[ad_1]

There are few actual property markets with as many enticing cities as California. From the attract of luxurious and way of life in Los Angeles to the expertise coronary heart of San Francisco, there’s a purpose why California rents are sometimes reported to be the best within the nation.

The California actual property market is a vital one for actual property traders because of its giant and various financial system that spans quite a few industries, together with expertise, leisure, and agriculture. This creates sky-high demand for housing, resulting in enticing rental earnings and constant property appreciation. It additionally makes California an extremely aggressive actual property market.

It’s not the simplest area to attain optimistic money stream in actual property, with a better entry level than many different states. Those that already personal property, have lately inherited a house, or have first rate capital to scale back debt servicing are inclined to fare one of the best within the Californian market.

Whether or not you’re a seasoned investor or new to the market, BiggerPockets has teamed up with Belong to carry you a snapshot of key areas that provide you with a sign of the market’s state and make it easier to make selections for the 12 months forward. Belong is a contemporary various to property administration corporations that humanizes the rental expertise and makes it simpler for particular person owners to handle actual property investments.

Rental Charges in California

Based on the 2021 Census information, California’s median gross hire paid per 30 days is $1,698, with 49% of households renter-occupied. After all, when median and statewide figures, it’s price remembering that these incorporate the whole lot from a studio house in Brentwood to an expensive mansion in Beverly Hills. Market charges fluctuate on a regular basis, and California is a giant state, too, with various distinctive and various localities inside it.

Right here’s a fast snapshot of the Californian market based mostly on the newest U.S. Census information.

Inhabitants: 39.24 million

Median annual family earnings: $84,907

Median month-to-month gross hire: $1,698

Median month-to-month family prices: $1,810

Median annual actual property taxes: $5,151

Renter-occupied: 49.1%

Does this paint a sensible image of what to anticipate within the Californian actual property market? Not essentially. Though the median month-to-month family price is $1,810, the truth is that 42.6% of households have prices over $2,000 per 30 days, with nearly 20% dealing with prices of over $3,000 per 30 days.

Let’s check out a few of the main metropolitan areas inside California, together with their census information and trending information from Belong and their information companions on what persons are really paying in these areas.

Los Angeles

Los Angeles County is house to over 9.8 million individuals, with over 3.8 million residing within the L.A. metro space. The median family earnings is barely decrease than California as an entire at $76,367, with a median gross hire of $1,653.

What’s the common rental price in 2023?

Los Angeles is a high-demand metropolis, with 63% of households renter-occupied. Based on actual property itemizing websites and Belong’s information companions, the common hire in Los Angeles as of January 2023 is:

Studio: $1,698 (+10% YoY)

1-Bed room: $2,395 (+7% YoY)

2-Bed room: $3,190 (+7% YoY)

3-Bed room: $4,378 (+4% YoY)

4-Bed room: $5,925 (no change)

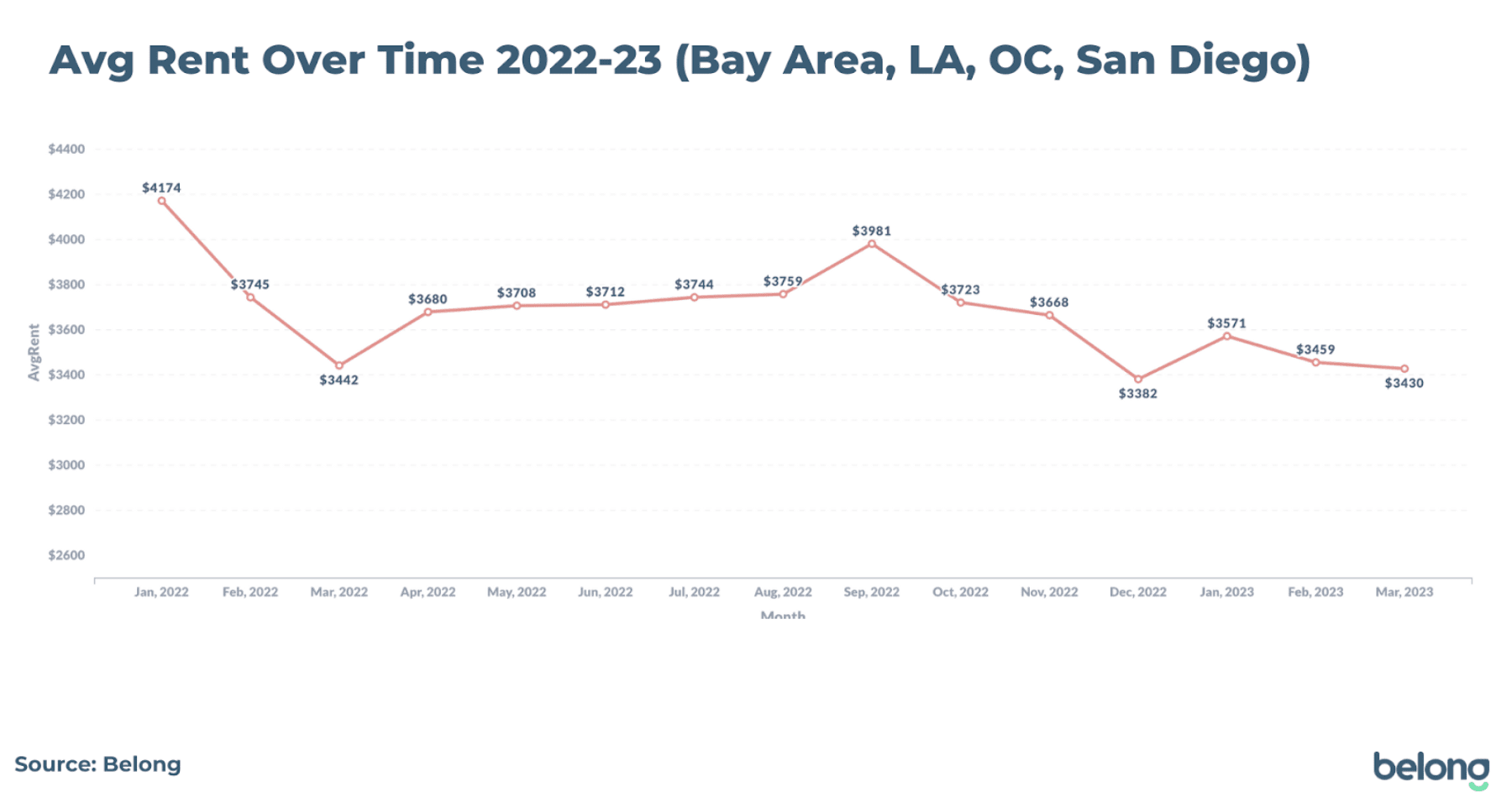

Belong, who caters primarily to homeowners of single-family properties and condos, has seen an common rental price of $3,885.92/month for the Los Angeles market. Cities within the L.A. market entice the best charges on the Belong platform, sitting 3% above San Francisco’s Bay Space and 53% increased than the common hire in Miami, Florida.

Whereas rents have continued to rise throughout California, it hasn’t been all “flowers and sunshine” for owners and actual property traders in Los Angeles. Between 2020 – 2022, many particular person traders have been hit with hire freezes and eviction moratoriums. In some areas, rents even dropped as individuals left key metro areas in favor of extra reasonably priced housing and bigger areas.

Because the pandemic impact slows and folks return to cities, the rental market is seeing a return to extra common seasonal adjustments. So regardless of reviews of rental development dropping for single-family properties, L.A. rents are nonetheless up year-on-year, and dips might be extra carefully associated to slower demand through the winter months.

San Francisco

In San Francisco’s Bay Space, with a fruitful job market and smaller inhabitants than Los Angeles, the common earnings is significantly increased at $126,187. The asking rents match, with the common studio house renting above $2,000 and single-family properties with two or extra bedrooms averaging $4,000/month or increased.

Inhabitants: 815,201

Median annual family earnings: $126,187

Median month-to-month gross hire: $2,130

What’s the common rental price in San Francisco in 2023?

Based on Belong’s information accomplice, the common hire in San Francisco as of January 2023 is:

Studio: $2,195 (+6% YoY)

1-Bed room: $2,950 (+4% YoY)

2-Bed room: $3,950 (no change)

3-Bed room: $4,895 (+5% YoY)

4-Bed room: $6,000 (+6% YoY)

Like Los Angeles, the Bay Space has a excessive demand for leases, with 62% of households renter-occupied, because of the profitable expertise {industry} and the job market. Like most expertise hubs, the Bay Space noticed a decline in rents when the pandemic hit and extra individuals labored from house. As individuals return to cities, San Franciso is seeing a development in rental charges, albeit slower than different metropolitan areas. One thing to be careful for will probably be lay-offs, with many high-profile expertise companies shedding workers, which may considerably gradual migration and leases within the metropolis.

It needs to be famous that the market rents have been at all times excessive, so any downward tendencies in development are usually not leading to below-market charges on leases. For instance, Sacramento loved file development in 2021 however nonetheless has rental charges considerably decrease than the Bay Space.

Belong sees an common price of $3,753.92 per 30 days for single-family properties and apartment leases within the Bay Space market. It is a 30% premium over Sacramento, which sees a median hire of $2,733.33 per 30 days.

San Diego

San Diego has lengthy been an awesome selection for traders. With miles of picturesque shoreline, a sunny local weather, and a wholesome financial system, it’s fascinating for residents, and single-family properties can entice robust returns. Whereas it’s not the most cost effective place to purchase actual property, you may discover higher worth than in lots of different components of California. Additionally, the state’s hire management provisions are extra favorable towards owners in San Diego than in Los Angeles.

San Diego is house to greater than 1.3 million individuals, with a median family earnings of $89,457. The median month-to-month gross hire sits at $1,885.

For a long-time, actual property traders within the San Diego space have concentrated closely on the short-term rental market. A lot in order that San Diego County has launched new caps to make extra properties out there to long-term renters. Any new stock hitting the long-term rental market may also help with the availability points, however with robust demand, rental costs aren’t taking a success.

What’s the common rental price in San Diego in 2023?

Based on Belong’s information companions, that is the common hire in San Diego as of January 2023:

Studio: $1,825 (no change)

1-Bed room: $2,295 (+5% YoY)

2-Bed room: $2,995 (+2% YoY)

3-Bed room: $3,900 (+8% YoY)

4-Bed room: $4,945 (+12% YoY)

Belong sees an common price of $3,526.15 per 30 days for single-family properties and apartment leases within the San Diego market.

Rental Pricing Traits Throughout the Californian Market

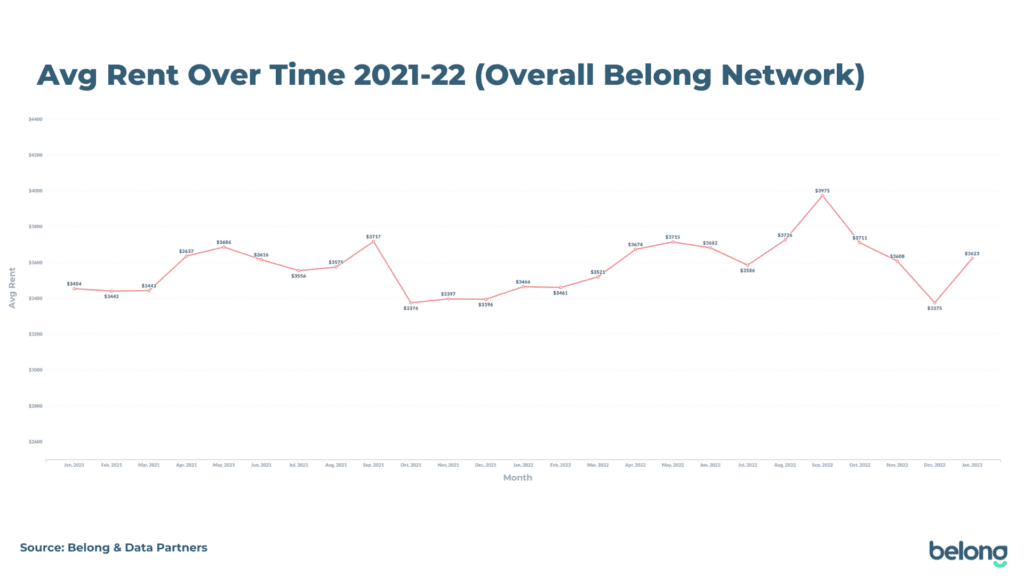

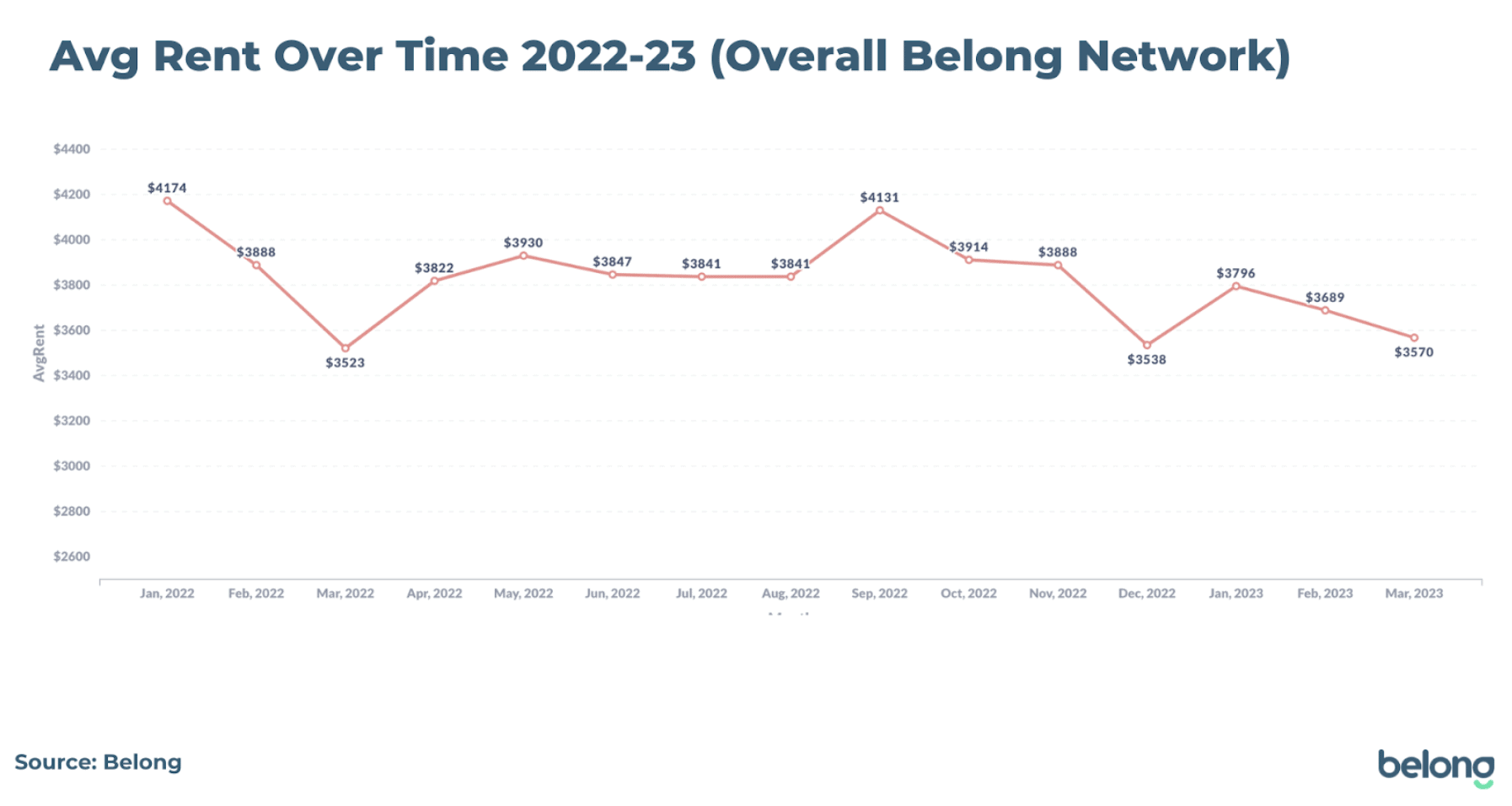

One other factor that median and common hire stats don’t account for is the seasonality of the Californian actual property market. The common rents sometimes peak between April and June and once more in September earlier than dropping off and hitting their lowest through the winter.

For the previous two years, rents have seen consecutive development and adopted much less of a seasonal sample. Nevertheless, the latest slowing of costs from October to December means that that is stabilizing. In 2023 and going ahead, owners are prone to be extra reliant on listings through the peak months of August-September to attain optimum pricing for his or her rental property.

Under is a graph based mostly on the common hire on the Belong community over 2021-2022. Even with rising rents, each years see regular rises in summer season, with a peak in September, earlier than dropping off once more from October.

Throughout 2022, we will see that rents have been excessive in January earlier than coming down in March. They rose once more in September earlier than dropping off once more. Wanting forward on the projected rents for February and March (based mostly on leases which might be but to start, so that is topic to alter), we see {that a} dip is projected in March 2023, and we’d anticipate to see an increase in April-Might main into the summer season interval.

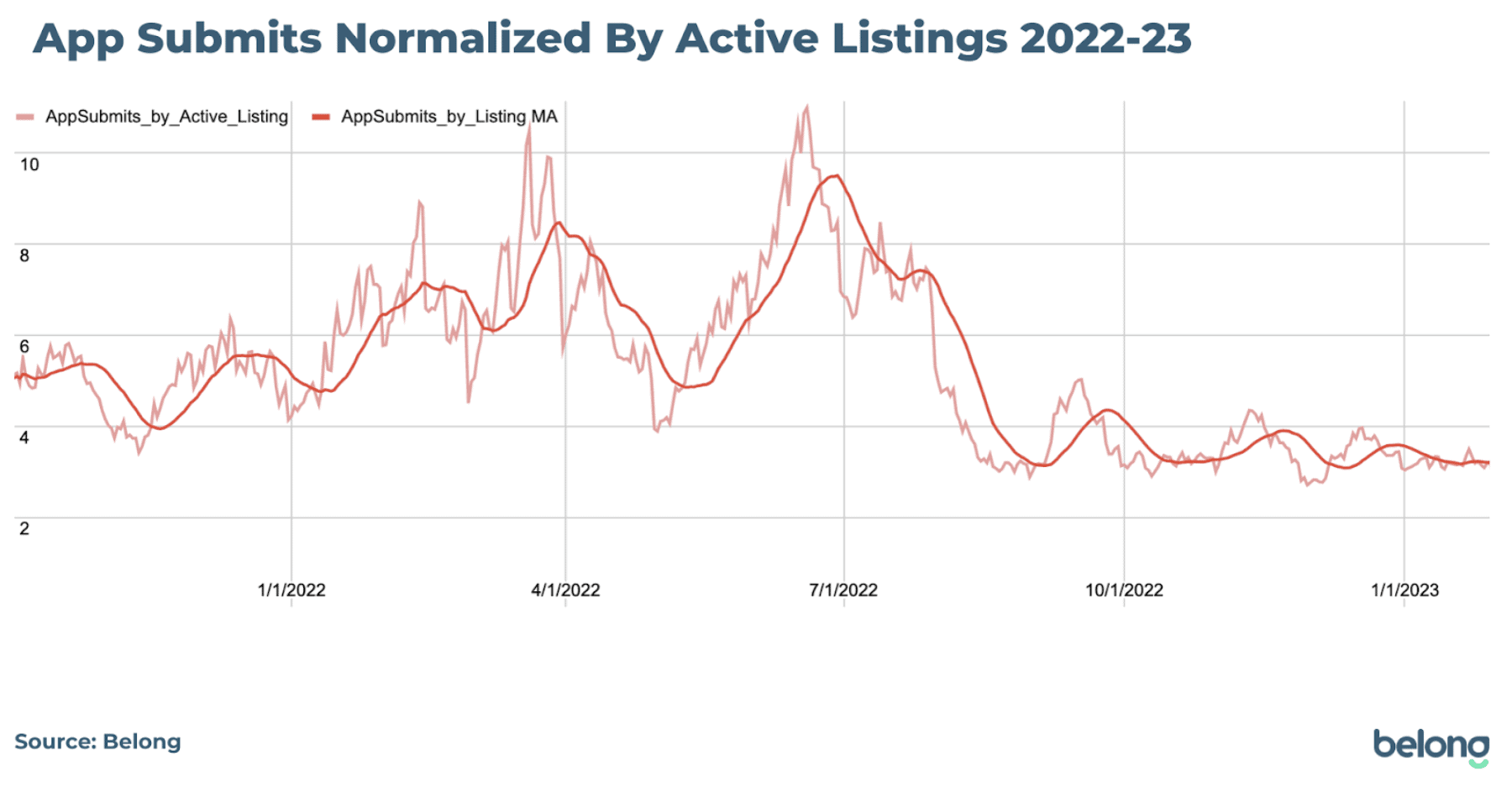

patterns of rental demand, the subsequent chart seems at Belong’s variety of rental property purposes, normalized by what number of energetic listings are on the platform. This exhibits that the variety of rental purposes/listings follows comparable seasonal patterns, with rising costs not turning candidates off. As an alternative, the seasonal demand peaks assist to buoy worth will increase as demand exceeds provide. When the solar is shining, owners can comfortably ask for extra hire as competitors will increase on high quality properties.

What can also be clear is that the steadiness of provide and demand can flip rapidly. A sizzling market with low emptiness can flip in a matter of weeks, as evidenced by the fast rise in candidates/listings main into the summer season and the fast lower popping out of it. Virtually, because of this to maximise your money stream, it’s essential to have a robust pulse available on the market and adapt rapidly.

Professional Tip: If you happen to’re making ready your private home for the rental market, work together with your property supervisor (or another corresponding to Belong’s residential community) to get your private home listed throughout peak months to lock within the highest potential price to optimize your money stream. Belong, for instance, leverages real-time demand alerts from the market to assist maximize rental earnings and preserve owners money stream optimistic. If your private home wants upkeep work or renovations, it will be smart to plan for this to happen between now and the winter months, when rental earnings is at its lowest, earlier than placing it again available on the market on the peak.

Rental Emptiness Charges in California

On the subject of figuring out the general provide and demand for leases, an awesome place to begin is the emptiness price. A “good” emptiness price is a low one, round 2-4%, indicating robust demand and low provide that pushes up rental pricing. A market emptiness price above 5% alerts that there’s loads of stock available on the market, and relying in your property sort, potential residents might need to negotiate on worth.

The rental emptiness price in California was sitting at 4.1% towards the tip of 2022, decrease than 2021 (4.3%) however barely increased than the beginning of the 12 months, the place emptiness charges have been a fair tighter 3.8%.

metropolitan areas, Los Angeles-Lengthy Seaside-Anaheim completed 2022 with a emptiness price of 5.1%, which has elevated considerably from 3.5%. That is coming off the again of two years of fast hire will increase and low affordability, which can have seen vacancies unlock as individuals selected to maneuver in with household or housemates to ease the price of residing and inflation pressures. Zillow reported a slight lower in rental costs in December 2022. Nevertheless, this is also linked to common seasonality and associated decrease demand (as evidenced by Belong’s information) somewhat than an inflow of stock.

In Riverside, rental vacancies stay low at 3.4%. Whereas that is increased than initially of 2022, the place they have been simply 2.4%, it alerts that sizzling rental competitors stays.

In San Diego, has the brand new Brief-Time period Rental Ordinance put extra stock available on the market or dented emptiness charges? It doesn’t seem that means, with emptiness charges sitting decrease in Q3 than in Q1 at a low 3.1%.

Over to the Bay Space, rental vacancies are increased at 5.2%, although that is trending downward from 5.6% firstly of 2022.

Rental emptiness charges in California, Q3 2022:

- San Francisco-Oakland-Hayward: 5.2% (down from 5.6%)

- Los Angeles-Lengthy Seaside-Anaheim: 5.1% (up from 3.5%)

- San Jose-Sunnyvale-Santa Clara: 4.6% (up from 3.7%)

- Riverside-San Bernardino-Ontario: 3.4% (up from 2.4%)

- Sacramento-Roseville-Arden-Arcade: 3.1% (up from 3.0%)

- San Diego-Carlsbad: 3.1% (down from 3.7%)

Supply: U.S. Census

As lately famous, there seems to be a “sellers strike” happening within the U.S., with many owners opting to hire out their properties and hire elsewhere somewhat than promote and quit their low fixed-term rates of interest. This might see extra stock hit the market, but in addition introduce extra residents into the rental market. For potential traders, it means stock may stay tight and supply much less alternative to benefit from cooling costs.

How Actual Property Buyers Can Hold Monitor of California’s Market

Whether or not you’re new to the true property investing recreation, coping with a problematic property administration firm, or burnt out on self-managing your rental house, BiggerPockets, and Belong may also help.

From ebooks to podcasts, BiggerPockets provides instructional sources for each stage of actual property funding expertise and technique. On the subject of managing your private home, Belong just isn’t a property administration firm however a residential community providing distinctive providers to each owners and their residents.

From not charging charges for the necessities to guaranteeing hire, Belong will accomplice with you to make proudly owning a rental property price it. And also you’ll by no means must carry a finger. Study extra and discover out if your private home is eligible (even should you’re mid-lease!) at belong.com/owners.

This text is introduced by Belong

Personal a rental property? Say goodbye to property administration and hiya to Belong. Belong brings end-to-end house administration providers to your fingertips.

Take pleasure in assured rental funds, vetted residents who love your private home the way in which you do, 24/7 assist for you and your residents, modern money stream options, an industry-leading cellular app, and maximized rental worth.

With Belong, you’ll be able to create long-term wealth whereas incomes passive earnings.

Observe By BiggerPockets: These are opinions written by the creator and don’t essentially signify the opinions of BiggerPockets.

[ad_2]