[ad_1]

Except you’re one of many few individuals who is aware of precisely what they need to do with their life, selecting your future profession might be difficult.

With a excessive job satisfaction charge and a wholesome actual property market, extra individuals are turning to the true property {industry}.

Throughout the {industry}, it’s estimated that Actual Property Funding Trusts (REITs) supported 3.2 million jobs in 2021, in keeping with a research commissioned by the Nationwide Affiliation of Actual Property Funding Trusts (Nareit).

The market continues to broaden, creating extra alternatives for profession progress in varied property administration and growth positions.

On this article, I’ll share the best-paying jobs in actual property funding trusts and associated data you’ll need to know to make an knowledgeable determination about your profession.

Desk of Contents

- What Are Actual Property Funding Trusts?

- How Many Actual Property Funding Trusts Are There in Complete?

- What Is The Job Outlook For Individuals In Actual Property Funding Trusts?

- How Many Jobs Are Obtainable In Actual Property Funding Trusts?

- 12 Finest REIT Jobs for 2023

- 1. Chief Govt Officer (Wage: As much as $500,000)

- 3. Chief Working Officer (Wage: Up the $325,000)

- 4. REIT Analyst (Wage: $75,000-$100,000)

- 5. Finance Supervisor (Wage: $55,000-$65,000)

- 6. Property Developer (Wage: $80,000-$100,000 )

- 7. Property Supervisor (Wage: $70,000 – $120,000)

- 8. Funding Analysts (Wage: $100,000 – $130,000)

- 9. Lawyer or Lawyer (Wage: $100,000 – $150,000)

- 10. Web site Acquisition Specialist (Wage: $130,000 – $160,000)

- 11. Actual Property Acquirer (Wage: $140,000 – $200,000)

- 12. Head of Advertising and marketing (Wage: $130,000 – $160,000)

- Advantages of Working for a REIT

- How A lot Can You Earn Working For A REIT?

- How Do I Develop into A Actual Property Funding Belief Skilled?

- Closing Ideas on the Finest REIT Jobs

What Are Actual Property Funding Trusts?

Actual property funding trusts or REITs are pooled funding funds that personal and function income-generating properties in residential, business, and industrial actual property. They permit common and accredited buyers to put money into actual property with out the capital requirement and complexity of proudly owning total properties.

If you buy a REIT, you aren’t shopping for any single property outright – you’re investing in an organization that owns actual property. These corporations maintain the properties long-term and generate earnings by lease or lease funds.

For instance: Suppose you need to put money into property in a sure location. You would both purchase a property or buy shares of a REIT that owns property in that market space. The REIT will then handle the property and acquire lease or lease funds. They might additionally develop and enhance the property to extend its worth.

How Many Actual Property Funding Trusts Are There in Complete?

Globally, hundreds of REITs exist immediately. With a collective market capitalization of greater than $1.4 trillion, they personal an array of property sorts – from purchasing malls to medical workplace buildings or information facilities – in each state.

The Actual Property Funding Trusts {industry} within the US has seen common annual progress of 0.3% between 2017 and 2022, in keeping with the IBIS World report.

Greater than 225 actual property funding trusts (REITs) are registered with the Securities and Trade Fee (SEC) in the USA that commerce on a significant inventory alternate, resembling Nasdaq or the New York Inventory Trade. A lot of the greater than 1,100 REITs which have filed tax returns with the IRS are privately held entities.

What Is The Job Outlook For Individuals In Actual Property Funding Trusts?

The demand for individuals in actual property funding trusts is excessive as a result of the true property {industry} frequently wants extra employees, and there are numerous alternatives for development.

The actual property market is anticipated to develop, with rising numbers of individuals investing in REITs and extra alternatives accessible for REIT workers.

The Bureau of Labor Statistics (BLS) estimates that the projected job progress for actual property and rental providers will likely be 5% between 2021 and 2031.

Consequently, the job marketplace for people in actual property funding trusts is projected to broaden at a charge of 9% to 10% yearly, signifying that extra top-level positions will likely be accessible in upcoming years.

Furthermore, 30% of all REIT jobs require a enterprise diploma to start out working at a managerial stage. Though, you may find entry-level positions to begin your profession with out having any prior expertise or formal {qualifications}.

How Many Jobs Are Obtainable In Actual Property Funding Trusts?

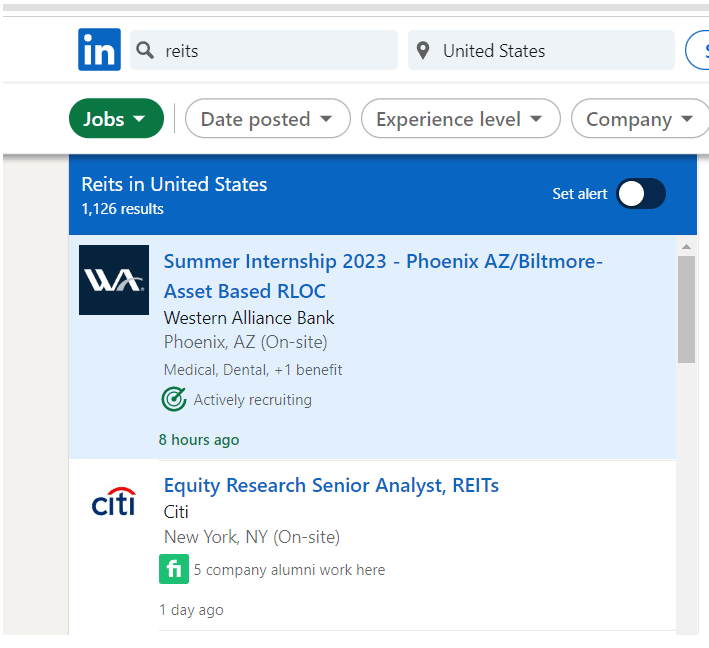

As the true property market continues to develop and develop, the variety of jobs accessible in REITs additionally will increase. In accordance with a LinkedIn job search, there are presently 1100 jobs in actual property funding trusts accessible.

This contains a wide range of job titles, resembling property managers, fairness analysis senior analysts, actual property property appraisers, and Company Improvement managers.

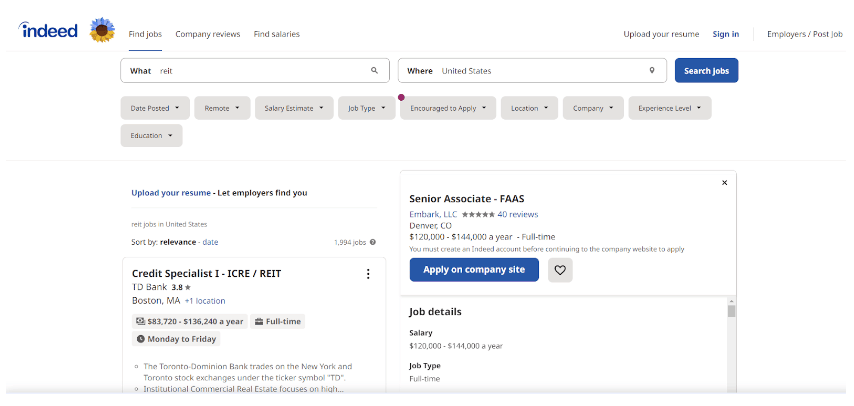

On Certainly, the variety of job openings within the US is even increased, with over 1900 jobs marketed.

The actual property sector affords a variety of job alternatives for people trying to enter the sector. Whether or not you have an interest in changing into an actual property investor, actual property agent, monetary analyst, or company supervisor, REITs present a complete platform to start your journey.

12 Finest REIT Jobs for 2023

Since the true property sector is anticipated to expertise progress within the upcoming years, it may be assumed that the REIT job market will change into more and more aggressive. Like most fields, the best-paid positions in REITs are managerial and government.

No matter your {qualifications} and expertise stage, there are nonetheless a wide range of profitable jobs accessible in REITs. Here’s a listing of the highest-paying jobs in Actual Property Funding Trusts in 2023:

1. Chief Govt Officer (Wage: As much as $500,000)

Usually, the CEO is the corporate’s highest-paid particular person.

However what makes a CEO price such a hefty paycheck? It’s easy – their choices have the ability to form all the course of the corporate. Because the highest-paid particular person within the group, the CEO is chargeable for making strategic decisions that may influence not solely the corporate’s efficiency but additionally the efficiency of all the direct studies.

It’s no simple process, and it’s not given to only anybody. CEOs in the true property funding trusts {industry} are sometimes seasoned professionals with no less than 20 years of expertise. They’ve confirmed themselves, profitable leaders, rising by the ranks and taking over varied departmental roles.

Briefly, the place of CEO is likely one of the most demanding and rewarding jobs in the true property funding trusts {industry}. It requires sturdy management abilities, intensive {industry} information, and the power to make powerful choices. However for individuals who are as much as the problem, the rewards are effectively price it.

2. Chief Finance Officer (Wage: Up the $350,000)

The Chief Finance Officer of an actual property funding belief manages the group’s monetary well being and ensures its long-term stability and progress. Their duties embrace overseeing the budgeting and monetary planning course of, analyzing monetary information to establish traits and areas for enchancment, and creating methods to optimize the corporate’s monetary efficiency.

Different duties embrace managing the accounting and finance staff and constructing relationships with key stakeholders resembling buyers, lenders, and regulatory our bodies. They’ll considerably influence the group’s success and are effectively compensated for his or her experience.

3. Chief Working Officer (Wage: Up the $325,000)

The Chief Working Officer (COO) serves because the group’s spine, making certain the challenge’s clean operating and success. From managing groups to main senior operators and fostering junior personnel, the COO holds many duties and should have glorious organizational abilities.

By leveraging their experience in operations and administration, they be certain that all the pieces runs inside funds and on time. This makes them a extremely sought-after place for individuals who have established themselves on this discipline.

One of the necessary abilities a COO will deliver to any group is considering strategically and creating long-term methods for achievement.

4. REIT Analyst (Wage: $75,000-$100,000)

REIT Analysts play a key position within the success of a REIT. Their salaries vary between $75,000 and $100,000. A bachelor’s diploma in both finance or actual property is important to qualify. The REIT Analyst should be capable of successfully analysis, analyze and develop methods for any new or present actual property alternatives.

They share the outcomes with the acquisition staff, who determine whether or not the REIT ought to make investments based mostly on the info supplied. REIT analysts additionally think about different market alternatives and consider their worth.

5. Finance Supervisor (Wage: $55,000-$65,000)

In the event you’re in search of a high-paying, steady REIT profession, think about changing into a Finance Supervisor. Armed with a finance diploma, the Finance Supervisor ensures that REIT investments are effectively managed and tasks are reported on precisely.

They forecast, create budgets, and be certain that builders aren’t overspending or stretching sources too skinny. Finance Managers report on to the Chief Monetary Officer and are concerned with among the most important tasks inside REITs. They’re an integral a part of any profitable REIT staff.

6. Property Developer (Wage: $80,000-$100,000 )

Property Builders are the shining stars of the REIT scene. With salaries starting from $80,000 to $100,000, they’ve one of the vital sought-after roles within the {industry}.

You might want an MBA to qualify for this position, as they have to monitor complicated tasks from initiation by completion. This contains hiring and firing contractors, staying on funds, and making certain that growth runs easily. If in case you have earlier expertise, it should show beneficial.

7. Property Supervisor (Wage: $70,000 – $120,000)

Working as a REIT Property Supervisor might be financially and professionally rewarding. Although no formal {qualifications} are wanted, having a bachelor’s diploma is closely really helpful, and former expertise within the discipline can provide you a bonus.

Relying on the kind of REIT, your position as a Property Supervisor might contain overseeing leases or managing a number of areas with potential for leases.

With salaries starting from $70,000-$120,000 relying on managerial expertise and workload, this profession path has nice potential for monetary rewards {and professional} development.

8. Funding Analysts (Wage: $100,000 – $130,000)

Funding Analysts are essential to a REITs success. They’re additionally among the many highest paid professionals within the {industry}. To be an Funding Analyst, you need to possess a bachelor’s diploma in enterprise, funding administration, or finance.

Funding Analysts work intently with the REIT’s finance and acquisitions groups. The info and analysis for any new challenge should cross their assessment to find out whether it is actionable. Analysts can even supply further perception into potential investments.

9. Lawyer or Lawyer (Wage: $100,000 – $150,000)

Changing into a lawyer is an alternative choice when you’re contemplating a profession in actual property funding trusts. It’s because legal professionals can channel their experience into authorized proceedings, resembling mortgage contracts, actual property paperwork, and different authorized issues.

An actual property lawyer will handle all of the authorized paperwork associated to purchasing and operating property on behalf of their employer and even symbolize them ought to any difficulties come up. So when you’re trying to develop your earnings with a profitable job on this sector subsequent yr, pursuing a profession as a lawyer is price contemplating.

10. Web site Acquisition Specialist (Wage: $130,000 – $160,000)

In the event you’re in search of a high-paying profession within the REIT discipline, think about changing into a Web site Acquisition Specialist. They deal with the ins and outs of buying property, together with the authorized and contractual obligations. The position requires an in-depth information of entitlements, constructing codes, and leasing.

11. Actual Property Acquirer (Wage: $140,000 – $200,000)

Actual property acquirers be certain that a REIT doesn’t overpay for valuable land or property. They have to stay calm and picked up and have glorious negotiating abilities.

You might want a bachelor’s diploma in finance, however don’t let that cease you. Being an acquirer might be extremely rewarding, with potential salaries starting from $140,000 to $200,000. However it’s a demanding position, requiring technical information and interpersonal abilities for negotiations and information evaluation.

12. Head of Advertising and marketing (Wage: $130,000 – $160,000)

Within the aggressive actual property market of 2023, a Advertising and marketing Head position in a REIT (Actual Property Funding Belief) is likely one of the most engaging positions for these with a bachelor’s diploma in advertising, public relations, or associated fields.

With Salaries starting from $130,000 – $160,000, the Advertising and marketing Head is vital to attracting buyers and tenants to new business properties.

Advertising and marketing Heads have to be inventive and savvy when creating campaigns focusing on companies and customers.

Advantages of Working for a REIT

Working for a Actual Property Funding Belief (REIT) might be an effective way to achieve expertise in the true property {industry}. Listed here are among the benefits of working for a REIT:

Flexibility

Many REIT companies supply versatile work schedules and permit workers to rearrange their hours in keeping with their private wants and preferences, one thing that’s exhausting to search out in lots of different industries.

Profession Development

With REITs, you may work your manner up rapidly as you acquire expertise and information within the {industry}. There will likely be many alternatives for promotion or lateral motion into different enterprise areas.

Monetary Alternatives

You’ll be able to earn a excessive wage working for a REIT and be eligible for beneficiant bonuses or inventory choices as you progress.

Variety of Companies

REITs assist numerous companies catering to totally different industries. You would end up doing something from managing retail shops to investing massive quantities of cash in actual property portfolios – every day is exclusive and comes with its personal set of challenges.

Stability & Safety

One important benefit of working at a REIT is job safety; not like many different industries, the true property sector doesn’t fluctuate wildly, and jobs are steady.

How A lot Can You Earn Working For A REIT?

Working for a REIT (Actual Property Funding Belief) is usually a rewarding profession selection. Whereas I’ve lined the highest-paying REIT jobs on this article, $75,000 is the typical base wage for the {industry}. That’s considerably increased than median salaries in different industries. Smaller corporations with decrease revenue margins have a tendency to supply the lowest-paid jobs, whereas bigger organizations with extra complicated job duties sometimes pay extra.

How Do I Develop into A Actual Property Funding Belief Skilled?

Right here’s a fast information to getting began as a Actual Property Funding Belief skilled:

Step 1: Get Educated on the Matter: Take programs and applications to be taught what it’s essential learn about actual property investing.

Step 2: Construct Your Community: Join with professionals within the {industry} and discover mentors who may also help information you.

Step 3: Analysis Corporations: Do the analysis and discover the appropriate firm.

Step 4: Put together for Success: Be sure you’re prepared for the problem of working in REITs by making ready your self for achievement. For instance, making ready business actual property property evaluation and studying tips on how to construction business actual property offers.

Closing Ideas on the Finest REIT Jobs

As you may see, a profession within the REIT {industry} might be very rewarding. The positions I’ve highlighted are among the best-paying jobs accessible and supply stability and progress potential, however additionally they require specialised abilities and loads of expertise. If a profession in actual property doesn’t curiosity you, there are different methods to generate income as an investor. For extra data, right here’s an article that exhibits you tips on how to put money into actual property.

Cited Analysis Articles

1. Nareit. (n.d.) Financial contribution of REITs in the USA. Retrieved from https://www.reit.com/data-research/analysis/sponsored-research/economic-contribution-reits-united-states

2. IBISWorld. (2022, September 23). Actual Property Funding Trusts within the US. Retrieved from https://www.ibisworld.com/industry-statistics/market-size/real-estate-investment-trusts-united-states/

3. Nasdaq. (n.d.) Retrieved from https://www.nasdaq.com/.

4. New York Inventory Trade (NYSE). (n.d.). Retrieved from https://www.nyse.com/index

5. US Bureau of Labor Statistics. (n.d.) Occupational Outlook Handbook. Retrieved from https://www.bls.gov/ooh/gross sales/real-estate-brokers-and-sales-agents.htm

6. LinkedIn. (n.d.) Job Search. Retrieved from https://www.linkedin.com/jobs/s/?currentJobId=3421710019

7. Payscale.com. (n.d.) Wage for Trade: Actual Property Funding Belief. Retrieved from https://www.payscale.com/analysis/US/Trade=Real_Estate_Investment_Trust_(REIT)/Wage

[ad_2]