[ad_1]

Extra importantly, long-run tendencies present little good points for median balances.

It’s at all times attention-grabbing to take a look at Vanguard’s most up-to-date version of “How America Saves.” And it’s notably attention-grabbing to get the numbers for 2022 – not a great 12 months for the inventory market. Certainly, the information isn’t good for 2022. Extra importantly, the longer-run tendencies – regardless of an incredible enlargement in auto-enrollment – usually are not very encouraging both.

Vanguard stories a considerable decline between 2021 and 2022 in each median and imply 401(okay) balances. The large distinction between the median and the common is because of a small variety of accounts which have actually massive balances. Common balances are extra typical of long-tenured, extra prosperous members, whereas the median stability represents the standard participant. Imply balances dropped from $141,500 to $112,600, and median balances from $35,300 to $27,400 – declines of 20 % and 23 %, respectively, from 2021. Vanguard attributes the decline primarily to a unfavourable return on plan property in 2022 of -15.8 %, plus a altering mixture of members.

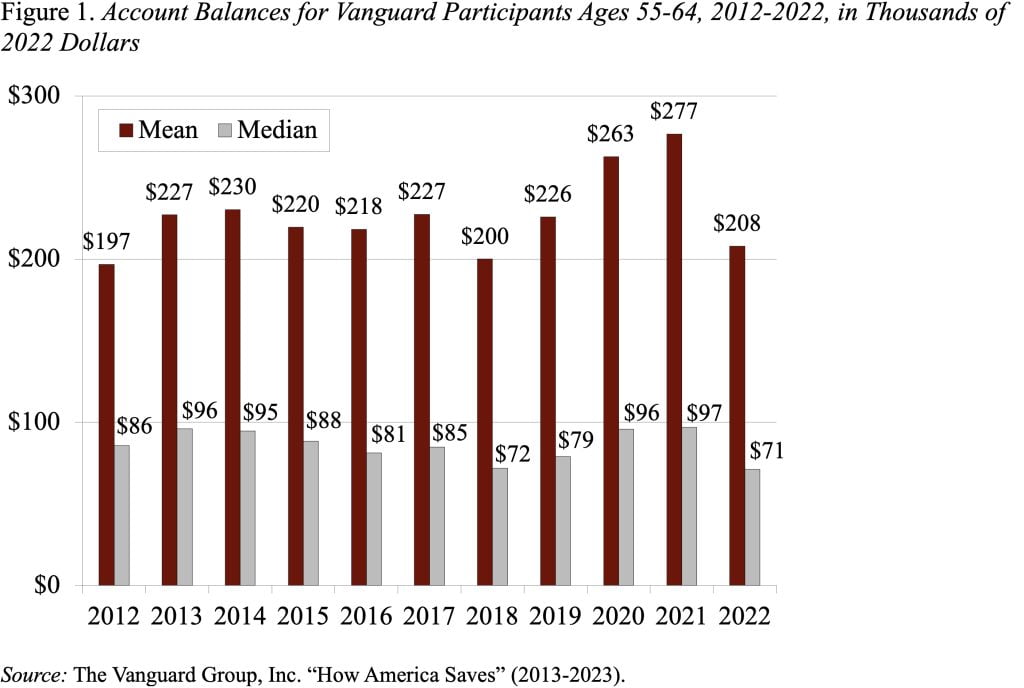

However low balances usually are not only a short-run drawback. Balances typically are puny. Contemplate the holdings of these approaching retirement – ages 55-64. As one would anticipate, these balances are a lot bigger than these for the complete participant inhabitants. However nonetheless the median is $71,000, which signifies that half of members have lower than this quantity and half extra (see Determine 1). Furthermore, Vanguard tends to manage bigger plans, so the plans are higher designed than common and members have increased incomes. In different phrases, it presents the perfect face of the 401(okay) system.

After all, these particular person 401(okay) balances don’t inform the entire story about retirement saving. First, when members change jobs, their 401(okay) accounts could stay with their outdated employer, so people could have multiple 401(okay) account. Second, 401(okay) balances could also be rolled over to an IRA, and monetary providers corporations can not monitor mixed 401(okay)/IRA holdings. Third, by necessity, balances are offered on a person, slightly than a family, foundation. For all these causes, we’re trying ahead to information from the Federal Reserve’s 2022 Survey of Shopper Funds, which shall be launched within the fall.

However assume that the median 401(okay)/IRA holdings for households approaching retirement become twice the Vanguard quantity for particular person members – a ratio in step with earlier years. That might imply {that a} family 55-64 with a 401(okay) would have complete 401(okay)/IRA balances of $142,000.

If a pair makes use of its $142,000 to purchase a joint-and-survivor annuity, they’ll obtain – even with right this moment’s excessive rates of interest – about $745 monthly. Since this quantity shouldn’t be listed for inflation, its buying energy will decline over time. Furthermore, this $745 is prone to be the one supply of retirement earnings to complement Social Safety, as a result of the standard family holds nearly no monetary property exterior of its 401(okay).

Furthermore, households with a 401(okay) plan are the fortunate ones. Solely about half of households within the center third of the earnings distribution have such a plan.

The underside line is that our personal sector retirement system works nicely for the highest third of households, gives a little bit for the center third, and affords nearly nothing for the underside third. We should always be capable of do higher than that.

[ad_2]