[ad_1]

Partial Have a look at the Fashions and Positions

On Friday, I used to be a part of the Pageant of Studying, sponsored by Actual Imaginative and prescient, to assist new and skilled merchants. The matters that got here up have been in keeping with what everybody who trades desires extra insights on:

- FOMO

- Place Sizing

- Danger Administration

- Entries Stops and Exits

- Portfolio Administration

- Managing Feelings

One query was on AI and Robo Buying and selling, one thing we all know lots about.

First off, having a long time of discretionary buying and selling expertise, evolving into algos was a course of. All of our rule-based, structured disciplined approaches as discretionary merchants are an integral a part of the quant fashions and blends. Our objective is to create an “edge” utilizing fairness tendencies from varied markets and asset courses.

The explanation I convey this up at present is as a result of lots of the positions are inline with our private view of the macro. And lots of the positions are following our trend-strength indicators which have positioned us in sectors we might have doubtlessly ignored on our personal. What fascinates me, proper now, is the injection of liquidity by the Fed, which in fact will not be being known as by its rightful name–Quantitative Easing.

That leads me to think–what else can we purchase now, that hasn’t been crowded by the FOMO crowd?

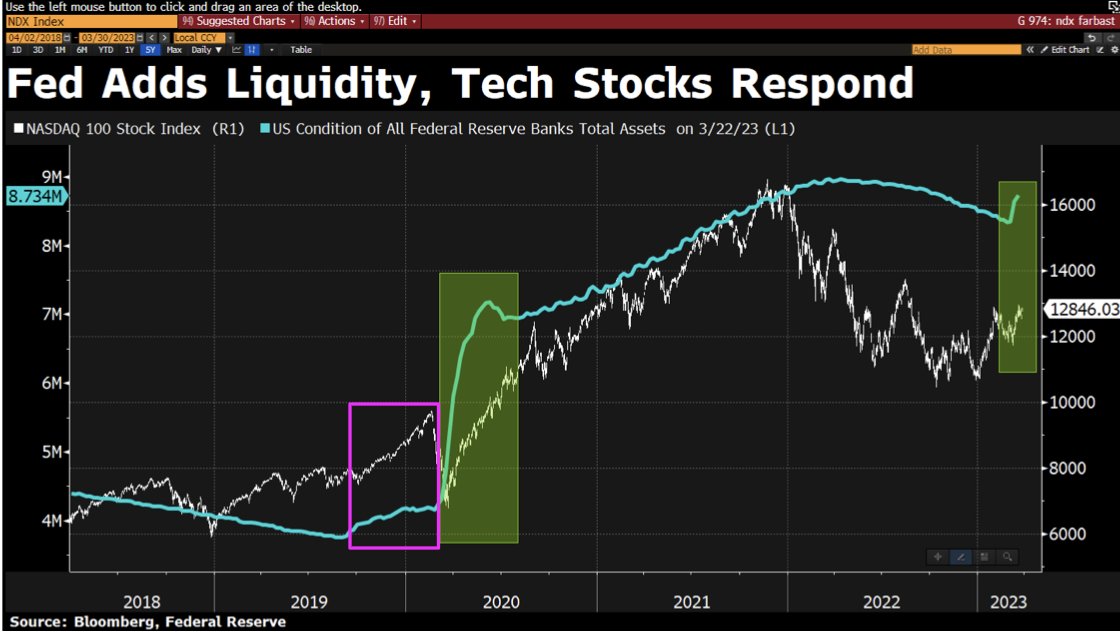

As you may see within the Bloomberg chart, trigger/impact for tech, but in addition for a lot of totally different sectors begging for the Fed repair.

The Financial Fashionable Household, although, has many different points. As the first quarter ended, solely Semiconductors closed above the 2-year or 23-month enterprise cycle to point out enlargement. The remainder of the Household didn’t, and Retail and Regional Banks nonetheless approach underperform. Which might imply extra QE on the way in which, with the remainder of the indices and key sectors following SMH, or it might imply a wakeup name for the 2nd quarter.

Both approach, we nonetheless consider that almost all are #lookingforinflationinallthewrongplaces.

Positive, the market loves the liquidity within the title of saving any future financial institution points. However all the pieces although the Fed does, as we nicely know, has a price.

Final week, I wrote about agricultural commodities and DBA, the Ag ETF. Since that Day by day, DBA has risen over 4%. So, what ought to we search for subsequent?

I wrote about lengthy bonds (TLT). TLTs rallied with the market. The excellent news is that lengthy bonds are underperforming SPY, which is danger on. If yields fall additional, nonetheless, will that be good for the market when, impulsively, the Fed has to grow to be extra aggressive once more to manage rising inflation? Have not we discovered but that the extra “QE”, the extra spending, the extra inflation, and so forth?

So, watch the bonds. Contemplate the grains. And because the PCE launched Friday excludes meals and power, hold observe of valuable metals, sugar and crude oil.

Our quants haven’t gotten into oil but, so, from a macro perspective, over $82, we have an interest.

Search for momentum to clear the 50-DMA together with worth. Then, the danger can be minimal, and the reward considerably nice.

But in addition, the associated fee to the economic system.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Marketing consultant, to study extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Mish talks with CNBC Asia about hope, concern, and greed, and what might occur going ahead.

On the Thursday version of StockCharts TV’s Your Day by day 5, Mish walks you thru the place we’re within the financial cycle on the finish of the primary quarter, then highlights what to search for (and commerce) as we enter the second quarter.

On this look on CMC Markets, Mish offers you clear actionable info to help why commodities look to go larger from right here.

Mish talks in search of inventory market alternatives on Enterprise First AM.

Mish discusses lengthy bonds, Silver to Gold and the Greenback on this look on BNN Bloomberg.

Mish sits down with Kristen on Cheddar TV’s closing bell to speak what Gold is saying and extra.

Mish and Dave Keller of StockCharts have a look at long run charts and talk about motion plans on the Thursday, March 17 version of StockCharts TV’s The Closing Bar.

Mish covers present market situations strengths and weaknesses on this look on CMC Markets.

Mish sees alternative in Vietnam, is buying and selling SPX as a variety, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole talk about particular inventory suggestions and Fed expectations on TD Ameritrade.

Coming Up:

April 4th: The RoShowPod with Rosanna Prestia

April 24-26: Mish at The Cash Present in Las Vegas

Might 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 405-410 again in focus.

- Russell 2000 (IWM): 170 help, 180 resistance nonetheless.

- Dow (DIA): Wants a second shut over 332.

- Nasdaq (QQQ): 329 the 23-month transferring average–huge.

- Regional Banks (KRE): Weekly worth motion extra contained in the vary of the final 2 weeks–still seems to be weak.

- Semiconductors (SMH): And he or she’s off–255 key help, 270 resistance.

- Transportation (IYT): Cleared the weekly transferring common, so now has to carry 225.

- Biotechnology (IBB): Good efficiency however not sufficient but, except clears 130 space.

- Retail (XRT): Ran proper to large resistance at 64.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary info and training to 1000’s of people, in addition to to giant monetary establishments and publications reminiscent of Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified each time a brand new publish is added to this weblog!

[ad_2]