[ad_1]

My back-to-work morning prepare WFH reads:

• Print Cash: Money could appear old style lately — however in a lot of the world, money continues to be king. The method of getting cash requires groups of skilled designers and engravers who etch the plates with portraits, vignettes, lettering and ornamentation. The designs are crafted with each aesthetics and safety in thoughts. (New York Occasions)

• Residence Rents Fall as Crush of New Provide Hits Market: Declines sign tenants could also be maxed-out on how a lot revenue they will commit to lease. (Wall Road Journal) see additionally US Housing Market Posts $2.3 Trillion Drop, Largest Since 2008: San Francisco and New York are slumping because the pandemic increase fizzles out, however migration to Florida has boosted Miami. (Bloomberg)

• Does Lengthy-Time period Investing Work Exterior of america? The MSCI World ex-USA dates again to 1970. These had been the annual returns1 from 1970 by way of January 2023: S&P 500: 10.5% MSCI ex-USA: 8.4% (Wealth of Widespread Sense)

• I’m not Certain Hypothesis Is Gone: Jim Chanos, president and founding father of Chanos & Firm, believes the extent of silliness and hypothesis seen in 2020 and 2021 marked an necessary second for valuations. He talks concerning the largest fraud which is hiding in plain sight and why he believes Tesla has an extended approach to go down. (The Market)

• Welcome to the 5% World, The place Yield Chases You: The darkish cloud of rising rates of interest comes with some vital silver linings (Wall Road Journal)

• What You Can Be taught From Warren Buffett’s Errors: The incessant discuss in Berkshire’s shareholder letters about what went unsuitable could have a objective. (Bloomberg) see additionally To the Shareholders of Berkshire Hathaway Inc. The disposition of cash unmasks people. Charlie and I watch with pleasure the huge circulate of Berkshire-generated funds to public wants and, alongside, the infrequency with which our shareholders go for look-at-me belongings and dynasty-building. Who wouldn’t get pleasure from working for shareholders like ours? (berkshirehathaway)

• Awards are meaningless: From the Oscars to finest in enterprise, why will we do awards for adults? “Loads of issues are deeply unsuitable with America at present; being good to 6-year-olds isn’t tremendous one in all them…” (Vox)

• How irritation within the physique could clarify despair within the mind: Irritation is a pathway to despair — and a possible avenue for remedy, analysis suggests. (Washington Submit)

• We’re residing in an age of small creatures: 340-pound penguins had been as soon as regular—and possibly they are going to be once more sometime. (Slate)

• The 20 finest time-travel films – ranked! As Adam Driver by accident winds up 65m years in the past, dealing with not simply dinosaurs however an asteroid, we depend down the most effective movies about going backwards, or forwards, by way of the ages (The Guardian)

Make sure to try our Masters in Enterprise interview this weekend with David Layton, CEO of Companions Group. The agency is the most important listed PE/Buyout agency in Europe, managing $135 billion in belongings in Non-public fairness, infrastructure, actual property and debt.

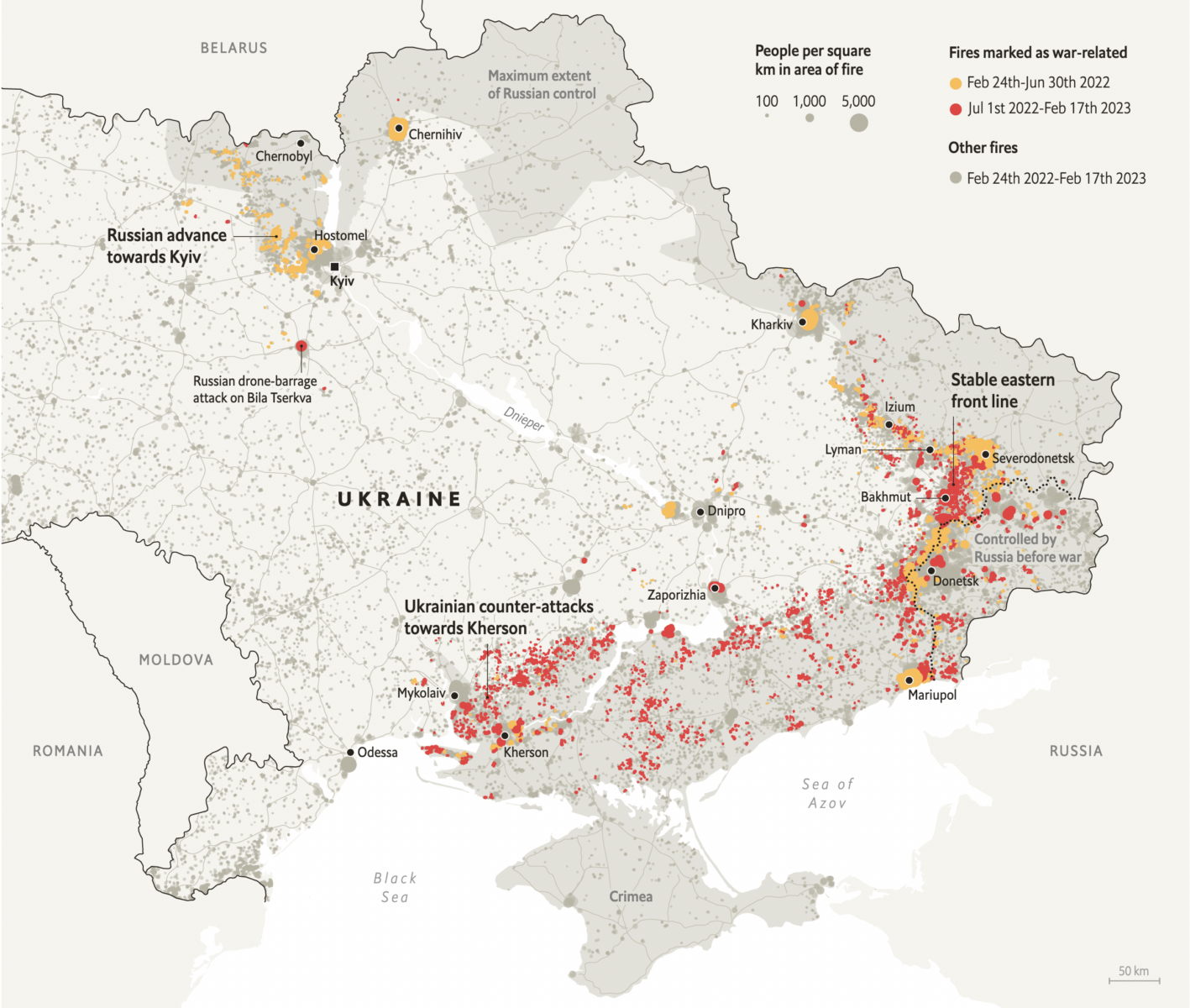

Knowledge from satellites reveal the huge extent of combating in Ukraine

Supply: Economist

Join our reads-only mailing checklist right here.

[ad_2]