[ad_1]

My mid-week morning prepare reads:

• The Finest Time to Purchase Shares: Some individuals merely can not assist themselves in relation to shopping for after shares go up and promoting them after they go down. Let’s simply hope all the individuals who got here charging into the inventory market these previous few years stick round. It might be a disgrace if a brand new group of traders entered due to a bull market and stopped investing due to a bear market. (A Wealth of Widespread Sense)

• Even Cathie Wooden Can’t Spot the Subsequent Bull Market: She constructed her fame on selecting tech developments. Now she is having to defend bailing out of Nvidia. (Bloomberg) see additionally Cathie Wooden can’t battle the Fed: Ark Innovation ETF’s dependence on rate of interest forecasts undermine stockpicking fame. (Monetary Instances)

• How Moneyball Investing Ran Right into a Information Squeeze Play: Quants can arbitrage away the benefits in components and statistics nearly as quickly as they’re found. Take a look at the once-innovative Oakland A’s. (Bloomberg)

• U.S. Traders Need Extra Publicity to Japan. Right here’s What They Ought to Know Beforehand. “At first, investing in Japan or predicting Japan is so tough; it’s fairly a novel market,” stated Ryoji Musha. (Institutional Investor)

• Billionaires and the Evolution of Overconfidence: To know billionaires, it’s essential perceive horizontal inequality, illusory management, self-selection bias, quantified self-worth, and the evolution of overconfidence. (The Backyard of Forking Paths)

• American Cities Are Beginning to Thrive Once more. Simply Not Close to Workplace Buildings. Neighborhoods are benefiting from distant work. (Wall Road Journal) see additionally Downtown LA Workplace Emptiness Units Report, Causes Misery: Brookfield has defaulted on three towers, whereas different landlords have bought for a loss or face foreclosures. (Bloomberg)

• A.I.-Generated Content material Found on Information Websites, Content material Farms and Product Opinions: The findings in two new experiences increase recent considerations over how synthetic intelligence could rework the misinformation panorama on-line. (New York Instances)

• The unusual survival of Guinness World Data: For greater than half a century, one organisation has been cataloguing all of life’s superlatives. However has it gone from being concerning the pursuit of information to easily one other massive enterprise? (The Guardian)

• ‘Trump Bucks’ promise wealth for MAGA loyalty. Some lose 1000’s. The merchandise are marketed on-line as a sort of golden ticket that may assist propel Trump’s 2024 bid and make the “actual patriots” who help him wealthy when cashed in. (NBC Information)

• Jazz Struggles on Streaming, However Vinyl Gross sales Give the Style Hope: The style accounts for lower than 1% of music streams. Verve, Ella Fitzgerald’s outdated label, eyes new artists like Samara Pleasure to vary that. (Businessweek)

Be sure you try our Masters in Enterprise subsequent week with John Hope Bryant, the founder and chief govt officer of Operation HOPE. The agency focuses on offering monetary illiteracy as a option to deal with systemic points for under-served people and small companies. He’s additionally the CEO of Bryant Group Ventures, and The Promise Properties Firm. Bryant was named 2016 American Banker ‘Innovator of the 12 months,’ He has been an advisor to the final three sitting U.S. presidents.

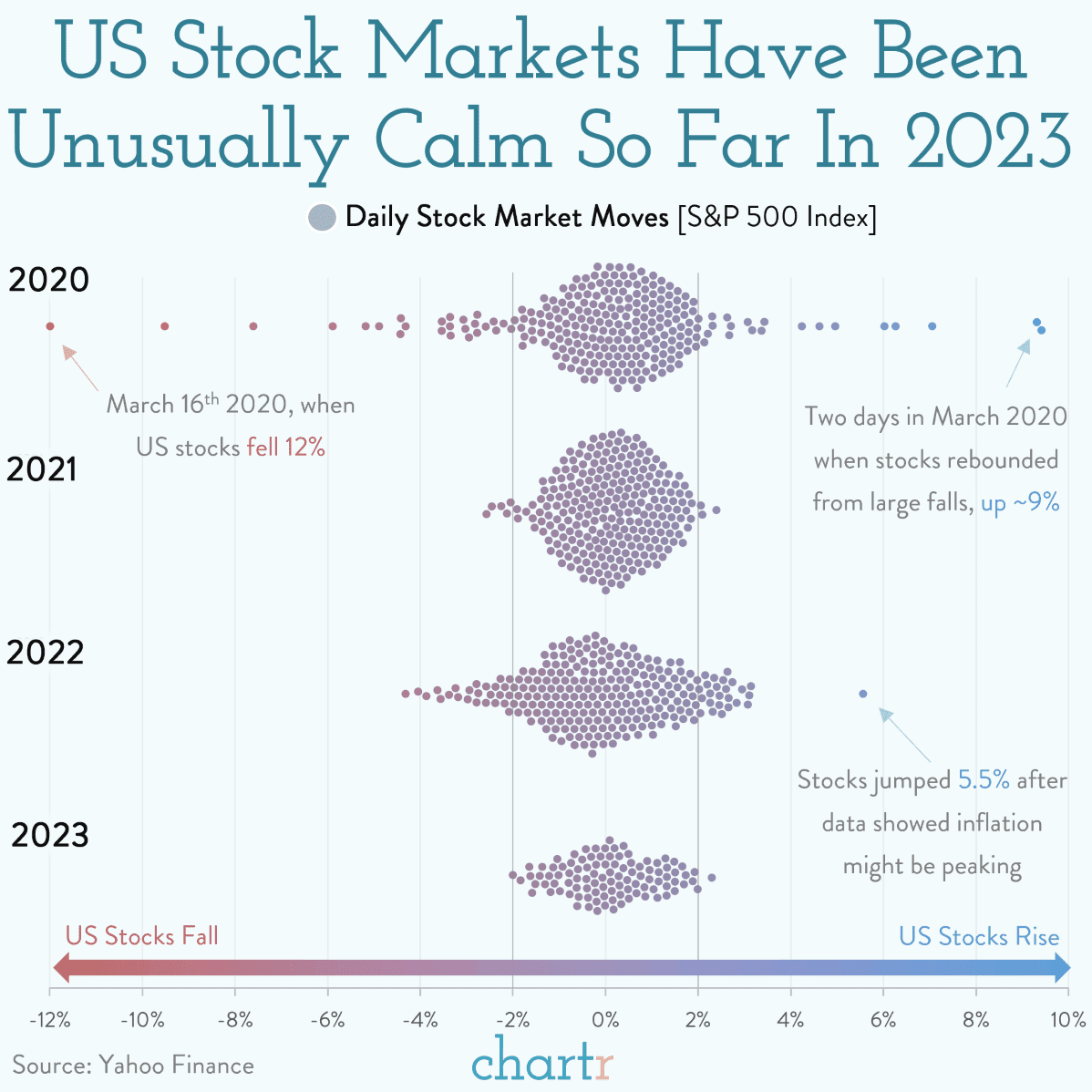

Inventory markets are calm, regardless of the headlines

Supply: Chartr

Join our reads-only mailing listing right here.

[ad_2]