[ad_1]

I really like shopping for dividend shares in a market correction as a result of low pricing means I can earn increased yields. Dividend shares had been completely shattered final 12 months as rising rates of interest and market volatility put strain on sure firms. A number of of those shares have rallied for the reason that begin of the 12 months, however some are nonetheless down, together with two of the most important actual property funding trusts (REITs) by market capitalization, American Tower (AMT 2.52%) and Public Storage (PSA 1.19%).

These shares are leaders of their respective industries. Given their dimension, monetary place, and efficiency historical past, they hardly ever go on sale. However proper now, they each sit down 12.3% and 16.5%, respectively, over the previous 12 months.

This is a more in-depth take a look at the 2 firms and why their shares are each screaming buys proper now.

1. American Tower

American Tower is a number one infrastructure actual property funding belief (REIT) that owns and leases over 225,000 communication property. Its cellphone towers, antennas, and knowledge middle services are situated throughout six continents and quite a few nations. The REIT performs an integral position in protecting the world linked.

The corporate has been managing in opposition to a rising variety of headwinds over the past 12 months. Tenant consolidation, excessive inflation, overseas foreign money volatility, and rising rates of interest have all affected its working prices and eaten into earnings. The continued roll-out of 5G expertise in worldwide markets and the acquisition of information middle REIT CoreSite on the finish of 2021 helped the corporate fight these headwinds and nonetheless put up sturdy earnings for the complete 12 months.

American Tower administration predicts these short-term headwinds will proceed to influence the corporate in 2023, which is the primary cause the inventory is down 15% this 12 months. However even with these challenges, the REIT’s long-term outlook nonetheless seems to be extremely sturdy. Demand for its property ought to solely enhance as knowledge consumption and smartphone utilization develop. Plus new applied sciences like synthetic intelligence and cloud-based providers will want knowledge facilities to soundly retailer and transmit knowledge. In different phrases, its providers will not be rendered out of date.

The inventory trades round 20 occasions its adjusted funds from operations (AFFO). This metric, which works equally to earnings per share, signifies the corporate is pretty priced for its efficiency and long-term development alternatives. At present it pays a dividend yield of three%, and it has raised its payouts each quarter for the final 10 years, equal to a 500% enhance.

2. Public Storage

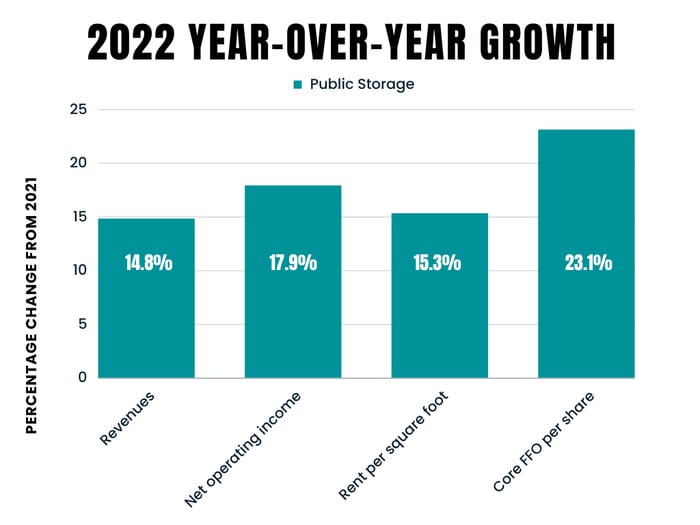

Public Storage’s inventory is rallying after its fourth-quarter and full-year 2022 earnings beat analysts’ projections. The most important self-storage REIT, with curiosity or possession in over 2,800 self-storage services, reported improbable development in its income, web working revenue, and core FFO per share in comparison with the 12 months prior.

Knowledge supply: Public Storage’s This autumn and full-year 2022 earnings. Chart by writer.

The sturdy efficiency is partly because of Public Storage’s acquisition efforts over the previous couple of years, during which it spent over $8 billion and grew its portfolio by 26% since 2019. Nevertheless it’s additionally associated to increased rental charges for its storage models. Occupancy in its properties dipped barely since final 12 months, it is now at 95%. However charges for its models stay up, which helps offset the marginal rise in operational prices.

A variety of REITs battle in right now’s rising rate of interest setting. Increased charges equate to extra curiosity paid on property being managed, which eats into earnings. Fortunately, Public Storage has maintained low debt ratios traditionally, that means rising rates of interest do not influence the corporate as a lot as different REITs. It additionally has an A credit standing, which provides it extra favorable phrases for the debt it does carry. Proper now its ratio of debt to earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) is round 3.3 occasions, which is much better than the REIT common of 5 occasions.

Its dividend yield of two% might not appear tremendous juicy in comparison with another high-yielding REITs, however buyers can relaxation straightforward figuring out it is effectively coated (it is simply 72% of core FFO) and that they’re getting access to the main self-storage REIT. Getting this REIT at a reduced value is only a bonus.

[ad_2]