[ad_1]

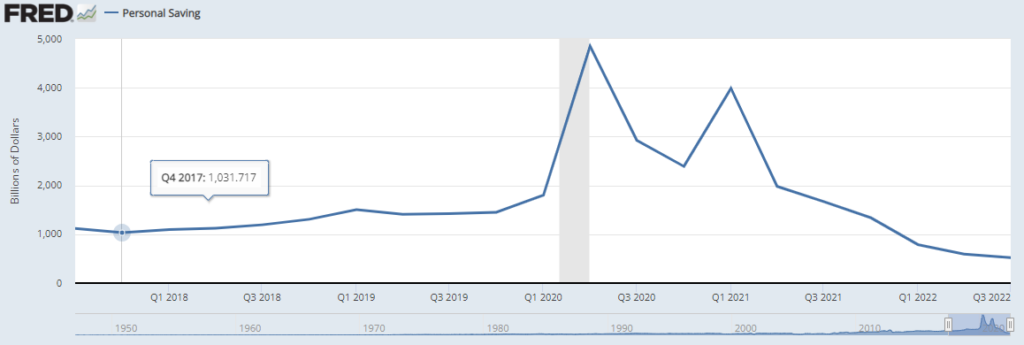

Individuals’ private financial savings have completely cratered because the center of 2020. In keeping with information from the Federal Reserve Financial institution of St. Louis, the greenback worth of our collective piggy financial institution declined from practically $5 trillion within the second quarter of 2020 to simply $626 billion within the the third quarter, or $15,990.59 per particular person. And it’s nonetheless dropping.

That is by far the largest private financial savings decline on file. It comes at a time of traditionally excessive inflation and a looming recession. It’s not good.

Even when your private monetary place is powerful, the non-public financial savings disaster impacts you. Tens of millions of individuals reside paycheck to paycheck, with no financial savings in any respect, and hundreds extra be a part of them each pay interval. When the economically weak fall on exhausting occasions, the financial system suffers, affecting folks up and down the revenue and wealth scale. So spend a couple of minutes with our private financial savings evaluation to learn the way we obtained right here and the place we is likely to be going.

What Do You Imply $15,990.59 Misplaced for Each American?!

No, each American didn’t actually lose $15,990.59. Many didn’t have 16 grand to lose within the first place.

However on common, Individuals’ further money declined by $15,990.59 per particular person between March 2021 and October 2022. It’s nonetheless falling, however that is the latest determine we now have.

We obtained these numbers from the U.S. Bureau of Financial Evaluation’ month-to-month Private Earnings and Its Disposition information set. It’s a complete measure of how a lot Individuals earn, spend, and save every month.

To calculate the per-person loss for every month, we divided the bureau’s complete private financial savings determine by the overall U.S. inhabitants (roughly 332 million). For March 2021, we obtained $17,269.61 in private financial savings per particular person. For October 2022, we obtained simply $1,279.03. The distinction: a whopping $15,990.59.

This information set isn’t the one private financial savings measure the U.S. authorities makes use of. The Federal Reserve Financial institution of St. Louis has an easier private financial savings components that calculates how a lot Individuals save every year. It reviews the annualized figures every quarter to indicate shorter-term tendencies.

The St. Louis Fed’s measure reveals private financial savings topping out at $4.85 trillion within the second quarter of 2020, when the pandemic was in full swing. Within the first quarter of 2021, coinciding with the bureau’s excessive March 2021 studying, private financial savings hit $3.99 trillion. Then the underside fell out: The third quarter 2022 studying was simply $520.6 billion. On a per-person foundation, that’s:

- Q2 2020: $14,608.43

- Q1 2021: $12,018.07

- Q3 2022: $1,568.07

So between Q1 2021 and Q3 2022, private financial savings dropped by $10,450 per American.

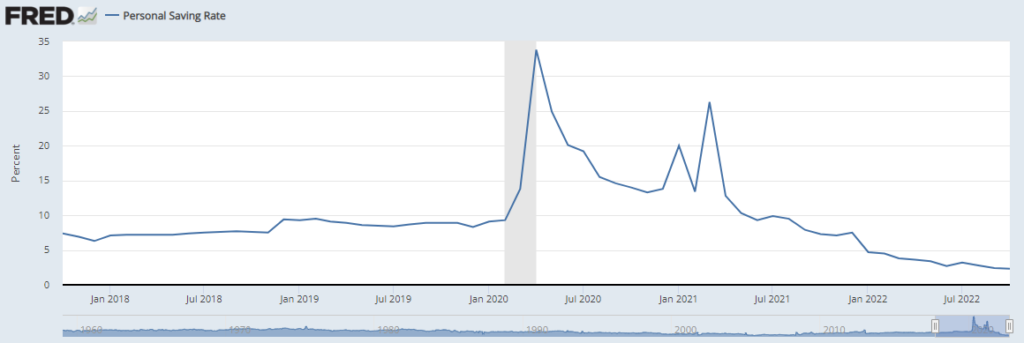

One other method to measure adjustments in private financial savings is the non-public financial savings fee, which measures the proportion of disposable revenue Individuals save on a month-to-month foundation if saved up for a full yr. The development seems to be acquainted:

We see that the non-public financial savings fee skyrocketed in early 2020 because the pandemic set in. It reached 33.8% in April 2020 earlier than falling simply as sharply, then bounced again as much as 26.3% in March 2021 as recent authorities stimulus checks arrived.

That bounce didn’t final. By June 2021, the non-public financial savings fee was underneath 10%, and it closed out 2021 at 7.5%. The October 2022 fee was 2.3%, practically matching the all-time low of two.1%. If present tendencies maintain, the U.S. private financial savings fee might make a brand new low in early 2023.

What May We Do With All That Cash?

Even going by the extra conservative St. Louis Fed determine, Individuals’ collective private financial savings declined by greater than $3.4 trillion between March 2021 and October 2022 — $3.47 trillion, to be precise.

That’s some huge cash. It’s sufficient to repay Individuals’ complete scholar debt burden ($1.75 trillion) and have $1.72 trillion left over, very practically sufficient to do it once more.

We don’t have to repay Individuals’ scholar debt twice, after all. However we might pay it off as soon as and nonetheless:

On second thought, why would we do any of that? Paying off debt is boring. Balancing budgets, much more so.

Let’s as an alternative purchase each American — outdated of us and newborns alike — a McDonald’s Massive Mac meal at $5.99 a pop. Then let’s purchase them every 863 extra.

Possibly Burger King can get in on the motion in the event that they ask properly. We’ll see.

Why Did Private Financial savings Spike in 2020 and 2021?

Again to actuality.

The non-public financial savings fee jumped nearly in a single day within the first quarter of 2020 because the COVID-19 pandemic took maintain and enormous swathes of the worldwide financial system shut down. These are the three main components that drove the eye-watering improve.

Widespread Fears of an Financial Despair

Dealing with an unprecedented public well being emergency of unclear length, policymakers world wide had motive to worry that the COVID-19 pandemic would gravely harm the worldwide financial system and arrange a rerun of the Nice Despair (or worse). So did common of us questioning what the pandemic would imply for his or her private funds.

For most individuals, even those that saved their jobs by these darkish early days, the pure response was to dramatically scale back discretionary spending. Coupled with large job losses in industries depending on in-person exercise — the unemployment fee spiked above 14% in April 2020 — client spending cratered. A lot of that cash ended up in financial savings accounts, at the very least briefly.

Widespread Enterprise Closures in Key Industries

Most journey and hospitality companies went on hiatus or severely curtailed operations when the pandemic hit. Retail was additionally hard-hit.

Individuals nonetheless ordered takeout and purchased stuff on-line, however they weren’t getting on planes or staying in motels or consuming fancy meals in eating places. Even when they weren’t inclined to chop again spending amid all of the uncertainty, their budgets for enjoyable had been a lot smaller by necessity. Many selected to save lots of the excess.

A number of Rounds of Authorities Stimulus

The worst-case state of affairs predictions concerning the international financial system didn’t come to go — largely as a consequence of large, coordinated stimulus by governments world wide.

Right here in the US, the primary of three stimulus checks arrived in April 2020, showering most taxpayers with $1,200 in tax-free money. Individuals who weren’t dwelling paycheck to paycheck might afford to sock this cost away, and lots of did. A $600 verify adopted in late 2020, adopted by a $1,400 cost in early 2021. That final cost coincided with an enormous soar in private financial savings in March 2021, to $17,269.61 per particular person within the extra complete Bureau of Financial Evaluation measure.

Companies obtained in on the motion too because of the Paycheck Safety Program, which unloaded tons of of billions of {dollars}. These funds helped enterprise house owners hold the lights on (and pay staff) throughout the pandemic, however recipients weren’t required to spend all of the money on payroll or hire, a lot of it ended up within the financial institution.

Why Did Private Financial savings Collapse in 2022?

The non-public financial savings fee dropped considerably later in 2020 however remained elevated by historic requirements. It jumped once more within the first quarter of 2021, then started a protracted decline that accelerated in 2022.

A number of components had been chargeable for the drop.

No Extra Pandemic Stimulus

The final stimulus cost went out the door in March 2021. The final PPP spherical closed two months later. Prolonged unemployment advantages, eviction moratoria, state and native assist — all however the scholar mortgage cost pause have lengthy since ended.

Meaning there’s much less cash sloshing across the system. Individuals must depend on the revenue sources that sustained them earlier than the pandemic, reminiscent of wages, enterprise revenue, retirement revenue, and authorities advantages.

Increased Costs & Falling Actual Incomes

Cash doesn’t go as far with inflation at 40-year highs. Costs rose 8% in comparison with the identical interval final yr for a lot of 2022, 4 occasions sooner than the Federal Reserve’s 2% inflation goal. Wages rose at a brisk tempo too, however not rapidly sufficient to maintain up — that means actual incomes fell after accounting for worth hikes.

That’s placing the squeeze on lower- and middle-class shoppers and a few larger earners too. They’re pressured to dip into their financial savings to make ends meet or on the very least spend extra of what they earn on requirements like housing, meals, and utilities.

Slower Financial Progress

Financial savings charges typically improve in periods of slower financial progress. We noticed this throughout the Nice Recession and for years after, when households slowly unwound the debt they’d accrued throughout the housing growth and put away cash for the following wet day.

The present slowdown isn’t typical, although. It’s extra just like the persistent stagflation of the Seventies, a decade marred by excessive inflation and underwhelming financial progress. Till inflation returns to one thing approaching regular, as we speak’s slower-growth atmosphere finds households spending extra of what they earn and even dipping into their present financial savings to make ends meet.

Households can solely spend greater than they earn for therefore lengthy. Finally, their financial savings deplete and so they’re confronted with a selection: reduce spending or go into debt.

Both state of affairs is unhealthy for the financial system. Slowing client demand helped tip the U.S. into the early-2000s recession, and extreme family debt foretold the Nice Recession. As a result of the Federal Reserve appears set on elevating rates of interest till client spending buckles, my cash is on a demand-induced recession in 2023 relatively than a debt-induced one.

If and when that occurs, we’ll see households financial institution extra of the money they might have spent on issues and experiences. The financial savings fee will cease falling after which start to extend. Absent some unknowable future shock of an analogous scale, it received’t once more attain the heights of the early COVID-19 pandemic, however I’d guess on a sluggish, regular return to the 5% to 7% vary by 2026.

Since January 2022, Curiosity Charges Have Skyrocketed

One motive I’m assured 2022’s super-low financial savings fee isn’t a brand new regular is that client rates of interest are larger than they’ve been in a few years. Certificates of deposit charges haven’t been this excessive in 15 years, and high-yield financial savings accounts are lastly dwelling as much as their promise. In case you have money to save lots of, it’s a unbelievable time to take action.

We have now the Federal Reserve to thank for this saver-friendly flip of occasions. The Fed has relentlessly hiked the federal funds fee since early 2022, elevating this key benchmark from close to zero to 4.25%. That’s the quickest tempo because the early Nineteen Eighties and the largest share soar in historical past.

The Fed’s said aim is to get inflation underneath management by lowering demand for items and providers, however its marketing campaign has the aspect impact of forcing banks to pay extra for client deposits. And with private financial savings at near-historic lows, banks must compete fiercely for the comparatively few {dollars} obtainable, including to the upward strain on prevailing financial savings charges.

Now Is the Time to Save

In case you have spare money — or can elevate it by trimming spending or boosting your revenue — now is a superb time to extend your private financial savings fee.

Curiosity Charges Are Already Increased Than They’ve Been in Years

The federal funds fee now tops 4%, larger than it has been because the Nice Recession. That’s pushing up checking account yields. Essentially the most beneficiant high-yield financial savings accounts now pay 4% curiosity or higher, and longer-term CDs have even larger yields.

These yields don’t but beat inflation, however they’re getting shut. And with the speed of worth will increase anticipated to fall in 2023, they’ll seemingly get extra engaging over time even when rates of interest don’t rise additional.

Curiosity Charges Will Go Increased & Stay Elevated By 2023

Rates of interest will most likely rise additional. The Federal Reserve is predicted to hike the federal funds fee by at the very least 0.25% in early February 2023. Fed watchers anticipate one other 0.25% hike in March 2023.

After that, all bets are off. The most definitely final result is a several-month pause throughout which the Fed leaves rates of interest the place they’re, which at that time can be between 4.75% and 5%. They’ll use this era to assemble extra information on inflation, employment, and different measures of financial well being. If and when it seems to be like we’re headed for (or already in) a recession, the Fed might start decreasing rates of interest.

However that most likely received’t occur till the second half of 2023, if not later. Till then, banks will elevate deposit account yields in response to the Fed’s anticipated will increase, then maintain them regular till the Fed acts once more. By Could or June 2023, the most effective high-yield financial savings accounts might yield 4.5% or higher, and probably the most beneficiant 12-month CDs might pay 5%.

So you continue to have time to construct and profit from an enormous financial savings cushion. Financial savings yields aren’t heading again towards 0% anytime quickly.

The Inventory Market May Underwhelm within the Coming Years

Traditionally, the broad-market S&P 500 inventory index — which comprises the five hundred largest public U.S. corporations and is an efficient proxy for the inventory market as a complete — returns 8% to 10% per yr, relying on the place you begin and the way you calculate returns. However that’s a multidecade common that features loads of lengthy bear markets, or durations of flat or declining returns.

It has been some time since we’ve seen a correct bear market. The S&P 500 bottomed out at 676 on March 9, 2009, then went on a largely uninterrupted tear for the following 12 years. In January 2022, it touched an all-time excessive round 4,800, greater than seven occasions its Nice Recession low. Different main indices adopted swimsuit.

The S&P 500 misplaced greater than 20% of its worth in 2022 and now trades beneath 4,000. That’s nonetheless effectively above its prepandemic ranges, and whereas most buyers don’t anticipate a full retreat, even fewer anticipate a brand new all-time excessive anytime quickly. As in, anytime within the subsequent few years.

In different phrases, the inventory market most likely received’t do as effectively within the coming 10 years because it did within the earlier 10.

This doesn’t imply the world will finish — though it might — or that the inventory market will really underperform financial savings accounts over the following decade. (It would most likely outperform financial savings accounts, albeit with better volatility.) But it surely does imply that you just’d be clever to hedge your bets and hold extra of what’s yours in FDIC-insured financial savings accounts and CDs, particularly should you’re risk-averse by nature or nearing retirement.

Last Phrase

Individuals collectively constructed up an historic private financial savings reserve throughout the COVID-19 pandemic. Two years later, most of it was gone.

That’s sobering to consider, even scary. The speedy financial savings drawdown occurred amid sky-high inflation, falling actual incomes, and an more and more unsure international financial outlook. Regardless of tentative indicators that inflation has peaked and actual incomes are stabilizing, the financial outlook stays bleak, and there’s no assure issues received’t worsen earlier than they get higher.

Then once more, there’s a glass-half-full case to be made right here. The pandemic was (hopefully) a once-in-a-lifetime shock that led to unprecedented stimulus and an unprecedented pullback in spending, which prompted folks to save lots of at unprecedented charges. When the stimulus dried up and the financial system opened again up, folks and companies spent at larger charges than earlier than, laying the groundwork for worth will increase that might drive of us to spend down their financial savings — main us right here. A quick recession would possibly ensue, however then spending and saving charges ought to normalize, and we’ll resume our prepandemic trajectory.

Will that rosy state of affairs pan out? It’s too early to inform. What’s clear proper now’s that it’s an excellent time to be a saver. Just about every thing else remains to be up within the air.

[ad_2]