[ad_1]

My mid-week morning practice reads:

• The insider: how Michael Lewis obtained a backstage cross for the autumn of Sam Bankman-Fried: As creator of The Large Quick and Moneyball, Michael Lewis is probably essentially the most celebrated journalist of his technology. Now he delivers an astonishing portrait of the fallen crypto billionaire. However did he get too shut? (The Guardian) however see In Michael Lewis, Sam Bankman-Fried discovered his final and most prepared sufferer. The primary hazard in telling an enormous story via the eyes of its major participant is the necessity to depend on his model because the trustworthy reality. Journalism colleges will have the ability to use “Going Infinite: The Rise and Fall of a New Tycoon,” Michael Lewis’ new guide concerning the collapse of the FTX cryptocurrency trade and the autumn of its boss, Sam Bankman-Fried, as a textbook on the crucial must strategy a topic with a wholesome serving to of skepticism. (Los Angeles Instances)

• $67 Billion of Uncommon Minerals Is Buried Underneath One of many World’s Largest Carbon Sinks: A battle is brewing in Canada about how, or whether or not, to dig out supplies important for EV batteries that lie deep beneath huge peat bogs. (Wall Road Journal)

• Why Nearly Each Household Workplace Worker Is Getting a Fats Elevate in 2023: The wealthiest households are preventing one another for a small pool of expertise and driving up compensation. (Institutional Investor)

• The Yen Nonetheless Appears Weak. That’s Good for Japanese Shares: Deflationary Japan is seeing unheard-of value rises, with core inflation staying above 3% yearly for the previous yr. BOJ Governor Kazuo Ueda hinted in a press interview three weeks in the past that the financial institution would possibly reply by lifting its -0.1% prime rate of interest, sparking a mini-rally within the yen. Then the financial institution stood pat at a Sept. 21 coverage assembly, citing “extraordinarily excessive uncertainties.” The yen then tumbled anew towards a file low of 150 to the greenback. (Barron’s)

• Why a US Recession Is Nonetheless Doubtless — and Coming Quickly: The federal government is staying open for now. However Bloomberg Economics sees dangers forward, from strikes to larger charges and oil costs. (Bloomberg) see additionally A New Curiosity-Charge Regime Has Begun. These Are the Market’s Winners and Losers. Bond costs, the Magnificent Seven and rising markets are below stress. (Wall Road Journal)

• New York Likes to Hate Him. Can a $2.3 Billion Sphere Redeem Jim Dolan? Mr. Dolan, who controls the corporate that owns the Knicks and the Rangers, is about to open a behemoth area in Las Vegas that he hopes will revolutionize stay leisure. Again dwelling in New York, he’s going through the wrath of legal professionals, politicians and sports activities followers. (New York Instances)

• Cybersecurity Investing Should Navigate Progress Slowdown: Regardless of the continued hacker risk, some prospects are pulling again on digital protection spending. (Chief Funding Officer)

• How Many Microbes Does It Take to Make You Sick? Publicity to a virus isn’t an all-or-nothing proposition. The idea of “infectious dose” suggests methods to maintain ourselves safer from hurt. (Quanta Journal)

• Why do individuals love dwelling in Canada? Three of the Canada’s cities — Vancouver, Calgary and Toronto — are all ranked within the high 10 of the World Liveability Index 2023, we converse to residents in every metropolis to search out out what makes life so candy. (BBC)

• What ‘The Workplace’ reboot ought to appear like, in keeping with workplace staff:Dwight is now monitoring your key strokes, Stanley and Kevin are at all times black tiles on Zoom and there’s a brand new Gen Z workplace influencer filming all the things. (Washington Submit)

Make sure to try our Masters in Enterprise with Gary Cohn, Assistant to the President for Financial Coverage and Director of the Nationwide Financial Council from 2017-2018; he was President and Chief Working Officer of The Goldman Sachs Group from 2006-2016. At present, he’s Vice Chairman of IBM.

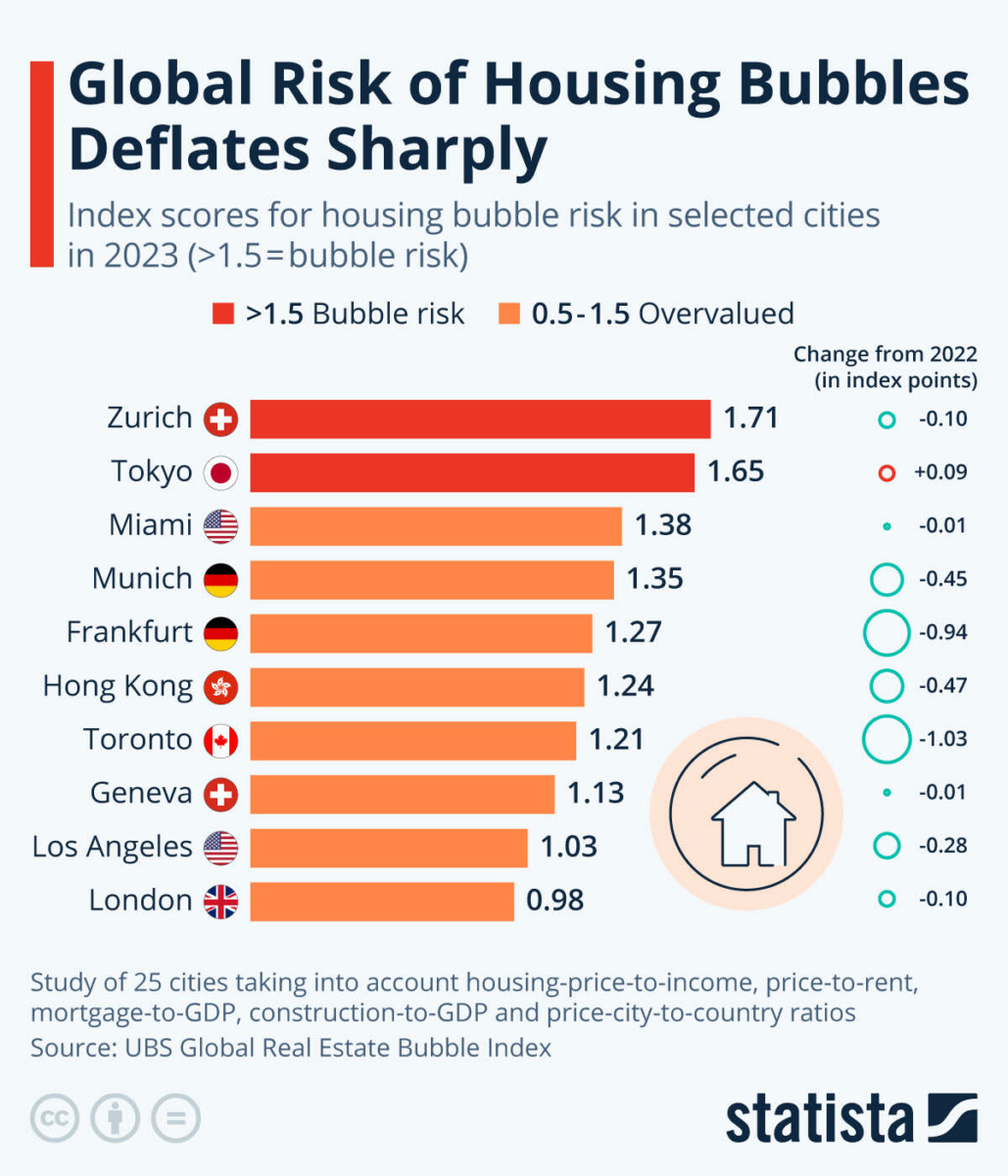

World Danger of Housing Bubbles Deflates Sharply

Supply: Statista

Join our reads-only mailing listing right here.

[ad_2]