[ad_1]

My mid-week morning prepare WFH reads:

• The Tremendous Wealthy Are Anxious. Ought to You Be? We human beings act irrationally, which makes for bursts of creativity within the arts and, sure, even on Wall Avenue, however inevitably precipitates overexuberance in capital markets and financial institution runs. It additionally means that there’s most likely some restrict on the marginal utility of incremental items of regulation, I suppose. However does that imply we are able to by no means tame these spirits? (Barron’s)

• There may be No Index Fund For the Housing Market: Whereas inventory market possession throughout the Nice Melancholy was a rounding error of the overall inhabitants, loads of individuals owned homes. Actual property bought obliterated similar to every thing else within the financial system again then however the homeownership price nonetheless solely bought as little as 44% following the Nice Melancholy. (A Wealth of Widespread Sense) see additionally No Sellers, No Patrons: Like each different market on the planet, actual property has a big psychological element. However in contrast to liquid markets the place Animal Spirits can dominate, main residences are extra ruled by arithmetic than virtually anything. The costs are what they’re, and you’ll both pay for the mortgage otherwise you can’t. (Irrelevant Investor)

• Right here’s The place Market Timing Works: Issue timing has its champions and skeptics — so teachers got down to discover a solution to the controversial observe. (Institutional Investor)

• The within story of Credit score Suisse’s collapse, by Credit score Suisse: Dispatches from the room the place nothing was occurring. (Monetary Occasions)

• Hospital ‘Black Packing containers’ Put Surgical Practices Below the Microscope: Hospitals have begun to make use of the know-how to assist cut back medical errors and enhance affected person security. (Wall Avenue Journal)

• Elon Musk: Proudly owning Twitter has been “fairly painful” and “a rollercoaster”: The multi-billionaire entrepreneur mentioned he would promote the corporate if the suitable particular person got here alongside. Musk, who additionally runs automobile maker Tesla and rocket agency SpaceX, purchased Twitter for $44bn in October. The interview on the agency’s HQ in San Francisco additionally coated the mass lay-offs, misinformation and his work habits. (BBC) see additionally Twitter Isn’t a Firm Anymore: It’s been merged into a brand new entity known as X Corp. Right here’s what that would imply. (Slate)

• Abortion was a 50/50 concern. Now, it’s Republican quicksand. Six in 10 voters help authorized abortion generally. Simply over a 3rd need it to be completely or largely unlawful. (Politico)

• China Could Not Want Western Know-how A lot Longer: The most recent rating of worldwide spending on analysis and improvement has US tech firms on prime and Chinese language rivals on the rise. (Bloomberg)

• How Russia’s Offensive Ran Aground: After months of pouring troopers into japanese Ukraine, Russia’s progress basically provides as much as this: three small settlements and a part of the town of Bakhmut, a high-profile battlefield with restricted strategic worth. (New York Occasions)

• ‘Secret Invasion’ Revealed: Inside Samuel L. Jackson’s Eye-Opening New Marvel Sequence. Why he has no eyepatch, the place you’ve seen Emilia Clarke’s thriller character earlier than, and 10 new pictures from the shape-shifting alien saga. (Vainness Honest)

Make sure you take a look at our Masters in Enterprise subsequent week with Aswath Damodaran, Professor of Finance at New York College’s Stern Faculty of Enterprise. Generally known as the Dean of Valuation, he teaches Company Finance and Valuation to the MBA college students at Stern the place he has been voted “Professor of the Yr” by the graduating M.B.A. class 9 occasions. His textbook “Funding Valuation” is the usual within the area. His subsequent e-book comes out in December, and is titled The Company Lifecycle: Enterprise, Funding, and Administration Implications.

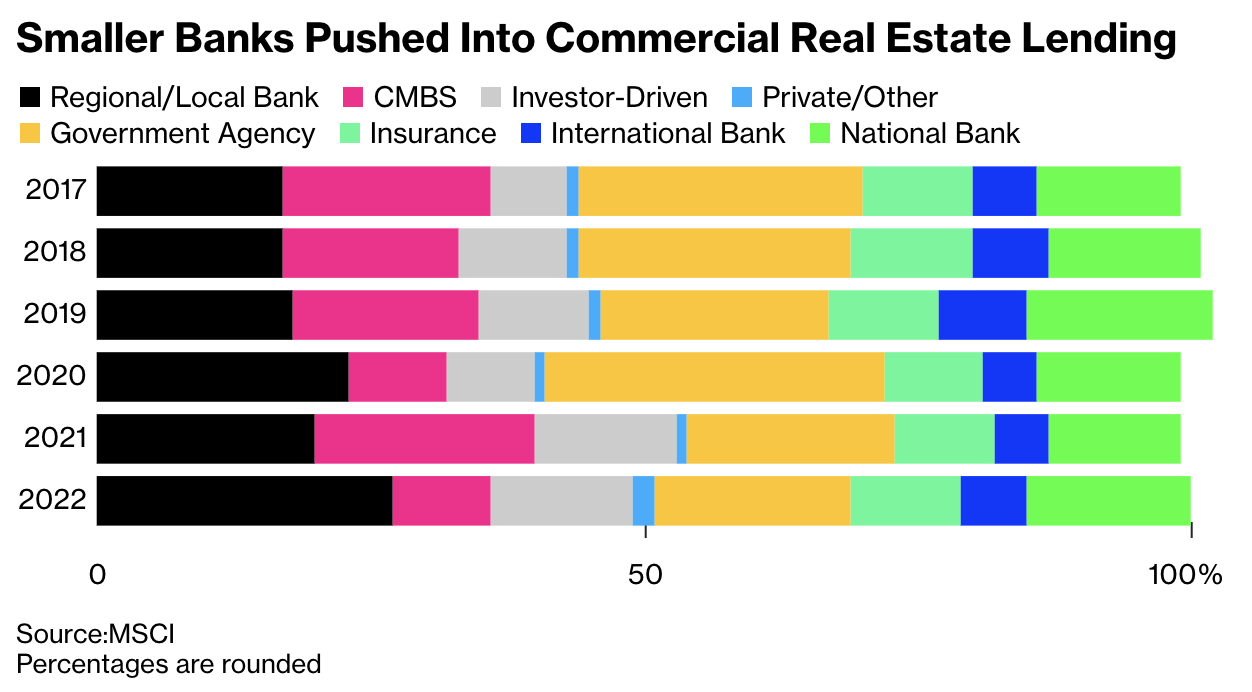

A $1.5 Trillion Wall of Debt Is Looming for US Business Properties

Supply: Bloomberg

Join our reads-only mailing record right here.

[ad_2]