[ad_1]

The previous few months have seen economists and regulators fear in regards to the influence of continued wage development on inflation and employer outlook. After important fee hikes from the Fed, indicators are starting to slowly revert.

Our knowledge from the US and Canada displays a brand new yr ebb in financial exercise at small companies.

Previous variations of this report have mentioned continued concern over the tempo of wage development and low jobless claims main the Fed to take care of its robust strategy to fee hikes. As alerts of an financial system working scorching start to abate, Homebase seeks to know how the broader financial surroundings is affecting small companies and their workers in the course of the begin of 2023 by analyzing behavioral knowledge from greater than two million workers working at multiple hundred thousand SMBs.

Abstract of findings: Homebase high-frequency timesheet knowledge point out continued slowdown in hours labored and workers working, throughout most industries and main metro areas

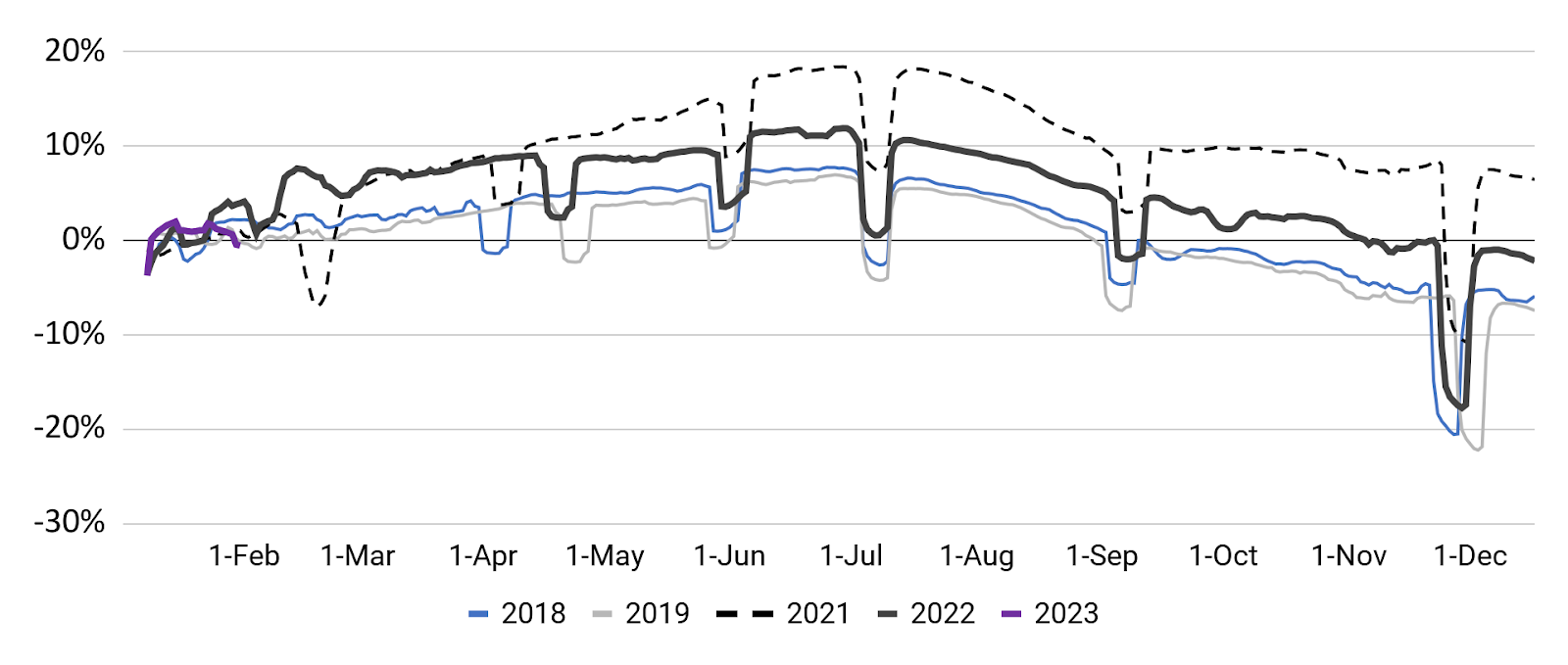

- January has seen a gradual begin with a unbroken downward trajectory; whereas 2022 noticed development in hours labored by way of Q1, 2023 ranges for workers working and hours labored are 4-5 proportion factors under their January 2022 marks.

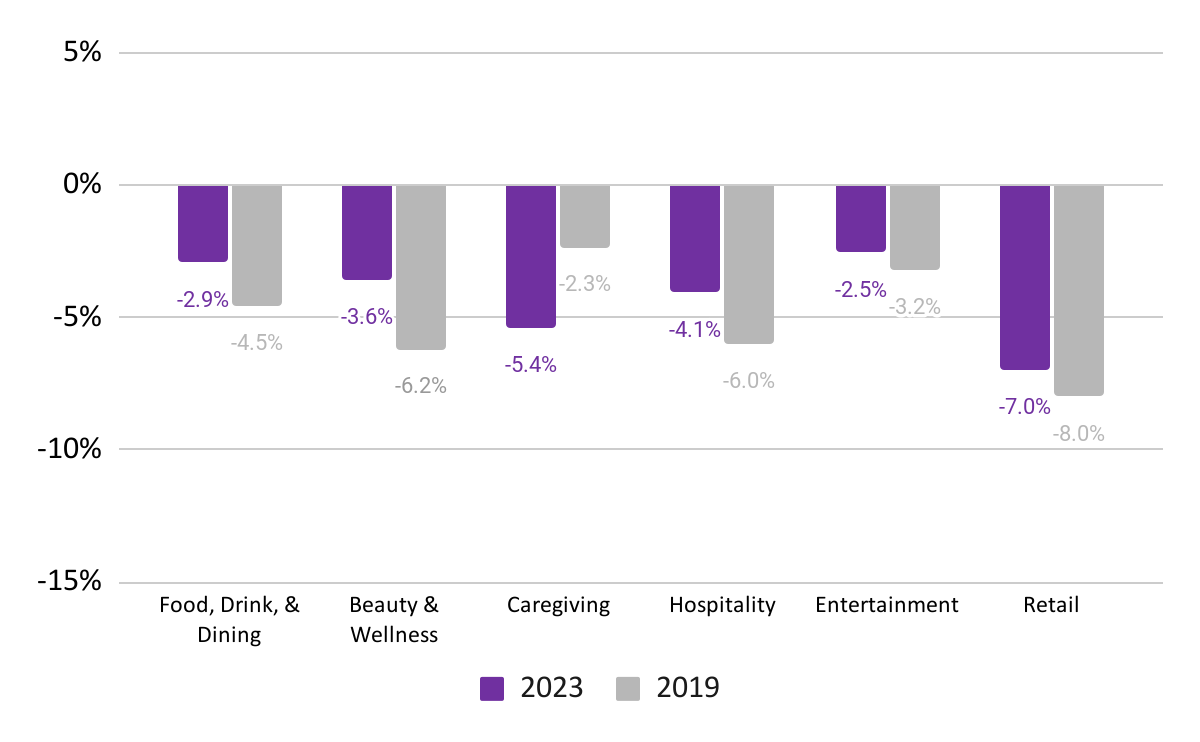

- Put up-holiday declines throughout industries are softer than what we noticed pre-COVID apart from caregiving; workforce participation in leisure has rebounded probably the most considerably from vacation lows, solely 2.3% under mid-December ranges.

- Hours labored throughout metro areas stay barely under their pre-holiday ranges, a development much like prior years; nevertheless, January 2023 ranges have remained comparatively fixed by way of the month, relatively than rising as they did in 2021 and 2022.

January has seen a gradual begin with a unbroken downward trajectory; whereas 2022 noticed development in hours labored by way of Q1, 2023 ranges for workers working and hours labored are 4-5 proportion factors under their January 2022 marks.

Workers working

(Rolling 7-day common; relative to Jan. of reported yr)

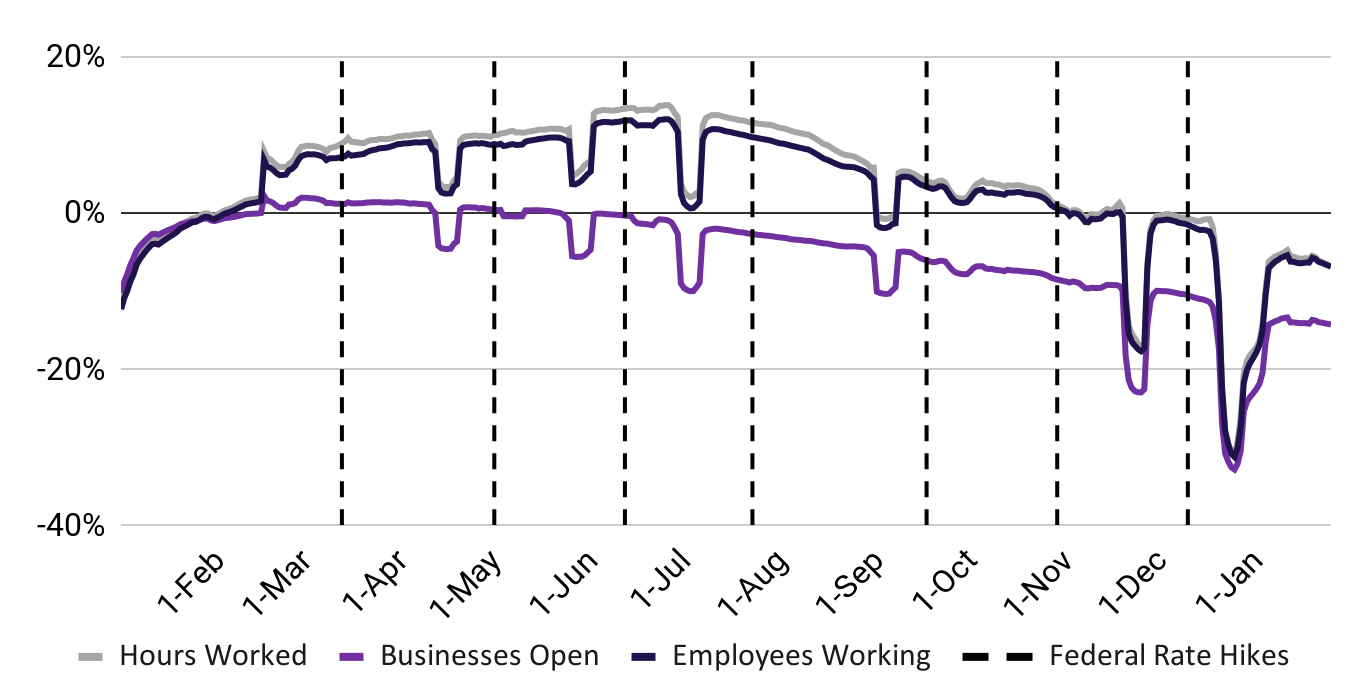

Primary Avenue Well being Metrics1

(Rolling 7-day common; relative to Jan. 2022)

1. Some important dips as a result of main U.S. holidays. Pronounced dip in mid-February 2021 coincides with the interval together with the Texas energy disaster and extreme climate within the Midwest. Dip in late September coincides with Hurricane Ian. Supply: Homebase knowledge.

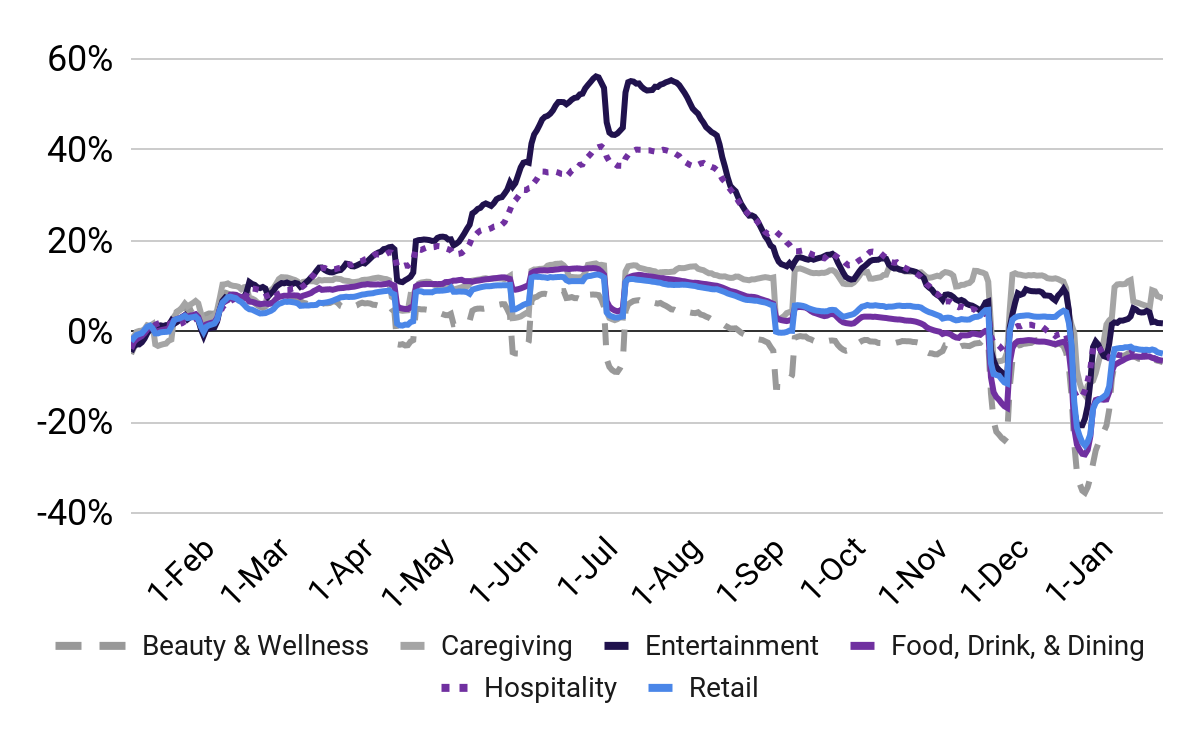

Put up-holiday declines throughout industries are softer than what we noticed pre-COVID apart from caregiving; workforce participation in leisure has rebounded probably the most considerably from vacation lows, solely 2.3% under mid-December ranges.

P.c change in workers working

(In comparison with January 2022 baseline utilizing 7-day rolling common)1

P.c change in workers working

(Mid-January vs. mid-December of prior yr, utilizing Jan. ‘22 and Jan. ‘19 baselines)1

1. January 15-21 vs. December 11-17 (2022/2023) and January 12-18 vs. December 8-14 (2019/2020). Pronounced dips typically coincide with main US Holidays. Supply: Homebase knowledge

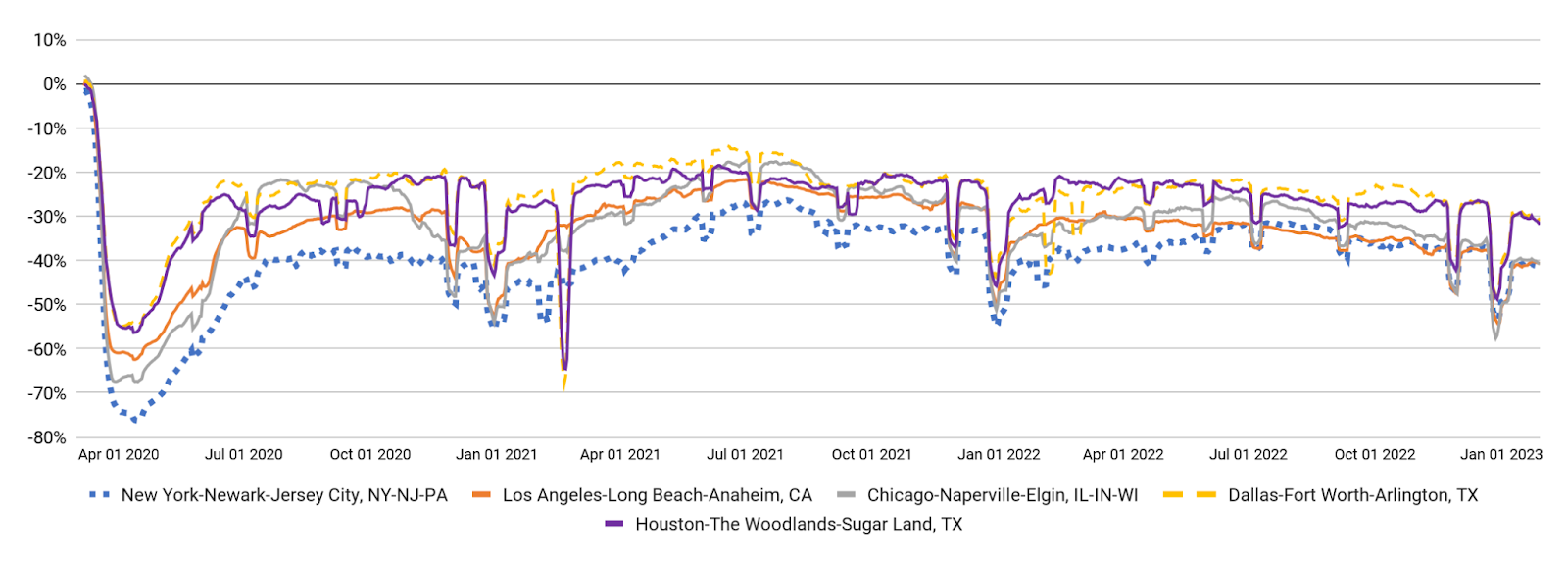

Hours labored throughout metro areas stay barely under their pre-holiday ranges, a development much like prior years; nevertheless, January 2023 ranges have remained comparatively fixed by way of the month, relatively than rising as they did in 2021 and 2022.

Hours labored

(Rolling 7-day common; relative to Jan. 2020 (pre-Covid))

1. Some important dips as a result of main U.S. holidays. Pronounced dip in mid-February 2021 coincides with the interval together with the Texas energy disaster and extreme climate within the Midwest. Supply: Homebase knowledge.

For a PDF of our January report, please go to this PDF; when you select to make use of this knowledge for analysis or reporting functions, please cite Homebase.

Hyperlink to PDF of: January 2023 Homebase Primary Avenue Well being Report

[ad_2]