[ad_1]

The virtues of worth investing have been re-established in 2022 as development shares have been mauled by the bear market taking over rather more ache than the common S&P 500 (SPY) inventory. Sadly, that shift in technique exposes 3 deadly flaws that may additionally hamper funding outcomes. This text will share a confirmed technique that solves these 3 points resulting in vastly superior efficiency. Learn on beneath for extra….

Some folks have been beginning to consider that worth investing was useless.

Sure, that sounds excessive. Nevertheless, for the majority of the final a number of years the trail to inventory market success was paved with shopping for development corporations irrespective of how a lot momentum…irrespective of how excessive their nostril bleed PE.

I’m referring to each scorching development from Electrical Automobiles to Hashish to 3D Printers to Metaverse to (fill within the clean).

This development solely funding blueprint appeared to negate the advantage of traditional worth rules pioneered by Benjamin Graham (and his most well-known pupil Warren Buffett) as these “in favor” investments have gravity defying multiples.

Then got here alongside the bear market of 2022 the place development shares have been mauled to demise (that could be a truthful description if you see the larger than 60% losses levied on the expansion inventory poster youngster Cathie Wooden’s ARK Innovation ETF).

On the similar time worth inventory methods confirmed their advantage. Together with our proprietary technique that truly gained 9% on the yr. Extra on that later.

The rise of worth methods in 2022 led many buyers to flock again to this essentially sound investing method.

Sadly, newcomers usually tend to fall sufferer to three deadly flaws:

- Worth Traps (the place shares head decrease and decrease)

- Traditional Worth Metrics Don’t Work Anymore

- Lack of Timeliness Deadens ROI

So, what’s the answer?

Please give me only a few minutes of your time so I can spell it out for you. It will put you in the absolute best place to outperform in 2023.

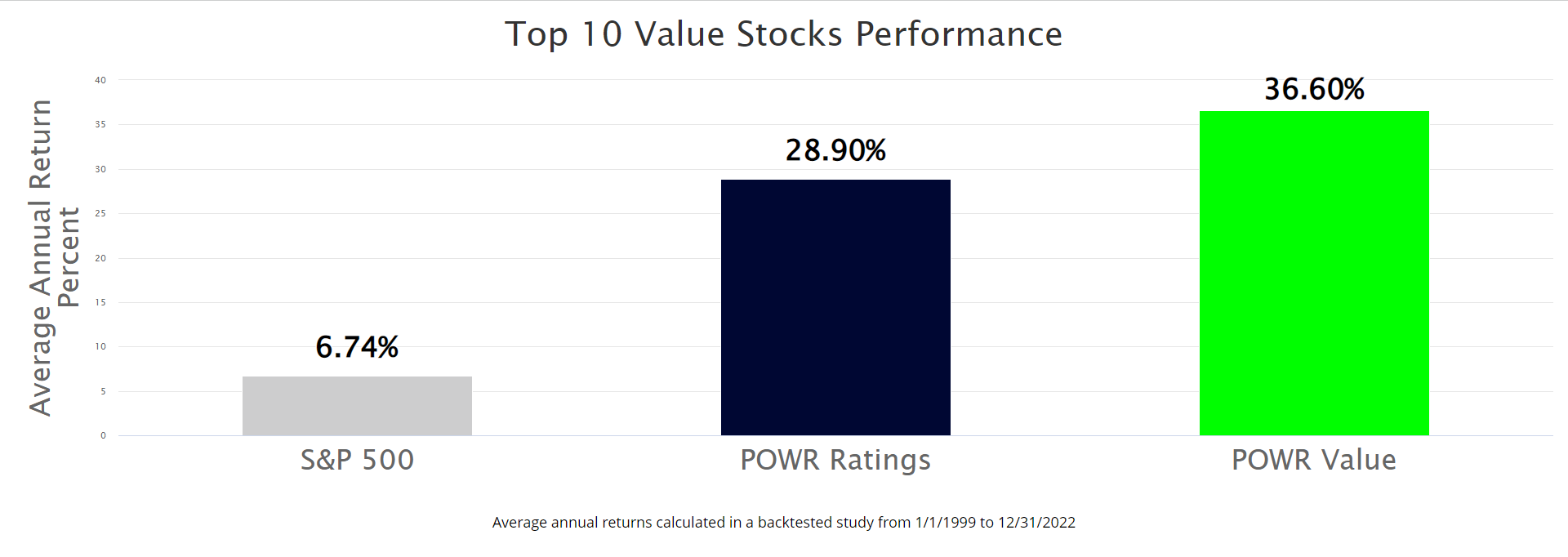

This consists of sharing particulars on our coveted Prime 10 Worth Shares technique that has scored a mean +36.60% achieve since 1999 (5.4x higher than the S&P 500 over that stretch).

Let me first inform you extra about this pc generated mannequin. Then we’ll focus on the way it solves all 3 of the deadly flaws of worth investing.

That journey begins with a quick dialogue of our quant rating system; the POWR Rankings.

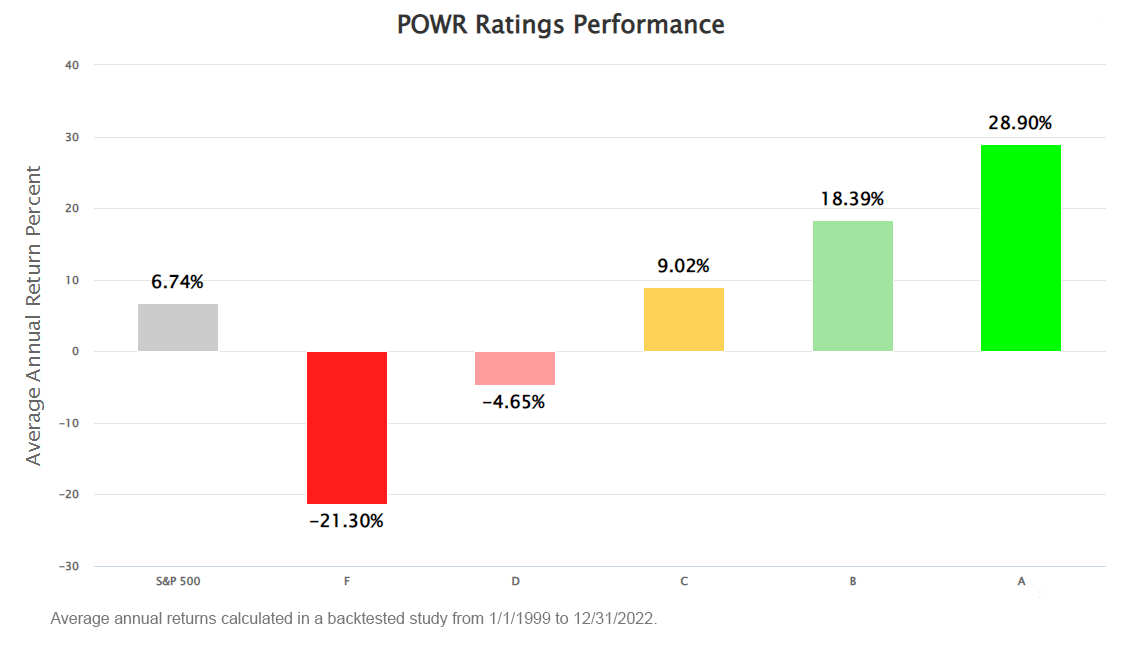

In case you have spent any time on StockNews.com you could have definitely seen data on our unique POWR Rankings system. Certainly, these scores actually do assist buyers achieve a determined benefit over the market, as can clearly be seen within the efficiency chart beneath.

The place Does the Outperformance Come From?

The POWR Rankings mannequin is essentially the most full evaluation of a inventory accessible to particular person buyers at present. All in all, we take a look at 118 various factors of a inventory earlier than assigning an A to F ranking.

Which 118 components?

The straightforward reply is ONLY those that result in extra worthwhile inventory choice. Really this is sort of a DNA test of every inventory getting right down to the molecular degree to understand the shares constructed to outperform.

As soon as that evaluation of the general POWR Ranking is completed, we then break down these 118 components into 6 further grades to understand the advantage of a inventory on the next dimensions:

- Worth

- Progress

- Momentum

- Stability

- High quality

- Sentiment

For these fast on the draw, you in all probability simply discovered that if you happen to mix a robust general POWR Ranking with a wholesome Worth rating, that you’re effectively in your method to choosing one of the best worth shares.

Gladly that course of will get you getting in the appropriate course.

Sadly you’ll nonetheless find yourself with an inventory of over 700 shares to analysis.

That isn’t so unhealthy if choosing shares is your full-time job. Nevertheless, for many of you that’s far too time consuming.

This led to an “Aha!” second.

What if we may develop a method to unearth the ten high worth shares at any time producing constant outperformance?

So, we went again to the identical Information Scientist who created the POWR Rankings and requested the seemingly unattainable—may he flip up the amount on the worth metrics and one way or the other exceed their already market beating returns?

After months of analysis and rigorous testing the Prime 10 Worth Shares technique was born.

Not solely did we slender to simply 10 worth shares. However we additionally significantly elevated efficiency to +36.60% per yr since 1999.

The hallmark of this display screen is a zealous concentrate on the 31 particular person worth components that assist to constantly uncover the market’s greatest worth shares (and simply as importantly, ignoring the 100’s of things that truly don’t work in any respect!).

Combining these 31 distinctive worth components collectively in optimum vogue results in uncovering this extremely constant profitable technique.

The Key Phrase is “Consistency”

That’s as a result of the POWR Rankings additionally focuses on the consistency of development. Not simply earnings development, but additionally enhancements in income, revenue margins and money stream.

Then our ranking mannequin goes additional into the High quality of a inventory by drilling down on the principle metrics that present the well being of operations over time.

The steps famous above resolve the #1 deadly flaw of worth investing. That being how you can keep away from the worth traps which might be actually simply poorly run corporations that go from unhealthy to worse. The concentrate on Progress and High quality elements are the absolute best well being checks to alleviate these issues.

Which means that we glance past the overly simplistic worth measurements used previously, permitting us to ship to you the healthiest rising corporations, that simply so occur to be buying and selling at enticing low cost costs.

Subsequent up we have to deal with the twond deadly flaw. Which is that the majority traditional worth metrics don’t work like they used to.

Take into account this.

Pc pushed buying and selling now dominates the funding panorama. Not is it seasoned funding managers making the choices. As an alternative the overwhelming majority of trades are run by these quant fashions.

This has been true for greater than 10 years. And actually billions of {dollars} have been thrown at these quant fashions to squeeze out each final drop of revenue hidden in shares.

So way back these fashions tapped into the good thing about the everyday worth approaches like PE, Ebook Worth, PEG, Worth to Gross sales and so forth.

Now after years of excessive quantity buying and selling of those fashions it might be mentioned that the worth effectively has run dry.

Extra exactly, one of the best worth metrics have little or no profit on their very own. So the important thing to success is to stack as many of those metrics in your favor as potential. Just like the 31 worth metrics contained in the POWR Rankings mannequin.

That’s 31 benefits working in your favor to generate outperformance. Every one growing the percentages of success. And that’s how the Prime 10 Worth Shares technique is ready to produce a +36.60% annual return.

Lastly we tackle the threerd deadly flaw which is that worth shares are usually not well timed which damages your ROI.

Worth is taken into account a contrarian investing type. That’s since you are betting on corporations which might be at present out of favor hoping that the share value turns round.

Sadly the longer it takes…the extra it harms your Return On Funding.

Gladly the POWR Rankings focuses on 25 various factors that significantly improve the timeliness and ROI of the shares.

13 Sentiment Elements

12 Momentum Elements

Sentiment components observe what the sensible cash is doing with the inventory equivalent to institutional possession, Wall Avenue analyst estimates and insider shopping for. These are time-tested methods of discovering well timed, in-favor shares.

Subsequent up is narrowing in on 12 totally different Momentum components that targets shares able to rise. Certainly Momentum is rather like physics the place “a physique in movement… stays in movement”.

All in all of the POWR Rankings applies 118 components to seek out one of the best shares. The mix of which actually helps overcome the three deadly flaws of worth investing.

Then we dial up worth attributes to create the Prime 10 Worth Shares technique that will increase efficiency to a stellar +36.60% a yr.

That is the way you resolve the three deadly flaws of worth investing.

And that is the constant path to discovering one of the best shares sooner or later…

One final enchancment

For as nice because the Prime 10 Worth Shares technique actually is, there’s nonetheless one obtrusive flaw that exists in all quantitative programs. And that’s understanding the all-important WHY behind which shares to purchase, and when to promote to maximise features.

That’s the reason I am going one step additional, utilizing my 40 years of investing expertise to dive deeper into every inventory, pulling the curtain again on the all-important qualitative metrics that no pc scores system can uncover.

The ultimate result’s the perfect worth shares, that I hand choose for subscribers to our standard POWR Worth E-newsletter.

That is actually a better of each world’s answer:

+36.60% annual return from Prime 10 Worth technique

+

Steve Reitmeister with 40+ years of investing expertise with a eager eye for uncovering hidden worth shares

=

POWR Worth publication that can assist you uncover one of the best worth shares for at present’s market.

What To Do Subsequent?

When you’d wish to see extra high worth shares, then you must take a look at our free particular report:

What makes these shares nice additions to any portfolio?

First, as a result of they’re all undervalued corporations with thrilling upside potential.

However much more essential, is that they’re all high Purchase rated shares in accordance with our coveted POWR Rankings system.

Click on beneath now to see these 7 stellar worth shares with the appropriate stuff to outperform within the coming months.

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com

Editor of Reitmeister Whole Return & POWR Worth

SPY shares fell $0.15 (-0.04%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 7.82%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish 3 Deadly Flaws of Investing Revealed appeared first on StockNews.com

[ad_2]