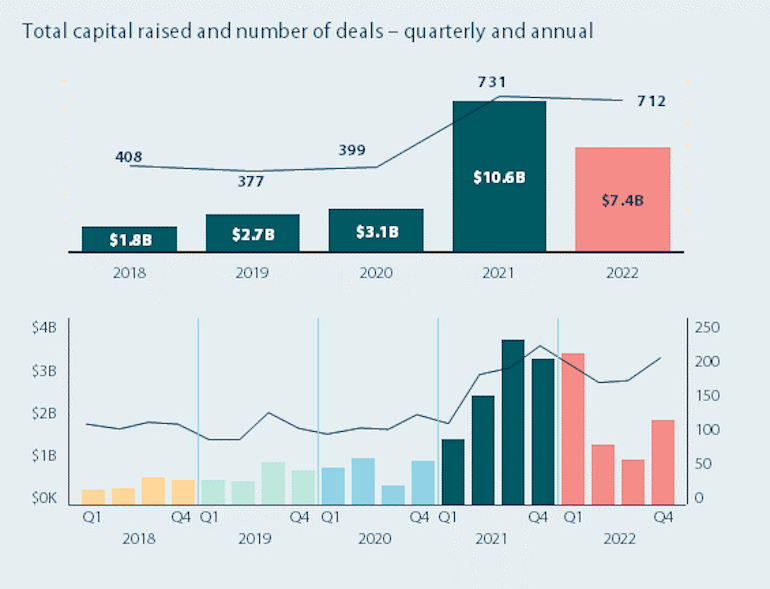

- Startup funding in 2022 hit $7.4 billion

- It’s a 30% fall on 2021, however lower than a world drop of 35%

- Traders made 712 offers

- Feminine founders obtain extra offers, however much less funds

- Funding has grown 5x in 5 years

It’s a good time to be an early-stage founder, a brand new evaluation of Australian startup funding for 2022 reveals, with a report variety of founders backed within the final 12 months.

The second annual version of The State Of Australian Startup Funding report, from Lower By means of Enterprise and Folklore Ventures, reveals Pre-Seed and Seed levels attain report ranges in 2022 in defiance of a fall in total funding by round 30% – $3.2 billion – to $7.4 billion final 12 months.

To place it in perspective, the 2022 numbers proceed an astonishing development story for native funding in such a brief house of time. 2022’s $7.4bn remains to be 5 time greater than 2018’s $1.4bn, 3 times bigger than 2019’s pre-pandemic stage of $2.7bn and greater than double the scale of 2020’s $3.1bn.

Supply: The State Of Australian Startup Funding

Fintech as soon as once more attracted the lion’s share of funding at $1.3 billion, however enterprise and enterprise software program is rising strongly, reaching $1.2bn in 2022, and with fintech barely on the nostril with traders following huge falls in valuations for BNPLs similar to Klarna, and the failure of ASX-listed Openpay, enterprise SaaS seems set to grow to be the favorite in 2023.

Australian funding outperformed its world friends – VC funding fell by 35% globally – and within the context of public markets and valuations, remained remarkably bullish during the last 12 months, with traders nonetheless desirous to again the subsequent potential unicorn.

Deal numbers in 2022 climbed above 700 for the second 12 months in a row at 712 – simply 19 lower than 2021’s 731. However little doubt to the reduction of traders and VC groups on due diligence, the frantic tempo of 2021’s overheated market abated.

The Lower By means of Enterprise funding report discovered that 88% of surveyed traders reported longer fundraising processes, with 61% have been taking longer to determine on investments, even when a powerful urge for food to speculate remained.

Investing stays aggressive

Greater than a 3rd (35%) of traders surveyed reported that early offers have been extra aggressive than ever.

The unimaginable present of confidence comes on the proper time for Australia’s founders and VCs as current market challenges triggered interrogations from many round the way forward for funding in Australia.

However the huge distinction final 12 months is a drop in mega rounds above $50 million and outlier offers at each stage. The variety of sub-$5 million investments remained regular amid broader falls, whereas complete funding for early-stage startups elevated by 7%.

And there might be no scarcity of capital accessible for the precise founders over the subsequent few years, provided that the highest three funds, Airtree, Blackbird and Sq. Peg raised a staggering $2.4 billion in new funds final 12 months, with Blackbird elevating Australia’s first $1 billion VC fund. All three have pledged to proceed to again early-stage assupporting portofolio corporations in later stage rounds.

Report co-author Chris Gillings, founding father of Lower By means of Enterprise and associate at later stage VC fund 5 V Capital, stated that whereas there’s loads of dry powder in VC wallets for the years forward, it’s being deployed extra cautiously.

“Given the worldwide atmosphere, it’s no shock that funding was down in 2022. What’s encouraging, although, is the resilience that the market confirmed: it’s a testomony to the breadth, depth and maturity of the startup ecosystem,” he stated.

Restricted Companions (LPs) in VC funds now demand extra conservative funding cadence, portfolio corporations have been instructed to scale back prices, and 60% of VC companions reported a decreased LP urge for food the report discovered. On the identical time, greater than 60% of founders stated they plan to boost their subsequent capital spherical in 2023.

The excellent news for early-stage founders is angel investing continued on its upward trajectory in 2022, with feminine angels remaining assured all year long, and extra bullish about 2023 than their male counterparts. Virtually twice as many feminine angel traders (83% vs. 42% for male angel traders) anticipate to extend their angel investments subsequent 12 months.

It was a blended outcome for feminine founders, with their involvement in raises growing, however the dimension of investments and their total slice of the capital pie falling.

Offers for ladies method up, quantities down

Feminine founder participation hit an all-time excessive in 2022, however their share of funding dropped to its lowest stage lately.

Pre-Seed and Seed startups based by girls took in considerably extra funding, and 23% of all offers included corporations with at the least one feminine founder. Nonetheless, complete funding dropped to 10% — from 21% in 2021 — and so they raised a median quantity 39% decrease than for all-male groups.

Folklore Ventures founder and managing associate Alister Coleman stated 2022 was a case of the brand new regular returning to the previous regular.

“The ebb and movement of the final two years is a pure a part of our ecosystem maturing, and we should always anticipate funding environments to periodically develop and contract over time, as is the character of capital markets,” he stated.

“Zooming out, there are actual causes to be excited concerning the abundance of world-class expertise and innovation in Australia’s startup ecosystem, and the well being of the funding atmosphere captured on this report is an indication of simply how far now we have come during the last decade.”

Amid the uncertainly of the final 12 months, the place the tempo of offers continued from 2021 earlier than a significant slowdown over the second half of the 12 months, Coleman believes the momentum will stay robust with regards to backing new startups.

“In 2022, we noticed early-stage funding attain an all-time excessive, and looking out ahead, we imagine this pattern will proceed off the again of great dry powder in VC funds and a pure tendency for troublesome occasions to be a catalyst for nice innovation,” he stated.

“Folklore has lengthy held that startup investing is a long-term journey starting with a primary cheque, so we start 2023 excited and able to help the subsequent era of Australian startup success tales.”

Lower By means of Enterprise makes use of knowledge collected from greater than 80 enterprise capital funds, alongside reporting from media and founders to constructed probably the most correct image of the native funding sector. All up, survey knowledge from greater than 500 Australian founders, enterprise and angel traders helped construct probably the most complete image of native startup funding

And people backing the The State Of Australian Startup Funding report are JP Morgan, Silicon Valley Financial institution, and Deloitte.

Silicon Valley Financial institution’s ANZ market lead Sara Rona stated they “are nonetheless very optimistic” about Australia as a maturing startup ecosystem, regardless of the present macroeconomic headwinds.

“The funding knowledge from the State of Australian Startup Funding report reveals that Australia’s ecosystem has remained resilient, with vital alternatives for development in some sectors in 2023 together with in its distinctive strengths like SaaS corporations and local weather tech,” she stated.

The total report is out there free of charge at australianstartupfunding.com

Supply: The State Of Australian Startup Funding

[ad_2]