[ad_1]

My mid-week morning Turkey journey day reads:

• The Hidden Hero Fueling Tender-Touchdown Hopes: A Enhance in Provide: Rising labor drive, productiveness lowered inflation regardless of still-strong progress, taking strain off Fed to lift charges. (Wall Avenue Journal)

• The New Financial Geography of the Housing Scarcity: How the Pandemic Accelerated Residence Value Will increase in America’s As soon as-Inexpensive Areas. (Apricitas Economics) see additionally How All people Miscalculated Housing Demand (2021): The hangover from GFC arrives, and new dwelling development grinds to a halt. Builders shift to multi-family and house buildings. It is going to take greater than a decade for brand spanking new single-family dwelling development and gross sales to return to their pre-boom common. Put up GFC Family formation is weak, as fewer younger persons are getting married, beginning households, shopping for houses. Nobody appears to note the rise in inhabitants + delayed marriages as postponed, future dwelling patrons. (The Huge Image)

• Falling gas costs and airfares carry reduction forward of US Thanksgiving: “Individuals are set to take pleasure in their least costly Thanksgiving vacation because the pandemic, as falling transportation costs and decrease prices for festive meals fundamentals reminiscent of turkey and potatoes carry reduction after months of rampant economy-wide inflation. Falling gas costs and airfares carry reduction forward of US Thanksgiving “Individuals are set to take pleasure in their least costly Thanksgiving vacation because the pandemic, as falling transportation costs and decrease prices for festive meals fundamentals reminiscent of turkey and potatoes carry reduction after months of rampant economy-wide inflation. (Monetary Occasions)

• The Largest Hidden Bias in Politics: Pundits, political analysts, and political scientists all have a severe bias that makes them misunderstand our world. And…it could actually allow you to make sense of your loopy relative this Thanksgiving, too. (The Backyard of Forking Paths)

• A 30-Yr Entice: The Drawback With America’s Bizarre Mortgages: One large cause the U.S. housing market is damaged: Homeowners don’t wish to hand over their comfortable outdated loans. (New York Occasions)

• From airways to ticket sellers, firms combat U.S. to maintain junk charges An array of highly effective moneyed lobbyists have warred with the Biden administration over its new regulatory crackdown as they scramble to guard their earnings. (Washington Put up)

• ‘Getting old is a illness’: Contained in the drive to postpone dying indefinitely: Longevity has turn out to be an trade, a topic of bestsellers, podcasts and newsletters. However is a life meted out in metrics, usually for a worth, price it? (Washington Put up)

• Some Individuals Are Simply Fortunate. You Can Make Your self Considered one of Them. Unfortunate folks skip over alternatives proper in entrance of them. Be sure you don’t miss out. (Wall Avenue Journal) see additionally 40% of individuals willfully select to be ignorant. Right here’s why: All of us have a spot in our lives the place we glance the opposite method and fake all the things is okay. It’s a built-in excuse to behave selfishly. (Huge Assume)

• The Invisible Struggle in Ukraine Being Fought Over Radio Waves: Utilizing electromagnetic waves to flummox and comply with smarter weapons has turn out to be a vital a part of the cat-and-mouse recreation between Ukraine and Russia. The US, China and others have taken notice. (New York Occasions)

• Jezebel, the Oral Historical past: ‘There Was This Riotous Sense of Enjoyable’ The positioning outlined an period of feminism for tens of millions of readers. In response to its editors and writers, it was additionally an exhilarating place to work. (New York Occasions)

Make sure to take a look at our Masters in Enterprise this week with Brad Gerstner, founder and CEO of Altimeter Capital. The tech-focused fund began in 2008 and invests in each private and non-private corporations. Gerstner started as an entrepreneur and has had a number of exits, together with journey startup NLG (to IAC). Openlist.com, (to Marchex) and Farecast (to MSFT). He additionally was an early investor in Zillow, Actual Self, Nor 1, Instacart, Expedia, Silver Rail Tech and Room 77. After returning $7B in earnings to its LPs, Altimeter manages presently manages $10B in property.

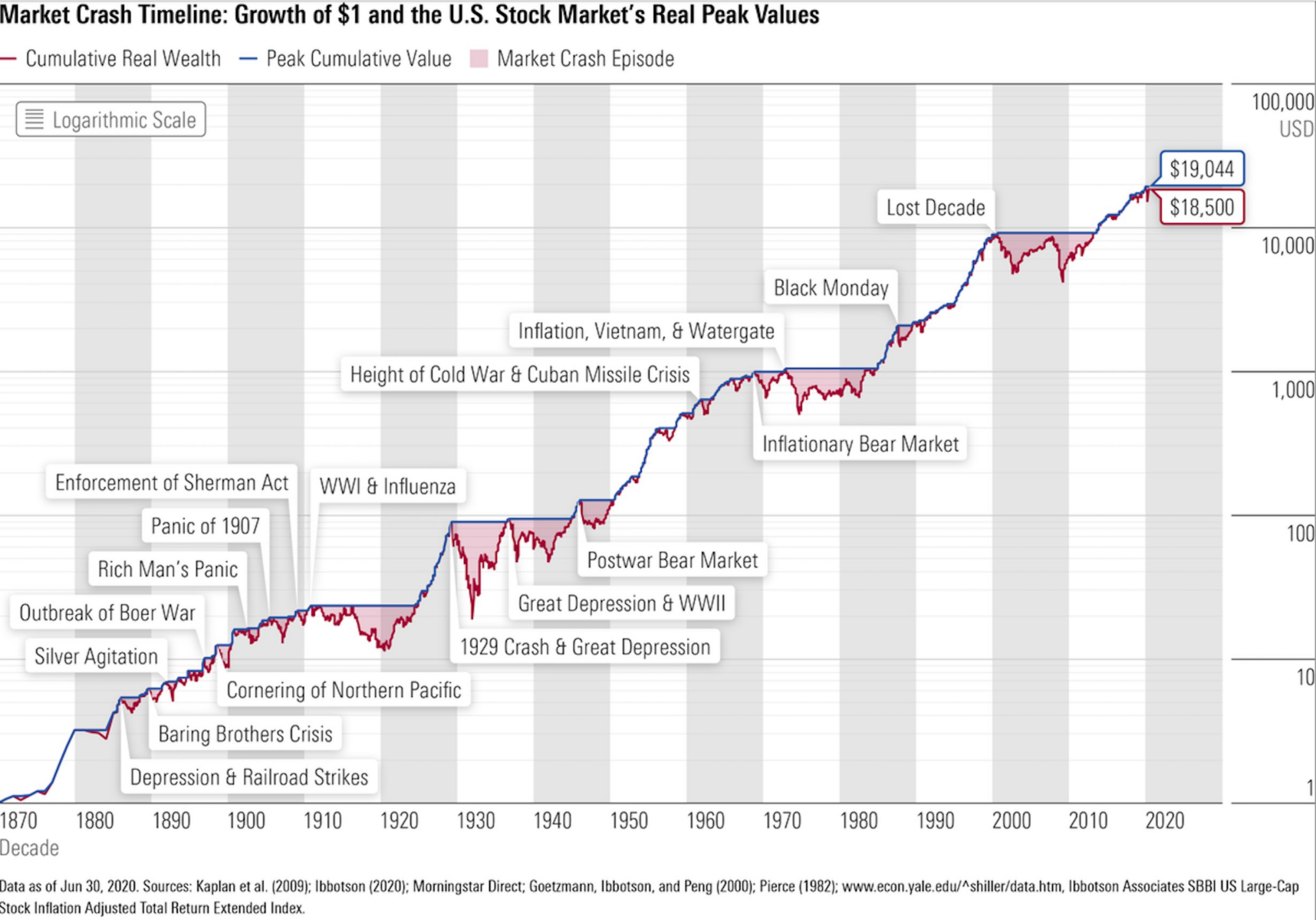

Market crashes in context

Supply: @BrianFeroldi

Join our reads-only mailing record right here.

[ad_2]