[ad_1]

We’re again from the ETF Trade occasion and able to rumble! (Or not less than learn). With no additional adieu, the morning practice WFH reads:

• The AI Bubble of 2023: The repetition of patterns is superb. In each era we see new bubbles, which kind when a brand new innovation comes alongside and everybody will get excited in regards to the future. The group will get swept away on a wave of insanity, fueled by the latest positive factors they’ve seen for themselves (or for others) and all different concerns exit the window. Get me in, I don’t care how, I can’t miss out on this. (Reformed Dealer)

• Don’t Learn His Lips: Jerome Powell has a troublesome job as chair of the Federal Reserve, making an attempt to make Fed coverage completely clear. Is anybody listening correctly? (The Atlantic) see additionally Goldilocks Financial system Is a Fairy Story Too Good to Be True: The latest stock-market rally isn’t nearly a brand new model of the not-too-hot, not-too-cold economic system, however a wild race to load up on danger (Wall Avenue Journal)

• The Inventory Market Is within the Temper to Rally, Even when It Defies Logic: There’s nonetheless an enormous disconnect out there’s logic. If the labor market and the economic system maintain up, then the Fed would most likely not really feel inclined to decrease rates of interest within the again half of 2023, as futures pricing implies. It’s laborious to see a situation other than charges staying greater for longer—lifting bond yields and placing stress on inventory valuations—or development disappointing, dragging down earnings. (Barron’s)

• Robust Greenback Nonetheless Rattles U.S. Multinational Company Earnings: Income for firms that derive most of their income abroad drop sharply. (Wall Avenue Journal)

• Inventory buybacks don’t actually matter: However folks like to get mad about them. (Noahpinion)

• The “damaged” Vix: What’s up with the down volatility index? (Monetary Instances)

• A Jim Simons Market Thriller — Solved? A secretive funding fund backed by the legendary quant shows a penchant for biotech shares. There’s a great cause for that. (Institutional Investor)

• The Unlikely New TikTok Influencers: Previous-Faculty Watch Sellers. Their rapid-fire haggling in Manhattan’s diamond district teases the fantasy of constructing a market, moderately than simply being topic to it. (New York Instances)

• The GOP Is Simply Obnoxious: It’s why they maintain shedding elections. (The Atlantic)

• Rating the Finest Moments of LeBron James’s Profession: The King is formally the NBA’s all-time main scorer. The place does Tuesday’s record-breaking second rank in his illustrious profession? (The Ringer) see additionally What the sports activities world says about LeBron James, NBA’s new scoring chief: ‘An iconic determine’ (The Athletic)

You’ll want to try our Masters in Enterprise interview this weekend with Rick Rieder, Chief Funding Officer of World Mounted Earnings at BlackRock, Head of the World Allocation Funding Group, and Senior Managing Director. Rieder helps to handle $2.5 trillion in fixed-income property as a member of BlackRock’s World Working Committee and is Chairman of the firm-wide BlackRock Funding Council.

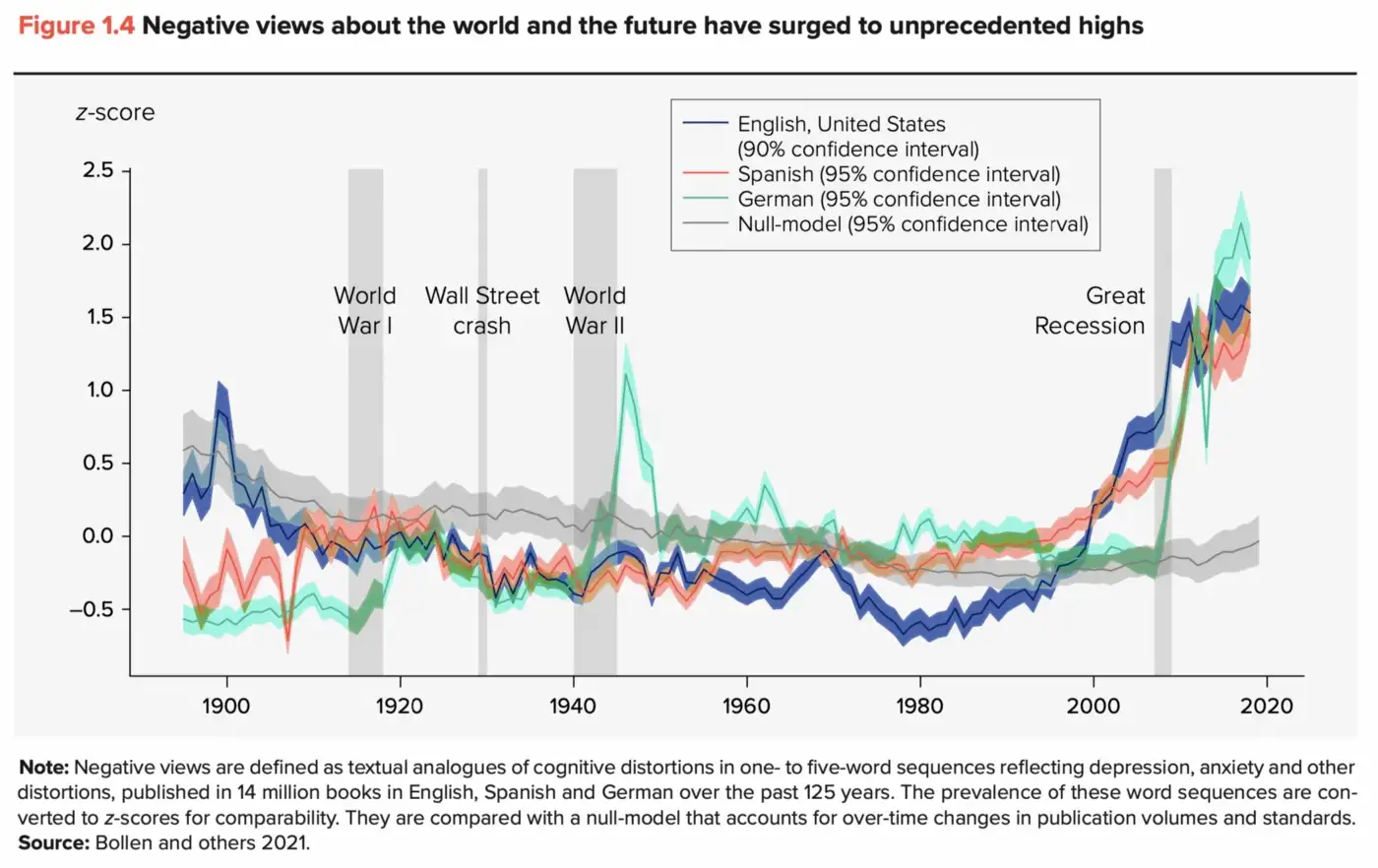

The Apocalypse is All the time Nigh: For all too many people, all too usually.

Supply: The Higher Letter

Join our reads-only mailing checklist right here.

[ad_2]