[ad_1]

Glad New 12 months everybody! I’ve made objectives publicly for over ten years as a result of it helps hold me accountable. Making objectives additionally makes the yr extra thrilling and difficult. Therefore, listed here are my objectives for 2023.

As soon as once more, I’ve divided the objectives into 5 classes: Well being, Wealth, Household, Monetary Samurai, and X-Issue. My objective is to attain 70% of my objectives.

Well being Objectives For 2023: Upkeep Mode

1) Keep the identical weight

As a substitute of a weight reduction objective, my objective is to play tennis or pickleball 4 occasions per week on common all yr. Higher health and psychological well being will naturally include common exercise.

I’ll keep the identical weight of between 167-168 kilos all of 2023. The ideally suited weight chart says I must be between 151 – 163 kilos at 5’10”. However screw that! I’m not an adolescent any longer.

2) Keep injury-free

At 45, my thoughts is commonly stronger than my physique. I believe I can play 5 days per week however I actually can’t with out ache or a heightened threat of damage. Every little thing from my heels to my hips to my shoulders aches after enjoying sports activities.

I’ll stretch for 5 minutes earlier than and after each match. A foam curler will probably be my new greatest buddy. Each off day I’ll soak within the sizzling tub. Lastly, I’ll use elastic bands to strengthen my shoulders 4 occasions per week.

Getting injured would additionally stop me from enjoying with my youngsters and I can’t let that occur at their present ages of three and 5. We play “fly” the place I choose them up and so they faux to be birds or planes. Then we play “jumpy leap” the place I assist them leap actually excessive on the couch. Wholesome shoulders and knees are a should for these actions.

Wealth Objectives For 2023: Flat Is The New Up

1) Observe the first rule of economic independence: by no means lose cash

I believe we’ll be fortunate (~40% likelihood) if the S&P 500 closes the yr within the 4,000 – 4,250 vary. I count on a 60% likelihood the S&P 500 will go down one other 10% sooner or later in 2023, i.e. <3,500 for S&P 500. Listed below are the 2023 Wall Road forecasts.

With ~30% of my internet price in public equities, a ten% decline will drag down my internet price by 3%. The Fed appears decided to trigger one other recession, regardless of all indicators clearly pointing to declining inflation.

I count on the nationwide median dwelling worth to say no by about 8% in 2023. This can end in a 4% drag on my internet price given actual property counts for about 50% of my internet price. Nonetheless, I’ve already priced my actual property portfolio about 10% beneath market costs. Listed below are the 2023 housing worth forecasts.

Primarily based on the above expectations, my lifelike draw back state of affairs is a 7% decline in internet price.

A sensible upside state of affairs is that shares shut up 5% – 10% to 4,000 – 4,235, leading to a internet price improve of 1.5% – 3%. In the meantime, I believe the lifelike best-case state of affairs is for housing costs to remain flat. In consequence, my best-case lifelike upside state of affairs is a 3% improve in internet price.

Primarily based on the blended assumptions, I count on my internet price to be down about 3% in 2023. In consequence, I have to generate sufficient after-tax earnings to cowl the shortfall.

I ought to have a 95%+ likelihood of producing sufficient on-line earnings to make up for a 3% internet price decline with out additional effort. If not, I’ll simply work tougher to not violate the primary rule of economic independence. Consulting can also be another choice.

2) Improve passive earnings by 5% to $400,000

I count on CPI to go beneath 5% by year-end, if not by July. Therefore, my actual passive earnings objective is to beat the typical inflation fee for 2023.

The rise in rates of interest helped increase our passive earnings by 10% to ~$380,000 in 2022. As rates of interest come down and my Treasury bonds mature in 2023, I’ll want to seek out new methods to generate extra passive earnings.

My hope is that by mid-2023, there will probably be extra personal actual property offers at decrease valuations and better yields. If that’s the case, I’ll roll lots of of 1000’s of {dollars} into personal actual property funds and offers from my expiring short-term Treasury bonds.

Given there may be extra threat concerned with actual property, I count on a better fee of return than the 4.2% – 4.7% risk-free from Treasuries. 8-10% returns appear affordable however are clearly not assured.

Along with boosting funding yields by means of actual property, my plan is to reinvest 80%+ of all on-line earnings into shares, actual property, and personal investments.

As soon as once more, money move is extra vital than internet price. It’s money move that funds your way of life. You probably have a lifetime pension that may pay for all of your dwelling bills, rejoice! Your pension is price extra than you understand.

3) Enhance spending by 20%

We spent about $240,000 a yr after taxes in 2022, which is equal to about $320,000 a yr in passive earnings. Due to this fact, we plan to spice up spending by $48,000 to $288,000. $288,000 equals $384,000 in gross passive earnings. In different phrases, we plan to spend all of our annual passive earnings in 2023.

Though we’re pleased with our present spending, I’ve began my decumulation part given I’ll be 46 in mid-2023. Some concepts for spending an extra $48,000 embody:

- $5,000 donation to the Pomeroy Rehabilitation & Recreation Middle for disabled youngsters and adults

- $12,000 extra on yummier meals

- $10,000 on nicer flights for my mother and father and in-laws to come back go to

- $12,000 on household holidays

- $5,000 on childcare

- $4,000 items

Shedding a lot of cash within the inventory market in 2022 has made spending more cash in 2023 simpler. Given I count on one other troublesome yr, I’d a lot quite spend my cash than lose it.

If I handle to maintain our internet price flat in 2023, then we should always actually improve our spending by 50% – 100% to decumulate. However this dramatic of a rise is hard to implement.

If we improve to a dearer without end dwelling decumulation will probably be simpler. However not now.

4) Beat again actual property FOMO

If my expectations are right, there will probably be extra housing offers by mid-2023. By then, costs could possibly be down 10% and mortgage charges could possibly be again down to five% for the typical 30-year mounted. The temptation to improve to a nicer dwelling will probably be nice!

However identical to how consuming a fifth slice of key lime pie is unhealthy on your physique, shopping for a fifth property in San Francisco is unhealthy for my sanity. Being a landlord decreases the standard of my life. One thing at all times comes up. Plus, my spouse doesn’t wish to transfer and I would like to understand what we now have.

Apart from, I’d quite diversify towards the heartland quite than have extra focus threat in San Francisco. Heartland actual property is a multi-decade pattern I can’t miss.

Household Objectives For 2023

1) Give as a lot consideration to my daughter as I did to my son

My depth in the direction of childcare has waned. A part of the reason being that I’ve already learn all of the books, watched all of the movies, and know what to anticipate. Another excuse is because of an improve in laziness.

When my son repeatedly gave me the chilly shoulder between ages 1.5 – 3, I attempted tougher to create a bond. When my daughter displayed related conduct at that age, I discovered myself giving up extra simply. From expertise, I imagine in the end she’ll come to understand her dad at all times being there for her.

Now that our daughter is three, it’s time to focus once more! Her recollections will type and I’ve seen, identical to our son, she now desires to spend extra time with me. In consequence, I’m going to do exactly that.

To be particular, my objective is to spend two hours within the morning along with her, two hours within the afternoon, and half-hour within the night. She will probably be attending preschool two days per week.

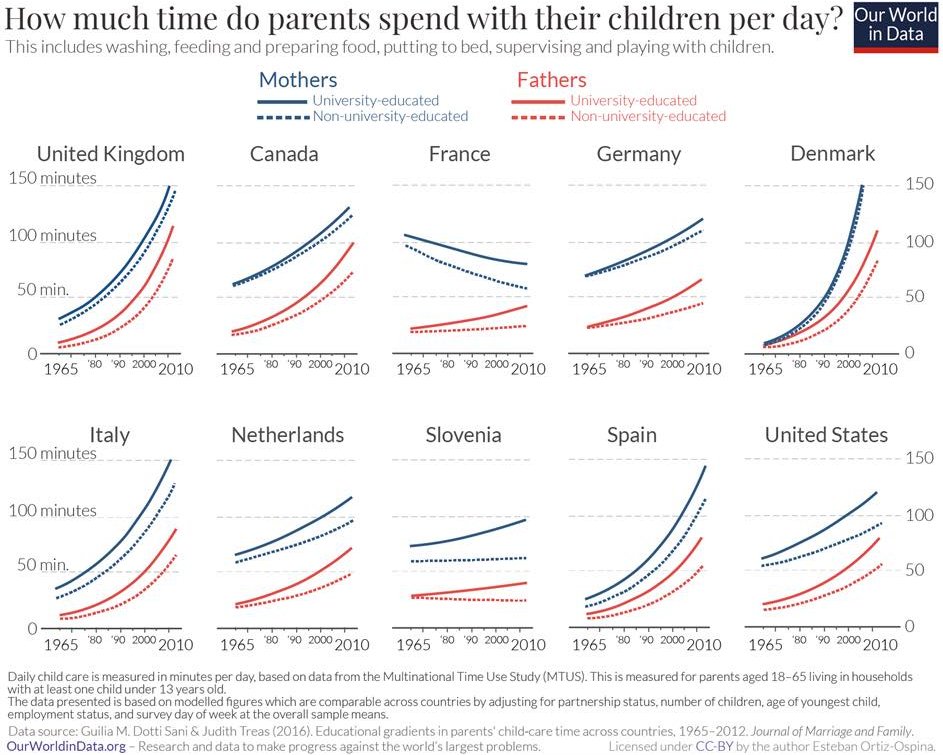

The typical time a college-educated mom spends with their baby in America is two hours a day. Therefore, my objective is to spend at double the period of time on common till she now not desires to spend time with me.

2) See my mother and father twice

It sounds sort of unhappy to have a objective of seeing my mother and father solely twice a yr. However they reside in Honolulu and I reside in San Francisco. They made a giant effort to go to us in 2022. I hope to persuade them to go to for per week once more in 2023.

I can even fly out to go to them for per week a minimum of as soon as this yr, both on my own or with household. We nonetheless haven’t taken the children on an airplane but. However possibly we are going to this summer time!

3) Train my boy swim.

I regarded into personal classes and so they value $80 for 20 minutes! WTF. The swim faculty stated it’ll take a toddler roughly 24-48, 20-minute classes to discover ways to swim. Therefore, we’re speaking $1,920 to $3,840. Truly, including up the whole value doesn’t sound as unhealthy because the 20-minute fee.

Given we don’t have a pool and I can’t appear to ever get a spot on the less expensive group classes, I could must go this costly route. Regardless, I’ll positively give my boy classes once we go as much as Lake Tahoe.

4) Be higher aligned on parenting kinds.

Though I believe I’m good, I’m positive my spouse would say I’ve a extra “powerful love” sort of parenting fashion. She, alternatively, has a extra light parenting fashion. I’d like for us to slender the hole.

Instance: Son slips and falls after being informed 5 occasions to not run on a moist sidewalk. He’s crying.

Me: “Embrace the ache. In case you didn’t wish to really feel ache, you wouldn’t have run.”

She: “Are you OK? I’m sorry you’re damage. We informed you to not run. Please hear subsequent time.”

Oh, snap! Perhaps I’m being too militant!

One in every of my best fears is elevating gentle children who can not launch as adults. In my neighborhood, there are a minimum of 5 sons between the ages of 26 – 35 nonetheless dwelling at dwelling with their mother and father. Then there are the folks on-line who get upset on the littlest issues. What occurred?

If we coddle our youngsters an excessive amount of, they might change into weak. If a perpetual security internet removes their worry of failure, they could find yourself at all times being depending on us.

Wrestle is a privilege! The satisfaction of overcoming a troublesome problem is great.

Monetary Samurai Objectives For 2023

1) Publish thrice per week on common, not 4 occasions

I stated I’ve printed thrice per week on common since 2009. However in actuality, I’ve averaged nearer to 4 occasions per week because of my free weekly publication.

My publication normally comes out on Sunday morning, which suggests I typically spend Friday night time, Saturday morning, or Sunday morning writing it. This additionally means I can by no means absolutely take the weekend off. This can change in 2023.

I’ll both publish two posts per week and one publication or publish a bi-weekly publication going ahead.

For my 14th yr working Monetary Samurai, I have to take issues right down to rejuvenate the thoughts. My eyes are additionally getting extra simply fatigued, which suggests much less display screen time.

2) Write 25% shorter posts

Because of social media, fewer folks learn nice private finance books and long-form content material on-line. Therefore, as a author, I ought to evolve with the occasions if I wish to appeal to a youthful viewers.

Writing shorter posts additionally reduces my workload, in addition to my father’s and spouse’s workloads as editors. I’ll get to the purpose faster.

3) Report a minimum of 30 extra podcast episodes

In December 2022, I got here up with the observe of recording podcast episodes in my automotive after dropping off my son in school. The acoustics are adequate and my ideas are recent. I additionally needed to be productive earlier than enjoying sports activities.

Releasing podcasts is a enjoyable option to join with readers and share nuanced ideas about my newest posts. I typically incorporate reader suggestions, which comes within the feedback part after posts are printed.

The years of recording podcasts additionally helped me change into a greater interviewee after I was on my three-month ebook tour for Purchase This, Not That. Lastly, I wish to file a big archive of episodes for my children in case I die prematurely.

X-Issue Objectives For 2023

An X-factor is one thing out of the strange that may convey you pleasure, which means, and/or earnings.

1) Develop into a 4.5-level pickleball participant

I’m hooked on pickleball. It’s a sport I see myself enjoying by means of my 70s, if I reside that lengthy. After a number of successful years at 4.0 tennis, I obtained bumped as much as 4.5. Then on the age of 39, I obtained bumped as much as 5.0 and stayed there for 5 years till 2022. The progress was exhilarating! I’d love to do the identical with pickleball.

I’ve already performed in opposition to and with 4.5 gamers and did superb. Due to this fact, all I have to do is get my official DUPR score and play in some tournaments. A 4.5-level pickleball participant is a high 6% participant.

By 2027, I wish to get to five.0 and win a minimum of $1,000 a yr enjoying skilled tournaments. 2027 is after I flip 50 and get to compete on the senior tour! Oh, how time flies.

2) Write one other ebook

Though writing a historically printed ebook is extraordinarily exhausting, I’d love to do it once more. My first ebook, an book entitled, How To Engineer Your Layoff, has helped 1000’s of individuals negotiate a severance. With the ability to stroll away from a job you now not like with cash in your pocket appears like successful the lottery.

My second ebook, a historically printed ebook entitled, Purchase This, Not That, went on to change into a Wall Road Journal bestseller. I believe it has an excellent likelihood to change into a basic private finance ebook that can stand the take a look at of time.

Publishing a bodily ebook with a good writer has given me an incredible quantity of unanticipated satisfaction. My youngsters are proud to see my work. I noticed having some standing is nicer than being a no one. Serving to readers acquire monetary braveness is gratifying. Lastly, it’s at all times great to create one thing from nothing.

Now I simply have to hammer out a brand new ebook deal.

3) Make one good new buddy

Making associates appears to get tougher as an grownup. Nonetheless, I’d wish to make a minimum of one good new buddy from my son’s faculty or by means of sports activities.

Pre-pandemic, I used to go to numerous fintech and startup meetups. Pre-kids, I used to go to conferences domestically and internationally. I’m not lonely, however I would really like a greater social life to make up for 2020-2021.

A Easy Life For 2023

With probably one other troublesome yr for our investments, I’ll focus extra of my time on household, associates, and private endeavors. Early retirement and minimalism go completely collectively.

In case you can afford to, an financial downturn is the time to have extra enjoyable. The return on effort (ROE) to make more cash is decrease. Are you able to think about working 60 hours per week solely to see your organization’s share worth go down 60%? What a waste of time!

I’ve embraced the Fed’s need to harm the livelihood of hundreds of thousands so we will lower your expenses on the grocery retailer. Personally, I’d quite eat all of the meals I purchase to economize, as an alternative of waste 25% like the typical American. However that will be too logical. Preventing the Fed is futile.

If inexperienced shoots start to sprout as soon as extra, I’ll be able to seize a few of the financial upside. However for now, I plan to take pleasure in a extra enjoyable 2023.

Reader Questions And Suggestions

Readers, what are a few of your objectives for 2023? What are a few of your expectations for this yr?

Try Private Capital, the most effective free instrument that can assist you handle your funds. With Private Capital, you may observe your investments, see your asset allocation, x-ray your portfolios for extreme charges, and extra. Staying on high of your investments throughout risky occasions is a should.

Begin your yr off proper by selecting up a duplicate of Purchase This, Not That, my prompt Wall Road Journal bestseller. The ebook helps you make extra optimum funding selections so you may reside a greater, extra fulfilling life.

For extra nuanced private finance content material, be a part of 55,000+ others and join the free Monetary Samurai publication and posts by way of e-mail. Monetary Samurai is among the largest independently-owned private finance websites that began in 2009.

[ad_2]