[ad_1]

Enterprise threat is something that threatens the continued success of your follow, and it might assume many varieties. Sadly, many enterprise homeowners overlook the potential dangers that may derail a long-standing enterprise. By understanding and addressing the potential dangers forward, you’ll be higher positioned to guard what you are promoting—and your shoppers.

To get you began, listed below are eight strategic dangers to concentrate on in your monetary advisory follow.

Threat 1: Competitors

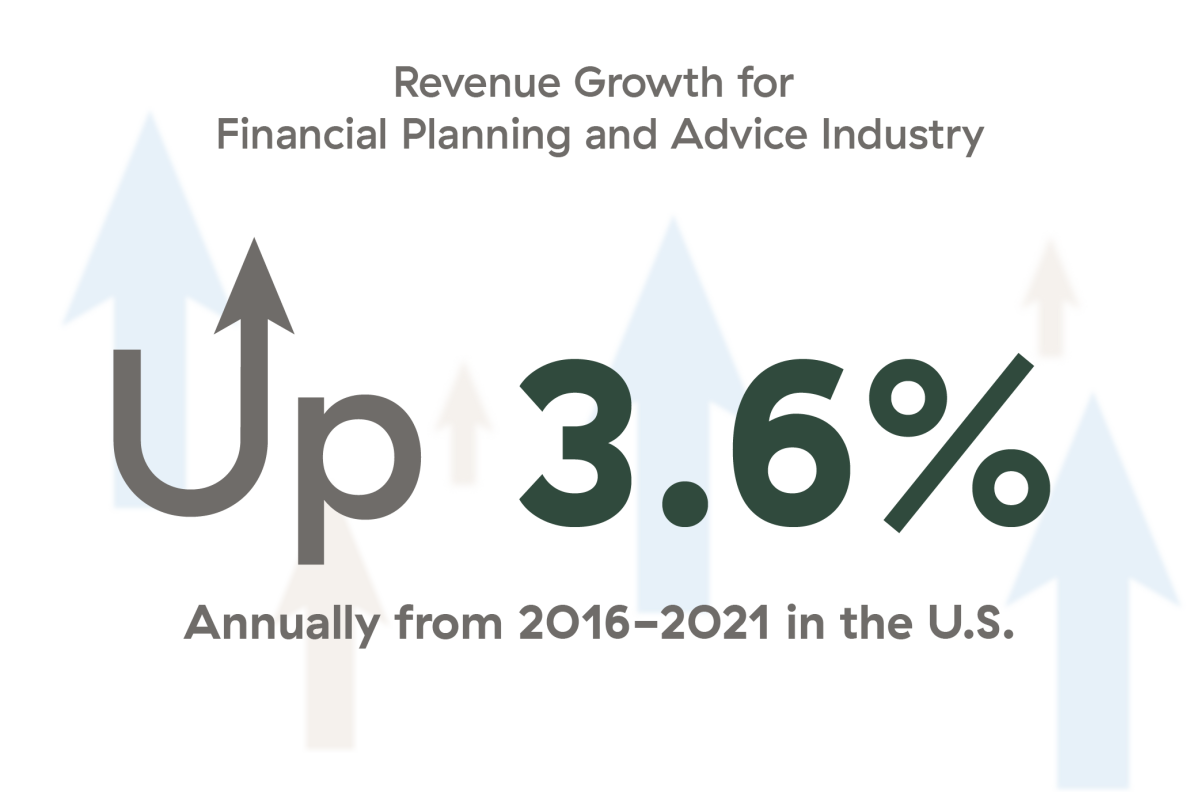

The competitors current within the monetary planning and recommendation trade is consistently rising and altering. In keeping with the market analysis agency IBISWorld, Ameriprise Monetary, Raymond James Monetary, and Graystone Consulting maintain the biggest market share, and income throughout the U.S. monetary planning and recommendation trade confirmed regular development from 2016 to 2021:

The competitors with robo-advisors is ongoing, with firms resembling Wealthfront, Betterment, and Acorns offering state-of-the-art cell functions and progressive investing methodologies.

Altering consumer demographics are calling for high-tech, high-touch providers for the rising prosperous market. If you wish to rating new, best shoppers, contemplate exploring methods to succeed in out to millennials. And be ready to make clear the aggressive worth you present in areas resembling service, trustworthiness, and high quality relationships.

Threat 2: Income Progress Stress

Good development will allow you to reinvest in additional consumer providers—a plus on this aggressive market. Given payment compression and elevated competitors for consumer {dollars}, discovering methods to develop is much more essential. Just a few choices for driving your agency’s development are:

As a phrase to the smart, contemplate that development is nice and crucial for a thriving enterprise, however rising inefficiently will solely dilute the excessive degree of service and worth you carry to shoppers.

Threat 3: Specialization Calls for

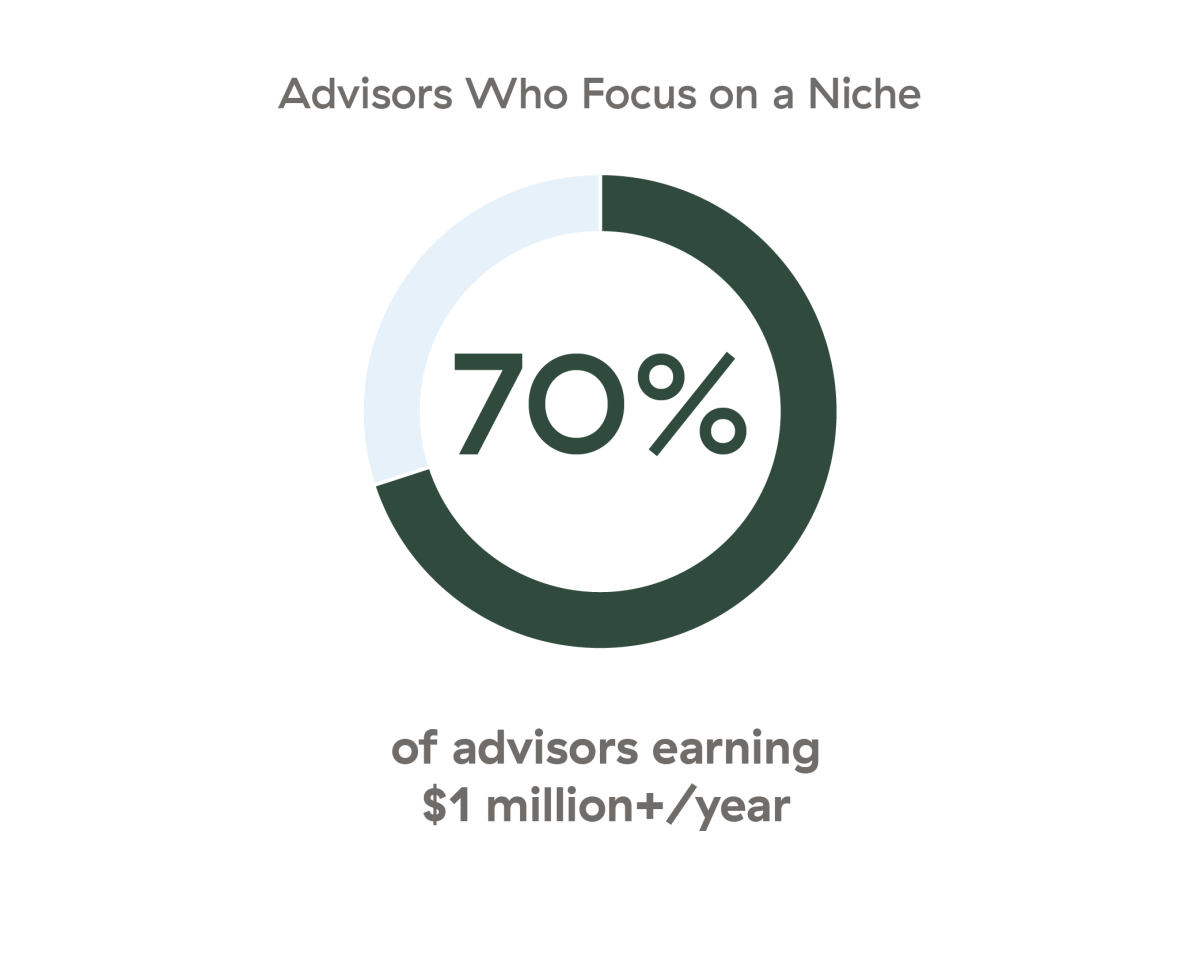

Creating your providers round a distinct segment can assist with attracting best shoppers. Deciding on an space you have an interest in, have expertise in, or have a ardour for will assist gas your success. The truth is, information collected by CEG Worldwide means that discovering a distinct segment focus might be a fantastic subsequent transfer to develop your agency:

Threat 4: Advances in Know-how

It’s nicely documented that millennials favor monetary recommendation supported by expertise. A 2021 survey carried out by Roubini ThoughtLab uncovered the next information:

In gentle of those statistics, contemplate assembly nearly with youthful shoppers, or use Twitter or LinkedIn to succeed in out to this group—simply as they’re utilizing social media to be taught extra about you.

Due to the Covid-19 pandemic, expertise has allowed us to proceed working seamlessly from anyplace. Whereas this can be a blessing, it poses an extra threat we beforehand hadn’t thought-about. Your shoppers are comfy and will really feel that Zoom conferences at the moment are the ‘’norm,’’ so there will not be a robust want to satisfy in particular person or to have an advisor with a neighborhood presence.

The flexibility to obviously articulate the worth you ship to shoppers is extra essential than ever. To remain aggressive, contemplate the next actions:

Verify your search outcomes. Google your self and your agency to see what the search returns. If crucial, improve your web site to precisely mirror each your skilled and private identities. This shift may allow you to stand out from the opposite wealth managers and monetary advisors selling themselves on-line.

Spend money on new expertise. Know-how has additionally affected buying and selling instruments and automation by facilitating well timed trades and the supply of refined funding methods in addition to creating extra safeguards in opposition to market downturns. Your skill to make use of these instruments could be the decisive, strategic edge to draw shoppers. Plus, investing in expertise can create efficiencies, drive profitability, and allow you to proceed to thrive.

Threat 5: Human Capital Administration

Even with the rise of robo-advisors, don’t underestimate the human contact. Your market data and monetary planning and decision-making expertise ought to all the time provide you with an edge over robo-advisors. However you’ll must do your half in serving to shoppers acknowledge your worth by using the best-of-the-best people to work with them.

A human sources supervisor can assist guarantee good hires. If good hiring practices will not be used, your advisory enterprise may face a variety of human capital dangers, resembling:

-

Failure to draw staff

-

The hiring of the fallacious particular person

-

Unsatisfactory efficiency

-

Turnover

-

Absenteeism

-

Accident/damage

-

Fraud

-

Authorized/compliance points

Any of those dangers may interrupt what you are promoting, and two or three on the similar time may critically disrupt it.

Threat 6: Elevated Regulation

You’re nicely conscious that the SEC regulates monetary companies. But, debacles just like the Enron and Wells Fargo scandals, Bernie Madoff, and the 2008 monetary disaster occurred—and we will count on related occasions to proceed to occur. Most advisors count on extra, not fewer, laws sooner or later.

Within the present atmosphere, elevated laws require cautious planning and allocation of sources to make sure that compliance doesn’t derail the profitability of your agency. To maintain abreast of trade adjustments, evaluate FINRA’s report on its examination and threat monitoring priorities for 2022.

Threat 7: Scale and Capability

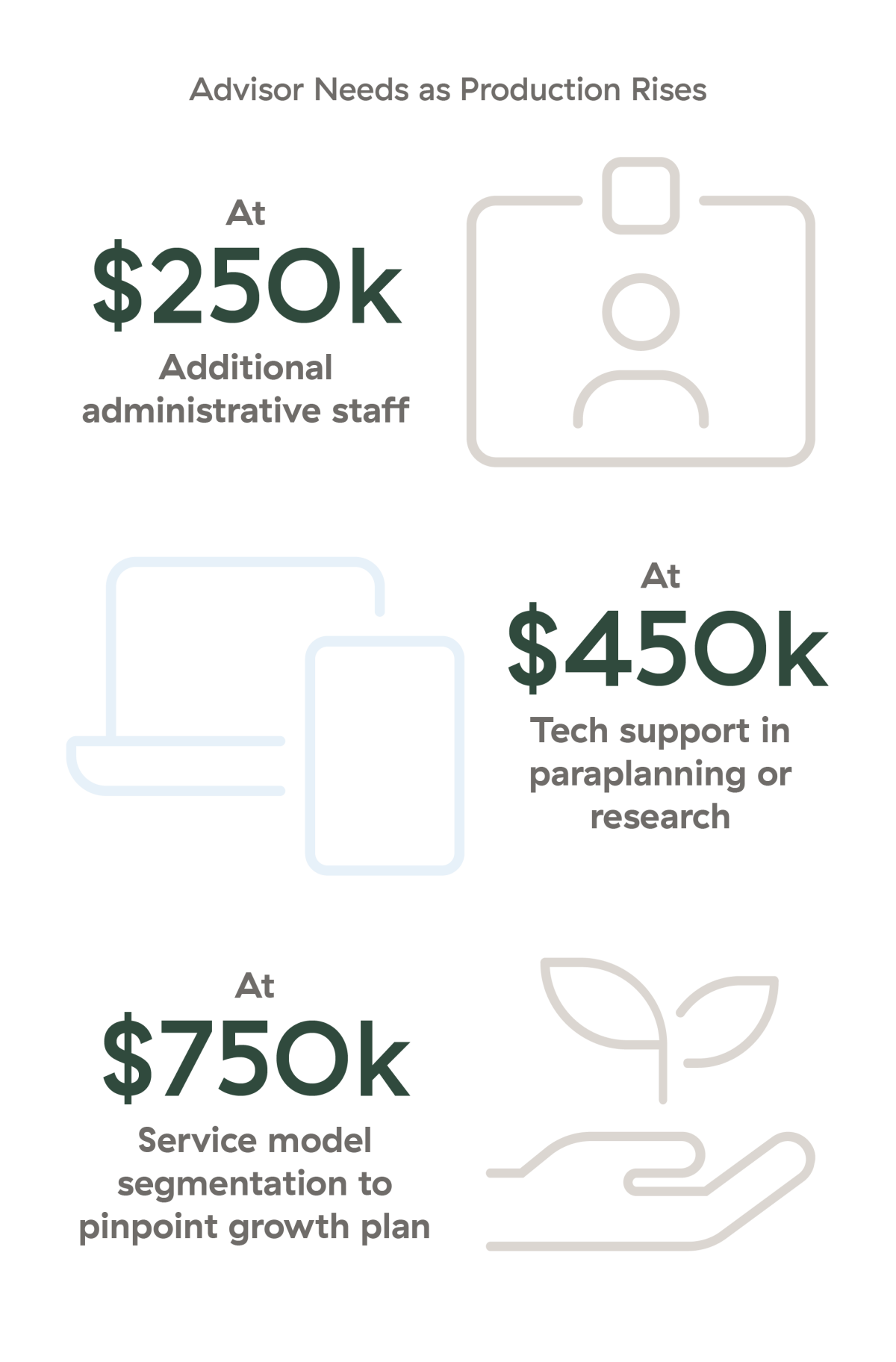

Right here at Commonwealth, our Apply Administration group has noticed that advisors are inclined to expertise “ache factors” at predictable intervals:

How are you going to cope with inflection factors resembling these? Begin by creating repeatable workplace procedures, in addition to understanding income distribution amongst shoppers, profitability by consumer, and optimum service fashions. When you have workers, work with them to assist with these duties—they usually know the workplace procedures and workflows intimately and will have concepts to enhance them.

Threat 8: Advisor Safety

Relating to defending your self, contemplate an outdated insurance coverage gross sales query: “Should you had a cash machine in your basement that pumped out $600,000 a yr, would you insure it?” After all, the punch line is that you are the cash machine. Are you defending your self in opposition to the losses that would derail your cash machine? Vital loss threats embrace advisor demise or incapacity, key particular person loss, an sudden catastrophe (pure or in any other case), lawsuits, and failure to plan for enterprise succession.

Greatest practices embrace insurance coverage and continuity plans to guard these belongings you can not afford to lose. So, make sure to carry out annual evaluations to replace these plans in response to altering market circumstances.

Addressing the Chance of Threat at Your Agency

Now that we’ve lined some widespread enterprise dangers, take these subsequent three steps:

-

Draw a threat matrix with 4 quadrants.

-

Label the row headers with the implications of threat and the column headers with threat chance.

-

Brainstorm the dangers you understand in your agency and categorize them.

Lastly, use the next methods to handle each threat in your quadrant matrix:

6 Methods to Construct a Higher Enterprise Plan

-

Develop a imaginative and prescient. The place do you wish to be in three years? What would you want to perform?

-

Assess your agency utilizing SWOT (strengths, weaknesses, alternatives, and threats) evaluation. The aim is to know your agency’s strengths and weaknesses on the within and alternatives and threats on the skin.

-

Create strategic directives. What actions can you’re taking to attain your agency’s imaginative and prescient whereas maintaining threat discount in thoughts?

-

Outline significant annual objectives. Use SMART objectives—strategic, measurable, achievable, real looking, and time-bound.

-

Implement a plan of motion. Checklist duties and timelines to attain your objectives. A smart particular person as soon as mentioned, “In some unspecified time in the future, all the pieces degenerates to work.”

-

Evaluate yearly. By constructing time to trace objectives, you’ll be capable to modify your plan accordingly.

[ad_2]