[ad_1]

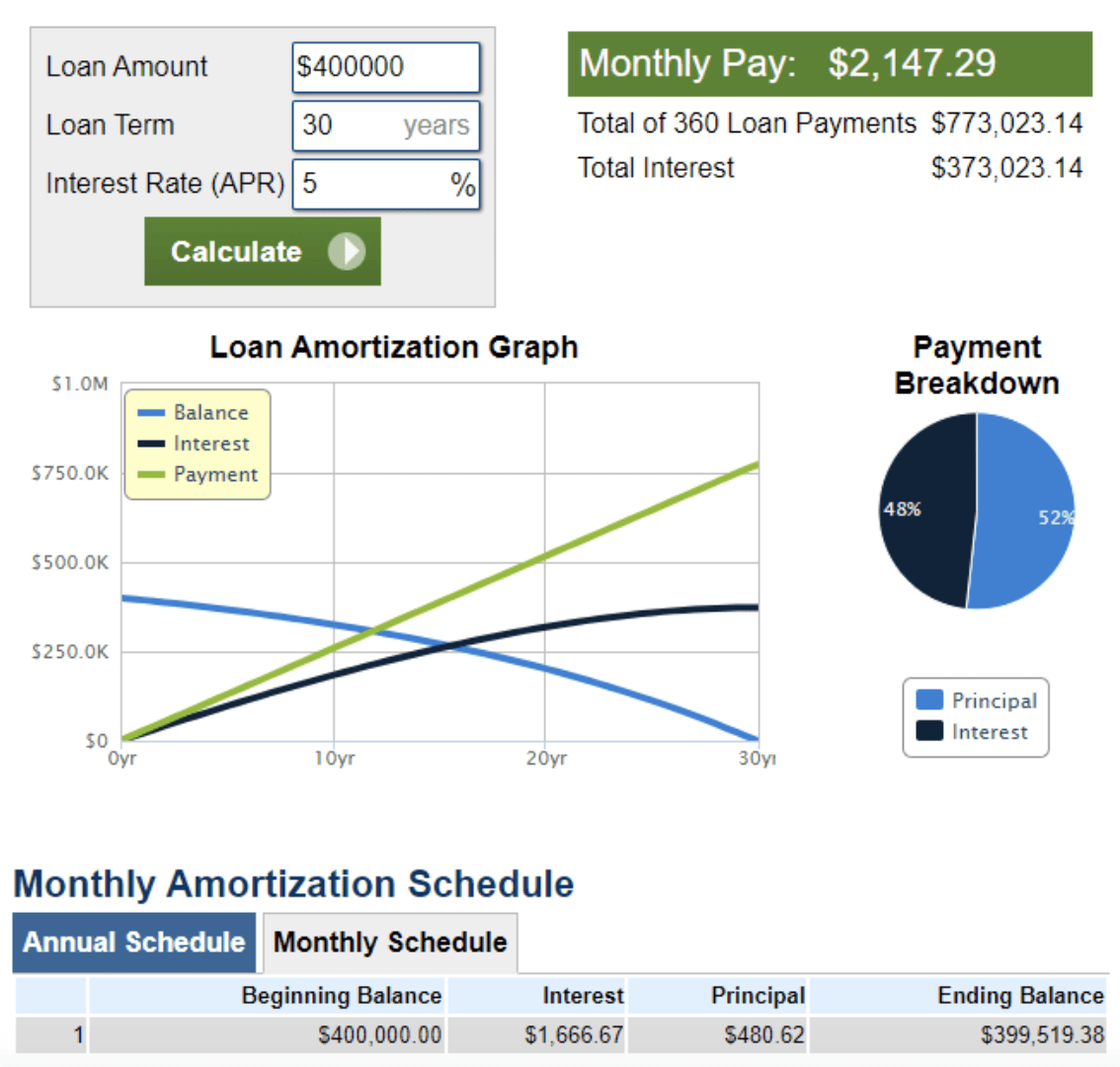

Calculating the principal and curiosity in your mortgage helps you determine the precise price of a property. In case you have a $400,000 mortgage at a 30-year fastened fee of 5%, the quantity you spend after 30 years isn’t $400,000. It’s truly $773,158. $400,000 will go towards your principal, whereas the opposite $373,158 will go towards your curiosity.

Whenever you purchase a house with a fastened rate of interest, your month-to-month mortgage fee would be the identical all through your mortgage. Nevertheless, although you’re writing a examine for a similar quantity each month, how a lot you set towards your principal and curiosity will all the time be totally different.

On this submit, we’ll outline what your principal and curiosity funds are on a mortgage and present it’s a must to calculate how a lot a home will price you to make a extra knowledgeable choice when buying a property. We’ll additionally focus on the distinction between APR and your rate of interest, what components influence your rate of interest, and easy methods to monitor the place your fixed-rate mortgage funds are going.

Right here’s easy methods to calculate the principal and curiosity in your mortgage:

What’s the Principal on a Mortgage?

Whenever you take out a house mortgage, your principal is the quantity you borrow from a lender. If the overall buy worth of your private home is $300,000 and also you make a 20% down fee of $60,000, the remaining $240,000 is your principal stability.

Buy Value – Down fee = Principal stability

Use our mortgage calculator to find out how a lot house you possibly can afford. Your principal equates to your mortgage quantity, making it some of the necessary numbers to know. Your mortgage principal begins accumulating curiosity proper after you are taking out your mortgage. Mixed, the 2 make up most of what you’ll pay month-to-month.

What’s an Curiosity Fee?

Lending establishments don’t mortgage you lots of of hundreds of {dollars} and get nothing in return. Your lender costs you curiosity on the mortgage, normally primarily based on the annual share fee (APR).

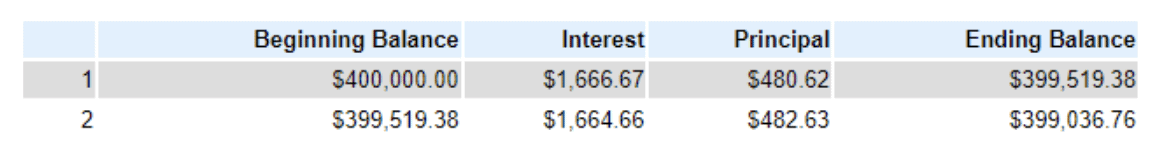

Most first-time house consumers are stunned to study that, even with a low-interest fee, they’ll be spending some huge cash towards the mortgage curiosity every month. For instance, should you take out a 30-year mortgage for $400,000 at a 5% rate of interest, your month-to-month fee is $2,147.29. For the primary month, $1,666.67 of that fee goes in direction of curiosity, and solely $480.62 goes towards paying down your principal.

How is Your Curiosity Fee Calculated?

Calculating your curiosity fee requires a bit extra math. The formulation is:

Month-to-month Curiosity Fee = Principal Mortgage Quantity x (Annual Curiosity Charge / 12)

Principal mortgage quantity = $400,000

Rate of interest = 5%, or 0.05

On this case, your curiosity is:

Curiosity = $400,000 x (.05/12)

Curiosity = $1,666.67

With a hard and fast fee, you’ll pay much less curiosity with every mortgage fee as a result of your principal stability decreases. After your first mortgage fee, your principal stability goes from $400,000 to $399,519.38. For month two, your curiosity equation is:

Curiosity = $399,519 x (.05/12)

Curiosity = $1,664.66

When you solely find yourself placing $2.01 extra towards your principal stability, you’ll slowly pay down increasingly of your mortgage over time, which brings us to amortization.

What’s Amortization?

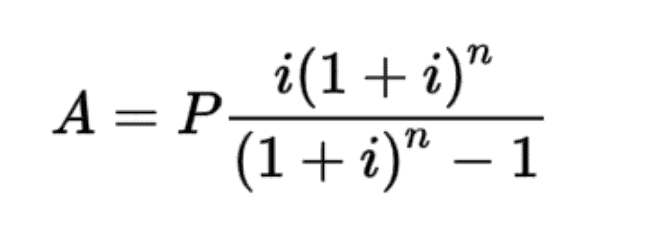

Amortization means paying off your private home mortgage by common principal and curiosity mortgage funds over time. Calculating amortization requires utilizing the formulation:

A = Month-to-month Mortgage Fee

P = Principal Steadiness

I = Periodic Curiosity Charge

N = Whole Variety of Funds

We advocate utilizing an amortization calculator as an alternative.

Why Amortization Issues

Amortization helps householders and actual property buyers determine their prices over time.

For tax functions, amortization tables present you the way a lot you’ll pay in curiosity annually. Mortgage curiosity is tax-deductible, that means you declare it should you itemize your bills and surpass the usual deduction threshold.

Amortization additionally exhibits how a lot you’ll owe in your principal stability annually or month. The decrease your stability, the extra fairness you’ve in your house. To maintain it easy, let’s assume your private home by no means will increase in worth. Earlier than you make your first fee, you’ve $100,000 in fairness (a.ok.a. Your down fee).

Utilizing the above instance, right here’s how a lot your principal stability is at numerous time intervals:

| Month/12 months | Preliminary Down Fee | Steadiness | Fairness |

| 0 months / 0 years | $100,000 | $400,000 | $100,000 |

| 12 months / 1 12 months | $100,000 | $394,098.54 | $105,901.46 |

| 60 months / 5 years | $100,000 | $367,314.93 | $132,685.07 |

| 120 months / 10 years | $100,000 | $325,368.26 | $174,631.74 |

| 180 months / 15 years | $100,000 | $271,535.63 | $228,464.37 |

| 240 months / 20 years | $100,000 | $202,449.07 | $297,550.93 |

| 300 months / 25 years | $100,000 | $113,786.23 | $386,213.77 |

| 360 months / 30 years | $100,000 | $0 | $500,000 |

On this state of affairs, you construct extra fairness the longer you’ve the mortgage. It is because extra mortgage funds go towards your month-to-month principal stability.

APR vs. Curiosity Charge: What’s the Distinction?

Each charges are expressed as a share, however there’s a key distinction between them.

Your rate of interest refers back to the annual price of your mortgage however doesn’t replicate any charges or costs you may need to pay for the mortgage.

Your APR is a extra holistic expression of what you’re borrowing and is commonly larger than your rate of interest. It displays your rate of interest, mortgage dealer charges, any mortgage factors, and different costs you incur to get your mortgage.

What Components Affect Your Curiosity Charge?

The decrease your rate of interest, the much less your month-to-month mortgage funds will probably be—and each share level counts! To your $400,000 30-year mortgage at 5%, your month-to-month fee is $2,147. Nevertheless, in case your rate of interest is 4%, your month-to-month fee drops to $1,910. That’s a $237 distinction!

Listed here are just a few components that decide your rate of interest:

- Credit score Rating: The upper your FICO rating, the decrease your rate of interest. You’ll sometimes qualify for the very best charges in case your credit score rating is within the 700s or larger.

- Mortgage Time period: In case your mortgage is for a shorter time period, your rate of interest will doubtless be decrease. If you happen to qualify for a 30-year mortgage at 5%, the identical lender would possibly give you a 15-year mortgage at 4%.

- Location: If you happen to’re in an space the place extra householders default, your rate of interest could also be larger.

- Down Fee: In case your down fee is lower than 20%, most loans require you to pay personal mortgage insurance coverage (PMI), which is an extra 0.58% – 1.86% added curiosity.

- Present Curiosity Charges: The state of the housing market and the Federal Reserve influence house mortgage charges.

What Else is Included in Your Month-to-month Mortgage Fee?

Your principal and curiosity make up the bottom of your month-to-month mortgage fee, which gained’t improve throughout the length of your mortgage. Nevertheless, there are different charges to think about:

- Property Taxes: These taxes are what your native authorities costs you primarily based on the assessed worth of your property. The assessed worth is what a property assessor says your private home is price and isn’t the identical because the market worth. Property taxes fluctuate from state to state.

- House owner’s Insurance coverage: House owner’s insurance coverage normally covers inside and exterior harm to your private home, the loss or harm of non-public belongings, and legal responsibility protection if an accident happens in your house or in your property.

- PMI: As talked about earlier, you could pay PMI in case your down fee is lower than 20%. This insurance coverage protects your mortgage lender should you don’t pay your mortgage. It goes away when your loan-to-value (LTV) ratio drops to 78% or decrease.

- House owner’s Affiliation (HOA) Dues: If you happen to transfer right into a apartment or neighborhood with a home-owner’s affiliation, you could pay HOA charges. These fluctuate primarily based in your HOA.

Holding Monitor of Your Principal and Curiosity

To recap, your principal is the quantity you borrow from a lender when taking out a house mortgage, and your curiosity is what a lender costs you to borrow that cash. Now that you understand how they work and easy methods to use an amortization calculator to see how a lot you’re paying and when you may make a extra knowledgeable choice when shopping for a house.

FAQs

Ought to You Pay the Principal or Curiosity?

Relying on the phrases of your mortgage, you possibly can pay extra every month. The additional cash goes towards your principal stability and helps you repay your mortgage quicker.

How Else Can You Pay Your Mortgage Off Sooner?

Some corporations will allow you to make biweekly mortgage funds. As an alternative of creating 12 month-to-month funds, you’ll earn 26 biweekly funds which are equal to half your month-to-month quantity. With this technique, you’ll pay an additional month annually and may shave a number of years off your mortgage.

What Share of Fee is Principal?

This share varies primarily based in your mortgage size, quantity, and rate of interest.

Be a part of the Neighborhood

Our large group of over 2+ million members makes BiggerPockets the most important on-line group of actual property buyers, ever. Be taught about funding methods, analyze properties, and join with a group that may enable you to obtain your targets. Be a part of FREE. What are you ready for?

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]