[ad_1]

My mid-week morning practice WFH reads:

• NYSE Investigates Technical Subject That Precipitated Wild Market Open: A minimum of 40 S&P 500 shares had been hit with buying and selling halts. NYSE says it’s investigating points with the opening public sale. (Bloomberg)

• For Tech Corporations, Years of Straightforward Cash Yield to Laborious Instances: Rock-bottom charges had been the key engine fueling $1 billion start-ups and digital makes an attempt to overcome the bodily world. However in 2023, actuality bites. (New York Instances) however see Cease Worrying About All These Tech Layoffs… What appears to be like like big layoffs are a tiny proportion of the current hiring of those similar companies, which signify 3% of the workforce. The large scary tech layoffs are a small portion of the general workforce. (The Huge Image)

• Why Put money into Shares When Bond Yields Are Larger? Within the fall of 1981 the yield on 30 yr U.S. Treasury bonds hit 15%. That was the bond shopping for alternative of a lifetime. These are the sorts of yields the place you may go to the seaside and stay off the curiosity…and nobody needed them. (A Wealth of Widespread Sense)

• Hedge Fund That Obtained China Proper Sees Threat in US Credit score, Shares: Vantage CIO warns in opposition to ignoring drop in new manufacturing facility orders Ferres sees crimson flag in tight spreads for US high-yield credit score. (Bloomberg)

• What Microsoft will get from betting billions on the maker of ChatGPT: The reported $10 billion funding in OpenAI will preserve the most well liked AI firm on Microsoft’s Azure cloud platform. (Vox)

• Wealthy Prospects Pull Cash From Banks Providing Paltry Curiosity Charges: Wealth-management shoppers are shifting deposits into higher-yielding Treasurys and money-market funds (Wall Road Journal)

• Induction stoves: The expertise, the politics and why a lot of the world is on board: And the explanations America doesn’t really feel the necessity to transfer to induction cooking. (Grid)

• Lengthy Covid Is Conserving Important Numbers of Folks Out of Work, Examine Finds: An evaluation of staff’ compensation claims in New York discovered that 71 % of claimants with lengthy Covid wanted persevering with medical remedy or had been unable to work for six months or extra. (New York Instances)

• “I Nonetheless Discover Myself Questioning If This Is Actual Life”: Adam Kinzinger Has Little Hope for the Way forward for His Social gathering: The previous congressman and newly minted CNN commentator tells Self-importance Honest there are “no heroes” in at present’s GOP, sounds off on Kevin McCarthy’s Speakership, and displays on the Jan. 6 committee’s legacy. “I believe the largest impression will simply be within the arc of historical past,” he says. (Self-importance Honest)

• Federer and Williams Have been the Finest Ever. Or Perhaps Not. The greatness that counts is the greatness we’ve seen. And what these two tennis gamers have in frequent – aside from all the foremost titles – is that their achievements are in current reminiscence. (Bloomberg)

Remember to take a look at our Masters in Enterprise interview this weekend with Steven Klinsky, Founder and CEO, New Mountain Capital. Previous to founding New Mountain Capital in 1999, he was co-founder of the Leverage Buyout Group of Goldman Sachs, the place he did $3+ billion of transactions earlier than becoming a member of Forstmann Little as a associate, the place he oversaw $10+ billion in capital.

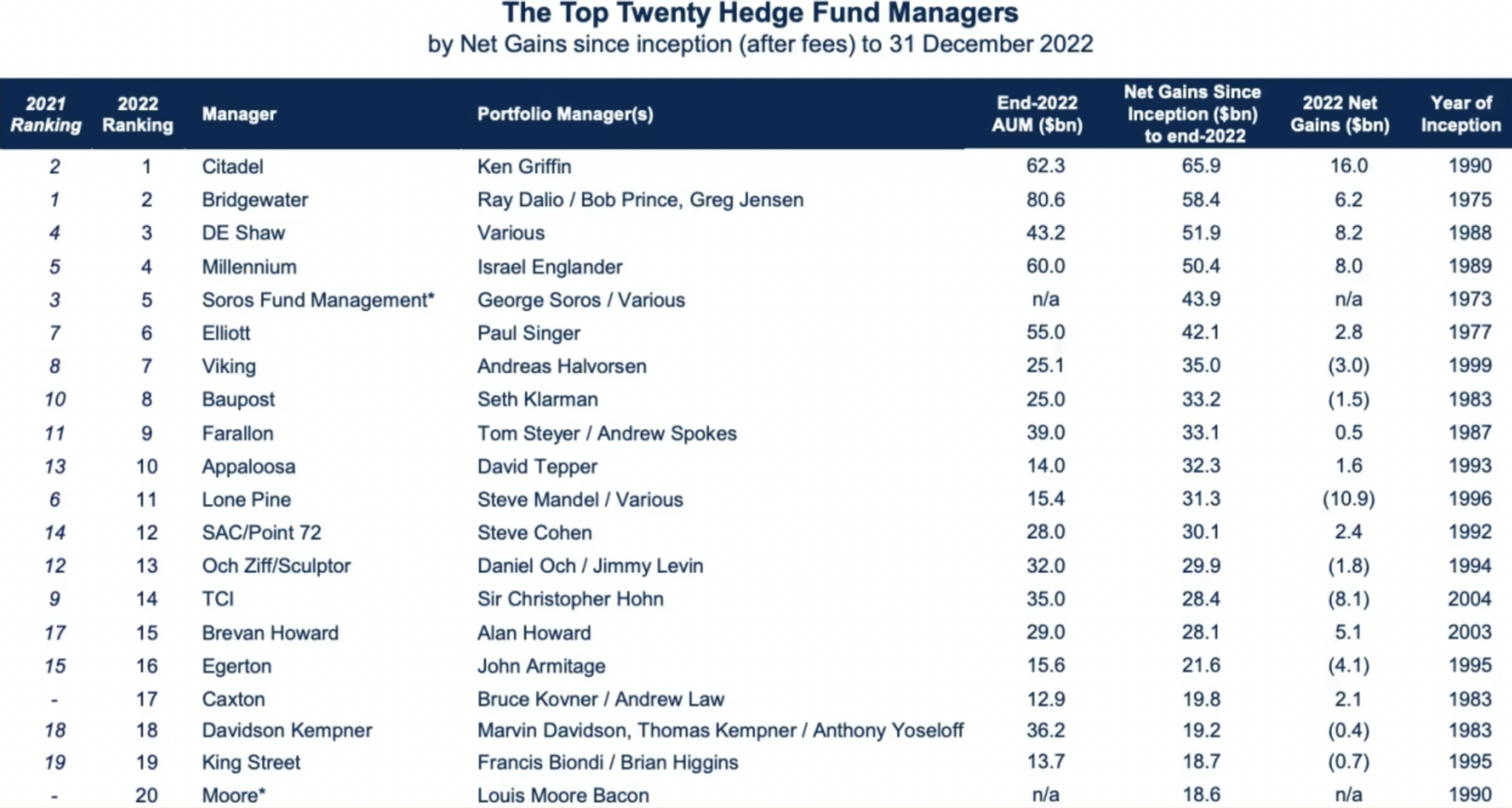

LCH Investments record of the best-performing hedge fund managers of all time

Supply: Monetary Instances

Join our reads-only mailing record right here.

[ad_2]